Earnings summaries and quarterly performance for Woodward.

Research analysts who have asked questions during Woodward earnings calls.

Louis Raffetto

Wolfe Research

8 questions for WWD

Noah Poponak

Goldman Sachs

8 questions for WWD

Scott Mikus

Melius Research

8 questions for WWD

Gautam Khanna

TD Cowen

7 questions for WWD

Gavin Parsons

UBS Group AG

7 questions for WWD

Scott Deuschle

Deutsche Bank

7 questions for WWD

Michael Ciarmoli

Truist Securities, Inc.

6 questions for WWD

Christopher Glynn

Oppenheimer & Co. Inc.

5 questions for WWD

Sheila Kahyaoglu

Jefferies

5 questions for WWD

David Strauss

Barclays

3 questions for WWD

Matthew Akers

Wells Fargo & Company

3 questions for WWD

Peter Skibitski

Alembic Global Advisors

3 questions for WWD

Alexandra Mandery

Truist Securities

2 questions for WWD

Kyle Wenclawiak

Jefferies

2 questions for WWD

George Bancroft

Gabelli Funds

1 question for WWD

Josh Korn

Barclays

1 question for WWD

Sheila Cuygle

Jefferies

1 question for WWD

Spencer Breitzke

TD Cowen

1 question for WWD

Recent press releases and 8-K filings for WWD.

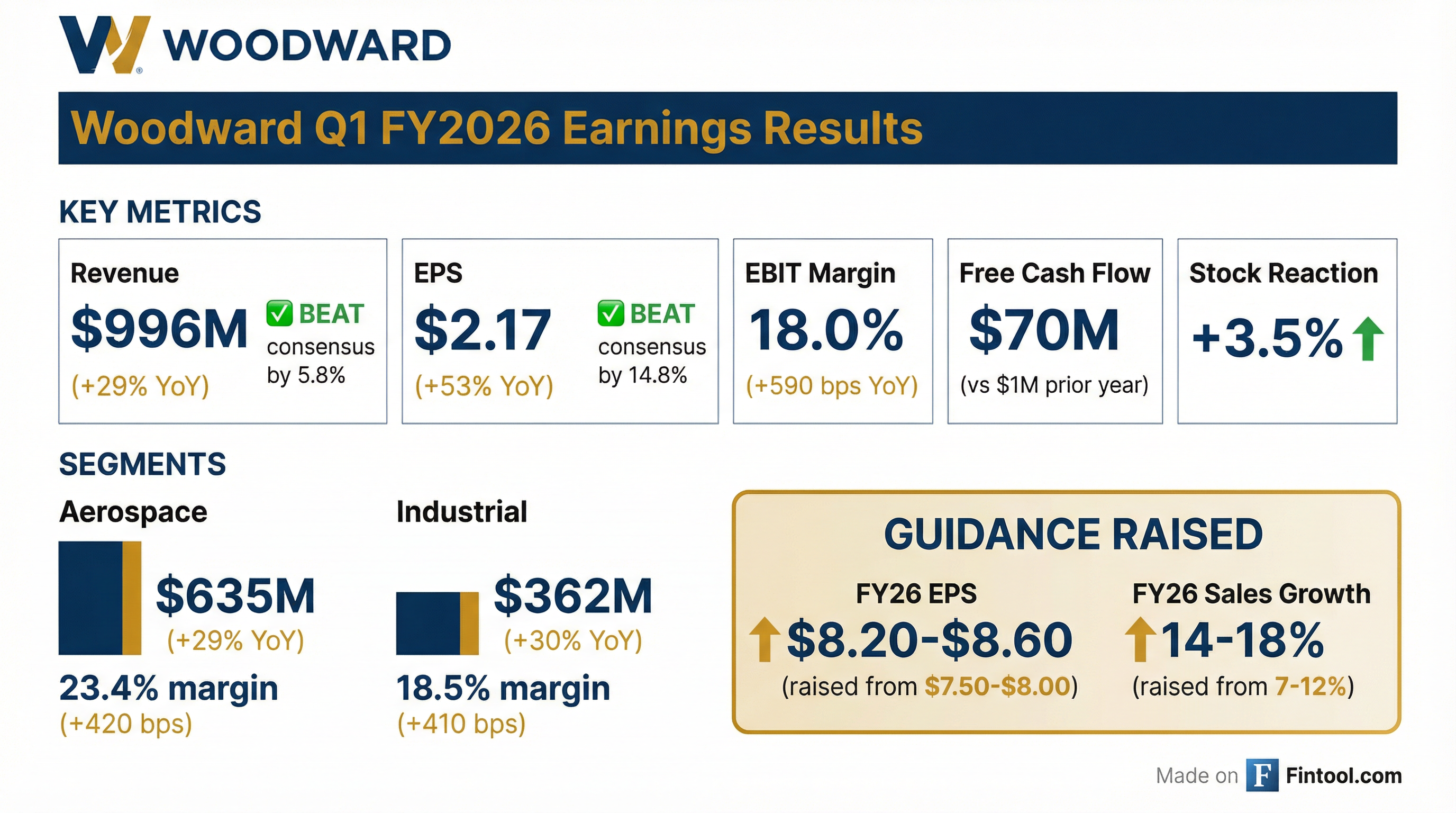

- Woodward (WWD) reported a strong start to fiscal year 2026, with net sales growing 29% year-over-year to $996 million and earnings per share increasing 54% to $2.17 in Q1 2026.

- Both the Aerospace and Industrial segments demonstrated robust growth, with Aerospace sales increasing 29% to $635 million and Industrial sales increasing 30% to $362 million. Both segments also achieved significant margin expansion.

- The company is raising its full-year sales and earnings guidance for fiscal 2026, with aerospace sales growth now expected between 15%-20% and industrial sales growth between 11%-14%. The full-year price expectation has been revised to 7%.

- Woodward announced a strategic decision to wind down its China On-Highway product lines by the end of the fiscal year, anticipating $20 million-$25 million in associated costs.

- Woodward reported a strong start to fiscal 2026, with net sales increasing 29% to $996 million and earnings per share rising 54% to $2.17 in the first quarter.

- The company raised its full-year 2026 guidance, now expecting consolidated sales growth of 14%-18% and EPS between $8.20-$8.60.

- Woodward announced a strategic decision to wind down its China On-Highway product lines by the end of the fiscal year due to inconsistent performance and limited order visibility.

- Despite the strong Q1 performance, the fiscal 2026 free cash flow guidance was reaffirmed at $300 million-$350 million, as the company plans to maintain higher inventory levels to meet customer demand.

- Woodward reported strong Q1 FY26 performance with net sales increasing 29% year-over-year to $996 million and reported net earnings rising 54% to $134 million, resulting in reported EPS of $2.17.

- The company raised its full-year FY26 guidance for sales growth to 14% to 18% (from 7% to 12%) and EPS to $8.20-$8.60 (from $7.50-$8.00).

- Both segments contributed to growth, with Aerospace sales up 29% to $635 million and Industrial sales up 30% to $362 million in Q1 FY26.

- Woodward generated $70 million in Free Cash Flow and returned $146 million to stockholders through dividends and share repurchases in Q1 FY26.

- Woodward Inc. reported strong Q1 fiscal year 2026 net sales of $996 million, a 29% increase, and earnings per share of $2.17.

- The company raised its full-year fiscal year 2026 guidance, now expecting consolidated sales growth of 14%-18% and EPS between $8.20-$8.60. Free cash flow guidance remains unchanged at $300-$350 million.

- A strategic decision was made to wind down the China On-Highway product lines by the end of the fiscal year, citing inconsistent performance and limited order visibility.

- In Q1 2026, Aerospace segment sales increased 29% to $635 million, largely due to a 50% rise in commercial services sales, while Industrial segment sales grew 30% to $362 million.

- Woodward, Inc. reported strong first quarter fiscal year 2026 results for the period ended December 31, 2025, with net sales of $996 million, a 29% increase year-over-year, and earnings per share (EPS) of $2.17, up 53% from the prior year.

- Based on this outperformance, the company is raising its full-year fiscal 2026 sales and earnings guidance.

- The strong performance was attributed to broad-based growth across both Aerospace and Industrial segments, reflecting strong demand and disciplined execution.

- The Aerospace segment's sales increased by 29% to $635 million, with segment earnings growing 57% to $148 million.

- The Industrial segment saw sales increase by 30% to $362 million, and segment earnings rose 67% to $67 million.

- Woodward reported strong first quarter fiscal year 2026 results, with net sales of $996 million, a 29% increase year-over-year, and diluted EPS of $2.17, up 53%.

- The company's performance was driven by broad-based growth across both Aerospace and Industrial segments, contributing to $70 million in free cash flow for the quarter.

- Based on this strong start, Woodward raised its full-year fiscal 2026 guidance, with sales growth now projected to be 14% to 18% and EPS expected to be $8.20 to $8.60.

- Woodward, Inc. announced on January 15, 2026, its decision to wind down its China On-Highway Natural Gas Truck Business (China OH), a strategic move to optimize its Industrial segment portfolio after unsuccessful divestiture efforts.

- This business has not consistently contributed significantly to Woodward's overall financial performance.

- The company expects to incur cumulative pre-tax charges of approximately $20 million to $25 million, with $15 million to $20 million anticipated to result in future cash expenditures.

- The majority of these charges are expected in the second and third quarters of fiscal year 2026, with the wind-down substantially completed by the end of fiscal year 2026.

- Woodward, Inc. reported record performance for the fiscal year ended September 30, 2025, with net sales of $3.6 billion, an increase of 7% year over year.

- Net earnings grew 19% to $442 million, and diluted earnings per share (EPS) increased 20% to $7.19.

- Strategic milestones included the acquisition of an industry-leading electromechanical actuation business and securing its first primary flight control system on a commercial aircraft (Airbus A350).

- Woodward Inc. achieved record annual revenue of $3.6 billion, a 7% increase, and all-time high adjusted earnings per share of $6.89 for fiscal year 2025.

- For fiscal year 2026, the company projects net sales growth between 7% and 12% and adjusted earnings per share between $7.50 and $8.00.

- Strategic investments include breaking ground on a new Spartanburg, South Carolina facility for aerospace production and continued focus on automation, contributing to expected capital expenditures of approximately $290 million in 2026.

- Woodward completed its prior $600 million share repurchase authorization in November 2025 and announced a new $1.8 billion program, planning to return $650-$700 million to shareholders in fiscal year 2026.

- Woodward achieved record net sales of $3.6 billion in fiscal year 2025, marking a 7% increase year-over-year, alongside adjusted earnings per share of $6.89.

- For fiscal year 2026, the company forecasts net sales growth of 7% to 12% and adjusted earnings per share in the range of $7.50 to $8.00.

- The company announced a new $1.8 billion share repurchase program and plans to return $650 million to $700 million to shareholders in fiscal year 2026 through dividends and repurchases.

- Strategic investments in fiscal year 2026 include approximately $290 million in capital expenditures, with $130 million allocated to the new Spartanburg facility and continued automation efforts.

- The Aerospace segment saw 14% sales growth to $2.3 billion in FY 2025, while the Industrial segment's core sales increased 10%, contributing to overall strong performance.

Quarterly earnings call transcripts for Woodward.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more