Earnings summaries and quarterly performance for HONEYWELL INTERNATIONAL.

Executive leadership at HONEYWELL INTERNATIONAL.

Vimal Kapur

Chief Executive Officer

James Currier

President and CEO, Aerospace Technologies

Mike Stepniak

Senior Vice President and Chief Financial Officer

Peter Lau

President and CEO, Industrial Automation

Su Ping Lu

Senior Vice President, General Counsel and Corporate Secretary

Board of directors at HONEYWELL INTERNATIONAL.

D. Scott Davis

Director

Deborah Flint

Director

Duncan Angove

Director

Grace Lieblein

Director

Kevin Burke

Director

Michael Lamach

Director

Robin Watson

Director

Rose Lee

Director

Stephen Williamson

Director

William Ayer

Lead Independent Director

Research analysts who have asked questions during HONEYWELL INTERNATIONAL earnings calls.

Christopher Snyder

Morgan Stanley

9 questions for HON

Julian Mitchell

Barclays Investment Bank

9 questions for HON

Nigel Coe

Wolfe Research, LLC

9 questions for HON

Scott Davis

Melius Research

9 questions for HON

Sheila Kahyaoglu

Jefferies

9 questions for HON

Deane Dray

RBC Capital Markets

7 questions for HON

Amit Mehrotra

UBS

5 questions for HON

Andrew Kaplowitz

Citigroup

5 questions for HON

Andrew Obin

Bank of America

5 questions for HON

Joe Ritchie

Goldman Sachs

4 questions for HON

Nicole DeBlase

Deutsche Bank

4 questions for HON

Steve Tusa

JPMorgan Chase & Co.

4 questions for HON

C. Stephen Tusa

JPMorgan Chase & Co.

3 questions for HON

Joseph Ritchie

Goldman Sachs

3 questions for HON

Andy Kaplowitz

Citigroup Inc.

2 questions for HON

Nicole DeBlase

BofA Securities

2 questions for HON

Stephen Tusa

J.P. Morgan

2 questions for HON

Deane Drey

RBC Capital Markets

1 question for HON

Recent press releases and 8-K filings for HON.

- Momentum remains in Q1 2026: building automation, aerospace, and North American industrial automation are strong; petrochemical catalyst demand is weak, while long-cycle process orders have grown for two consecutive quarters with backlog into 2027/28 supporting 2026 guidance.

- Separation of Advanced Materials (Solstice) has sharpened focus and strategic clarity across remaining segments, aligning Aerospace and Automation to capitalize on emerging AI tailwinds.

- Pricing strategy targets 3%–4% increases in 2026 amid persistent ~3.5% industrial inflation, backed by enhanced customer communication, productivity improvements, and new-product value capture.

- Quantinuum hardware achieved 48 logical qubits at >99% fidelity in November 2025, with a 100-qubit system expected within 12 months, driving engagement in banking and pharmaceutical use cases.

- Disciplined bolt-on M&A and carve-outs (Carrier Access Solutions, LNG, Sundyne) reshaped the portfolio by 30% (15% exited, 15% added), reinforcing mission-critical automation and the build-and-mine installed-base model.

- Honeywell sees continuing momentum in Q1 2026, with strong building automation and aerospace, industrial automation robust in North America but softer in Europe and China, and expects long-cycle LNG and refining orders to remain strong while petrochemical catalyst demand stays subdued.

- Management reports benefits from recent separations (e.g., Solstice), driving greater focus and strategic clarity across pure-play segments like industrial automation and aerospace, and notes AI as a tailwind for its automation offerings.

- The company targets 3%–4% pricing increases to offset persistent 3%–3.5% cost inflation, backed by enhanced customer communication, elasticity analysis and new product introductions to protect and expand margins.

- After establishing a unified installed-base record and advancing its Forge platform, Honeywell is accelerating aftermarket services, aiming to grow the services and software mix above the current ~40% of revenue.

- Quantinuum reached a milestone with its 48-logical qubit system delivering 99%+ fidelity, spurring customer engagement in banking and pharmaceuticals and positioning itself for a standalone spin-off (Honeywell owns 52%).

- Honeywell sees Q1 2026 momentum broadly in line with 2025, with strong Building Automation, aerospace and North American Industrial Automation offset by weaker demand in Europe and China; long-cycle LNG and aerospace bookings are constrained by capacity but extend into end 2027/early 2028.

- Since the October 2024 spin-off announcement, the remaining Honeywell (“RemainCo”) has gained strategic clarity, with Aero and Automation benefiting from focused investment and AI tailwinds in automation offerings.

- In 2025, Building Automation grew 7%, of which 4% came from new products and 3% from pricing; similar new-product-driven growth in Industrial Automation is expected to accelerate from H2 2026.

- The company targets 3–4% pricing in 2026, supported by more proactive customer dialogue on inflation, detailed elasticity analysis, productivity initiatives and value-based new products.

- Honeywell’s Quantinuum unit launched a 48-logical-qubit quantum computer in November 2025 (99%+ fidelity) and aims for 100 logical qubits within 12 months, with industrial customer engagement expected within a three-year window to support a standalone spin-out.

- U.S. industrial demand is stable into 2026; Aerospace and Building Automation remain strong, Industrial Automation is robust in North America but flat in Europe/China, and Process Automation is flattish due to overcapacity.

- Orders and backlog were very strong in H2 2025, with Process Automation backlog up double digits and long cycle times (12–24 months); a strong Q1 2026 is expected.

- The company plans 3–4% price increases in 2026 to offset persistent inflation, managed through continuous customer dialogue, productivity gains, and value-added new products.

- In the upcoming spin, Automation RemainCo targets mid-single-digit organic revenue growth and 30–50 bps annual margin expansion; stranded separation costs will be eliminated within 12–18 months post-spin.

- Aerospace margins are set to expand in 2026–2027 as OE mix normalizes, integration costs subside, supply-chain headwinds turn to tailwinds, and tariff pass-through improves.

- US industrial demand is stable for 2026, with very strong aerospace and building automation, robust North American industrial automation, offset by flat to slightly negative performance in Europe/China and flattish process markets due to petrochemical overcapacity.

- 2026 revenue growth is guided at 3–6%, with Q1 expected to be softer and a stronger second half driven by a growing backlog; performance at the top end assumes short-cycle demand remains consistent with 2025.

- Honeywell plans to maintain 3–4% pricing in 2026 amid ongoing electronics, commodity, and labor cost inflation by enhancing productivity, embedding inflation dialogue with customers, and accelerating higher-value new products.

- Ahead of the Q3 spin, stranded spin-related costs will be eliminated within 12–18 months, and the standalone Automation Co. is targeting mid- to high-single-digit organic revenue growth, 30–50 bps annual margin expansion, and >90% free cash flow conversion.

- Aerospace margins are set to expand in 2026–27 as OE mix normalizes, integration and tariff headwinds abate, and supply-chain leverage returns; through-cycle commercial OE volumes remain constrained but growing at high-single-digit rates.

- Honeywell sees strong aerospace and building automation demand, flat industrial automation ex-North America, and a weak energy sector; process segment expected to be flattish in 2026.

- Orders and backlog remain robust, supporting a 3–6% revenue growth guide for 2026, with a Q3–Q4 uplift from long-cycle process automation projects.

- Persistent inflation drives planned 3–4% price increases, backed by proactive customer dialogue, productivity initiatives and higher-value product launches.

- Post-spin Automation Co targets mid-single-digit organic revenue growth, 30–50 bps annual margin expansion and high-single-digit EPS growth, prioritizing debt paydown then bolt-on M&A.

- Aerospace margins set to expand in 2026 as OE mix normalizes, supply-chain costs peak and tariff pass-through eases; segment aims for single-digit through-cycle volume growth and >90% free cash flow conversion.

- Honeywell recorded $471 million of additional impairments in its 2025 Form 10-K (including a $436 M goodwill charge and $35 M on assets held for sale), partly offset by a $61 M tax benefit.

- These adjustments reduced reported EPS from continuing operations to $6.94, net income to $4,468 million, operating income to $5,573 million, and operating margin to 14.9%.

- Before the impairments, full-year net income from continuing operations was $4.89 billion (EPS $7.57), with operating income of $6.04 billion and a 16.1% margin.

- Honeywell reaffirmed its 2026 guidance and still expects to announce the sale of its Productivity Solutions & Services and Warehouse & Workflow Solutions businesses in H1 2026.

- Honeywell filed its Form 10-K for FY 2025 ended December 31, 2025, on February 17, 2026.

- Recorded incremental impairment charges, including a $436 million goodwill write-down in its Industrial Automation segment and a $35 million asset impairment with a $61 million tax benefit.

- Revised full-year results: EPS from continuing operations of $6.94, net income of $4,468 million, operating income of $5,573 million, and operating margin of 14.9%.

- Reaffirmed previously announced adjusted Q4 and full-year 2025 results and 2026 guidance.

- Continues to expect the sale of the PSS and WWS businesses in the first half of 2026.

- Honeywell filed its Annual Report on Form 10-K for the fiscal year ended December 31, 2025, recording incremental impairment charges of $436 million for goodwill and $35 million on assets held for sale (with a $61 million tax benefit), revising reported EPS to $6.94, net income to $4,468 million, operating income to $5,573 million, and operating margin to 14.9%.

- The Productivity Solutions and Services (PSS) and Warehouse and Workflow Solutions (WWS) businesses were classified as assets held for sale in Q4 2025 under its portfolio optimization strategy, with a sale expected in H1 2026.

- Honeywell reaffirmed its previously announced adjusted Q4 and full‐year 2025 results and its full‐year 2026 guidance, unaffected by these additional charges.

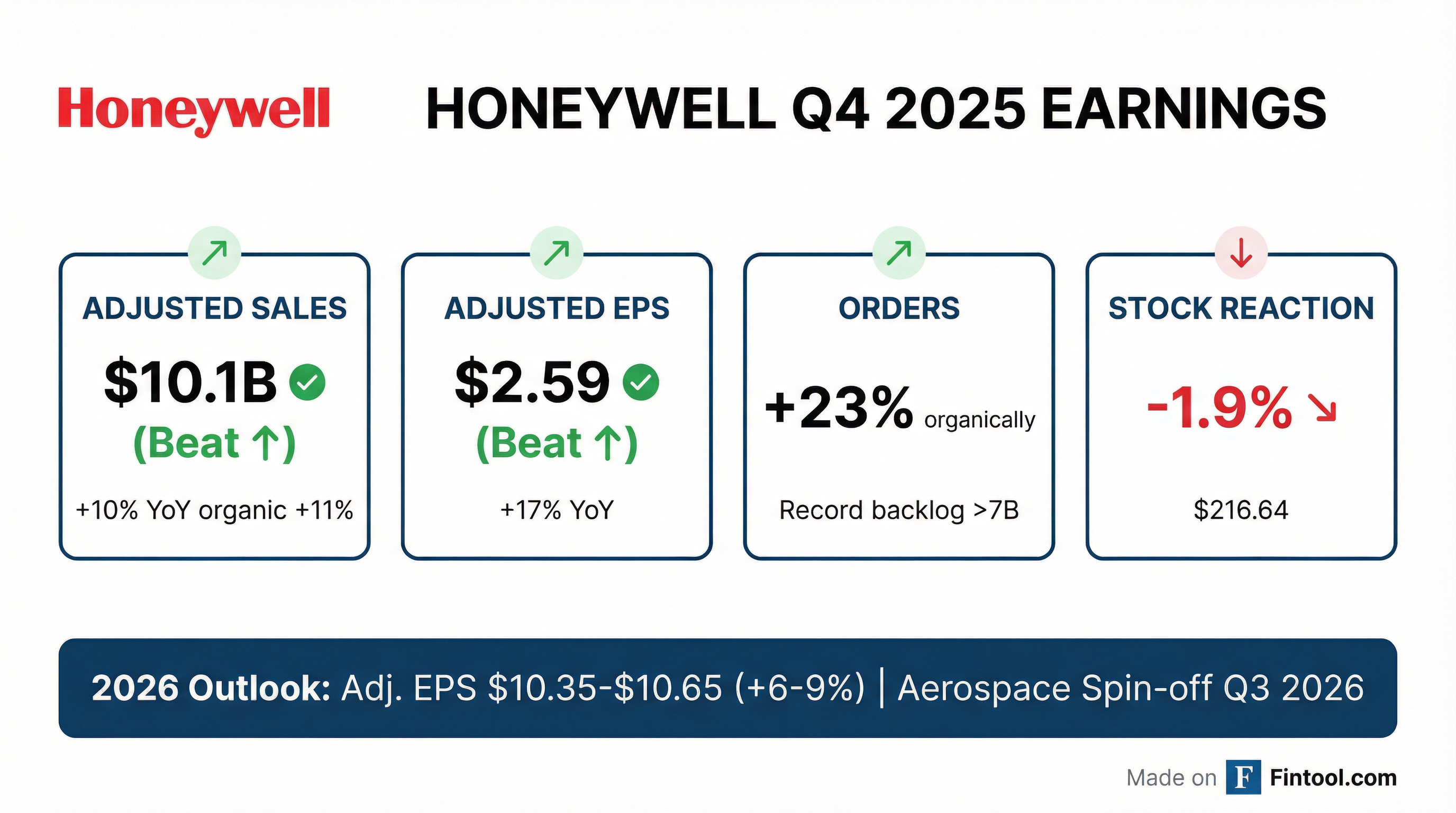

- Orders up 23% and backlog topped $37 billion; Q4 revenue was $9.76 billion (adjusted $10.07 billion, +11% organic) and adjusted EPS $2.59.

- Aerospace sales grew 13% to $4.52 billion (21% organic) and building automation rose 10% to $1.97 billion, while industrial automation declined 8%.

- Reported net income dropped to $309 million due to one-time asset sale and litigation charges, weighing on margins.

- Completed the Solstice Advanced Materials spin, moved the planned Aerospace spin to Q3 2026, and issued 2026 guidance of $38.8–$39.8 billion in sales and $10.35–$10.65 adjusted EPS.

Fintool News

In-depth analysis and coverage of HONEYWELL INTERNATIONAL.

Honeywell CEO Reveals Org Separation 'This Week' at Barclays Conference, Eyes Industrial M&A Post-Spin

Honeywell Accelerates Aerospace Spinoff to Q3 2026 as Q4 Beats Estimates

Honeywell's Quantum Spinoff Quantinuum Files for IPO, Eyes $20 Billion Valuation

Quarterly earnings call transcripts for HONEYWELL INTERNATIONAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more