Earnings summaries and quarterly performance for Parker-Hannifin.

Executive leadership at Parker-Hannifin.

Jennifer A. Parmentier

Chief Executive Officer

Andrew D. Ross

President and Chief Operating Officer

Joseph R. Leonti

Executive Vice President, General Counsel and Secretary

Patrick M. Scott

Vice President and President – Fluid Connectors Group

Todd M. Leombruno

Executive Vice President and Chief Financial Officer

Board of directors at Parker-Hannifin.

Beth A. Wozniak

Director

Denise Russell Fleming

Director

E. Jean Savage

Director

James L. Wainscott

Lead Independent Director

James R. Verrier

Director

Kevin A. Lobo

Director

Lance M. Fritz

Director

Laura K. Thompson

Director

Linda A. Harty

Director

Research analysts who have asked questions during Parker-Hannifin earnings calls.

Jeffrey Sprague

Vertical Research Partners

8 questions for PH

Andrew Obin

Bank of America

7 questions for PH

Jamie Cook

Truist Securities

7 questions for PH

Julian Mitchell

Barclays Investment Bank

7 questions for PH

Scott Davis

Melius Research

6 questions for PH

Amit Mehrotra

UBS

5 questions for PH

Mircea Dobre

Robert W. Baird & Co.

5 questions for PH

David Raso

Evercore ISI

4 questions for PH

Joseph O'Dea

Wells Fargo

4 questions for PH

Joseph O'Dea

Wells Fargo & Company

4 questions for PH

Joseph Ritchie

Goldman Sachs

4 questions for PH

Nigel Coe

Wolfe Research, LLC

4 questions for PH

Andrew Kaplowitz

Citigroup

3 questions for PH

Brett Linzey

Mizuho Securities

3 questions for PH

Christopher Snyder

Morgan Stanley

3 questions for PH

Andy Kaplowitz

Citigroup Inc.

2 questions for PH

Joe Ritchie

Goldman Sachs

2 questions for PH

Nicole DeBlase

BofA Securities

2 questions for PH

Stephen Tusa

J.P. Morgan

2 questions for PH

Andrew Ross

Barclays

1 question for PH

Brett Lindsey

Mizuho

1 question for PH

Jeffrey D. Hammond

KeyBanc Capital Markets Inc

1 question for PH

Joe O'Dea

Wells Fargo

1 question for PH

Jose

Citi

1 question for PH

Joseph Giordano

TD Cowen

1 question for PH

Matthew Laflash

Barclays

1 question for PH

Nathan Jones

Stifel

1 question for PH

Nathan Jones

Stifel, Nicolaus & Company, Incorporated

1 question for PH

Nicole DiBlasi

Deutsche Bank

1 question for PH

Nigel Kelly

Wolfe Research

1 question for PH

Stephen Volkmann

Jefferies

1 question for PH

Timothy Thein

Raymond James

1 question for PH

Vivek Srivastava

Wolfe Research

1 question for PH

Recent press releases and 8-K filings for PH.

- Parker-Hannifin’s orders rebounded in Q2, with aerospace organic growth in double digits for the fourth consecutive year and North American industrial orders up 7%, driven by both long- and short-cycle markets.

- FY 2026 guidance set at 5% organic growth at the midpoint, within the 4–6% long-term framework, supported by robust aerospace demand and early signs of industrial recovery.

- Achieved the 27% segment operating margin target three years ahead of schedule, propelled by aerospace performance, Meggitt synergies and operational excellence in industrial businesses.

- Announced the planned $220 million synergy Filtration Group acquisition, with an established biweekly senior integration process to capture cost and market opportunities.

- Maintains strong capital discipline, executing record share repurchases and committing to a 2.5% of sales CapEx program focused on productivity and safety.

- Positive order trends: Aerospace orders achieved a fourth consecutive year of double-digit organic growth, while industrial orders turned positive—North America up 7%—leading to FY2026 organic growth guidance of 5% midpoint within a 4-6% long-term framework.

- Tariff and cost management: Employs a total cost coverage approach—local-for-local manufacturing, dual sourcing, and disciplined pricing—to absorb tariff impacts with no expected margin or EPS degradation.

- M&A and integration: Accelerated realization of Meggitt synergies and advancing the Filtration Group acquisition with $220 million of targeted synergies, driven by bi-weekly senior-level cross-functional integration teams.

- Margin and financial targets: On track for 27–27.4% adjusted segment operating margin in FY2026 (three years ahead of plan) and reiterates FY2029 goals of 4–6% organic growth, 27% operating margin, 28% EBITDA margin, 10%+ EPS CAGR, and 17% free cash flow conversion.

- Industrial orders in North America turned positive to +7%, driven by both longer-cycle and shorter-cycle markets; management emphasizes local-for-local manufacturing and dual sourcing to mitigate tariffs and input-cost inflation.

- Aerospace segment delivers fourth consecutive year of double-digit organic growth, with aftermarket mix around 50% and record margins, underpinned by deeper customer partnerships and strengthened supply-chain capabilities.

- For FY2026, Parker-Hannifin guides to 5% organic growth at midpoint (within its 4–6% target range) and reaffirms a 27% adjusted segment operating-margin, achieved three years ahead of schedule, while upholding FY2029 goals of 10%+ EPS CAGR and 17% free-cash-flow conversion.

- The company advances its M&A agenda: Meggitt integration outpaces synergy targets via biweekly senior-level reviews, and the pending Filtration Group deal—expected to generate $220 million in synergies—will create one of the largest industrial filtration platforms.

- Management sees a gradual industrial recovery with positive momentum in power generation, construction and distributorship restocking, alongside early organic-growth inflections in Asia Pacific and Europe following prolonged declines.

- Parker Hannifin is guiding to $21 billion in sales for fiscal 2026, with a balanced portfolio split—31% aerospace, 30% international and 40% North America—and nearly equal end-market exposure across its four technology platforms.

- Over the past decade, the company delivered a 6% revenue CAGR, 1,150 bps of margin expansion, 16% EPS CAGR and 10% cash‐flow CAGR, driven 60% by its Win Strategy and 40% by five strategic acquisitions (Clarcor, LORD, Exotic, Meggitt, Curtiss).

- Aerospace organic growth is in its third year of double‐digit increases, and Diversified Industrial orders have turned positive, prompting a raise in full-year industrial organic growth guidance to 2.5%.

- M&A remains a core growth lever: Parker Hannifin expects to close its acquisition of Filtration Group later in the year and continues to target bolt-on businesses with superior growth profiles.

- Guidance for FY2026 sales of $21 billion, with end markets balanced across aerospace (31%) and diversified industrial segments (international ~30%, North America ~40%).

- Industrial orders have turned positive, driving a raise in organic growth guidance to 2.5%, with strength in in-plant equipment, highway, mining and construction, while transportation remains soft.

- Aerospace organic growth at double-digit for a third consecutive year, backed by record backlog and a 50/50 aftermarket-OEM mix, with no expected margin drag from OE production ramps.

- Win Strategy delivers sustained margin expansion, with 10-year performance including 6% revenue CAGR, +1,150 bps margin expansion, 16% EPS CAGR and a CapEx increase to 2.5% of sales to support automation and capacity.

- M&A momentum continues, integrating Curtis as planned and targeting the pending Filtration Group acquisition, following previous deals (CLARCOR, LORD, Exotic, Meggitt, Curtis) to add faster-growing businesses.

- Guides to $21 billion in sales for fiscal 2026 with end-market exposure split: aerospace & defense 35%, plant & industrial equipment 20%, transportation 15%, off-highway 13%.

- Industrial orders have turned positive, driving a raised organic growth target of 2.5% (up from 1% to 2% earlier) for the year.

- Over the past decade, the company delivered a 6% revenue CAGR, expanded margins by 1,150 bps, achieved a 16% EPS CAGR and grew cash flow at 10% CAGR under its decentralized “Win Strategy”.

- Six bolt-on acquisitions (CLARCOR, LORD, Exotic, Meggitt, Curtis and others) have been integrated, with the pending Filtration Group deal set to boost filtration aftermarket exposure by 500 bps.

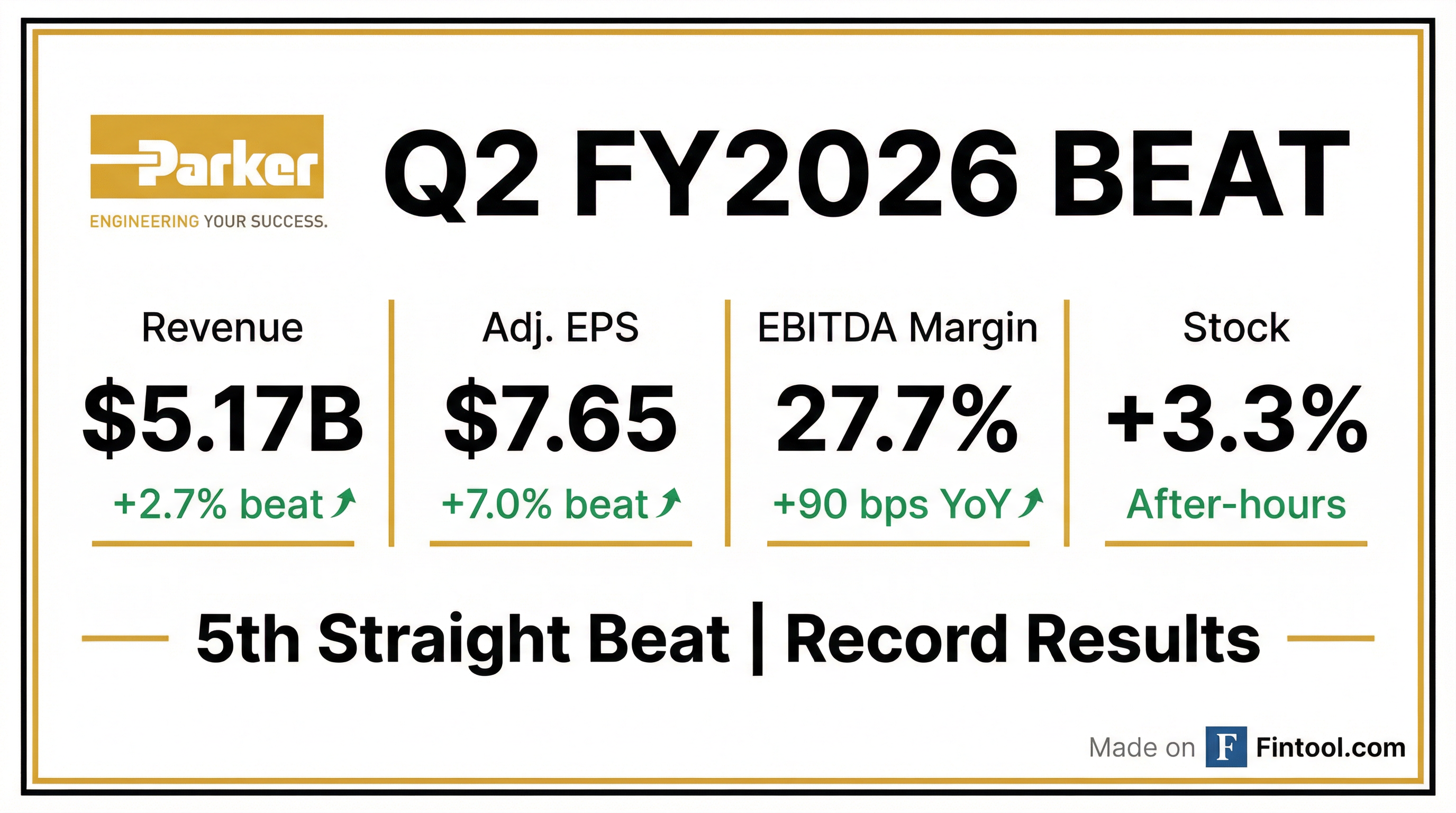

- Parker Hannifin posted record Q2 sales of $5.2 billion, delivered 6.6% organic growth, expanded adjusted segment operating margin by 150 bps to 27.1%, and generated $7.65 EPS (+17%) and $1.6 billion operating cash flow

- The company agreed to acquire Filtration Group Corporation, expecting close in 6–12 months, adding $220 million in cost synergies and boosting filtration aftermarket sales by 500 bps

- Full-year 2026 guidance was raised: EPS to $30.70, adjusted segment operating margin to 27.2%, and free cash flow to $3.2–3.6 billion; Q3 sales are guided to $5.4 billion with 5% organic growth and 27% margin

- Aerospace Systems achieved record Q2 sales of $1.7 billion (+14.5%), 30.2% margin, and backlog reached $8 billion

- Record Q2 sales of $5.2 billion, with organic growth of 6.6% and $1.6 billion of operating cash flow.

- Adjusted segment operating margin expanded 150 bps to 27.1%, and adjusted EPS rose 17% to $7.65.

- YTD free cash flow of $1.5 billion (14.2% of sales), supporting commitment to >100% cash flow conversion.

- Raised FY2026 guidance: organic sales growth to 4–6% (midpoint 5%), reported sales to 5.5–7.5%, adjusted EPS to $30.70, and free cash flow to $3.2–3.6 billion.

- Announced acquisition of Filtration Group Corporation, targeting $220 million in cost synergies and expected to close in 6–12 months.

- Delivered record Q2 sales of $5.2 B (+9% reported; +6.6% organic), 27.1% adjusted segment operating margin (+150 bps), $7.65 adjusted EPS (+17%), and $1.6 B operating cash flow.

- Achieved all-time high margins across segments: North America sales of ~$2 B (+2.5% organic; 25.4% margin) , International sales of $1.5 B (+4.6% organic; 26.0% margin) and Aerospace Systems sales of $1.7 B (+13.5% organic; 30.2% margin; $8 B backlog).

- Raised full-year 2026 guidance: reported sales up 5.5%–7.5% (6.5% midpoint), organic growth 4%–6% (5% midpoint), adjusted segment operating margin 27.2%, adjusted EPS $30.70, and free cash flow $3.2 B–$3.6 B.

- Announced acquisition of Filtration Group, planning to close in 6–12 months with integration underway and targeting $220 M of cost synergies by year three.

- Record Q2 FY26 sales of $5.2 billion, up 9% reported and 6.6% organic year-over-year

- Adjusted segment operating margin of 27.1%, a 150 bps increase from Q2 FY25

- Adjusted EPS of $7.65, up 17% from $6.53 in Q2 FY25

- Adjusted EBITDA of $1.431 billion, representing a 27.7% margin, up 90 bps year-over-year

- Announced acquisition of Filtration Group Corporation

Quarterly earnings call transcripts for Parker-Hannifin.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more