Earnings summaries and quarterly performance for CARRIER GLOBAL.

Executive leadership at CARRIER GLOBAL.

David Gitlin

Chief Executive Officer

Ajay Agrawal

Senior Vice President, Global Services, Business Development & Chief Strategy Officer

Beril Yildiz

Vice President, Controller and Chief Accounting Officer

Gaurang Pandya

President, HVAC Americas and CHVAC EMEA

Patrick Goris

Senior Vice President and Chief Financial Officer

Board of directors at CARRIER GLOBAL.

Amy Miles

Director

Charles Holley

Director

Jean-Pierre Garnier

Director

John Greisch

Lead Independent Director

Max Viessmann

Director

Michael McNamara

Director

Michael Todman

Director

Susan Story

Director

Virginia Wilson

Director

Research analysts who have asked questions during CARRIER GLOBAL earnings calls.

Andrew Kaplowitz

Citigroup

8 questions for CARR

Christopher Snyder

Morgan Stanley

8 questions for CARR

Deane Dray

RBC Capital Markets

8 questions for CARR

Julian Mitchell

Barclays Investment Bank

8 questions for CARR

Nigel Coe

Wolfe Research, LLC

8 questions for CARR

Amit Mehrotra

UBS

6 questions for CARR

Jeffrey Sprague

Vertical Research Partners

6 questions for CARR

Andrew Obin

Bank of America

5 questions for CARR

Joe Ritchie

Goldman Sachs

5 questions for CARR

Scott Davis

Melius Research

5 questions for CARR

Steve Tusa

JPMorgan Chase & Co.

5 questions for CARR

C. Stephen Tusa

JPMorgan Chase & Co.

3 questions for CARR

Joseph O'Dea

Wells Fargo & Company

3 questions for CARR

Joseph Ritchie

Goldman Sachs

3 questions for CARR

Nicole DeBlase

Deutsche Bank

2 questions for CARR

Noah Kaye

Oppenheimer & Co. Inc.

2 questions for CARR

Stephen Volkmann

Jefferies

2 questions for CARR

Thomas Moll

Stephens Inc.

2 questions for CARR

Tommy Moll

Stephens Inc.

2 questions for CARR

Joe O'Dea

Wells Fargo

1 question for CARR

Joseph O'Dea

Wells Fargo

1 question for CARR

Recent press releases and 8-K filings for CARR.

- Carrier reiterated that Q1 and full-year 2026 guidance remain unchanged, targeting 6%–8% organic growth once short-cycle headwinds (3–4 pts in CSA residential and Europe RLC) subside.

- Data center orders in 4Q surged 400%, doubling data center deployments and targeting an additional 50% growth in 2026 through differentiated mag-lev chillers and system-level offerings including CDUs and BMS integration.

- Aftermarket services are being scaled via digital connectivity (connected units up from 17,000 to over 70,000) and extended service agreements (service chillers increased from ~50,000 to 110,000), driving sustained double-digit growth.

- Management plans $1.5 billion of share repurchases in 2026 while prioritizing organic investments in R&D, capacity expansions, and selective small-scale M&A to address technology gaps.

- Launching the Tell Me More AI-driven predictive maintenance platform and rolling out Home Energy Management Systems (HEMS) with integrated heat pump and battery in 2026 to manage grid peak loads and secure utility partnerships.

- Faces 3–4 points of market headwind in its CSA refrigeration and European residential businesses, but expects to return to its 6–8% growth algorithm once short-cycle tailwinds emerge.

- Data center remains a key growth driver: Q4 applied business orders were up 400%, the data center business doubled in 2025, and Carrier plans 50% further growth in 2026, backed by new 1 MW, 3 MW and 5 MW CDUs and integrated BMS offerings.

- Aftermarket expansion continues: connected device count rose from 17 k to 70 k, and chillers under service agreements increased from ~50 k to 110 k, with a target of double-digit aftermarket growth worldwide.

- Capital deployment focuses on a $1.5 B share buyback, organic R&D/CapEx and selective tuck-in M&A, with no large transformational acquisitions planned.

- Carrier expects to deliver 6–8% organic growth once market headwinds abate but anticipates a 3–4 point drag in 2026 from its CSA RLC downturn and European residential decline; Q1 and full-year 2026 guidance remain unchanged.

- The applied data center segment achieved 400% order growth in Q4 2025 and targets roughly 50% segment growth in 2026, driven by investments in mag-lev chillers and in-house CDUs, yielding mid-teens margins.

- Americas residential HVAC industry volumes are forecast down 10–15%, with Carrier expecting a high single-digit decline in its CSA business and projecting 40%+ incremental margins in 2H 2026 as destocking eases.

- Full-year 2026 capital allocation includes a $1.5 billion share buyback, continued organic R&D and capacity builds, plus selective tuck-in M&A to fill strategic technology gaps.

- Carrier targets 6–8% through-cycle organic growth, driven by +1 pp from product, +2 pp from aftermarket and +1–2 pp from systems versus a ~3–4 pp market headwind; 2026 growth is guided to ~1%, recovering as market growth normalizes.

- Q2 revenue is expected to step up by >$600 million sequentially on normal seasonality and higher-margin segments, with strong EBIT drop-through and ~$0.05 of productivity benefit.

- Facing a $60–70 million commodity headwind (copper, aluminum) for 2026, fully offset by ~$200 million of pricing actions (5% in the US, ~1% in Europe), yielding positive price-cost spread.

- US residential HVAC replacement cycle is ~9 million units/year (130 million homes ×6% replacement + new builds), with 2020–24 average volume of 9.7 million; volumes fell to 7.5 million in 2025 and are expected at 6.5 million in 2026 amid field inventory down 32% in January.

- Data-center cooling orders in CSA were up 5× in 4Q 2025, fueled by new Maglev chillers and liquid-cooling solutions; overall data-center cooling growth is expected at 20–25%, with liquid cooling ~2× that rate.

- Carrier reiterated its 6%–8% organic growth through-cycle target, citing 4–5 points from product innovation, aftermarket and systems versus a 3–4 point market headwind, with short-term drag from Americas RLC and China container.

- FY2026 first-half revenues expected to be ~49% of the full year, with Q2 sales stepping up by >$600 million quarter-over-quarter and benefiting from strong drop-through and $0.05 per share productivity gains.

- Anticipates $60–70 million of raw-material headwinds (copper, aluminum) fully offset by $200 million of price realizations (~1% price increase), remaining price-cost positive.

- Data center cooling momentum: CSA orders up 5× in 4Q y/y, new maglev-bearing chillers and forthcoming 3 MW/5 MW CDUs designed to capture liquid-cooling growth projected at 2× the 20–25% overall cooling rate.

- Prioritizing share buybacks over large-scale M&A while executing operational cost actions and enhancing capacity agility to capture recovery in residential and light commercial markets.

- Carrier reconfirmed its 6%–8% through-cycle organic growth goal, citing short-term headwinds from Americas RLC down high-single digits on ~$6 billion sales and China container weakness, but expects to hit targets as markets normalize to ~2% growth by leveraging product (1 pt), aftermarket (2 pts) and systems (1–2 pts) drivers against a 3–4 pt market headwind.

- Anticipates $60 M–$70 M of commodity cost pressure (copper, aluminum), fully offset by $200 M in pricing from a 1% average price increase—5% in U.S. residential, ~1% in Europe—keeping pricing > costs.

- U.S. residential unitary cooling deliveries totaled 7.5 M units in 2025 (vs. 9 M replacement cycle), with volumes down ~20% in 1H ’25 and channel field inventory cut by 32% as of January to prepare for recovery.

- Data center cooling demand surged, with Commercial & Specialty (CSA) orders up 5× in 4Q; overall data center cooling growth at 20%–25%, and liquid cooling at ~2× that rate, bolstered by new maglev-bearing chillers and in-house CDU launches.

- Margins slated to improve via better absorption, ongoing productivity and $100 M of cost cuts (3,000 roles), while Europe margin expansion awaits volume recovery; capital prioritized for share buybacks over large M&A.

- Carrier Connect Data Solutions CEO Mark Binns will present live at the AI & Technology Virtual Investor Conference on February 19, 2026 at 12:00 PM ET, with an archived webcast available after the event.

- Recent growth includes the acquisition of 4 MW via two data centers in Ottawa and a 2 MW data center in Perth, Australia.

- Announced a letter of intent to acquire a new data center in Saint John, New Brunswick, and raised over CAD 5 million in new financing.

- The company focuses on rolling up Tier II/III data centers internationally, serving AI companies, service providers and enterprises in Vancouver, Ottawa, and Perth.

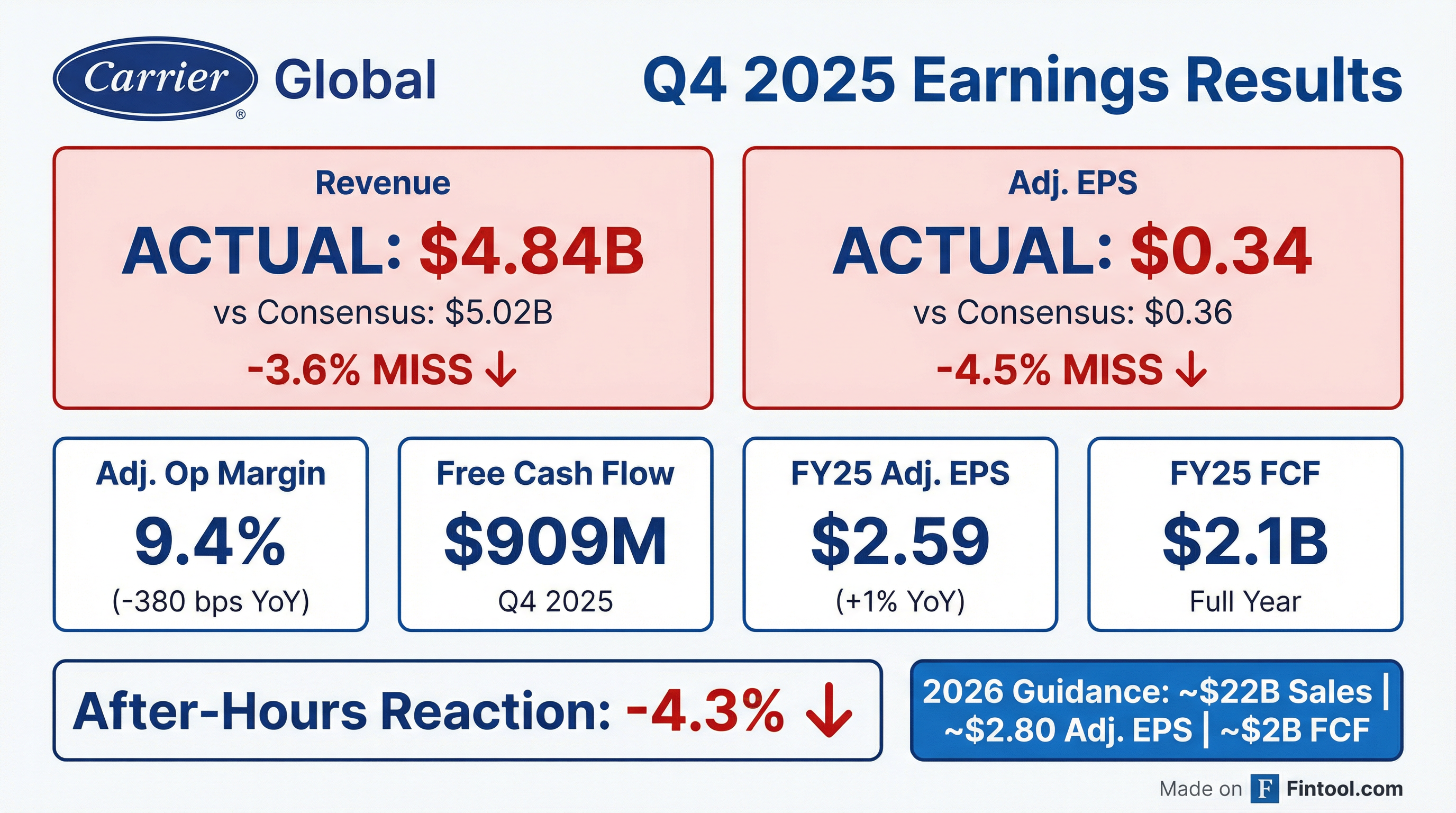

- Full-year 2025 sales were $21.7 billion (organic –1% Y/Y), with adjusted operating profit of $3.3 billion (–7% Y/Y), adjusted EPS of $2.59 (+1% Y/Y) and free cash flow of $2.1 billion.

- Q4 2025 sales of $4.84 billion (–6% Y/Y; organic –9%), adjusted EPS of $0.34 (–37% Y/Y) and free cash flow of $909 million.

- Data center momentum: full-year orders up

60%, Q4 orders up 4x, and data center sales doubled to **$1 billion** in 2025; 2026 data center sales expected to grow ~50%. - 2026 guidance calls for ~$22 billion in sales, ~$3.4 billion adjusted operating profit, ~$2.80 adjusted EPS and ~$2 billion free cash flow.

- Carrier Global reported Q4 2025 sales of $4.8 billion, adjusted operating profit of $455 million, and adjusted EPS of $0.34; Q4 free cash flow was $900 million, full-year FCF $2.1 billion, and $3.7 billion returned to shareholders via buybacks/dividends.

- Q4 organic sales fell 9%, driven by a 17% decline in the CSA segment (residential volume down ~40%, light commercial down 20%) with field inventories reduced ~30%; full-year organic sales were down 1%.

- Commercial HVAC and aftermarket remained robust: CSA commercial sales up 12% in Q4 and global commercial HVAC up 14% for 2025; aftermarket grew double digits for the fifth consecutive year; data center business reached $1 billion with Q4 CSA data center orders up over 5×.

- For 2026, Carrier expects flat to low-mid single-digit organic growth with ~$22 billion in sales, $3.4 billion adjusted operating profit, $2 billion free cash flow, $2.80 adjusted EPS, and $1.5 billion in share repurchases.

- Q4 sales of $4.8 billion, adjusted operating profit $455 million, adjusted EPS $0.34, and organic sales down 9%; free cash flow $900 million in Q4 and $2.1 billion for FY 2025.

- CSA segment organic sales down 17% (commercial +12%, residential –40%, light commercial –20%); field inventories down 30% year-over-year.

- Total company orders up 16% led by commercial HVAC orders +45% globally and CSA commercial orders +80%.

- 2026 outlook: flat to low-mid single-digit organic growth, $22 billion in sales, $3.4 billion adjusted operating profit, $2.80 EPS, $2 billion free cash flow, and $1.5 billion in share repurchases.

- Strategic milestones include growing data center business to $1 billion, five consecutive years of double-digit HVAC and aftermarket growth, and $3.7 billion returned to shareholders.

Quarterly earnings call transcripts for CARRIER GLOBAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more