Earnings summaries and quarterly performance for RTX.

Executive leadership at RTX.

Christopher Calio

Chairman, President & Chief Executive Officer

Neil Mitchill Jr.

Executive Vice President & Chief Financial Officer

Philip Jasper

President, Raytheon

Ramsaran Maharajh

Executive Vice President & General Counsel

Shane Eddy

President, Pratt & Whitney

Troy Brunk

President, Collins Aerospace

Board of directors at RTX.

Bernard Harris Jr.

Director

Brian Rogers

Director

Denise Ramos

Director

Ellen Pawlikowski

Director

Fredric Reynolds

Lead Independent Director

George Oliver

Director

James Winnefeld Jr.

Director

Leanne Caret

Director

Robert Work

Director

Tracy Atkinson

Director

Research analysts who have asked questions during RTX earnings calls.

Gautam Khanna

TD Cowen

8 questions for RTX

Peter Arment

Robert W. Baird & Co.

8 questions for RTX

Ronald Epstein

Bank of America

8 questions for RTX

Scott Deuschle

Deutsche Bank

8 questions for RTX

Seth Seifman

JPMorgan Chase & Co.

8 questions for RTX

Sheila Kahyaoglu

Jefferies

8 questions for RTX

Scott Mikus

Melius Research

7 questions for RTX

Jason Gursky

Citigroup Inc.

6 questions for RTX

Kristine Liwag

Morgan Stanley

6 questions for RTX

Myles Walton

Wolfe Research, LLC

6 questions for RTX

Robert Stallard

Vertical Research Partners

6 questions for RTX

Gavin Parsons

UBS Group AG

5 questions for RTX

David Strauss

Barclays

4 questions for RTX

Doug Harned

Bernstein

4 questions for RTX

Noah Poponak

Goldman Sachs

4 questions for RTX

Douglas Harned

Sanford C. Bernstein & Co., LLC

3 questions for RTX

Kenneth Herbert

RBC Capital Markets

3 questions for RTX

Matt Akers

BNP Paribas

2 questions for RTX

Matthew Akers

Wells Fargo & Company

2 questions for RTX

Miles Walton

Wolfe Research

2 questions for RTX

Rob Stallard

Vertical Research

2 questions for RTX

Recent press releases and 8-K filings for RTX.

- RTX’s Raytheon ELCAN business was awarded a production contract to deliver a bespoke variant of its Specter® DR 1–4x weapon sight to the German Armed Forces as part of Germany’s soldier system modernization program.

- The solution integrates an Aimpoint® reflex sight above the primary optic to enable rapid transitions between close-quarters and mid-range engagements.

- Since August 2024, European orders for Specter® DR sights by Germany, Denmark, Lithuania, Spain, Italy, and Finland have surpassed 100,000 units with a total value exceeding €193 million.

- The award underscores growing European demand for advanced optical systems and reinforces Raytheon ELCAN’s leadership in mission-ready weapon sights.

- The U.S. Navy approved Raytheon’s StormBreaker® smart weapon for operational use on the F/A-18-E/F Super Hornet, enhancing fleet lethality and survivability.

- StormBreaker can engage moving and stationary targets in all weather conditions, at sea or on land, and reduces aircrew exposure by autonomously tracking mobile threats.

- Deployed on the Super Hornet since 2023, StormBreaker is now approved for the F-15E and is being integrated on the F-35A/B/C platforms.

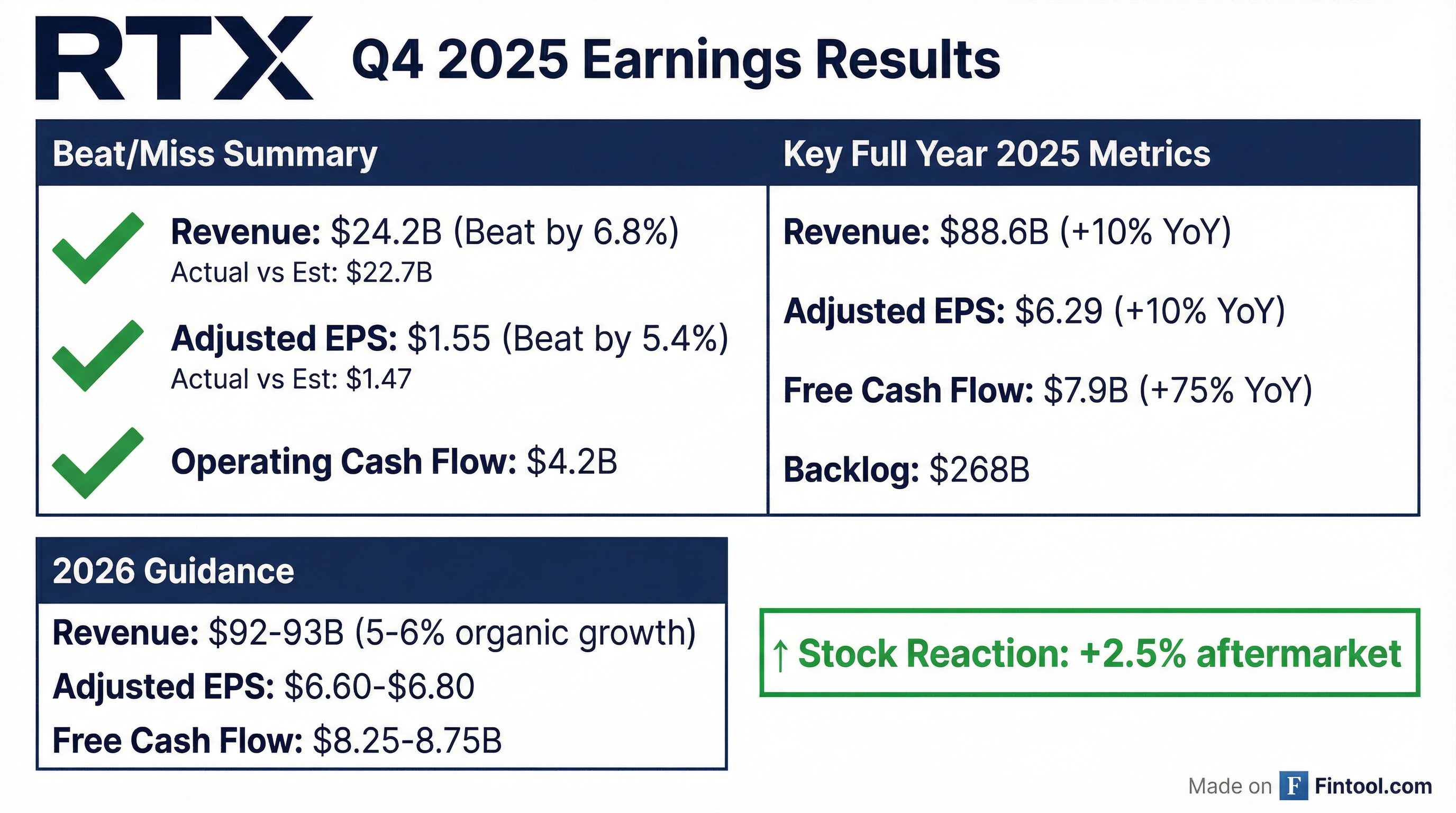

- RTX, the parent business, generated over $88 billion in sales in 2025 and has more than 180,000 employees, underscoring its scale in defense solutions.

- RTX cites 5% RPK growth in commercial aviation with demand for 40,000 aircraft over 20 years, and a 23% increase in its backlog to $268 billion, driven by strong defense replenishment and NATO budget growth.

- Collins Aerospace aims to monetise $105 billion of out-of-warranty aftermarket content; Pratt & Whitney holds an 8,000-engine GTF backlog with Advantage certification in 2026; Raytheon reports a $75 billion backlog and five munitions framework agreements to ramp production 2–4× by decade’s end.

- RTX plans $10 billion in R&D and CapEx for 2026 to expand capacity, supported by its CORE continuous-improvement system (nearly 12,000 events in 2025) and targeted supply-chain collaboration on castings, rocket motors, microelectronics, and critical minerals.

- Aftermarket execution is emphasised: Pratt’s MRO output grew 26% in 2025 (Q4 up 39%), Collins benefits from higher OE rates and cost-structure optimisations, and Raytheon targets further growth in radar and counter-UAS systems.

- RTX reconfirms 2026 guidance with $10 billion in R&D and CapEx to execute its $268 billion backlog (up 23% since end-2024).

- CEO Chris Calio cites strong macro tailwinds: 5% RPK growth, demand for 40,000 new aircraft over 20 years, and rising defense budgets (NATO 3.5%, APAC/MENA 3–4%).

- Raytheon secures five munitions framework agreements—outside current $75 billion backlog—to ramp production 2–4× over the next decade; sensors and counter-UAS also targeted for expansion.

- Pratt & Whitney reports 45 million GTF hours, an 8,000-engine backlog, GTF Advantage certification in 2026, and aftermarket growth: 26% MRO increase in 2025 (Q4: 39%); powder metal issue unchanged outlook.

- Collins Aerospace aims for 80 bps margin expansion in 2026 via aftermarket volume, OE rate absorption, and cost cuts (2025: 9% organic sales growth, 3% headcount reduction).

- RTX highlighted $88 B in 2025 sales and a $268 B backlog, up 23% since end-2024, supported by 5% RPK growth and durable commercial and defense demand.

- Announced five DoD framework agreements for munitions, targeting 2–4× current production rates over the next decade; these are outside the existing backlog and will require capacity and supply-chain investments.

- The Geared Turbofan (GTF) program surpassed 45 M flight hours, carries an 8 k-engine backlog, and will certify the GTF Advantage upgrade this year; the powder-metal issue remains on guidance with no outlook change.

- Emphasized integrated supply-chain management—key focus on castings, rocket motors, microelectronics, and critical minerals—and deployment of the CORE continuous-improvement system with nearly 12 000 events in 2025.

- RTX’s Raytheon business showcased the Coyote® Block 3 Non-Kinetic (NK) system defeating multiple drone swarms in a U.S. Army demo, highlighting its launch, flight, intercept and recovery capabilities.

- The recoverable Coyote Block 3NK uses a non-kinetic payload to minimize collateral damage and can be recalled and redeployed for additional engagements, offering a cost-effective counter-drone solution.

- Raytheon secured its largest counter-drone contract to date under the U.S. Army’s LIDS program, enabling significant investments in Coyote kinetic variant production and performance enhancements.

- Contract award: RTX BBN Technologies secured a Department of War contract, via the National Spectrum Consortium, to support the Advanced Spectrum Coexistence Demonstration, protecting defense radars in the 3.1–3.45 GHz band when shared with commercial 5G networks.

- Phase 1 goal: Develop a basic "smart spectrum manager" to detect radar activity and automatically reroute 5G traffic within seconds to prevent interference.

- Phase 2 enhancement: Build an advanced, self-managing prototype platform that automatically optimizes spectrum sharing with minimal human involvement.

- Consortium partners: Includes Raytheon Advanced Technology, Ericsson Federal Technologies, Signal Processing Technologies, Federated Wireless, Purdue University, and Novowi.

- Performance targets: Aim for a 50% increase in usable 5G capacity, 20 dB reduction in radar interference, and a 1,000-fold improvement in 5G link quality; deliver a cloud/edge "sandbox" spectrum access system.

- RTX’s Raytheon unit signed up to seven-year framework agreements with the Pentagon to produce over 1,000 Tomahawk cruise missiles and at least 1,900 AMRAAMs annually.

- The deals use a collaborative funding model designed to preserve upfront free cash flow while RTX invests in production capacity.

- The agreements align with President Trump’s “Arsenal of Freedom” strategy to rebuild U.S. stockpiles, potentially doubling or quadrupling production rates if finalized.

- RTX plans to invest over $139 million in Singapore to expand manufacturing and maintenance operations, and has factored these investments into its 2026 financial outlook.

- Vietjet Air selects an additional 44 GTF-powered Airbus A320neo family aircraft from RTX’s Pratt & Whitney, bringing its total GTF orders to 137.

- The order comprises 24 A321neos and 20 A321XLRs, with deliveries beginning in July 2026.

- Pratt & Whitney will support the fleet under a 12-year EngineWise Comprehensive service maintenance agreement.

- The GTF engine offers up to 20% lower fuel consumption and a 75% smaller noise footprint compared to prior-generation engines.

- RTX’s Raytheon business secured five up-to-seven-year framework agreements with the U.S. Department of War to scale production of Tomahawk, AMRAAM, SM-3 IB, SM-3 IIA and SM-6 missiles.

- Under these accords, annual output will rise to >1,000 Tomahawks, ≥1,900 AMRAAMs and >500 SM-6s, with 2–4× increases in existing rates.

- The deals adopt a collaborative funding structure to preserve upfront free cash flow, funding capacity expansions in technology, facilities and workforce.

- Production will be executed at Raytheon facilities in Tucson (AZ), Huntsville (AL) and Andover (MA), aligning with RTX’s 2026 financial outlook.

Fintool News

In-depth analysis and coverage of RTX.

Quarterly earnings call transcripts for RTX.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more