Earnings summaries and quarterly performance for EMERSON ELECTRIC.

Research analysts who have asked questions during EMERSON ELECTRIC earnings calls.

Deane Dray

RBC Capital Markets

8 questions for EMR

Nigel Coe

Wolfe Research, LLC

7 questions for EMR

Andrew Kaplowitz

Citigroup

6 questions for EMR

Andrew Obin

Bank of America

5 questions for EMR

Jeffrey Sprague

Vertical Research Partners

5 questions for EMR

Julian Mitchell

Barclays Investment Bank

5 questions for EMR

Joseph O'Dea

Wells Fargo & Company

4 questions for EMR

Scott Davis

Melius Research

4 questions for EMR

Brett Linzey

Mizuho Securities

3 questions for EMR

C. Stephen Tusa

JPMorgan Chase & Co.

3 questions for EMR

Steve Tusa

JPMorgan Chase & Co.

3 questions for EMR

Amit Mehrotra

UBS

2 questions for EMR

Andrew Buscaglia

BNP Paribas

2 questions for EMR

Andy Kaplowitz

Citigroup Inc.

2 questions for EMR

Chigusa Katoku

JPMorgan Chase & Co.

2 questions for EMR

David Ridley-Lane

Bank of America

2 questions for EMR

Christopher Glynn

Oppenheimer & Co. Inc.

1 question for EMR

Katie Fleischer

KeyBanc Capital Markets

1 question for EMR

Nicole DeBlase

BofA Securities

1 question for EMR

Saree Boroditsky

Jefferies

1 question for EMR

Recent press releases and 8-K filings for EMR.

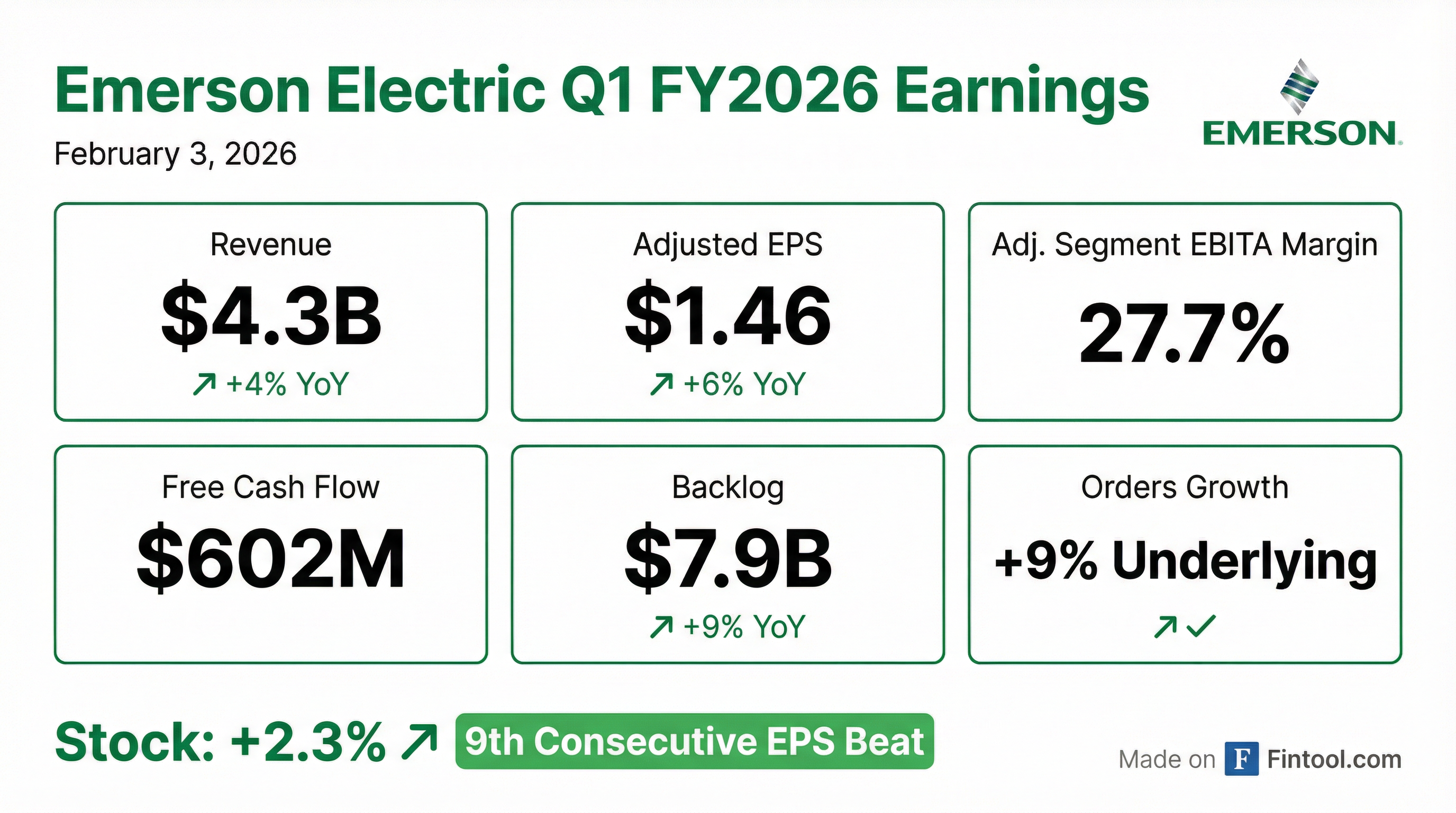

- Emerson delivered $4.3B in Q1 sales, with 2% underlying sales growth and $1.46 adjusted EPS.

- Adjusted segment EBITA margin was 27.7%, and free cash flow totaled $602M (13.9% margin).

- Underlying orders grew 9% YoY, and annual contract value (ACV) reached $1.6B, up 9%.

- Raised full-year 2026 guidance to ~5.5% sales growth (~4% underlying), ~28% adjusted EBITA margin, and $6.40–$6.55 adjusted EPS; plans ~$1B share repurchase and 5% dividend increase.

- Robust demand drove underlying orders up 9% year-over-year in Q1, marking four consecutive quarters of double-digit order growth.

- Underlying sales rose 2% YoY, with an adjusted segment EBITDA margin of 27.7% and adjusted EPS of $1.46.

- Annual Contract Value of software expanded 9% to $1.6 billion, reflecting continued strength in subscription-based offerings.

- Emerson reaffirmed 2026 guidance: 5.5% sales growth, 4% underlying sales growth, ~28% EBITDA margin, and raised adjusted EPS to $6.40–$6.55.

- Returned capital to shareholders via $250 million of share repurchases in Q1, part of a plan to deliver approximately $2.2 billion in dividends and buybacks.

- Underlying orders grew 9% in Q1, with backlog at $7.9 billion (up 9% yoy) and a book-to-bill of 1.13.

- Underlying sales rose 2% yoy; test & measurement increased 11% and Ovation accelerated 20%; adjusted segment EBITDA margin was 27.7%, and adjusted EPS was $1.46.

- Software Annual Contract Value reached $1.6 billion (up 9% yoy); next-generation Nigel AI and DeltaV version 16 were released to enhance software-enabled automation.

- Completed $250 million of share repurchases in Q1; reaffirmed full-year guidance of 5.5% sales growth, ~28% EBITDA margin, and raised EPS to $6.40–$6.55; targeting $2.2 billion in shareholder returns.

- Regional demand remained robust in North America, India, and the Middle East & Africa, while Europe and China continued to soften.

- Underlying orders grew 9%, and underlying sales increased 2% year-over-year.

- Adjusted segment EBITDA margin was 27.7%, with adjusted EPS of $1.46, up 6% year-over-year.

- Annual Contract Value of software reached $1.6 billion, up 9% year-over-year.

- Free cash flow of $602 million (14% margin) and $250 million of share repurchases executed in Q1.

- Full-year guidance reiterated: 5.5% sales growth (4% underlying), 28% EBITDA margin, $6.40–$6.55 EPS; Q2 EPS guided at $1.50–$1.55.

- Emerson reported Q1 FY2026 net sales of $4.346 billion (up 4% yoy), with underlying orders growth of 9% and underlying sales up 2%.

- GAAP EPS was $1.07, and adjusted EPS was $1.46, increases of 5% and 6% year-over-year, respectively.

- Q1 operating cash flow was $699 million and free cash flow was $602 million.

- The quarterly dividend was set at $0.555 per share, payable March 10, 2026; Emerson plans to return ~$2.2 billion in 2026 through ~$1.0 billion in share repurchases and ~$1.2 billion in dividends.

- For fiscal 2026, the company expects ~5.5% net sales growth, adjusted EPS of $6.40–$6.55, operating cash flow of $4.0–$4.1 billion, and free cash flow of $3.5–$3.6 billion.

- Emerson posted $4.346 billion in net sales in Q1 FY2026, up 4% year-over-year, with adjusted EPS of $1.46, a 6% increase.

- The board declared a $0.555/share quarterly dividend payable March 10, 2026.

- Fiscal 2026 guidance raised to ~5.5% net sales growth and $6.40–$6.55 in adjusted EPS.

- Capital return includes ~$1 billion in share repurchases and $1.2 billion in dividends for FY 2026.

- 136th Annual Meeting of Shareholders held on February 3, 2026; a quorum was achieved with 495.4 million shares (88% of outstanding) represented in person or by proxy.

- Shareholders voted on four proposals: election of three incumbent directors, advisory approval of FY 2025 executive compensation, ratification of KPMG LLP as independent auditor, and amendment to declassify the board.

- All three director nominees elected, executive compensation approved by ~90%, and KPMG ratification approved by ~92%, while the proposal to declassify the board failed to reach the 85% threshold.

- Executive review highlighted FY 2025 results: sales +3%, operating cash flow +11%, free cash flow +12%, EPS +43%, completion of Aspen Technology and National Instruments acquisitions, and Copeland divestiture.

- A quorum was established with 88% of outstanding shares represented, enabling the meeting to proceed.

- Incumbents Martin Craighead, Gloria Flach, and Matthew Levatich were re-elected to three-year terms by a substantial majority.

- An advisory vote on 2025 executive compensation passed with ~90% support, and the Audit Committee’s appointment of KPMG was ratified with ~92% in favor.

- The proposal to declassify the board did not reach the required 85% approval threshold and thus failed.

- Emerson highlighted its transformation via the acquisition of Aspen Technology, integration of National Instruments, and the divestiture of Copeland, aligning its automation portfolio with long-term trends.

- At the 136th Annual Meeting, shareholders re-elected incumbents Martin Craighead, Gloria Flach and Matthew Levatich to three-year terms by a substantial majority.

- Advisory vote on FY 2025 executive compensation was approved by approximately 90%, and ratification of KPMG LLP as auditor for FY 2026 passed with ~92%, while the proposal to declassify the board failed to reach the required 85% threshold.

- The company reported FY 2025 results of sales +3%, operating cash flow +11%, free cash flow +12%, EPS +43% and adjusted EPS +9%, and highlighted acquisitions of Aspen Technology and National Instruments coupled with the divestiture of Copeland to strengthen its automation portfolio.

- Final vote tabulations will be filed on Form 8-K within four business days post-meeting.

- At its 2025 Investor Conference, Emerson positioned itself as a global automation leader focused on engineering the autonomous future through innovation and a software-defined technology stack.

- Introduced a through-the-cycle value creation framework targeting 4–7% organic sales growth, 40% incremental margins, 10% adjusted EPS growth, and 18–20% free cash flow margin.

- Set 2028 financial targets of $21 billion in net sales (5% organic CAGR), 30% adjusted segment EBITA margin, $8.00 adjusted EPS (10% CAGR), and $12 billion cumulative free cash flow, with plans to return $10 billion to shareholders.

- Reiterated its 2026 Q1 and full-year outlook as previously provided on November 5, 2025.

Fintool News

In-depth analysis and coverage of EMERSON ELECTRIC.

Quarterly earnings call transcripts for EMERSON ELECTRIC.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more