Earnings summaries and quarterly performance for GENERAL DYNAMICS.

Executive leadership at GENERAL DYNAMICS.

Phebe N. Novakovic

Chief Executive Officer

Danny Deep

Executive Vice President, Global Operations

Jason W. Aiken

Executive Vice President, Technologies

Kimberly A. Kuryea

Senior Vice President and Chief Financial Officer

Mark L. Burns

Vice President and President, Gulfstream Aerospace

Robert E. Smith

Executive Vice President, Marine Systems

Board of directors at GENERAL DYNAMICS.

C. Howard Nye

Director

Catherine B. Reynolds

Director

Cecil D. Haney

Director

Charles W. Hooper

Director

James N. Mattis

Director

John G. Stratton

Director

Laura J. Schumacher

Lead Director

Mark M. Malcolm

Director

Peter A. Wall

Director

Richard D. Clarke

Director

Robert K. Steel

Director

Rudy F. deLeon

Director

Research analysts who have asked questions during GENERAL DYNAMICS earnings calls.

Gautam Khanna

TD Cowen

7 questions for GD

Myles Walton

Wolfe Research, LLC

7 questions for GD

Robert Stallard

Vertical Research Partners

7 questions for GD

Seth Seifman

JPMorgan Chase & Co.

7 questions for GD

Douglas Harned

Sanford C. Bernstein & Co., LLC

6 questions for GD

Sheila Kahyaoglu

Jefferies

6 questions for GD

Ronald Epstein

Bank of America

5 questions for GD

Scott Deuschle

Deutsche Bank

5 questions for GD

David Strauss

Barclays

4 questions for GD

Jason Gursky

Citigroup Inc.

4 questions for GD

Scott Mikus

Melius Research

4 questions for GD

Andre Madrid

BTIG

3 questions for GD

Kenneth Herbert

RBC Capital Markets

3 questions for GD

Peter Arment

Robert W. Baird & Co.

3 questions for GD

Gavin Parsons

UBS Group AG

2 questions for GD

Kristine Liwag

Morgan Stanley

2 questions for GD

Matthew Akers

Wells Fargo & Company

2 questions for GD

John Good

Citigroup Inc.

1 question for GD

Mariana Perez Mora

Bank of America

1 question for GD

Noah Poponak

Goldman Sachs

1 question for GD

Richard Safran

Seaport Research Partners

1 question for GD

Recent press releases and 8-K filings for GD.

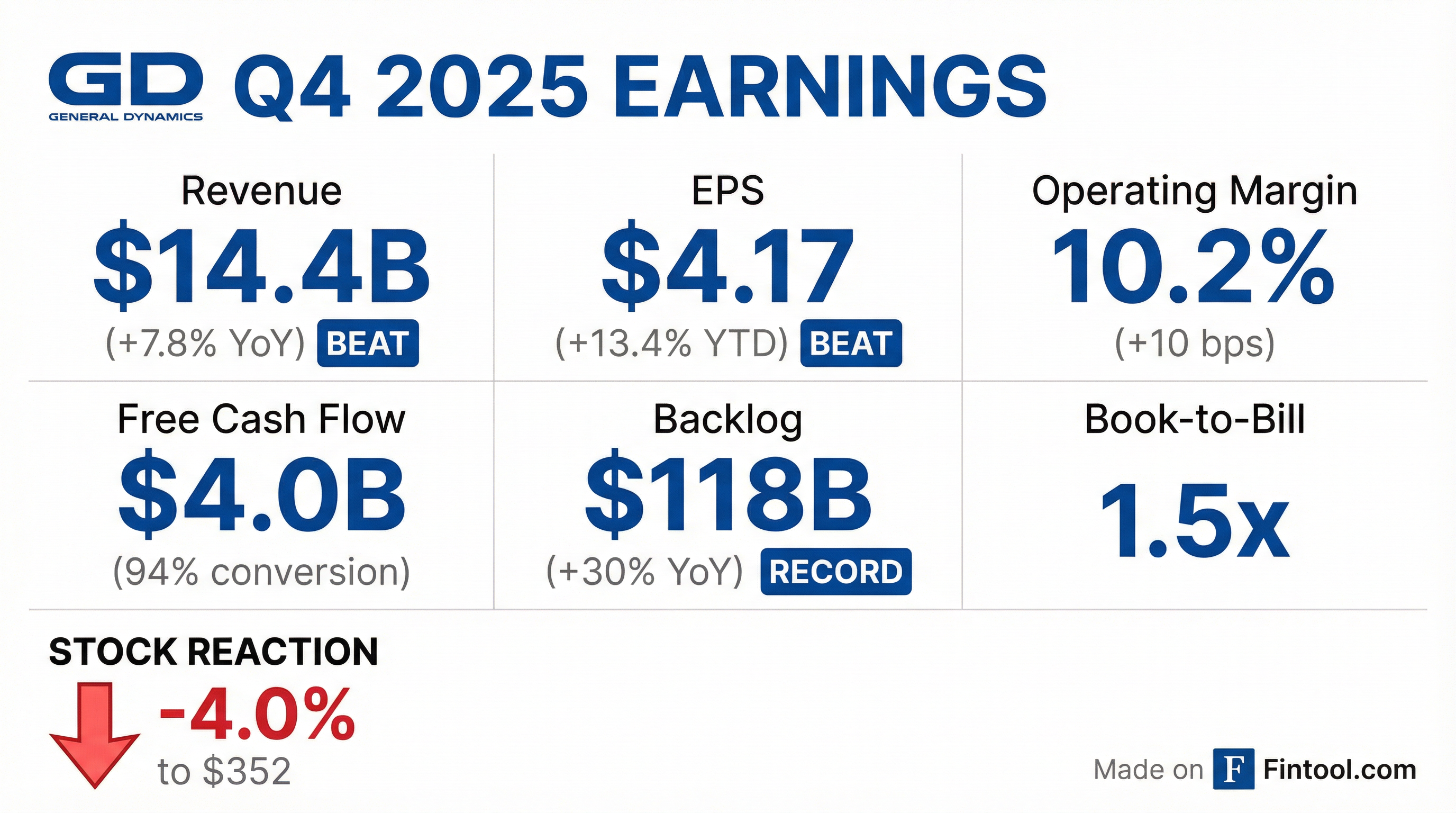

- Revenue of $52,550 million, up 10.1% year-over-year

- Net earnings of $4,210 million (+11.3%) and free cash flow of $3,959 million in 2025

- Operating earnings of $5,356 million (+11.7%) and EPS of $15.45 (+13.4%)

- Total backlog increased to $118,046 million, a 30.3% gain versus 2024

- Record backlog growth in key segments: Combat Systems backlog at $27.2 billion (+60% YoY) and Marine Systems backlog at $53.0 billion (+31% YoY)

- General Dynamics delivered Q4 2025 EPS of $4.17 on revenue of $14.379 billion, with operating earnings of $1.452 billion (+2% QoQ) and net earnings of $1.143 billion; for FY 2025, revenue rose 10.1%, operating earnings 11.7%, net earnings 11.3%, and EPS 13.4%.

- The company finished 2025 with a record total backlog of $118 billion (up 30% YoY) and estimated contract value of $179 billion (+24%); overall book-to-bill was 1.5×, led by Combat Systems (2.1×), Marine Systems (1.7×), Technologies (1.2×), and Aerospace (1.2×).

- Q4 operating cash flow was $1.6 billion, bringing FY 2025 operating cash flow to $5.1 billion; free cash flow was just under $4 billion (94% conversion) after capital expenditures of $1.2 billion (3.1% of sales), and year-end net debt stood at $5.7 billion.

- For 2026, GD forecasts revenue of $54.3 billion–$54.8 billion, an operating margin of 10.4%, and EPS of $16.10–$16.20.

- Q4 2025 EPS of $4.17, revenue of $14.379 billion, operating earnings of $1.452 billion, net earnings of $1.143 billion; sequential revenue +7.8%, operating earnings +2%

- FY 2025 revenue +10.1%, operating earnings +11.7%, net earnings +11.3%, EPS +13.4%

- Marine Systems Q4 revenue $4.8 billion (+21.7% YoY) and operating earnings $345 million (+72.5%); Combat Systems Q4 revenue $2.5 billion (+0.8%) and operating earnings $381 million (+7%); Combat backlog $27.2 billion, total ECV $42 billion, book-to-bill 4.3:1

- FY 2025 operating cash flow $5.1 billion, up $1 billion YoY; free cash flow ~$4 billion (94% conversion); CapEx $1.2 billion (3.1% of sales); net debt $5.7 billion

- 2026 guidance: revenue $54.3–54.8 billion, operating earnings ~$5.7 billion, EPS $16.10–16.20

- General Dynamics delivered Q4 revenue of $14.379 B (+7.8% YoY), operating earnings of $1.452 B (+2% YoY), net earnings of $1.143 B, and diluted EPS of $4.17, with sequential growth of 11.4%, 9.1%, 7.9%, and $0.29, respectively.

- For FY 2025, the company achieved 10.1% revenue growth, 11.7% operating earnings growth, 11.3% net earnings growth, and 13.4% EPS growth versus 2024.

- Backlog reached a record $118 B and total estimated contract value hit $179 B (↑30% and ↑24% vs. prior year), underpinned by strong book-to-bill across segments (Combat 2.1×, Marine 1.7×, Technology 1.2×, Aerospace 1.2×).

- Operating cash flow was $5.1 B in 2025 (+$1 B vs. 2024) with free cash flow of ~$4 B (94% conversion); net debt fell to $5.7 B. The company targets 100% free cash flow conversion and capex of 3.5–4% of sales in 2026.

- 2026 guidance: full-year revenue of $54.3–54.8 B, operating margin 10.4% (↑20 bps), operating earnings ~$5.7 B, and EPS of $16.10–16.20.

- General Dynamics posted fourth-quarter net earnings of $1.1 billion, diluted EPS of $4.17, on revenue of $14.4 billion.

- For full-year 2025, net earnings rose 11.3% year-over-year to $4.2 billion, diluted EPS of $15.45, on revenue up 10.1% to $52.6 billion.

- Operating cash flow was $1.6 billion in Q4 (137% of net earnings) and $5.1 billion for the year (122% of net earnings); capital expenditures totaled $1.2 billion, up 27% from 2024.

- Order momentum remained strong with a Q4 book-to-bill of 1.6×, full-year 1.5×, and year-end backlog of $118 billion.

- General Dynamics forecasts fiscal 2026 revenue of $54.3–$54.8 billion and targets a 10.4% operating margin, while committing to reinvestment and full free-cash-flow conversion.

- The aerospace (Gulfstream) segment is expected to generate $13.6 billion in revenue for FY 2026; management notes some supply-chain improvements but anticipates larger tariff impacts next year.

- In the latest quarter, GD reported adjusted EPS of $4.17 and revenue of $14.38 billion, beating consensus by 1.56% and 4.2%, respectively; shares are up 8.9% YTD versus the S&P 500’s 1.9% gain.

- Key metrics include an operating margin of 10.34%, net margin of 8.18%, debt-to-equity ratio near 0.4, interest coverage ~16.29; insiders sold 20,460 shares over the past three months.

- Fourth-quarter net earnings of $1.1 billion, diluted EPS of $4.17, on $14.4 billion in revenue

- Full-year net earnings of $4.2 billion, diluted EPS of $15.45, on $52.6 billion in revenue, up 11.3% and 10.1%, respectively, from 2024

- Operating cash flow of $1.6 billion in Q4 (137% of net earnings) and $5.1 billion for the year (122% of net earnings); $1.2 billion in 2025 capital expenditures

- Book-to-bill ratio of 1.6x in Q4 and 1.5x for the year, ending 2025 with a $118 billion backlog

- General Dynamics Information Technology (GDIT), a unit of General Dynamics, secured a $988 million contract in December for U.S. Navy C5ISR systems support, including a one-year base period, four one-year options and a six-month option.

- Under the award, GDIT will modernize and integrate command, control, communications, computers, combat, intelligence, surveillance and reconnaissance systems across surface combatant ships, aircraft carriers, Coast Guard vessels, manned and unmanned aircraft, and shore stations to boost fleet readiness.

- The scope covers end-to-end services—integration, engineering, procurement, logistics and installation—leveraging GDIT’s decades of naval support experience in electronic warfare technologies and AI/ML solutions.

- General Dynamics employs over 110,000 people worldwide and generated $47.7 billion in revenue in 2024, underscoring its scale in defense contracting.

- GDIT, a business unit of General Dynamics, won a $285 million contract from the Commonwealth of Virginia, featuring a 1-year transition, 5-year base, and three 1-year options.

- The company will deploy its Eclipse Defensive Cyber and Everest Zero Trust Digital Accelerators to provide vulnerability management, zero trust services, and a 24/7 security operations center for the Virginia Information Technologies Agency.

- GDIT will leverage AI-driven security monitoring and support post-quantum cryptography initiatives to enhance threat detection and future-proof encryption across 67 state agencies serving over 8.8 million residents.

- The award expands GDIT’s state and local government footprint, building on its technology services presence nationwide.

- General Dynamics declared a $1.50 quarterly dividend per share, with a forward yield of 1.79%.

- The dividend is backed by its diversified operations across aerospace, marine, combat systems, and technologies.

- In its latest results, General Dynamics reported $51.51 billion in revenue, a three-year revenue growth of 8%, an operating margin of 10.34%, and a net margin of 8.18%.

Fintool News

In-depth analysis and coverage of GENERAL DYNAMICS.

Quarterly earnings call transcripts for GENERAL DYNAMICS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more