Earnings summaries and quarterly performance for EMERSON ELECTRIC.

Research analysts who have asked questions during EMERSON ELECTRIC earnings calls.

Deane Dray

RBC Capital Markets

8 questions for EMR

Nigel Coe

Wolfe Research, LLC

7 questions for EMR

Andrew Kaplowitz

Citigroup

6 questions for EMR

Andrew Obin

Bank of America

5 questions for EMR

Jeffrey Sprague

Vertical Research Partners

5 questions for EMR

Julian Mitchell

Barclays Investment Bank

5 questions for EMR

Joseph O'Dea

Wells Fargo & Company

4 questions for EMR

Scott Davis

Melius Research

4 questions for EMR

Brett Linzey

Mizuho Securities

3 questions for EMR

C. Stephen Tusa

JPMorgan Chase & Co.

3 questions for EMR

Steve Tusa

JPMorgan Chase & Co.

3 questions for EMR

Amit Mehrotra

UBS

2 questions for EMR

Andrew Buscaglia

BNP Paribas

2 questions for EMR

Andy Kaplowitz

Citigroup Inc.

2 questions for EMR

Chigusa Katoku

JPMorgan Chase & Co.

2 questions for EMR

David Ridley-Lane

Bank of America

2 questions for EMR

Christopher Glynn

Oppenheimer & Co. Inc.

1 question for EMR

Katie Fleischer

KeyBanc Capital Markets

1 question for EMR

Nicole DeBlase

BofA Securities

1 question for EMR

Saree Boroditsky

Jefferies

1 question for EMR

Recent press releases and 8-K filings for EMR.

- Order intake accelerated, with trailing 3-month orders up 9% and backlog growth of 9%, driven by five growth vectors: power generation, LNG, semiconductors, life sciences, and aerospace & defense, led by the U.S. and select international markets.

- 2026 software ACV grew 9% in Q1, with expectations for high single-digit growth in Q2 and 10%+ for full-year 2026, despite a 2-point headwind from first-half software renewals.

- Organic sales guidance assumes mid-single-digit underlying order rates, with no recovery expected in China and continued weakness in Europe factored into the outlook.

- Pricing remains positive, with 2.5 points of price realization planned, supporting a 52%+ gross margin, and operating leverage targets of 40% on incremental profit improvements.

- Capital allocation prioritizes dividends and share buybacks, while pursuing only strategic bolt-on M&A to support growth in key verticals.

- Emerson reported a 9% increase in trailing three-month orders and 6% in trailing twelve-month orders, with backlog up 9%, driven by strength in five growth verticals—LNG, semiconductors, life sciences, aerospace & defense—and concentrated in the US and Arabian Peninsula.

- Management reiterated organic sales guidance assuming mid-single-digit underlying order rates (after a 2% software renewal drag) and acceleration in the back half of fiscal 2026, explicitly excluding reliance on a China recovery or European macro rebound.

- The software business, with $1.6 billion in annual contract value, grew ACV by 9% in Q1 and is expected to deliver high-single-digit ACV growth in Q2 and 10%+ growth for full-year 2026, boosted by AI-enabled solutions like the Nigel Virtual Advisor.

- Emerson aims for 40% operating leverage and 240 basis points of margin expansion, underpinned by 2.5% annual pricing power and productivity initiatives despite ongoing cost inflation.

- Capital allocation will prioritize dividends and share repurchases, with selective bolt-on M&A in key verticals while maintaining a disciplined approach to sustain 4-7% through-cycle growth.

- Emerson reported 9% trailing three-month order growth, 6% trailing twelve-month order growth and a 9% backlog increase, driven by five growth vectors (power gen/LNG, semiconductor, life sciences, aerospace & defense) across the U.S., Arabian Peninsula, Brazil, Japan and Southeast Asia; orders are expected to moderate to mid-single-digit levels, with no recovery assumed in China and continued weakness in Europe.

- In the U.S., Ovation automation orders jumped 74% and total power business revenues rose 20%, fueled by data center modernizations, a cyclical semiconductor rebound, aerospace/defense/New Space opportunities and life sciences expansion, while automotive and bulk chemicals remain weak.

- Emerson’s DeltaV control systems now operate over 50% of the world’s liquefied natural gas plants, and the current LNG investment wave—half of which is yet to be awarded—is larger than the first two waves combined, reinforcing its strategic position in global energy projects.

- The company’s $1.6 billion annual contract value software business grew 9% in Q1, with high-single-digit growth expected in Q2 and >10% ACV growth forecast for 2026; Emerson cites three moats against AI threats (vertical domain expertise, real-time/traceability in regulated industries, usage-based pricing) and has secured over $100 million in quotations for its Virtual Advisor offerings.

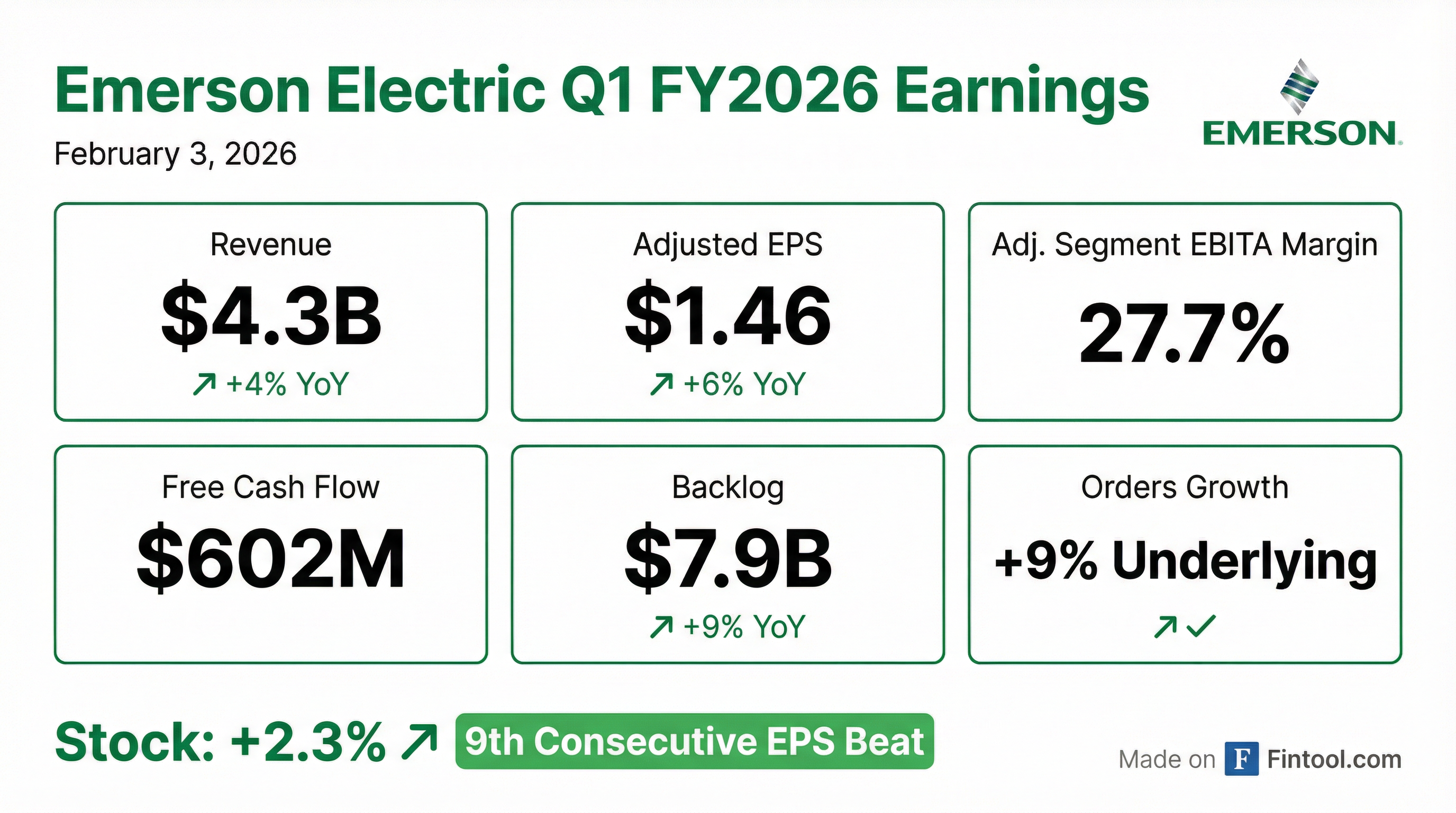

- Emerson delivered $4.3B in Q1 sales, with 2% underlying sales growth and $1.46 adjusted EPS.

- Adjusted segment EBITA margin was 27.7%, and free cash flow totaled $602M (13.9% margin).

- Underlying orders grew 9% YoY, and annual contract value (ACV) reached $1.6B, up 9%.

- Raised full-year 2026 guidance to ~5.5% sales growth (~4% underlying), ~28% adjusted EBITA margin, and $6.40–$6.55 adjusted EPS; plans ~$1B share repurchase and 5% dividend increase.

- Robust demand drove underlying orders up 9% year-over-year in Q1, marking four consecutive quarters of double-digit order growth.

- Underlying sales rose 2% YoY, with an adjusted segment EBITDA margin of 27.7% and adjusted EPS of $1.46.

- Annual Contract Value of software expanded 9% to $1.6 billion, reflecting continued strength in subscription-based offerings.

- Emerson reaffirmed 2026 guidance: 5.5% sales growth, 4% underlying sales growth, ~28% EBITDA margin, and raised adjusted EPS to $6.40–$6.55.

- Returned capital to shareholders via $250 million of share repurchases in Q1, part of a plan to deliver approximately $2.2 billion in dividends and buybacks.

- Underlying orders grew 9% in Q1, with backlog at $7.9 billion (up 9% yoy) and a book-to-bill of 1.13.

- Underlying sales rose 2% yoy; test & measurement increased 11% and Ovation accelerated 20%; adjusted segment EBITDA margin was 27.7%, and adjusted EPS was $1.46.

- Software Annual Contract Value reached $1.6 billion (up 9% yoy); next-generation Nigel AI and DeltaV version 16 were released to enhance software-enabled automation.

- Completed $250 million of share repurchases in Q1; reaffirmed full-year guidance of 5.5% sales growth, ~28% EBITDA margin, and raised EPS to $6.40–$6.55; targeting $2.2 billion in shareholder returns.

- Regional demand remained robust in North America, India, and the Middle East & Africa, while Europe and China continued to soften.

- Underlying orders grew 9%, and underlying sales increased 2% year-over-year.

- Adjusted segment EBITDA margin was 27.7%, with adjusted EPS of $1.46, up 6% year-over-year.

- Annual Contract Value of software reached $1.6 billion, up 9% year-over-year.

- Free cash flow of $602 million (14% margin) and $250 million of share repurchases executed in Q1.

- Full-year guidance reiterated: 5.5% sales growth (4% underlying), 28% EBITDA margin, $6.40–$6.55 EPS; Q2 EPS guided at $1.50–$1.55.

- Emerson reported Q1 FY2026 net sales of $4.346 billion (up 4% yoy), with underlying orders growth of 9% and underlying sales up 2%.

- GAAP EPS was $1.07, and adjusted EPS was $1.46, increases of 5% and 6% year-over-year, respectively.

- Q1 operating cash flow was $699 million and free cash flow was $602 million.

- The quarterly dividend was set at $0.555 per share, payable March 10, 2026; Emerson plans to return ~$2.2 billion in 2026 through ~$1.0 billion in share repurchases and ~$1.2 billion in dividends.

- For fiscal 2026, the company expects ~5.5% net sales growth, adjusted EPS of $6.40–$6.55, operating cash flow of $4.0–$4.1 billion, and free cash flow of $3.5–$3.6 billion.

- Emerson posted $4.346 billion in net sales in Q1 FY2026, up 4% year-over-year, with adjusted EPS of $1.46, a 6% increase.

- The board declared a $0.555/share quarterly dividend payable March 10, 2026.

- Fiscal 2026 guidance raised to ~5.5% net sales growth and $6.40–$6.55 in adjusted EPS.

- Capital return includes ~$1 billion in share repurchases and $1.2 billion in dividends for FY 2026.

- 136th Annual Meeting of Shareholders held on February 3, 2026; a quorum was achieved with 495.4 million shares (88% of outstanding) represented in person or by proxy.

- Shareholders voted on four proposals: election of three incumbent directors, advisory approval of FY 2025 executive compensation, ratification of KPMG LLP as independent auditor, and amendment to declassify the board.

- All three director nominees elected, executive compensation approved by ~90%, and KPMG ratification approved by ~92%, while the proposal to declassify the board failed to reach the 85% threshold.

- Executive review highlighted FY 2025 results: sales +3%, operating cash flow +11%, free cash flow +12%, EPS +43%, completion of Aspen Technology and National Instruments acquisitions, and Copeland divestiture.

Fintool News

In-depth analysis and coverage of EMERSON ELECTRIC.

Quarterly earnings call transcripts for EMERSON ELECTRIC.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more