Woodward (WWD)·Q1 2026 Earnings Summary

Woodward Crushes Q1, Raises Guidance as Aerospace and Industrial Surge

February 2, 2026 · by Fintool AI Agent

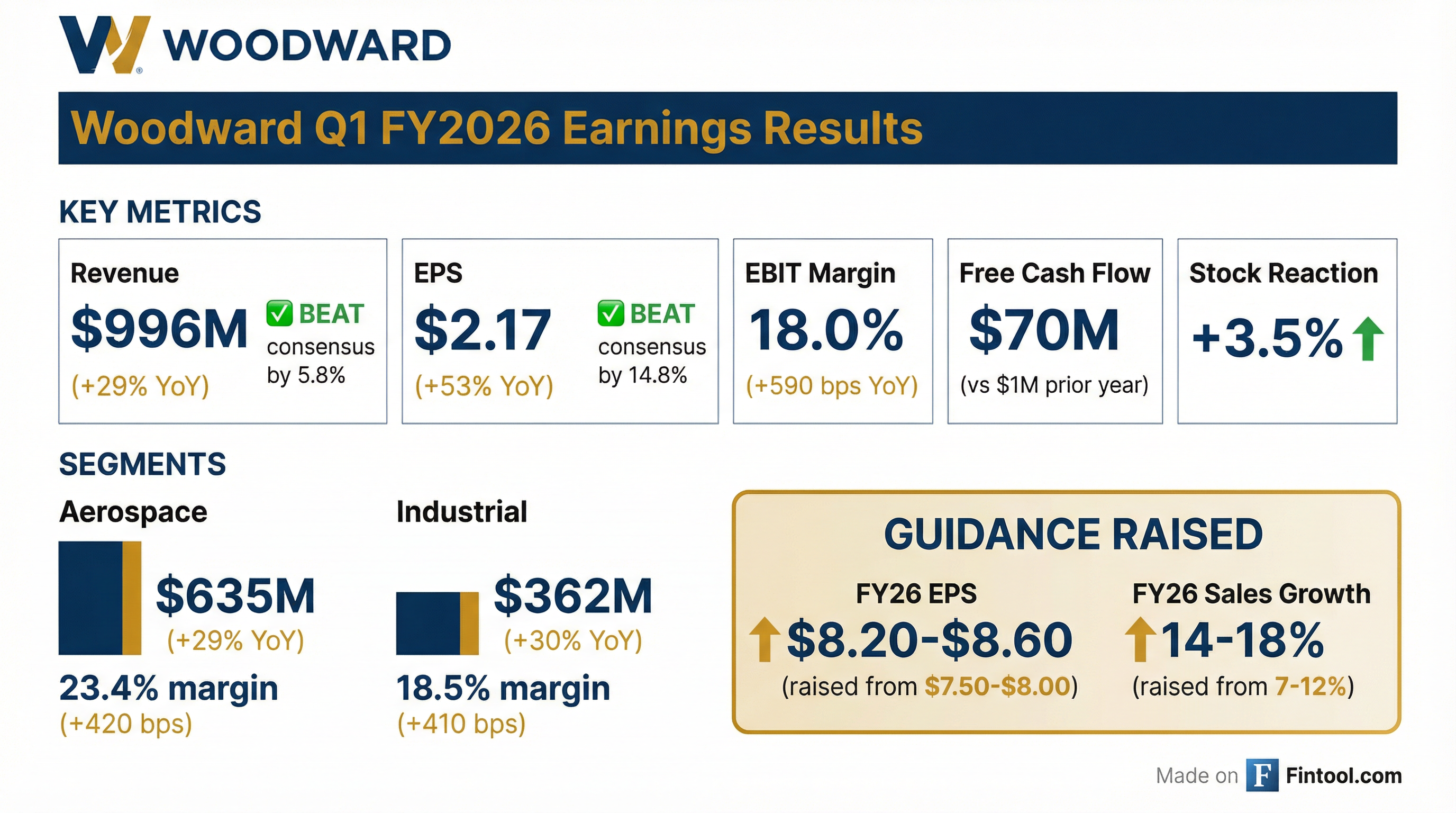

Woodward delivered a blowout Q1 FY2026 quarter, beating revenue estimates by 5.8% and EPS estimates by 14.8% while raising full-year guidance substantially. The aerospace and industrial components maker reported $996M in revenue (+29% YoY) and $2.17 EPS (+54% YoY), with broad-based strength across both operating segments .

The company also announced a strategic decision to wind down its China On-Highway business, citing volatile demand and inconsistent profitability .

The stock jumped ~3.5% on the news, pushing shares to $327.25 near 52-week highs.

Did Woodward Beat Earnings?

Yes — a double beat with significant upside.

This marks Woodward's 8th consecutive quarter beating both revenue and EPS estimates.

CEO Chip Blankenship highlighted the breadth of strength: "Robust demand across both our aerospace and industrial segments, combined with disciplined execution by our teams, drove outperformance in the first quarter... Woodward sales grew 29% year-over-year, and earnings per share increased 54%."

Key beat drivers:

- Commercial Services surged 50% YoY — elevated spare LRU (Line Replaceable Unit) provisioning orders, particularly for China customers

- China On-Highway came in higher than planned ($32M vs lower expectations), adding to the beat

- Counter-seasonal production — steady output without the typical Q1 drop-off

What Did Management Guide?

Guidance raised significantly across all key metrics.

Free cash flow guidance of $300-350M remained unchanged . CFO Bill Lacey explained: "We felt that it was best to probably keep our working capital level a little higher, mainly through inventory... we want to make sure we see that efficiency before we pull the inventory down."

Important caveat on guidance approach: Management explicitly stated they are layering in Q1 outperformance while keeping the remaining three quarters essentially unchanged . CEO Blankenship noted: "We recognized almost zero risks in the first quarter and all opportunities came through. As we look at the rest of the year, we feel like we have a balanced view."

What Changed From Last Quarter?

Margin expansion accelerated across both segments:

Pricing stronger than expected: Price realization came in at ~8% vs. the 5% full-year expectation. Management is now revising FY price expectations to ~7%, with aerospace contributing more than industrial .

Strategic shift — China On-Highway Wind Down:

Woodward announced it will exit its China On-Highway business by end of fiscal year. CFO Lacey: "This business often drove quarterly volatility within our industrial segment. It has been an inconsistent contributor to our overall financial results and operates in a highly unpredictable environment."

How Did the Stock React?

Woodward shares rose +3.5% to $327.25, approaching 52-week highs of $339.10.

The stock has more than doubled over the past 12 months, rising from ~$147 lows to current levels, reflecting improving aerospace and industrial fundamentals.

Segment Breakdown

Aerospace ($635M, +29% YoY)

Aerospace segment earnings of $148M represented a 23.4% margin, up 420 bps YoY. The margin expansion was driven by "solid price realization, primarily driven by the new JDAM pricing, higher volumes, and favorable mix, primarily due to strong commercial services growth" .

Commercial Services deep dive:

- LEAP, GTF, and legacy narrowbody repair volume up YoY, flat vs Q4

- Elevated spare LRU provisioning — management believes this was "driven by customer under-provisioning rather than a pull forward of demand"

- Strong widebody and regional platform performance

CEO on spare LRU dynamics: "There was an open window for trade... and the concern that that window might close is my hypothesis for why that activity was so strong in recent quarters."

Industrial ($362M, +30% YoY)

Core Industrial (excluding China On-Highway) sales increased 22% with margins expanding 200 bps to 17.3% .

Industrial segment earnings of $67M represented an 18.5% margin, up 410 bps YoY. China On-Highway contributed 210 bps of the margin expansion .

CEO on Industrial drivers: "On the oil and gas... quite a bit of the oil and gas midstream end application for us is gas turbine-related... it's both OEM and services-driven... Marine transportation is kind of the same thing where the shipyards are full and expanding."

Capacity Investments and Supply Chain

Woodward is aggressively expanding capacity to meet demand:

CEO on Prestwick: "It's in an aerospace park that has great workforce reputation and pipeline. It's right across the fence line from GE's Cal facility. So we're in a really good neighborhood there."

Supply chain remains a constraint:

- ~30 suppliers on risk watch, behind on deliveries

- Inventory higher than desired due to missing 1-2 parts for key customer deliveries

- Inventory turns not expected to improve meaningfully until late calendar 2026 or early 2027

CEO Blankenship: "We have plenty of orders to achieve the high end of the guide. It's really a question of, can we and our supply chain deliver that much output."

Q&A Highlights

On guidance conservatism (Noah Poponak, Goldman Sachs):

Q: Should we interpret the guidance revision as you left the remaining nine months the same and the upside is basically just Q1?

A: "Yes, that's correct... The part which Chip mentioned is the spare LRUs, potential upside there, which may or may not come, that is not something that we put in. And that was one of the larger drivers of our Q1 outperformance."

On risks to the high end of guidance:

CEO: "Some of our hard capacity constraints in our factories have been limiting our ability to respond to all this demand... a few suppliers could get in the way and knock down our ability to hit the very highest part of the guide. And then some of our customers could have problems with other suppliers, and they could reduce their demand to us."

On LEAP/GTF aftermarket capacity (Gavin Parsons, UBS):

Q: At some point, are you capacity constrained?

A: "We may have gotten a little bit behind on test stand capacity... we're eager to have one or two of those commissioning here in the next couple of months in our Rockford facility, which should alleviate some of that work in process and improve turn time."

On commercial aftermarket outlook (Scott Mikus, Melius Research):

Q: Will the $245M of commercial aftermarket sales in Q1 be the low point for the year?

A: "I don't think it's going to be the low point... We don't anticipate the same amount of spare LRUs shipping, so certainly that'll knock the peak of that revenue off. But we have modeled increasing repair and spare part sales."

On defense aftermarket (Alexandra Mandery, Truist):

Q: Defense aftermarket appears to be lagging behind defense OEM. Can you provide additional color?

A: "In some product lines, it's relatively steady. In a number of product lines, we get a batch of work in from the customer repair depots... Some product lines are steady, and then some are kind of lumpy."

Cash Flow and Capital Allocation

The company expects to return $650-700M to shareholders through dividends and share repurchases in FY2026 . EBITDA leverage improved to 1.2x .

Why didn't FCF guidance increase despite the beat?

CFO Lacey: "You would imply that from the earnings gain that we had, that we would have roughly maybe $40 million of free cash flow that would fall through... As we've gotten into the year and looked at sort of the supply chain and meeting our customer demand, we felt that it was best to probably keep our working capital level a little higher, mainly through inventory."

Forward Estimates

*Values retrieved from S&P Global consensus estimates.

Key Takeaways

- Blowout quarter — Revenue +5.8% and EPS +14.8% above consensus with 29% revenue growth YoY

- Guidance raised substantially — FY26 EPS midpoint raised $0.65 to $8.40; management taking conservative approach on remaining quarters

- Margin expansion story intact — Both segments delivered 400+ bps of margin improvement; pricing at 8% vs 5% expected

- Commercial aerospace services surging — 50% growth driven by elevated spare LRU orders (under-provisioning, not pull-forward)

- China On-Highway exit — Strategic wind down by fiscal year-end; $20-25M restructuring costs; removes source of volatility

- Capacity investments accelerating — Prestwick expansion, Rockford test stands, Spartanburg buildout, MRO licensing partnerships

- Supply chain still a constraint — 30+ suppliers on risk watch; inventory elevated; turns not improving until late CY2026

Conference call held at 5:00 PM ET on February 2, 2026. Transcript available at Woodward Q1 FY2026 Earnings Call.

View full company profile: Woodward (WWD)