Earnings summaries and quarterly performance for MOOG.

Research analysts covering MOOG.

Recent press releases and 8-K filings for MOG-A.

Moog Discusses Operational Improvements, Missile Business Growth, and Strategic M&A

MOG-A

New Projects/Investments

M&A

Revenue Acceleration/Inflection

- Moog is implementing an 80/20 initiative to improve operating margins, which had been stagnant for a decade, by focusing on pricing, simplification, portfolio shaping, and footprint rationalization. This initiative now covers over 80% of the company's revenue.

- The company's missile business is experiencing significant growth, with $200 million in fiscal 2025 and projected $250 million in fiscal 2026, representing a 20%+ growth rate. Moog's Salt Lake facility has the capacity to handle a 4x rate on PAC-3 production without expansion.

- Moog is actively mitigating tariff impacts, which caused higher-than-anticipated tariffs in Q1, through airline paperwork assistance and supply chain rerouting, with an expected 80 basis points of pressure for the year inclusive of these efforts.

- The company is shifting its M&A strategy to be more strategic, targeting acquisitions in the $100 million-$250 million range that add capability or scope, particularly in Europe. Capital deployment prioritizes organic growth, capital expenditures, and R&D, with share repurchases being opportunistic.

- Q1 earnings benefited from unexpected orders and accelerated earnings, such as a V-22 order representing a year's worth of activity, which pulled revenue and earnings forward from later in the year.

Feb 12, 2026, 7:05 PM

Moog Discusses Strategic Initiatives, Missile Program Growth, and Financial Outlook

MOG-A

New Projects/Investments

M&A

Guidance Update

- Moog is implementing an 80/20 initiative to improve operating margins, which has already covered over 80% of its revenue and involves pricing, simplification, portfolio shaping, and focused factories.

- The company is experiencing strong growth in missile programs, including PAC-3, with over $200 million in new orders from Lockheed Martin and existing facility capacity to support a four-fold increase in PAC-3 production.

- Moog faced higher-than-anticipated tariff impacts in Q1 but has largely mitigated these through operational changes and customer collaboration, with an 80 basis point pressure still anticipated for the year.

- Q1 EPS exceeded guidance by over $0.40, leading to a $0.20 increase in the full-year guide, partly driven by accelerated earnings from a V-22 aftermarket order and other defense activities.

- Moog is adopting a strategic M&A approach for deals typically in the $100-$250 million range to add capabilities, while prioritizing organic growth and dividends, with share repurchases being opportunistic.

Feb 12, 2026, 7:05 PM

Moog Details Strategic Initiatives, Missile Growth, and M&A Strategy

MOG-A

New Projects/Investments

Revenue Acceleration/Inflection

M&A

- Moog is implementing an 80/20 initiative to improve its operating margin, which had been around 10% for a decade, by focusing on pricing, simplification, portfolio shaping, footprint rationalization, and focused factories. Over 80% of the company's revenue is now covered by this initiative.

- The company's missile business is experiencing significant growth, projected to be $250 million in fiscal 2026 from $200 million in fiscal 2025, representing a 20%+ growth rate. This includes recent $100 million+ orders from Lockheed Martin for PAC-3.

- Moog beat its Q1 EPS guide by over $0.40 but only increased its full-year guide by $0.20 due to an acceleration of earnings from a V-22 order and other space and defense jobs pulling revenue and earnings from later in the year into Q1. The company also faced higher-than-anticipated tariffs in Q1, causing an 80 basis points pressure for the year, which is being mitigated through airline cooperation and supply chain adjustments.

- Moog is shifting to a more strategic and proactive M&A approach, targeting tuck-in acquisitions between $100 million and $250 million that add capability or scope, particularly in Europe. The primary focus for capital deployment remains organic growth, capital expenditures, and R&D, with M&A complementing this.

Feb 12, 2026, 7:05 PM

Moog Inc. Reports Record Q1 2026 Results, Raises Full-Year Guidance, and Increases Dividend

MOG-A

Earnings

Guidance Update

Dividends

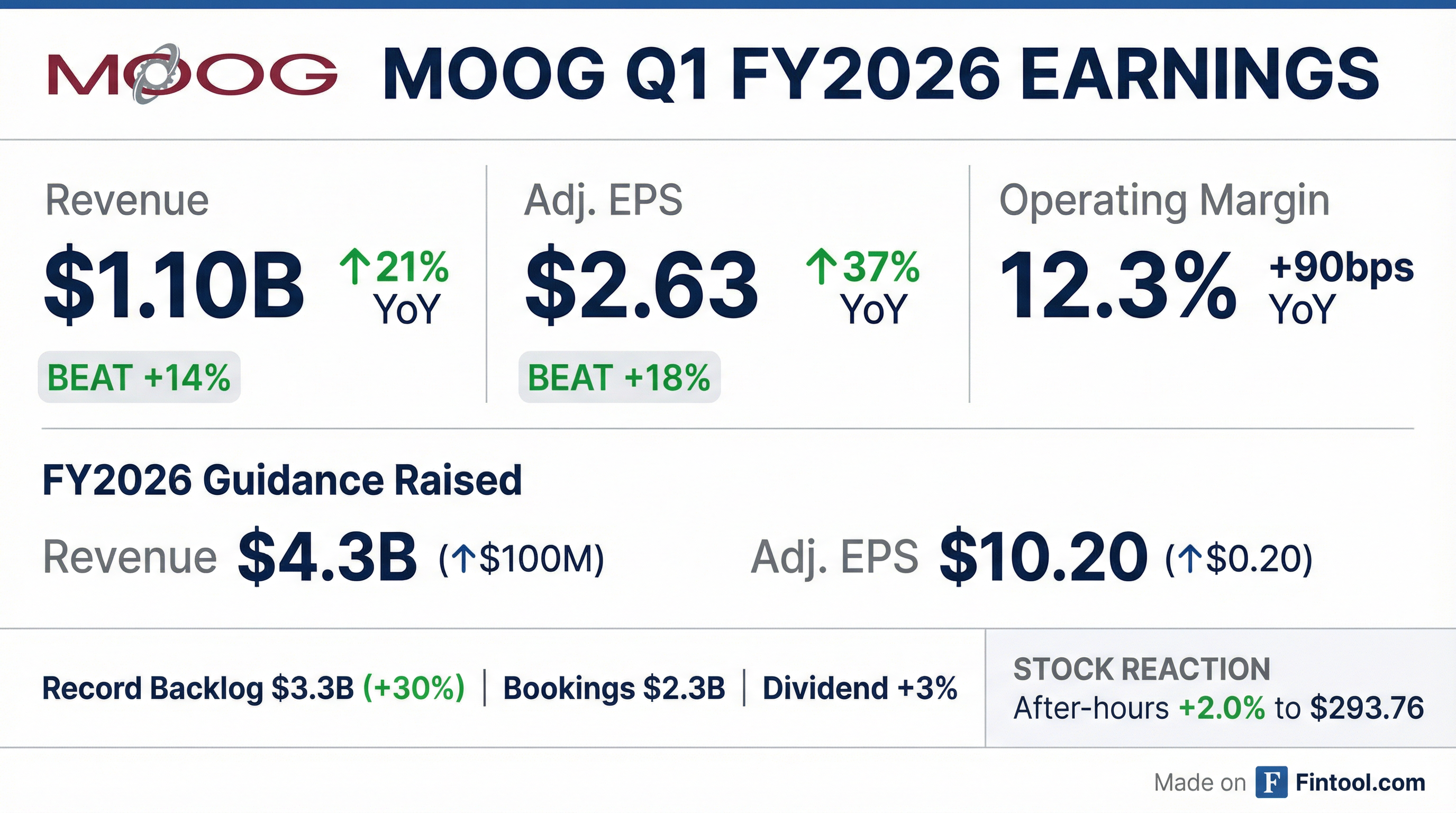

- Moog Inc. reported record first quarter 2026 results, with net sales of $1,100 million, a 21% increase from Q1 2025, and diluted net earnings per share of $2.46, up 38%.

- The company raised its fiscal year 2026 guidance, now projecting net sales of $4.3 billion and adjusted diluted net earnings per share of $10.20.

- An increase in the quarterly dividend was announced, bringing it to $0.30 per share, a 3% increase over the previous quarter, payable on February 26th, 2026.

- Bookings totaled $2.3 billion, and the twelve-month backlog increased 30% to a record $3.3 billion, reflecting continued demand across all markets.

Jan 30, 2026, 2:08 PM

Moog Inc. Reports Record Q1 2026 Results and Raises Full-Year Guidance

MOG-A

Earnings

Guidance Update

Revenue Acceleration/Inflection

- Moog Inc. reported record fiscal first quarter 2026 net sales of $1,100 million, a 21% increase from Q1 2025, and record diluted net earnings per share of $2.46, a 38% increase.

- The company achieved an operating margin of 12.3% in Q1 2026, an increase of 90 basis points compared to Q1 2025.

- Bookings reached $2.3 billion, contributing to a 30% increase in the twelve-month backlog to a record $3.3 billion.

- Moog Inc. raised its full-year 2026 guidance, now expecting net sales of $4.3 billion (up from $4.2 billion) and adjusted diluted net earnings per share of $10.20 (up from $10.00).

Jan 30, 2026, 12:55 PM

Moog Inc. Partners with Niron Magnetics for Rare-Earth-Free Actuator Designs

MOG-A

New Projects/Investments

Supply Chain Resilience

- Moog Inc. is collaborating with Niron Magnetics to develop and test rare-earth-free actuator designs for guided munitions systems in defense applications.

- This partnership aims to reduce reliance on rare earth minerals and strengthen supply chain resilience, aligning with the U.S. Department of Defense’s Acquisition Transformation Strategy.

- Moog is evaluating Niron Magnetics' Iron Nitride magnet technology, which is domestically produced and offers a sustainable way to meet demand for permanent magnets.

- The collaboration is expected to expand domestic production, shorten lead times, and de-risk operations for defense systems.

Dec 11, 2025, 3:33 PM

Moog Reports Record Q4 2025 Sales and Strong FY2026 Outlook

MOG-A

Earnings

Guidance Update

Dividends

- Moog Inc. reported record fourth-quarter sales and strong financial results for fiscal year 2025, with net sales rising 14% to $1.049 billion and adjusted net income increasing 19% to $82 million for the fourth quarter.

- For fiscal year 2026, Moog projects net sales to reach $4.2 billion, operating margins to improve to 13.4%, and diluted EPS to increase to $10.00. The company also aims to increase free cash flow conversion to 60%, up from 46% in 2025.

- Moog announced a quarterly dividend of $0.29 per share for its Class A and B common stock, payable on December 17, 2025.

- Analysts maintain a positive outlook with a consensus "buy" rating and a median 12-month price target of $230, approximately 13.7% above the current trading price.

Nov 21, 2025, 8:16 PM

Moog Inc. Reports Record Q4 and FY 2025 Results, Issues Strong FY 2026 Guidance

MOG-A

Earnings

Guidance Update

Financial Restatement

- Moog Inc. reported record financial results for the fourth quarter and fiscal year 2025, achieving record net sales, adjusted operating margin, and free cash flow.

- For Q4 2025, net sales reached $1,049 million, adjusted operating margin was 13.7%, and adjusted diluted net earnings per share were $2.56.

- For fiscal year 2025, net sales were $3,861 million, adjusted operating margin was 13.0%, and adjusted diluted net earnings per share were $8.69.

- The company issued strong fiscal 2026 guidance, forecasting net sales of $4.2 billion, an adjusted operating margin of 13.4%, and adjusted diluted net earnings per share of $10.00.

- The document also disclosed a revision of previously issued consolidated financial statements for prior periods due to immaterial misstatements.

Nov 21, 2025, 2:21 PM

Quarterly earnings call transcripts for MOOG.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more