Earnings summaries and quarterly performance for ROCKWELL AUTOMATION.

Research analysts who have asked questions during ROCKWELL AUTOMATION earnings calls.

Andrew Kaplowitz

Citigroup

9 questions for ROK

Christopher Snyder

Morgan Stanley

9 questions for ROK

Julian Mitchell

Barclays Investment Bank

9 questions for ROK

Scott Davis

Melius Research

9 questions for ROK

Nigel Coe

Wolfe Research, LLC

8 questions for ROK

Andrew Obin

Bank of America

6 questions for ROK

Steve Tusa

JPMorgan Chase & Co.

4 questions for ROK

Jeffrey Sprague

Vertical Research Partners

3 questions for ROK

Joseph O'Dea

Wells Fargo & Company

3 questions for ROK

Andrew Buscaglia

BNP Paribas

2 questions for ROK

Stephen Tusa

J.P. Morgan

2 questions for ROK

Tommy Moll

Stephens Inc.

2 questions for ROK

Andre Stillman Adams

Oppenheimer & Co. Inc.

1 question for ROK

Cigusa Katuka

JPMorgan Chase & Co.

1 question for ROK

Noah Kaye

Oppenheimer & Co. Inc.

1 question for ROK

Robert Mason

Robert W. Baird & Co.

1 question for ROK

Recent press releases and 8-K filings for ROK.

- CEO Blake Moret highlighted Rockwell’s enhanced resilience, with process now the largest served vertical and annual recurring revenue from software and high-value services at >10% of total revenue, contributing >10% segment profitability.

- The growth algorithm introduced in November 2023 targets 5%–8% organic growth, driven by secular automation demand, increasing ARR, market-share gains, and modest M&A.

- Full-year 2026 guidance remains at 4% organic growth at midpoint, with mid-single-digit top-line growth and double-digit earnings growth, and management sees upside toward the 5%–8% medium-term goal.

- North America new-capacity orders grew in double digits in Q1 and are expected to remain strong and broad-based across verticals, though some larger projects remain deferred.

- Annual recurring revenue (software and services) accounts for >10% of sales, pure software <10%, and large parts of the software business achieve >100% net dollar retention, underpinned by tight hardware integration and domain expertise.

- Rockwell highlighted its resilient business model with process as its largest served vertical, annual recurring revenue (software & high-value services) >10% of revenue, and focused operational excellence driving expanding margins.

- The company reiterated FY2026 organic growth guidance of 2–6% (4% midpoint) with a “good chance” to reach mid-single-digit growth and a 5–8% medium-term target introduced in November 2023.

- Segment margin corridors have been met for Lifecycle Services and Software & Control; Intelligent Devices is on a defined path to its corridor, supported by R&D investment at ~8% of revenue (higher in Software & Control).

- Data center automation is a fast-growing served market, currently low-single-digit of revenue, with potential to reach ≈5% in the near future.

- Post-supply-chain crisis, Rockwell maintains strong chip availability, increased memory inventory, and uses tariff-driven pricing adjustments that are EPS neutral.

- Rockwell reiterates its FY26 guide at 4% organic growth midpoint, with confidence in reaching 5–8% medium-term targets, driven by early strength in e-commerce, warehouse automation, chemical and core sectors and North America leading orders growth.

- Annual recurring revenue now exceeds 10% of total revenue, while pure software remains under 10%; the company expects resilient software demand supported by integrated runtimes, deterministic AI applications and net dollar retention above 100%.

- The Software & Control segment saw 20%+ y/y growth in Logix controllers globally (25%+ in North America); destocking is behind them, with Q2 sequential gains and full-year segment growth aligned to company targets, underpinned by a new Logix platform and ~8% R&D spend.

- The data center vertical is a fast-growing market and could represent ≈5% of revenue, as customers convert building-management systems to Logix for higher availability and safety, particularly in the U.S..

- Pricing initiatives—including annual and tariff-related adjustments designed to remain EPS-neutral—and increased memory-chip inventory support service levels and margin realization.

- Rockwell reconfirmed its full-year 2026 outlook of mid-single-digit organic growth and double-digit earnings growth, driven by its 5–8% organic growth algorithm (1–2% share gains, 1% ARR, 1% M&A).

- Lifecycle Services achieved a 1.16× book-to-bill ratio in Q1, reflecting stronger new-capacity orders and robust demand in North America.

- Annual Recurring Revenue grew 7% YoY in Q1, led by software (notably Plex) which posted record bookings, supported by enhanced go-to-market initiatives.

- Management plans to invest $2 billion over the coming years in plants, talent, and digital infrastructure to expand market share and margins.

- Continued emphasis on software-defined automation, integrated robotics, and entry into high-growth verticals (data centers, e-commerce/warehouse automation) underpins Rockwell’s growth strategy.

- Rockwell has bolstered its resilience with 40% process exposure, >10% annual recurring revenue, and a renewed focus on operational excellence across its supply chain.

- The company’s growth algorithm targets 5%–8% organic growth (3%–5% market, 1%–2% share gains, ~1% ARR, ~1% acquisitions), with guidance of mid-single-digit revenue growth and double-digit earnings growth for 2026.

- Annual recurring revenue rose 7% in Q1, driven by strong software performance and record Plex bookings, and is expected to achieve high single-digit ARR growth in 2026.

- Automation demand is supported by AI-enabled software-defined automation and integrated robotics, with Rockwell leveraging deep domain expertise to protect its mission-critical control software.

- A $2 billion investment over the coming years in plants, talent, and digital infrastructure aims to drive market-share gains and margin expansion, exemplified by a 30% labor-efficiency improvement at its Singapore software plant.

- Rockwell reiterated its full-year outlook of mid-single-digit revenue growth and double-digit earnings growth, with 2–6% organic growth guidance for 2026 versus a long-term 5–8% target.

- CEO Blake Moret emphasized the company’s “growth algorithm”—3–5% market growth, 1–2% share gains, 1% annual recurring revenue (ARR) growth, and 1% from acquisitions—and announced a $2 billion investment in plants, talent, and digital infrastructure to drive share and margin expansion.

- ARR grew 7% year-over-year in Q1, led by strong software performance: Plex set a record for new bookings, and Fiix and cybersecurity services also contributed to SaaS-based recurring revenue growth.

- Rockwell is advancing software-defined automation, integrated robotics, and AI-driven digital twins via Emulate3D and technology partnerships (e.g., NVIDIA) to simplify the design, commissioning, and operation of multi-vendor automation systems.

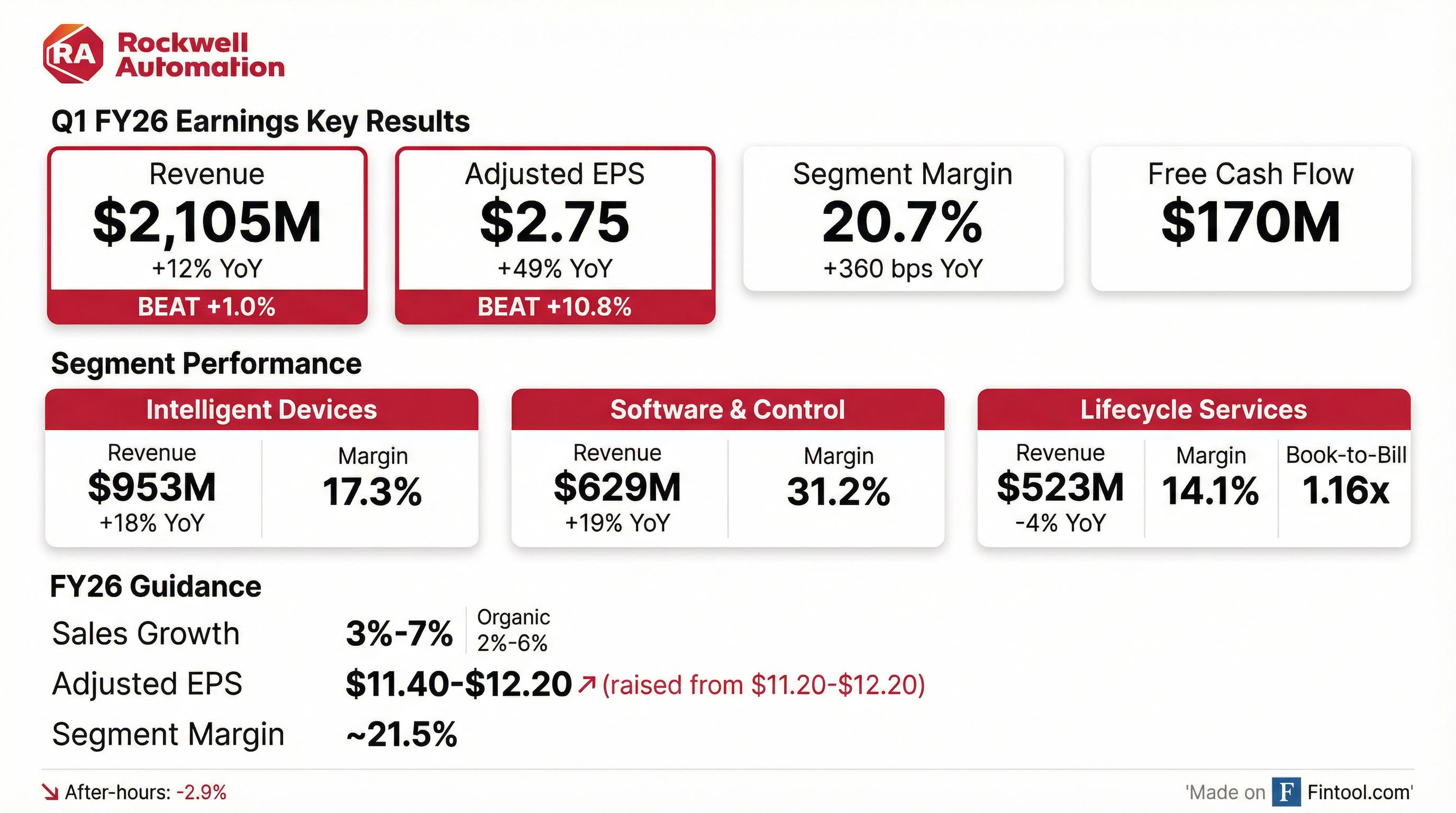

- Q1 reported sales grew 12% YoY, driven by price and currency, with organic sales up in double digits; segment margin was 20.7% and adjusted EPS was $2.75, all above expectations.

- Intelligent Devices achieved 16% organic sales growth, Software & Control grew 17%, and annual recurring revenue increased 7%, while Lifecycle Services declined 6% (Book-to-Bill 1.16).

- Productivity initiatives, price realization, and favorable mix drove 360 bps of segment margin expansion, with tariffs neutral on earnings.

- FY 2026 outlook maintained: 2–6% organic sales growth; adjusted EPS midpoint raised to $11.80; segment margin to expand by 100 bps; free cash flow conversion targeted at ~100%.

- Rockwell Automation delivered $2,105 M in Q1 sales, up 12% YOY driven by 10% organic growth and a 2% currency tailwind.

- Adjusted EPS rose to $2.75, a 49% increase from $1.85 in Q1 FY25.

- Segment operating margin expanded to 20.7%, up 360 bps year-over-year.

- FY26 guidance reaffirmed with 3%–7% reported sales growth, 2%–6% organic growth, and updated adjusted EPS range of $11.40–$12.20.

- Q1 reported sales rose 12% year-over-year, with double-digit organic growth, driving a 20.7% segment margin and $2.75 adjusted EPS, all above expectations.

- By segment, Intelligent Devices organic sales increased 16%, Software & Control grew 17%, while Lifecycle Services declined 6% with a 1.16 book-to-bill ratio.

- Annual recurring revenue grew 7%, Plex achieved its strongest quarter, and major wins included R.H. Sheppard on cloud-native Plex and Hindalco Industries for OT cybersecurity across six plants.

- Fiscal 2026 guidance maintained: organic sales growth of 2–6%, adjusted EPS midpoint raised to $11.80, segment margin expansion over 100 bps, and free cash flow conversion near 100%.

- Rockwell reported Q1 2026 sales up 12% year-over-year, driven by 3% price realization and a 2% currency tailwind, with double-digit organic growth in key segments.

- Total company segment margin expanded 360 bps to 20.7%, and adjusted EPS was $2.75.

- Segment performance: Intelligent Devices organic sales up 16%, Software & Control up 17%, while Lifecycle Services declined 6% with a book-to-bill of 1.16.

- Announced U.S. manufacturing investments, including a new “factory of the future” in New Berlin, WI, and the purchase of its Mequon, WI, facility.

- Maintained FY 2026 guidance: 2–6% organic sales growth, raised adjusted EPS midpoint to $11.80, and expects >100 bps margin expansion with ~100% free cash flow conversion.

Fintool News

In-depth analysis and coverage of ROCKWELL AUTOMATION.

Quarterly earnings call transcripts for ROCKWELL AUTOMATION.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more