Earnings summaries and quarterly performance for IDEX CORP /DE/.

Executive leadership at IDEX CORP /DE/.

Eric Ashleman

Chief Executive Officer and President

Akhil Mahendra

Interim Chief Financial Officer

Lisa Anderson

Senior Vice President, General Counsel and Corporate Secretary

Melissa Flores

Senior Vice President and Chief Human Resources Officer

Roopa Unnikrishnan

Senior Vice President, Chief Strategy and Innovation Officer

Board of directors at IDEX CORP /DE/.

Alejandro Quiroz

Director

Carl Christenson

Director

Katrina Helmkamp

Non-Executive Chair of the Board

Lakecia Gunter

Director

Mark Beck

Director

Mark Buthman

Director

Matthijs Glastra

Director

Paris Watts-Stanfield

Director

Stephanie Disher

Director

Research analysts who have asked questions during IDEX CORP /DE/ earnings calls.

Deane Dray

RBC Capital Markets

11 questions for IEX

Vladimir Bystricky

Citigroup

11 questions for IEX

Joseph Giordano

TD Cowen

10 questions for IEX

Brett Linzey

Mizuho Securities

8 questions for IEX

Michael Halloran

Baird

8 questions for IEX

Andrew Buscaglia

BNP Paribas

7 questions for IEX

Nathan Jones

Stifel, Nicolaus & Company, Incorporated

7 questions for IEX

Bryan Blair

Oppenheimer

6 questions for IEX

Matt Summerville

D.A. Davidson & Co.

4 questions for IEX

Nathan Jones

Stifel

4 questions for IEX

Robert Wertheimer

Melius Research

4 questions for IEX

Jeffrey Sprague

Vertical Research Partners

3 questions for IEX

Mike Halloran

Robert W. Baird & Co. Incorporated

2 questions for IEX

Rob Wertheimer

Melius Research LLC

2 questions for IEX

Walt Liptak

Seaport Research

2 questions for IEX

Rob Jamieson

TD Cowen

1 question for IEX

Rob Jamison

Vertical Research Partners

1 question for IEX

Recent press releases and 8-K filings for IEX.

- CEO Eric Ashleman says IDEX is about halfway through its “phase three” transformation, following a burst of acquisitions to build its HST (High-Performance Solutions) segment and targeting continued margin expansion.

- The HST segment delivered 34% organic order growth in Q4 and management guides to mid-single-digit order growth in FY2026.

- CFO Sean Gillen expects to maintain ~$75 million per quarter in share repurchases in FY2026 alongside selective bolt-on M&A, with longer-term cash flow redeployed into acquisitions as leverage permits.

- IDEX emphasizes a local manufacturing model, recently expanding with two incubation campuses in India to serve regional markets and leverage shared R&D and sourcing.

- The company is accelerating digital initiatives—centralizing customer-facing tools across its decentralized businesses—and exploring AI to transition from person-dependent sales to digital-first engagement.

- IDEX is halfway through phase three of its strategic evolution launched in 2020, focused on integrating acquisitions in the HST segment, which delivered 34% organic order growth in Q4 and is positioned for further momentum in 2026.

- The company entered 2026 with a backlog over $100 million higher year-over-year, with about 50% in data center projects and the remainder diversified across space/defense and pharmaceutical applications.

- Near-term capital deployment will blend ~$75 million quarterly share repurchases with bolt-on M&A, shifting longer term toward larger acquisitions as integration completes.

- In the FMT segment, water monitoring grew double digits in Q4 and mining demand remains strong, offset by weakness in energy and agriculture; margins are expected to be flat as price and productivity gains offset volume headwinds.

- In Phase Three since 2020, IDEX is focused on integrating newly acquired HST businesses, achieving 34% organic order growth in Q4 and positioning HST for mid-single-digit revenue growth in FY 2026 with a backlog >$100 million higher than a year ago.

- CFO Sean Gillen (joined Jan 2026) plans bolt-on M&A similar to Micro-LAM, alongside ~$75 million quarterly share repurchases in the near term, with longer-term capital prioritized for M&A based on cash flow and leverage.

- IDEX is accelerating digital transformation in its FMT segment, shifting from relationship-based to digital-first customer engagement, and testing AI for market analysis, internal data insights, R&D simulation, and quality assurance.

- Segment dynamics: FMT sees strength in water and mining, offsetting weakness in agriculture, chemicals, and energy, while FSDP faces softness in international fire & safety and U.S. dispensing, leading to a flat margin outlook for FMT in FY 2026.

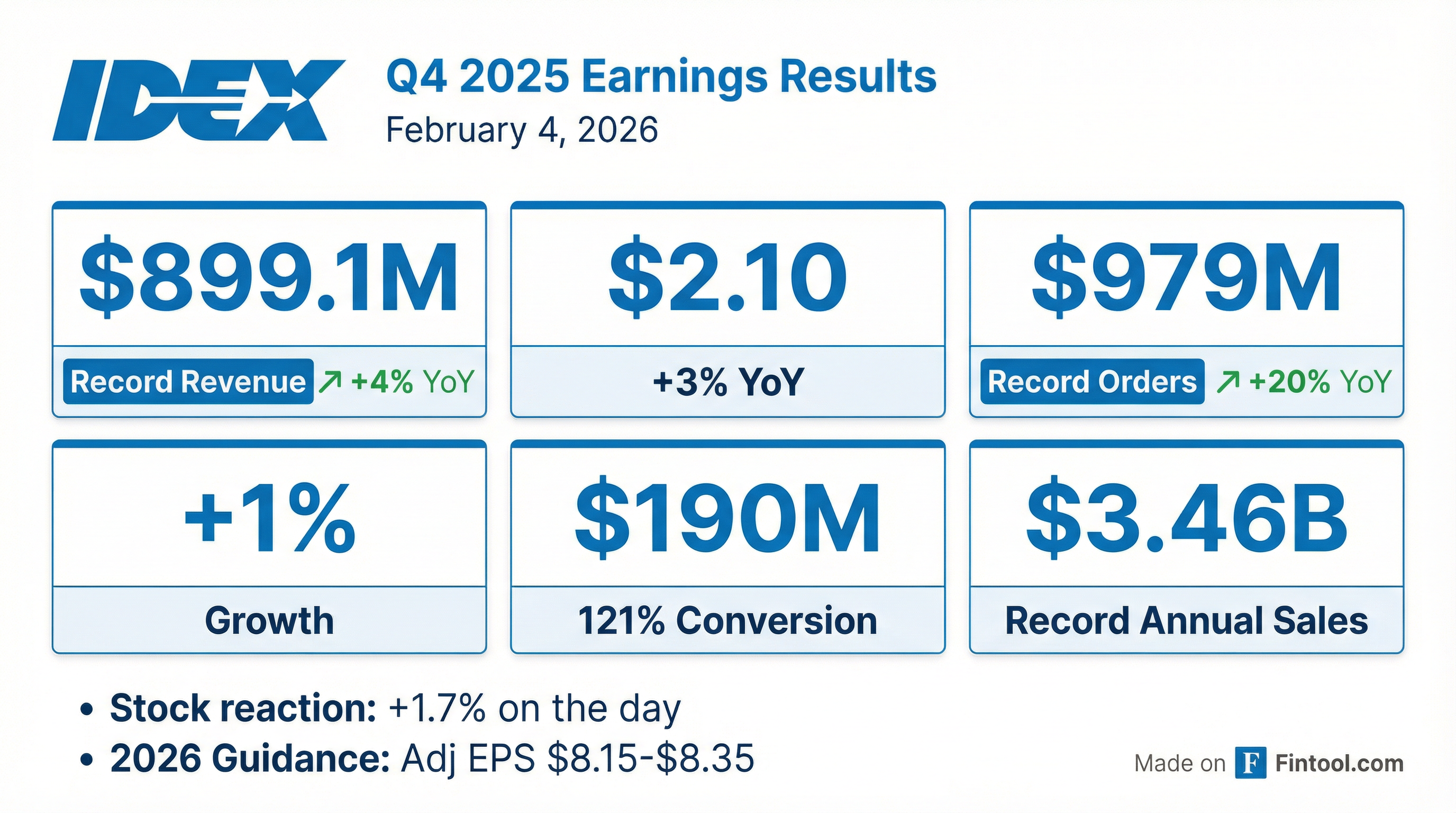

- Organic revenue growth of 1% and adjusted EBITDA margin up 40 bps YoY in Q4; free cash flow of $617 m (103% of adj. NI) in FY 2025; $73 m in share repurchases in Q4

- HST segment: Q4 organic orders +34% to $493 m, organic sales +5%, and adj. EBITDA margin +60 bps YoY

- FMT segment: Q4 organic orders +4%, sales +1%, adj. EBITDA margin –20 bps; FSDP segment: orders flat, sales –5%, adj. EBITDA margin +50 bps

- 2026 guidance: organic growth 1–2%, adj. EBITDA margin 26.5–27%, adj. EPS $8.15–8.35; Q1 ’26 organic ~1%, adj. EBITDA margin ~24.5%, EPS $1.73–1.78

- Capital allocation: maintain investment-grade rating, continue organic investments and bolt-on M&A, return capital via dividends (30–35% of adj. NI) and share repurchases

- IDEX delivered 1% organic revenue growth, 40 bps adjusted EBITDA margin expansion, and beat its EPS guidance in Q4 2025.

- The Health & Science Technologies segment saw 34% organic order growth, 5% revenue growth, and 60 bps margin expansion; Fluid & Metering Tech had 4% order growth, 1% sales growth, and a 20 bps margin decline; Fire, Safety & Dispensing orders were flat with 5% sales decline and 50 bps margin improvement.

- IDEX generated $190 M free cash flow in Q4 and $617 M for FY 2025 (103% cash conversion), ended with $1.1 B liquidity, and repurchased $73 M of shares in Q4 (total $250 M in 2025).

- For FY 2026, the company forecasts 1–2% organic growth, 26.5–27% EBITDA margin, and $8.15–8.35 EPS with a ~24% tax rate.

- IDEX reported Q4 revenues of $899 M, +1% organic, and adjusted EPS of $2.10, +3% y/y, with adj. EBITDA margin expanding 40 bps to 26.8%.

- Health & Science Technologies segment delivered record orders up 34% organic to $493 M and sales +5% organic to $408 M, with adj. EBITDA margin at 27.0% (+60 bps).

- Free cash flow conversion was 121% for Q4 and 101% for FY25, supporting balanced, returns-focused capital deployment.

- FY26 outlook guides 1–2% organic revenue growth, adjusted EBITDA margin of 26.5–27.0%, and adjusted EPS of $8.15–8.35.

- Sean Gillen joined as CFO in January, bringing over seven years of CFO experience at AAR Corp and a track record in operational efficiencies and disciplined capital allocation.

- In Q4 2025, organic revenue grew 1% and organic orders rose 16%, led by the Health & Science Technologies segment’s record $493 million in orders (+34% organically).

- Adjusted EBITDA margin expanded 40 bps year-over-year, with segment margin moves of +60 bps at HST, -20 bps at Fluid & Metering Technologies, and +50 bps at Fire, Safety & Specialty Products; adjusted EPS exceeded the guided range.

- Free cash flow was $190 million in Q4 and $617 million for FY 2025 (103% conversion), liquidity was $1.1 billion, and the company repurchased $73 million of shares in Q4 (total $250 million in 2025).

- For FY 2026, IDEX guides 1–2% organic growth, 26.5–27% adjusted EBITDA margin, an effective tax rate of 24%, and $8.15–8.35 in adjusted EPS; Q1 2026 outlook includes ~1% organic growth, 24.5% margin, and $1.73–1.78 EPS.

- IDEX delivered record Q4 sales of $899.1 million (+4% reported, +1% organic) and record orders of $979.2 million (+20% reported, +16% organic).

- Q4 reported diluted EPS rose to $1.71 (+6%), while adjusted diluted EPS reached $2.10 (+3%).

- FY 2025 net sales were $3.458 billion (+6% reported, +1% organic); adjusted diluted EPS was $7.95 (+1%); operating cash flow was $680.4 million (+2%) and free cash flow was $616.8 million (+2%), with a 103% conversion rate.

- The company repurchased $73 million of shares in Q4 and $248 million for the full year.

- 2026 outlook: organic sales up 1–2%, full-year adjusted diluted EPS of $8.15–8.35, and Q1 2026 adjusted diluted EPS of $1.73–1.78.

- Record Q4 2025 net sales were $899 million, up 4% reported and 1% organically; reported diluted EPS was $1.71 (+6%) and adjusted diluted EPS was $2.10 (+3%).

- Full-year 2025 net sales reached $3.46 billion (+6% reported, +1% organic); adjusted diluted EPS was $7.95 (+1%) and free cash flow was $617 million (103% conversion).

- Q4 orders hit a record $979 million (+20% reported, +16% organic), driving full-year orders of $3.56 billion (+12% reported, +6% organic).

- IDEX repurchased $73 million of shares in Q4 and $248 million for the full year 2025.

- 2026 outlook calls for 1–2% organic sales growth, adjusted diluted EPS of $8.15–8.35, Q1 2026 organic sales up ~1% and adjusted EPS of $1.73–1.78.

- IDEX delivered 5% organic sales growth, 7% order growth, and 40 bps adjusted EBITDA margin expansion in Q3 2025, led by strong HST performance.

- The Health & Science Technology segment posted 10% sales growth, 5% orders growth, and 120 bps margin expansion on volume leverage, platform savings, and pricing actions.

- Fluid & Metering Technologies remained flattish, while Fire & Safety/Diversified Products faced headwinds from funding disruptions and subdued replenishment spend.

- Free cash flow reached $189 million (123% of adjusted net income), and IDEX repurchased $75 million of shares in the quarter, totaling $175 million year-to-date.

- Management continues to apply its 80/20 discipline and integrate recent acquisitions (e.g., Microlam, Nexsight, Subterra) to target advantaged markets such as water, data centers, and material science.

Fintool News

In-depth analysis and coverage of IDEX CORP /DE/.

Quarterly earnings call transcripts for IDEX CORP /DE/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more