Earnings summaries and quarterly performance for PACCAR.

Executive leadership at PACCAR.

R. Preston Feight

Chief Executive Officer

Brice Poplawski

Senior Vice President and Chief Financial Officer

C. Michael Dozier

Executive Vice President

Darrin Siver

Executive Vice President

John Rich

Senior Vice President and Chief Technology Officer

Kevin Baney

Executive Vice President

Laura Bloch

Senior Vice President

Mark Pigott

Executive Chairman

Board of directors at PACCAR.

Alison Carnwath

Director

Barbara Hulit

Director

Brice Hill

Director

Cynthia Niekamp

Director

Ganesh Ramaswamy

Director

John Pigott

Director

Kirk Hachigian

Director

Luiz Pretti

Director

Mark Schulz

Lead Independent Director

Pierre Breber

Director

Research analysts who have asked questions during PACCAR earnings calls.

Angel Castillo Malpica

Morgan Stanley

9 questions for PCAR

Jamie Cook

Truist Securities

9 questions for PCAR

Jeffrey Kauffman

Vertical Research Partners

9 questions for PCAR

Kyle Menges

Citigroup

9 questions for PCAR

Michael Feniger

Bank of America

9 questions for PCAR

Tami Zakaria

JPMorgan Chase & Co.

9 questions for PCAR

David Raso

Evercore ISI

7 questions for PCAR

Jerry Revich

Goldman Sachs Group Inc.

7 questions for PCAR

Scott Group

Wolfe Research

7 questions for PCAR

Stephen Volkmann

Jefferies

7 questions for PCAR

Steven Fisher

UBS

7 questions for PCAR

Chad Dillard

AllianceBernstein

6 questions for PCAR

Rob Wertheimer

Melius Research LLC

4 questions for PCAR

Robert Wertheimer

Melius Research

3 questions for PCAR

Timothy Thein

Raymond James

3 questions for PCAR

Avi Jaroslawicz

UBS Group

2 questions for PCAR

Charles Albert Dillard

Bernstein

2 questions for PCAR

Nick Housden

RBC Capital Markets

2 questions for PCAR

Tim Thein

Raymond James Financial

2 questions for PCAR

Walter Piecyk

LightShed Partners

2 questions for PCAR

Max Liss

Kepler Cheuvreux

1 question for PCAR

Recent press releases and 8-K filings for PCAR.

- PACCAR reported FY2025 revenues of $28.4 B, adjusted net income of $2.6 B, and 144,200 truck deliveries in 2025.

- For 1Q2026, PACCAR forecasts ~33,000 deliveries, 12.5%–13.0% gross margin, and 2%–4% parts sales growth, with FY2026 guidance of 4%–8% parts sales growth, $725 M–$775 M CAPEX, $450 M–$500 M R&D, and 230K–270K North America unit shipments.

- The Parts & Financial Services segment delivered $1.668 B parts profit and $485 M financial services profit in 2025, accounting for 71% of corporate profit pools.

- Strategic investments include $800 M CAPEX and $400 M R&D planned for 2026 to support growth and technological leadership.

- Product roadmap emphasizes next-generation clean diesel, elevating zero-emission/hybrid mix from 0% in 2025 to 30% by 2030, and advancing Level 4 autonomous trucking deployments.

- PACCAR highlighted cycle-over-cycle strength, with revenues rising from $19 billion in 2014 to over $28 billion in 2025 and return on invested capital reaching a record 55.5% in 2024.

- For 2026, PACCAR expects Q1 truck deliveries of ~33,000 units, gross margins of 12.5%–13%, parts sales up 2%–4%, and full-year parts growth of 4%–8%; capital expenditures of $725–775 million and R&D of $450–500 million are planned.

- The product roadmap includes two new proprietary diesel engine platforms to meet the 2027 35 mg NOₓ standard, an expanded BEV lineup growing to 17 models, and DAF’s XD and XF electric trucks winning the 2026 International Truck of the Year award.

- PACCAR’s parts business targets a $70 billion global addressable market (15% share in North America, 13% in EMEA) and aims to gain 5 pp by 2030 for an incremental $3.5 billion in sales; the network now has 21 distribution centers, 99.9% shipping accuracy, and 92% auto-accept in its Managed Dealer Inventory program.

- PACCAR closed 2025 with $28.4 billion in revenue, $2.6 billion of adjusted net income and 144,200 trucks delivered, reflecting a ~50% revenue increase since 2014 and a 9.3% return on revenue in 2025.

- The company invested $5 billion over the past five years in facilities and products—building flexible, AI-driven factories, new parts distribution centers, proprietary 35 mg NOₓ engine platforms, expanded zero-emissions and BEV lineups, and an autonomous truck platform.

- Parts and financial services target a $70 billion global parts market (15% share in North America, 13% in Europe) with $6.9 billion of average annual sales (30.4% gross margin) and seek 5 pts of share gain by 2030; PACCAR Financial Services holds $23 billion of assets and a 2.6% five-year average ROA, outperforming peers.

- For 2026, PACCAR expects Q1 deliveries of ~33,000 units, gross margins of 12.5%–13%, parts sales up 2%–4%, and will invest $725 million–$775 million in capital expenditures and $450 million–$500 million in R&D.

- PACCAR highlighted advanced manufacturing and AI integration, including flexible factories, connected vehicle services, zero-emission vehicle portfolio, and an autonomous vehicle platform.

- The company will deploy two new proprietary diesel engine platforms to meet the 35 mg NOₓ standard in 2027 without electrification, has expanded its BEV lineup to 15 application-specific models on a common global driveline, and continues evaluating hydrogen solutions.

- PACCAR Parts achieved $6.9 B in sales, 30.4% gross margin, operates 21 global distribution centers, and targets a $70 B total addressable market; it holds 15% NA and 13% EU/ROW share, with plans to gain 5 pp by 2030 via AI-driven inventory and first/second owner strategies.

- PACCAR Financial Services manages $23 B in assets across 26 countries, supports dealer and customer financing, and has delivered a 2.6% five-year average ROA.

- For 2026, PACCAR expects Q1 deliveries of ~33,000 units with 12.5%–13% gross margins, FY parts sales growth of 4%–8%, capex of $725 M–$775 M, R&D of $450 M–$500 M, and truck market sizes of 230k–270k (US&C) and 280k–320k (Europe).

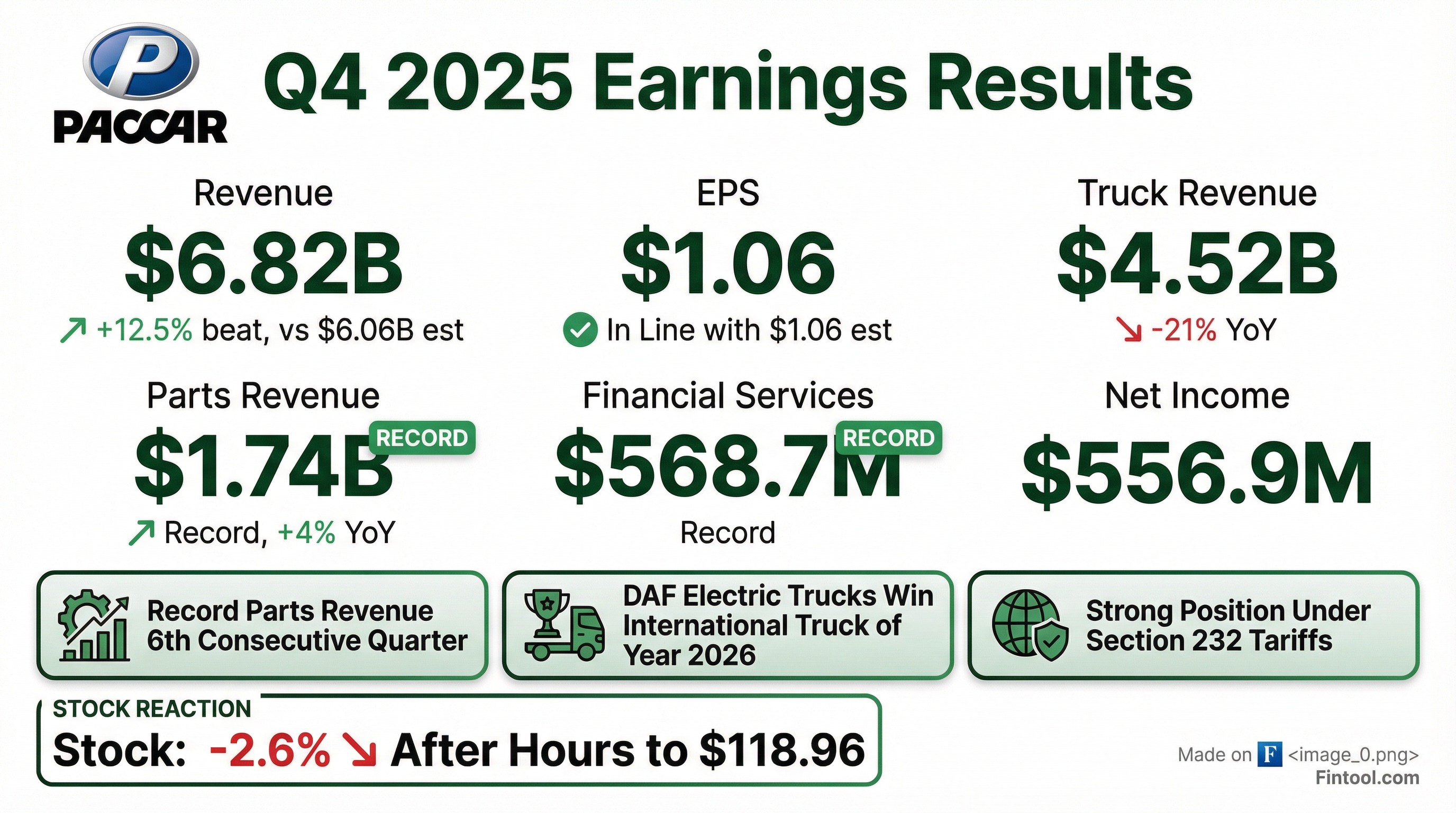

- PACCAR's Q4 revenues were $6.8 B with net income of $557 M; full-year 2025 revenues reached $28.4 B and adjusted net income was $2.64 B, delivering a 9.3% return on revenue.

- For 2026, PACCAR forecasts North American Class 8 retail sales of 230,000–270,000 units, European above-16 t registrations of 280,000–320,000, and South American above-16 t demand of 100,000–110,000 units.

- PACCAR Parts set record Q4 revenues of $1.7 B (pre-tax profit $415 M) and annual revenues of $6.9 B; PACCAR Financial Services posted Q4 revenues of $569 M (pre-tax income $115 M) and annual pre-tax income of $485 M.

- PACCAR delivered 32,900 trucks in Q4 2025 and expects Q1 2026 deliveries at a comparable level, with truck gross margins rising to 12.5%–13% from 12% in Q4.

- PACCAR declared $2.72 per share in 2025 dividends (84th consecutive year) and plans $725–775 M in capital investments and $450–500 M in R&D for 2026.

- Q4 revenue $6.8 B and net income $557 M; FY2025 revenue $28.4 B and adjusted net income $2.64 B (9.3% after-tax return on revenue)

- Dividends of $2.72 per share declared for 2025 (yield ~3%), marking 84 consecutive years of payouts

- PACCAR Parts Q4 revenue $1.7 B (+4%) with pre-tax profit $415 M; FY revenue $6.9 B (+3%) and pre-tax profit $1.67 B

- PACCAR Financial Services Q4 revenue $569 M and pre-tax income $115 M (+10%); FY revenue $2.2 B and pre-tax income $485 M (+11%)

- 2026 market outlook: North American Class 8 sales 230,000–270,000 units; European above-16 t registrations 280,000–320,000; South American above-16 t 100,000–110,000

- Q4 revenue was $6.8 B and net income $557 M; full-year 2025 revenues of $28.4 B and adjusted net income of $2.64 B, with adjusted after-tax return on revenue of 9.3%

- Declared dividends of $2.72 per share in 2025, including a $1.40 year-end payment, marking the 84th consecutive year of dividends and yielding ~3%

- Q4 truck deliveries totaled 32,900 units, with Q1 2026 deliveries expected at comparable levels; truck gross margins projected to rise from 12% in Q4 to 12.5–13% in Q1

- PACCAR Parts posted Q4 revenues of $1.7 B (+4%; pre-tax profit $415 M) and record FY revenues of $6.9 B (+3%; pre-tax $1.67 B), while PACCAR Financial recorded Q4 revenues of $569 M and pre-tax income of $115 M (FY rev $2.2 B; pre-tax $485 M)

- Full-year 2025 revenue of $28.4 B and net income of $2.38 B, lowered by a $264.5 M after-tax litigation charge.

- PACCAR Parts revenue rose 3% to $6.87 B, and Financial Services posted record revenue of $2.2 B with pretax income of $485.4 M; finance assets grew to $22.8 B (+1.8%).

- In Q4 2025, revenue was $6.82 B (–13.8% YoY) and EPS was $1.06, above the $6.12 B consensus.

- U.S. Class 8 truck deliveries declined 15% to 63,300 units in 2025 (Peterbilt 31,764; Kenworth 31,536).

- PACCAR reported Q4 2025 revenue of $6.82 billion and net income of $556.9 million ($1.06 per diluted share)

- Full-year 2025 revenue was $28.44 billion, with net income of $2.38 billion ($4.51 per diluted share) and adjusted net income of $2.64 billion ($5.01 per diluted share)

- PACCAR Parts and PACCAR Financial Services delivered record revenues and strong profits in 2025, supporting diversified earnings growth

- Cash dividends of $2.72 per share were declared for 2025, including a $1.40 year-end payout on January 7, 2026

- PACCAR posted Q3 revenue of $6.7 billion and net income of $590 million, with PACCAR Parts record revenues of $1.72 billion (up 4%) and pre-tax income of $410 million, and PACCAR Financial Services pre-tax income of $126 million.

- Third-quarter gross margins were 12.5%, pressured by steel and aluminum tariffs; Q4 margins are expected around 12% as tariffs peak in October, with new Section 232 duties effective November 1 set to reduce costs and improve competitive position.

- PACCAR forecasts the 2025 U.S./Canada Class 8 market at 238,000–245,000 trucks and 2026 at 230,000–270,000; Europe above-16 ton at 275,000–295,000 (2025) and 270,000–300,000 (2026); South America above-16 ton at 95,000–105,000 (2025 & 2026).

- Capital spending for 2025 is guided to $750–775 million (capex) and $450–465 million (R&D), with 2026 investments of $725–775 million and $450–500 million, supporting next-generation powertrains, ADAS, connected services, and expanded production capacity.

Quarterly earnings call transcripts for PACCAR.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more