Earnings summaries and quarterly performance for NORTHROP GRUMMAN CORP /DE/.

Executive leadership at NORTHROP GRUMMAN CORP /DE/.

Kathy J. Warden

Chair, Chief Executive Officer and President

John Greene

Chief Financial Officer

Robert J. Fleming

Corporate Vice President and President, Space Systems

Roshan S. Roeder

Corporate Vice President and President, Mission Systems

Thomas H. Jones

Corporate Vice President and President, Aeronautics Systems

Board of directors at NORTHROP GRUMMAN CORP /DE/.

Ann M. Fudge

Director

Arvind Krishna

Director

David P. Abney

Director

Gary Roughead

Director

James S. Turley

Director

Kimberly A. Ross

Director

Madeleine A. Kleiner

Lead Independent Director

Marianne C. Brown

Director

Mark A. Welsh III

Director

Mary A. Winston

Director

Thomas M. Schoewe

Director

Research analysts who have asked questions during NORTHROP GRUMMAN CORP /DE/ earnings calls.

Ronald Epstein

Bank of America

7 questions for NOC

Scott Deuschle

Deutsche Bank

7 questions for NOC

Seth Seifman

JPMorgan Chase & Co.

7 questions for NOC

Sheila Kahyaoglu

Jefferies

7 questions for NOC

Douglas Harned

Sanford C. Bernstein & Co., LLC

6 questions for NOC

Myles Walton

Wolfe Research, LLC

6 questions for NOC

Robert Stallard

Vertical Research Partners

6 questions for NOC

Gavin Parsons

UBS Group AG

5 questions for NOC

Kristine Liwag

Morgan Stanley

5 questions for NOC

Richard Safran

Seaport Research Partners

5 questions for NOC

Gautam Khanna

TD Cowen

4 questions for NOC

David Strauss

Barclays

3 questions for NOC

Jason Gursky

Citigroup Inc.

3 questions for NOC

Kenneth Herbert

RBC Capital Markets

3 questions for NOC

Matthew Akers

Wells Fargo & Company

3 questions for NOC

Michael Ciarmoli

Truist Securities, Inc.

3 questions for NOC

Scott Mikus

Melius Research

3 questions for NOC

John Godyn

Citigroup

2 questions for NOC

Ken Erbert

RBC

2 questions for NOC

Peter Arment

Robert W. Baird & Co.

2 questions for NOC

Doug Harned

Bernstein

1 question for NOC

Miles Walton

Wolfe Research

1 question for NOC

Rob Stallard

Vertical Research

1 question for NOC

Recent press releases and 8-K filings for NOC.

- Northrop expects mid-single-digit revenue growth in 2026, with segment operating margins of low- to mid-11% and free cash flow of $3.1 billion–$3.5 billion, driven by sustained defense demand.

- CEO Kathy Warden highlighted an unprecedented global defense demand cycle, including strategic triad recapitalization, space asset modernization, expanded tactical missile production and missile defense, with missile defense now ~10% of revenues and growing.

- The B-21 stealth bomber is outperforming in testing, and a framework agreement is expected by quarter-end to support an accelerated build rate, backed by a $2 billion–$3 billion capital investment.

- Northrop is advancing its unmanned systems portfolio—e.g., the Talon IQ testbed and a MUX TacAir partnership with Kratos—to meet evolving USAF, Navy and USMC collaborative combat aircraft needs.

- The company is scaling solid rocket motor capacity for U.S. and allied tactical missiles, progressing the Sentinel ICBM replacement restructure for completion this year, and ramping IBCS missile defense production ahead of schedule.

- Northrop forecasts mid-single-digit revenue growth in 2026, low- to mid-11% segment operating margins, and $3.1–$3.5 billion in free cash flow, driven by sustained global defense demand.

- The B-21 program “is performing even better than we modeled,” with a framework agreement to accelerate production expected by quarter-end and $2–$3 billion of CapEx planned to support higher build rates and improved returns.

- Missile defense now represents just under 10% of revenue and is growing across space, ground and intercept layers (e.g., IBCS), with production ahead of schedule for rapid deployment.

- Space segment returned to growth in Q4 2025 (+5%), with a strong backlog underpinning 2026 expansion; key drivers include the Golden Dome architecture, launch-motor capacity build-out and recapitalization of government satellites.

- CapEx guidance has been raised to fund B-21 scaling, munitions ramp-up and international orders, while maintaining a competitive dividend and deferring share buybacks pending capital-allocation clarity.

- Reaffirmed 2026 guidance for mid-single-digit revenue growth, low- to mid-11% segment operating margins and $3.1 B–$3.5 B free cash flow.

- B-21 bomber test performance is exceeding projections, and a framework agreement with the U.S. Air Force to accelerate production is expected by quarter-end.

- International demand is robust for munitions, missile defense (IBCS) and surveillance platforms (E-2D, Triton), with exportable product lines tripled under current leadership.

- Capital allocation plan increased CapEx to expand production capacity across B-21, munitions and launch motors, while maintaining a competitive dividend after board approval.

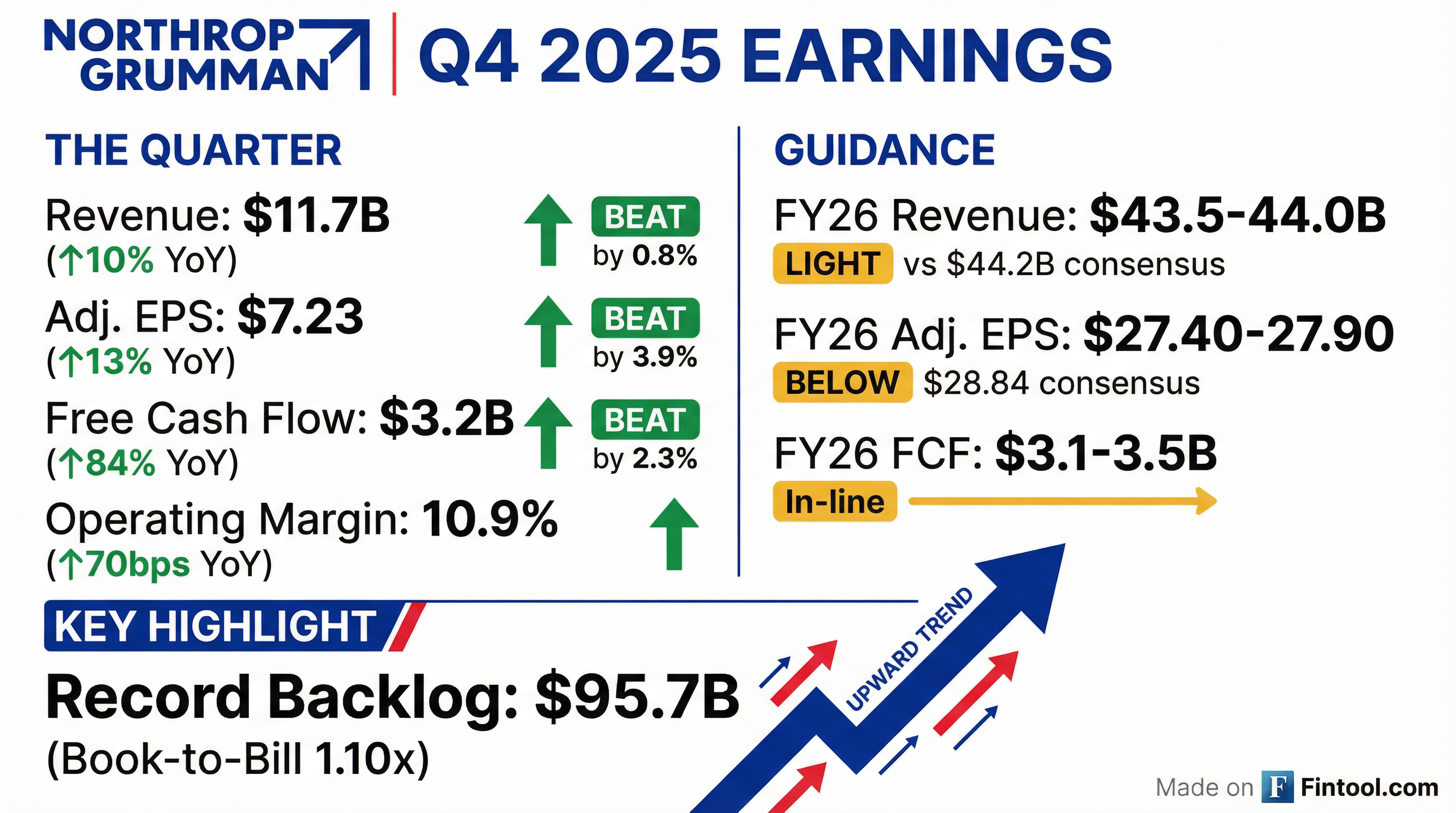

- Q4 organic sales rose 10% to $11.712 billion, led by Aeronautics Systems (+18%) and Mission Systems (+10%) growth¹

- Q4 segment operating income increased 10% to $1.313 billion, reflecting broad‐based portfolio strength²

- Full-year 2025 organic sales were $42.0 billion (+3%) and free cash flow reached $3.3 billion¹

- Record year-end backlog of $95.7 billion, up from $91.5 billion in 2024¹

- 2026 guidance: sales $43.5–44.0 billion, segment operating income $4.85–5.00 billion, MTM-adjusted EPS $27.40–27.90, free cash flow $3.1–3.5 billion²

- Fourth-quarter sales of $11.7 billion, up 10% year-over-year, and full-year sales of $42 billion (+3% organically).

- Record backlog of over $95 billion, driven by $46 billion in 2025 net awards and a five-year book-to-bill of 1.1×.

- Free cash flow of $3.3 billion, a 26% increase from 2024, marking the third consecutive year of ≥25% growth.

- 2026 guidance: sales of $43.5–$44 billion, adjusted EPS of $27.40–$27.90, free cash flow of $3.1–$3.5 billion, and capex of $1.65 billion.

- Management change: John Green joined as CFO, succeeding Ken Crews this month.

- 2026 guidance: Sales of $43.5 – $44 billion; segment operating income of $4.85 – $5 billion (mid-11% margin); adjusted EPS of $27.40 – $27.90; free cash flow of $3.1 – $3.5 billion; and CapEx of $1.65 billion (~4% of sales).

- Munitions capacity expansions: Since 2021, doubled tactical solid rocket motor production at the ABL facility and advancing to 3× capacity by early 2027; Elkton, MD site to 3× capacity by 2030.

- CFO transition: John Green joined as CFO in January 2026, succeeding Ken Crews following a smooth transition.

- 2025 momentum: International sales grew 20% and the company delivered its highest quarterly sales growth in Q4 2025, exceeding expectations across key metrics.

- Northrop Grumman closed FY2025 with a record backlog of over $95 billion, driven by $46 billion in net awards and a five-year average book-to-bill of 1.1x.

- FY2025 sales and EPS beat the high end of guidance, and the company generated $3.3 billion in free cash flow, up 26% year-over-year.

- For 2026, management issued guidance for sales of $43.5 – 44 billion, adjusted EPS of $27.40 – 27.90, and free cash flow of $3.1 – 3.5 billion, reflecting mid-single-digit growth.

- The portfolio is positioned for broad-based growth across all four segments, led by Digital Systems and Space (projected at ~$11 billion), underpinned by capacity and technology investments.

- Leadership transitioned as CEO Ken held his final earnings call after 22 years, with John assuming the role and emphasizing strategic acceleration.

- Q4 sales rose 10% to $11.7 B, with full-year 2025 sales of $42.0 B, up 2% year-over-year.

- Q4 operating income increased 17% to $1.3 B, delivering a 10.9% margin; 2025 diluted EPS was $29.08.

- Operating cash flow for 2025 was $4.8 B, and free cash flow reached $3.3 B.

- Backlog expanded to a record $95.7 B at year-end, driven by robust awards across programs.

- For 2026, the company guides to sales of $43.5–44.0 B, MTM-adjusted EPS of $27.40–27.90, and free cash flow of $3.1–3.5 B.

- Q4 net income rose to $1.427 billion ($9.99/share) with adjusted EPS of $7.23 and revenue up 9.6% to $11.712 billion.

- Free cash flow surged about 84% to $3.24 billion, and operating income of $1.27 billion beat estimates.

- Record backlog reached $95.7 billion amid F-35 and Virginia-class awards, but fiscal 2026 guidance of $43.5–44.0 billion in sales and $27.40–27.90 EPS fell below Street expectations.

- The space-based C4ISR market grew from $3.16 Billion in 2025 to $3.4 Billion in 2026 at a 7.5% CAGR.

- It is forecast to reach $4.49 Billion by 2030 at a 7.2% CAGR.

- Growth is driven by expansion of satellite constellations, secure military satellite communications, ground antenna installations, encryption devices, and advanced sensor payloads.

- Integration of AI-driven analytics for satellite intelligence and deployment of small-satellite networks are key trends, with North America as the largest market and Asia-Pacific the fastest-growing region.

- Industry consolidation is highlighted by BAE Systems’ $5.56 Billion acquisition of Ball Aerospace in 2024, strengthening space-based C4ISR capabilities.

Quarterly earnings call transcripts for NORTHROP GRUMMAN CORP /DE/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more