Earnings summaries and quarterly performance for Snap-on.

Executive leadership at Snap-on.

Nicholas Pinchuk

Chairman, President and Chief Executive Officer

Aldo Pagliari

Senior Vice President–Finance and Chief Financial Officer

Jesus Arregui

Senior Vice President and President–Commercial Group

Thomas Ward

Senior Vice President and President–Repair Systems and Information Group

Timothy Chambers

Senior Vice President and President–Snap-on Tools Group

Board of directors at Snap-on.

Research analysts who have asked questions during Snap-on earnings calls.

David Macgregor

Longbow Research

8 questions for SNA

Luke Junk

Robert W. Baird & Co.

8 questions for SNA

Scott Stember

ROTH MKM

7 questions for SNA

Bret Jordan

Jefferies

5 questions for SNA

Gary Prestopino

Barrington Research

5 questions for SNA

Christopher Glynn

Oppenheimer & Co. Inc.

4 questions for SNA

Sherif El-Sabbahy

Bank of America

4 questions for SNA

Patrick Buckley

Jefferies Financial Group Inc.

3 questions for SNA

Carolina Jolly

Gabelli Funds

1 question for SNA

Recent press releases and 8-K filings for SNA.

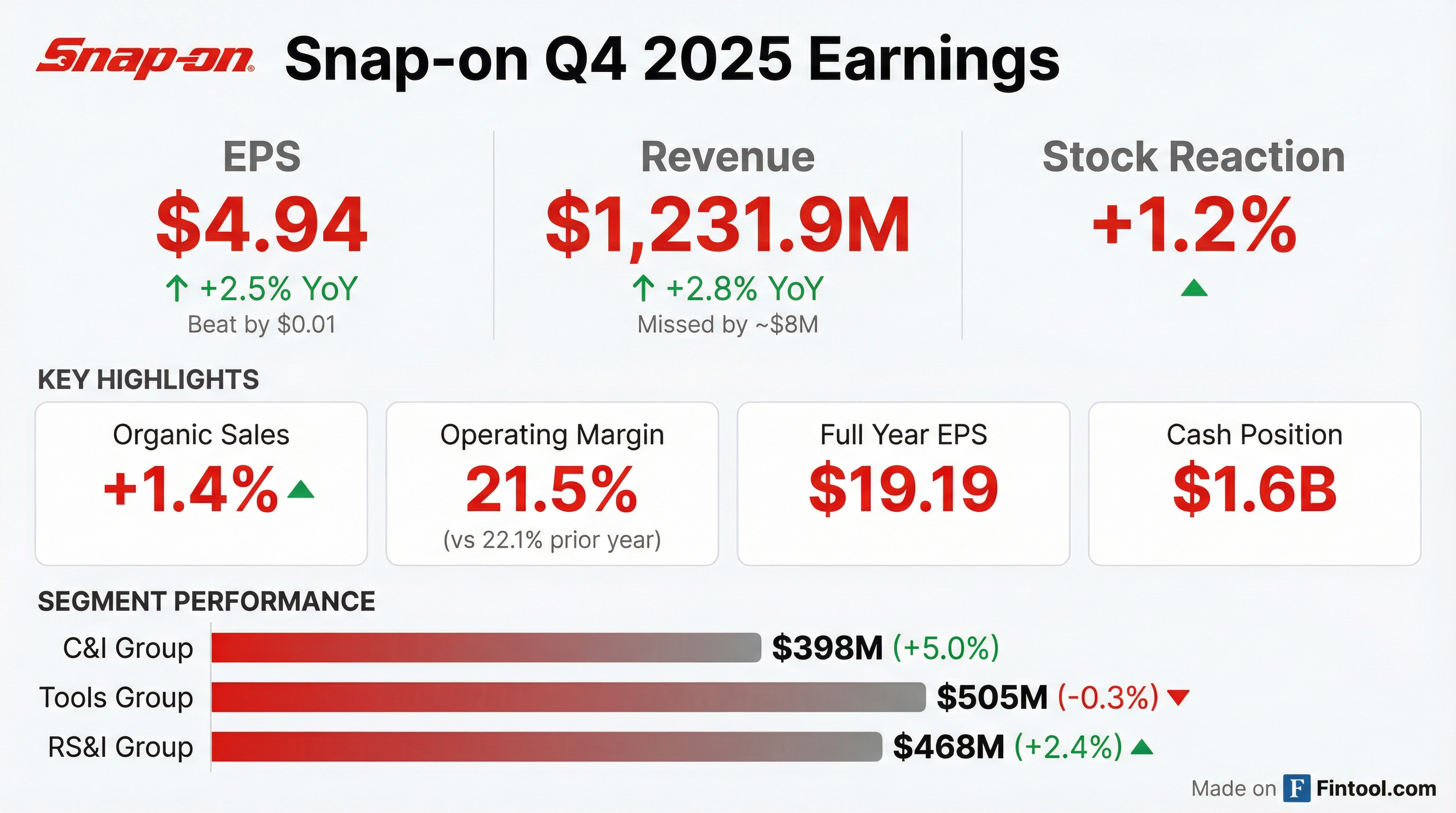

- Consolidated net sales of $1,231.9 million, up 2.8% y-o-y, and diluted EPS of $4.94, up $0.12 from prior year.

- By segment, C&I sales were $398.1 million (+5.0%), Tools Group sales $505.0 million (flat) with a 21.2% OI margin (+10 bps), and RS&I sales $467.8 million (+2.5%).

- Launched key new products: Nano Axcess cordless power tools, ControlTech+ torque wrench, and impact flex sockets to drive faster payback and fill access gaps.

- Declared a 14% dividend increase (16th consecutive year) and repurchased $80.4 million of shares in Q4, with $260 million remaining authorization.

- Net sales rose 2.8% to $1,231.9 M, driven by 1.4% organic growth, and diluted EPS increased 2.5% to $4.94.

- Commercial & Industrial segment sales grew 5.0% to $398.1 M, Snap-on Tools declined 0.3% to $505.0 M, and Repair Systems & Information sales increased 2.5% to $467.8 M.

- Financial services revenue was $108.0 M (up 7.5%), with operating earnings of $74.4 M (up 11.5%).

- Free cash flow of $265.8 M and net cash increased by $90.4 M; ended the quarter with $1,624.5 M in cash and net debt of $(421.9) M.

- Snap-on reported Q4 net sales of $1,231.9 million, up 2.8% year-over-year with a 1.4% organic gain, and delivered EPS of $4.94, up $0.12 from 2024.

- Segment performance: C&I sales rose 5% to $398.1 million (organic +2.8%) with an OI margin of 15.2%, led by power tools and critical industries ; Tools Group sales were flat at $505.0 million with gross margin up 150 bps and OI margin of 21.2% ; RS&I sales grew 2.5% to $467.8 million (organic +1.0%) with OI margin of 25.2%.

- Financial services benefited from a 53rd fiscal week, reporting revenue of $108.0 million and operating income of $74.4 million, contributing to consolidated operating earnings of $339.6 million, up 2.3%.

- Launched key products to address technician needs, including the NanoAxcess Cordless power tool lineup and the MT2600 diagnostic platform, to drive future growth.

- In Q4 FY2025, net sales were $1,231.9 million, up 2.8% (1.4% organic) year-over-year, and diluted EPS was $4.94, compared with $4.82 a year ago.

- The Commercial & Industrial group delivered $398.1 million in sales (+2.8% organic) with a 15.2% operating margin; Tools Group sales flattened at $505 million with gross margin up 150 bps to 46.1% and 21.2% OI margin; RS&I sales rose to $467.8 million (+1% organic) with a 25.2% operating margin.

- Snap-on launched several new products, including the MT2600 diagnostic platform, ControlTech+ Torque Wrench, Nano power tools, and a long-shaft impact flex socket set, reinforcing its innovation pipeline.

- In November, the company raised its quarterly dividend by 14%, marking the 16th consecutive annual increase.

- Fourth quarter net sales of $1,231.9 million, up 2.8% year-over-year with 1.4% organic growth.

- Diluted EPS of $4.94 versus $4.82 last year and net earnings of $260.7 million.

- Operating earnings before financial services flat at $265.2 million (21.5% of net sales) in Q4.

- Full-year 2025 net sales of $4,743.2 million, net earnings of $1,016.9 million and EPS of $19.19.

- 2026 outlook: capital expenditures of approximately $100 million and effective income tax rate of 22–23%.

- Snap-on reported Q4 net sales of $1,231.9 million, up 2.8% YoY (organic +1.4%)

- Q4 diluted EPS of $4.94, compared with $4.82 in Q4 2024

- FY 2025 net sales of $4,743.2 million, up 0.8% YoY; net earnings of $1,016.9 million, or $19.19 per diluted share, including a $16.2 million after-tax legal settlement benefit

- Q4 consolidated operating earnings of $339.6 million (25.3% of revenues) versus $331.9 million (25.5%) in Q4 2024

- The Tools Group achieved 1% sales growth and a 21.7% operating margin in Q3, while RS&I delivered a 25.6% margin despite legal settlements.

- Diagnostics momentum continued with strong uptake of new products like Triton, underscoring mechanics’ shift to tools with quicker ROI.

- Power-tool innovations—such as a 13" long-neck ratchet and the 7.5V “Nano”—have driven incremental sales by addressing tight-space applications.

- The credit portfolio remains profitable with a 16.5% yield and loss rates around 3.5%, showing resilience amid economic uncertainty.

- Manufacturing doctrine emphasizes proximity to end users: 36 factories (15 in the U.S.) supply 80% of van-channel products domestically, enhancing tariff-related flexibility.

- Snap-on leverages on-site customer connection and rapid continuous improvement across 85,000 SKUs, driving an average 85 bps annual increase in operating income margin over the past 15–17 years.

- Q3 seasonality in the Tools Group stems from summer vacations and the annual Franchisee Conference, making Q3-over-Q2 growth atypical—only occurring two to three times under current leadership.

- Diagnostics products delivered strong Q3 momentum, as their ability to improve repair speed and accuracy led to higher uptake, offsetting slower tool storage originations.

- A predominantly domestic manufacturing footprint (36 factories, 15 in the U.S.) preserved a 50.9% gross margin through tariffs, though some C&I customers are delaying capital projects amid tariff uncertainty.

- For 2026, Snap-on targets 4–6% sales growth with continued OI margin expansion, prioritizing internal investments (including AI), selective M&A, and has maintained an uninterrupted quarterly dividend since 1939.

- Snap-on Tools Group Q3 seasonality is driven by technician vacations and the annual franchisee conference, making the period highly variable, but the group delivered 1% sales growth and 21.7% OI margin in the quarter.

- Diagnostics tools posted strong Q3 growth, driven by high demand for solutions that improve repair speed and accuracy.

- New Power Tools such as the 13-inch long-neck ratchet and Nano 7.5V tool saw rapid adoption, enhancing category momentum.

- The company’s U.S.-centric manufacturing footprint—15 of 36 factories in the U.S., producing about 80% of van-sales parts—has largely mitigated tariff impacts.

- Snap-on’s credit portfolio maintains a robust 16.5% yield against 3.5% loan losses, levels consistent with historical stress tests.

- Snap-on reported Q3 2025 net sales of $1,190.8 M, up 3.8% YoY (3% organic growth, $9 M favorable FX), with a 50.9% gross margin and an operating income margin of 23.4% (21.5% ex-legal benefit).

- Third-quarter EPS was $5.02, or $4.71 adjusted to exclude a $0.31 per share legal settlement benefit, marking the highest-ever Q3 EPS.

- By segment, C&I sales of $367.7 M declined 0.8% organically (15.6% OI margin); Tools Group sales of $506.0 M rose 1% organically (21.7% margin); RS&I sales of $464.8 M increased 8.9% organically (30.4% margin including legal benefit).

- Financial Services revenue was $101.1 M (OI $68.9 M), and operating cash flow was $277.9 M, with $111.5 M dividends paid and $82.0 M in share repurchases during the quarter.

Quarterly earnings call transcripts for Snap-on.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more