Earnings summaries and quarterly performance for ITT.

Executive leadership at ITT.

Luca Savi

Chief Executive Officer and President

Bartek Makowiecki

Senior Vice President, Chief Strategy Officer and President, Industrial Process

Davide Barbon

Senior Vice President and President, Motion Technologies and Asia Pacific

Emmanuel Caprais

Senior Vice President and Chief Financial Officer

Emrana Sheikh

Senior Vice President and Chief Human Resources Officer

Lori Marino

Senior Vice President, Chief Legal Officer, Chief Compliance Officer & Secretary

Michael Guhde

Senior Vice President and President, Connect & Control Technologies

Board of directors at ITT.

Christopher O'Shea

Director

Donald DeFosset Jr.

Director

Douglas DelGrosso

Director

Kevin Berryman

Director

Maggie Chu

Director

Mary Laschinger

Director

Nazzic Keene

Director

Rebecca McDonald

Director

Sharon Szafranski

Director

Timothy Powers

Chairman of the Board

Research analysts who have asked questions during ITT earnings calls.

Jeffrey Hammond

KeyBanc Capital Markets

7 questions for ITT

Damian Karas

UBS

6 questions for ITT

Joseph Giordano

TD Cowen

6 questions for ITT

Michael Halloran

Baird

6 questions for ITT

Sabrina Abrams

Bank of America

6 questions for ITT

Vladimir Bystricky

Citigroup

5 questions for ITT

Nathan Jones

Stifel

4 questions for ITT

Joe Ritchie

Goldman Sachs

3 questions for ITT

Joseph Ritchie

Goldman Sachs

3 questions for ITT

Matt Summerville

D.A. Davidson & Co.

3 questions for ITT

Scott Davis

Melius Research

3 questions for ITT

Adam Farley

Stifel Financial Corp.

2 questions for ITT

Amit Mehrotra

UBS

2 questions for ITT

Bradley Hewitt

Wolfe Research

2 questions for ITT

Matthew Summerville

D.A. Davidson

2 questions for ITT

Mike Halloran

Robert W. Baird & Co. Incorporated

2 questions for ITT

Nathan Jones

Stifel, Nicolaus & Company, Incorporated

2 questions for ITT

Vladimir Bystricky

Citi

2 questions for ITT

Andrew Obin

Bank of America

1 question for ITT

Brad Hewitt

Wolfe Research, LLC

1 question for ITT

Michael Anastasiou

Cowen and Company

1 question for ITT

Vlad Bystricki

Citi

1 question for ITT

Recent press releases and 8-K filings for ITT.

- ITT Inc. entered into a credit agreement on February 18, 2026, providing $2,875,000,000 in delayed draw term loan commitments.

- These commitments are designated to finance the company's previously announced acquisition of SPX FLOW, Inc..

- The delayed draw term loan commitments expire on September 11, 2026, if undrawn, and an unused commitment fee of 0.10% per annum will accrue from May 3, 2026.

- Loans drawn under the agreement will mature two years from the date of the first borrowing and bear interest at a rate based on Term SOFR or an alternate base rate, plus a margin.

- The credit agreement includes a financial covenant requiring a maximum ratio of net consolidated total indebtedness to consolidated adjusted EBITDA of 3.50 to 1.00, with potential increases for certain periods following material acquisitions.

- ITT is an engineering company with a roughly $4 billion revenue, targeting 10% total growth and 5% organic growth until 2030, with an adjusted EPS target of more than $11 (or $12 adjusted for M&A) and an adjusted operating margin of 23%.

- The acquisition of SPX FLOW is expected to close in the first week of March 2026, which will reduce ITT's auto exposure to approximately 20% of its portfolio. Full-year guidance including SPX FLOW will be provided at the earnings call in May.

- For 2026, ITT anticipates significant order growth in aerospace and defense, while automotive is expected to be roughly flat to slightly down, though ITT aims to outperform this market by 400-500 basis points. Industrial Process is projected for low- to mid-single digits growth.

- Following the SPX FLOW closing, the company's debt ratio will be around 2.7, and the primary focus will be on debt reduction, with potential for small bolt-on acquisitions.

- ITT, an engineering company with approximately $4 billion in revenue, has set long-term targets until 2030 including 10% total growth, 5% organic growth, adjusted EPS over $11 (or $12 adjusted for M&A), an adjusted operating margin of 23%, and a cash flow margin of 14-15%.

- The company is on track to close its acquisition of SPX FLOW during the first week of March 2026, which is expected to reduce ITT's automotive exposure to roughly 20% of its total portfolio.

- Orders in Q4 2025 and January 2026 showed positive trends across various sectors, with Aerospace & Defense anticipated to be a high-growth area, while the automotive market is expected to be flat to slightly down, though ITT aims to outperform it by 400-500 basis points in 2026.

- Following the SPX FLOW acquisition, ITT's debt ratio is projected to be around 2.7, with a primary focus on debt reduction; small bolt-on acquisitions may be considered, but no large ones are planned.

- ITT is an engineering company with approximately $4 billion in annual revenue, achieving 7% organic growth and a 14% cash flow margin over the last three years.

- The company is set to close the acquisition of SPX FLOW in March , which is expected to reduce its automotive exposure to roughly 20% of the total portfolio.

- ITT has established long-term targets until 2030, aiming for 10% total growth, 5% organic growth, >$11 EPS (or $12 adjusted for M&A), 23% adjusted operating margin (or >25% EBITDA), and 14-15% cash flow margin.

- Order performance was positive in Q4 2025 and January 2026 across various sectors , with aerospace and defense anticipated to drive higher order growth in 2026.

- Following the SPX FLOW acquisition, ITT's primary focus will be on debt reduction, targeting a debt ratio of around 2.7, alongside considering small bolt-on acquisitions. Full-year guidance will be provided in May after the acquisition closes.

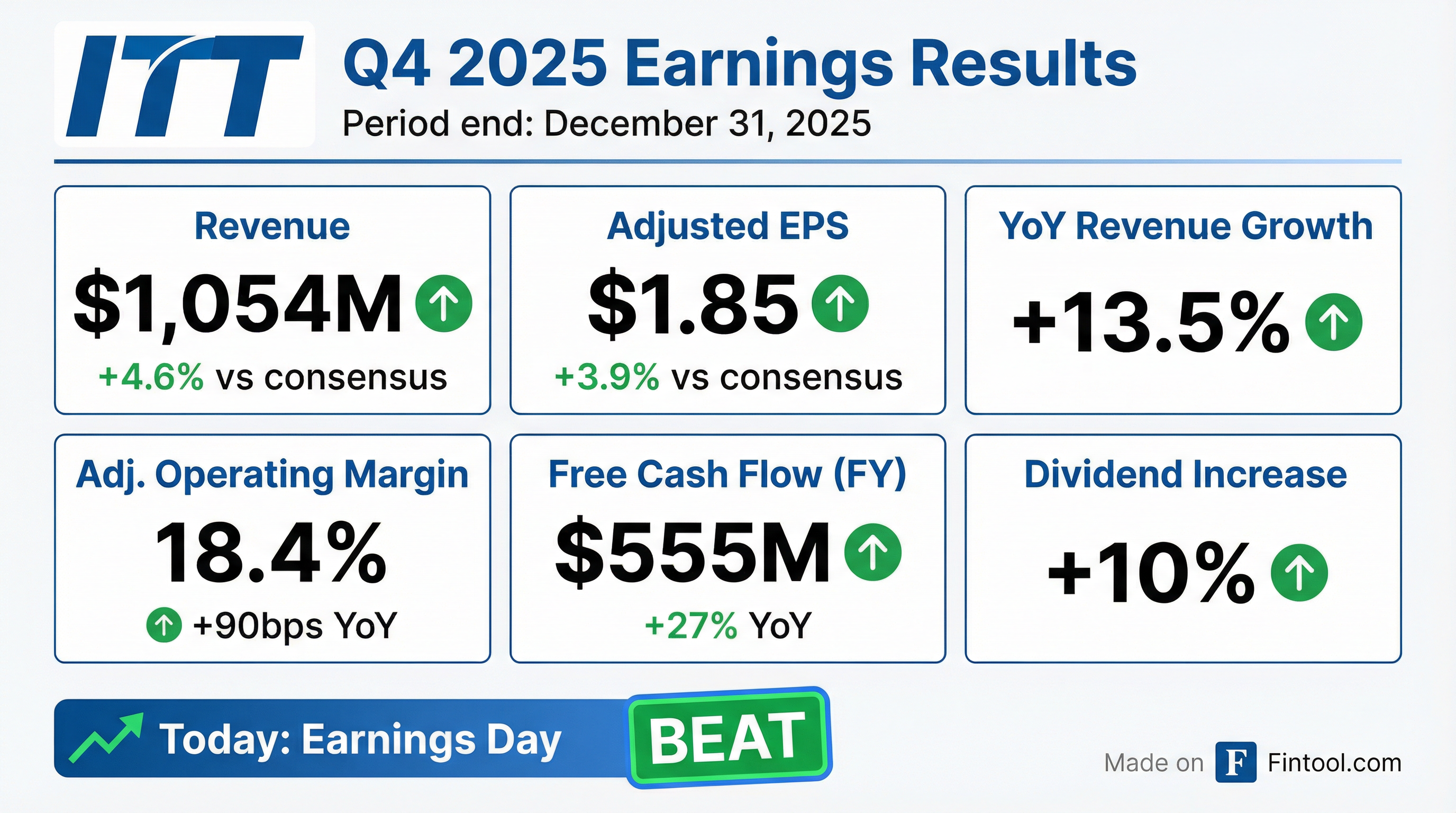

- For full-year 2025, ITT reported revenue growth of 8% (5% organically) and EPS growth of 14%.

- In Q4 2025, revenue surpassed $1 billion for the first time, increasing 13% (9% organically), with EPS reaching $1.85.

- The pending SPX Flow acquisition is expected to close in March 2026 and generate net single-digit EPS accretion for full-year 2026.

- For Q1 2026, ITT anticipates total revenue growth of approximately 11% (5% organically) and EPS of $1.70 at the midpoint, excluding the SPX Flow acquisition.

- A renewed multi-year contract with Boeing includes a high double-digit price adjustment, which is expected to significantly improve aerospace profitability.

- ITT reported strong financial performance for Q4 2025, with revenue exceeding $1 billion for the first time, growing 13% (9% organic), and EPS of $1.85, up 23%. For the full year, revenue grew 8% (5% organic), and EPS increased 14%.

- In 2025, the company's free cash flow grew 27% to over $550 million, achieving a 14% free cash flow margin, and $500 million was deployed for share repurchases.

- The pending SPX FLOW acquisition is on track to close in March and is anticipated to generate a net single-digit EPS accretion for full-year 2026.

- For Q1 2026, ITT expects total revenue growth of approximately 11% (5% organically) and projected EPS of $1.70 at the midpoint, representing a 29% increase when excluding the impact of the December equity offering.

- The full-year 2026 outlook (excluding SPX FLOW) forecasts mid-single-digit organic revenue growth and at least 50 basis points of margin expansion.

- ITT reported strong financial results for Q4 and full-year 2025, with Q4 revenue increasing 13% to $1,054 million and full-year revenue growing 8% to $3,939 million.

- Adjusted EPS also saw significant growth, reaching $1.85 in Q4 (up 23.3%) and $6.72 for the full year (up 14.3%).

- The company generated $555 million in free cash flow for fiscal year 2025, representing a 14.1% margin and 114% conversion.

- Orders increased 10% for the full year to over $4 billion, with a 15% rise in Q4, contributing to a $1.9 billion backlog.

- ITT is on track to close the $4.8 billion SPX FLOW acquisition in Q1 2026, which is expected to provide single-digit EPS accretion in 2026. The company also provided a Q1 2026 Adjusted EPS outlook of $1.68 to $1.72.

- ITT reported strong Q4 2025 results, with revenue exceeding $1 billion for the first time (up 13% total, 9% organic) and EPS of $1.85 (up 23%). For full year 2025, revenue grew 8% and EPS grew 14%, with free cash flow increasing 27% to over $550 million.

- The company issued Q1 2026 guidance for approximately 11% total revenue growth (5% organic) and EPS of $1.70 at the midpoint (up 29% excluding equity offering impact). For full year 2026, ITT expects mid-single-digit organic revenue growth and at least 50 basis points of margin expansion.

- The SPX Flow acquisition is on track to close in March, with an anticipated net single-digit EPS accretion in full year 2026. SPX Flow demonstrated strong 2025 performance, including mid-teens order growth and high teens backlog growth.

- ITT finalized a multi-year contract renewal with Boeing, featuring a high double-digit price adjustment that is expected to significantly improve aerospace profitability for the CCT segment.

- ITT Inc. reported Q4 2025 adjusted earnings per share (EPS) of $1.85 and full year 2025 adjusted EPS of $6.72. The company achieved Q4 revenue growth of 13% (9% organic) and full year revenue growth of 8% (5% organic).

- The company demonstrated strong cash flow generation, with full year operating cash flow of $669 million (17% margin) and free cash flow of $555 million (14% free cash flow margin), marking a 27% increase in free cash flow year-over-year.

- ITT Inc. announced a 10% increase in its quarterly dividend to $0.386 per share for the first quarter of 2026, payable on April 6, 2026.

- For Q1 2026, the company expects revenue growth of roughly 11% (5% organic) and adjusted EPS between $1.68 and $1.72. This outlook does not include the impact of the pending SPX FLOW acquisition, which is anticipated to close in Q1 2026.

- ITT reported Q4 2025 EPS of $1.64 and Adjusted EPS of $1.85, with revenue growth of 13% (9% organic).

- For the full year 2025, the company achieved EPS of $6.11 and Adjusted EPS of $6.72, alongside 8% revenue growth (5% organic) and a 27% increase in free cash flow to $555 million.

- The company announced a 10% increase in its quarterly dividend to $0.386 per share, payable on April 6, 2026.

- ITT provided Q1 2026 guidance for EPS between $1.67 and $1.71 and Adjusted EPS between $1.68 and $1.72, with expected revenue growth of approximately 11% (5% organic).

- The announced acquisition of SPX FLOW is expected to close in Q1 2026, which is anticipated to accelerate ITT's strategic shift towards higher-growth, higher-margin businesses.

Fintool News

In-depth analysis and coverage of ITT.

Quarterly earnings call transcripts for ITT.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more