AMDOCS (DOX)·Q1 2026 Earnings Summary

Amdocs Stock Drops 8.6% Despite Revenue Beat as GAAP Outlook Cut

February 3, 2026 · by Fintool AI Agent

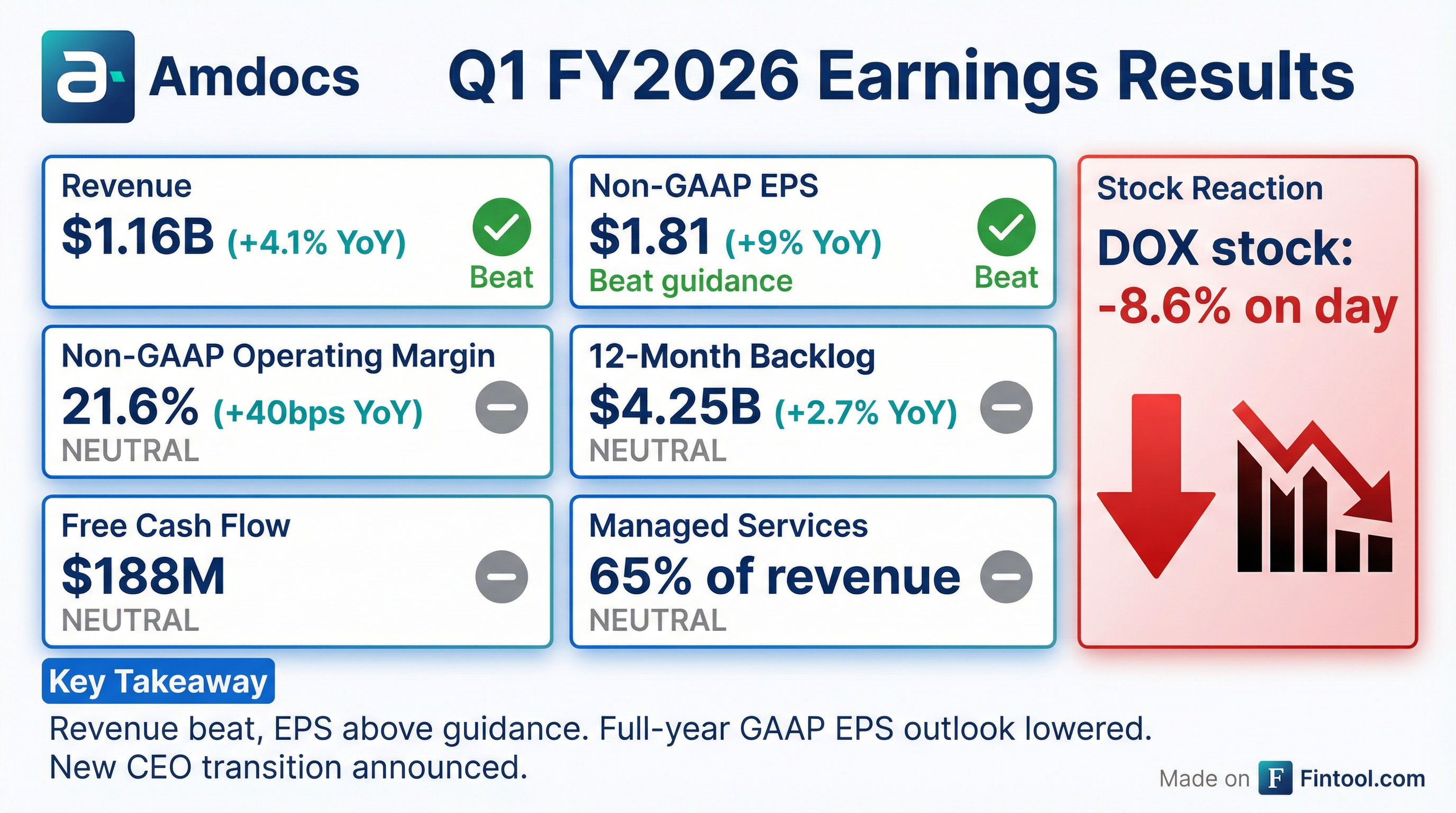

Amdocs Limited (NASDAQ: DOX) reported fiscal Q1 2026 results that beat revenue expectations and topped company EPS guidance, yet the stock tumbled 8.6% as management lowered full-year GAAP earnings outlook and announced a CEO transition. The telecom software and services provider posted revenue of $1.16 billion (+4.1% YoY) and non-GAAP EPS of $1.81, which exceeded the guided range of $1.73-$1.79 due to a lower-than-expected tax rate .

Did Amdocs Beat Earnings?

Revenue came in slightly above the guidance midpoint of $1.155B despite unfavorable FX headwinds of approximately $3M versus expectations . Non-GAAP EPS of $1.81 topped the high end of guidance ($1.79) but landed marginally below street consensus, primarily benefiting from a lower-than-anticipated non-GAAP effective tax rate .

Beat/miss history shows consistent execution:

*Values retrieved from S&P Global

How Did the Stock React?

DOX shares fell 8.6% to $74.02 on heavy volume of 3.2 million shares (vs. normal ~1.4M), marking the stock's worst single-day decline in over a year. The selloff pushed shares to a new 52-week low of $73.18, well below the 50-day moving average of $80.02 and 200-day average of $85.17.

Key factors driving the decline:

- GAAP EPS outlook lowered: Full-year GAAP EPS growth guidance cut from 13.5%-20.5% to 10.0%-17.0%

- CEO transition announced: Shimie Hortig succeeds Shuky Sheffer as CEO effective March 31, 2026

- FX headwinds: As-reported revenue growth guidance trimmed from 1.7%-5.7% to 1.5%-5.5% due to less favorable currency

- T-Mobile revenue decline expected: Revenue from T-Mobile expected to decline in FY26, consistent with prior guidance

What Did Management Guide?

Management reiterated core non-GAAP metrics while the GAAP revision reflects timing and tax-related items rather than operational deterioration. The company expects approximately 90% earnings-to-cash-flow conversion and an attractive ~8% free cash flow yield .

What Changed From Last Quarter?

Positive developments:

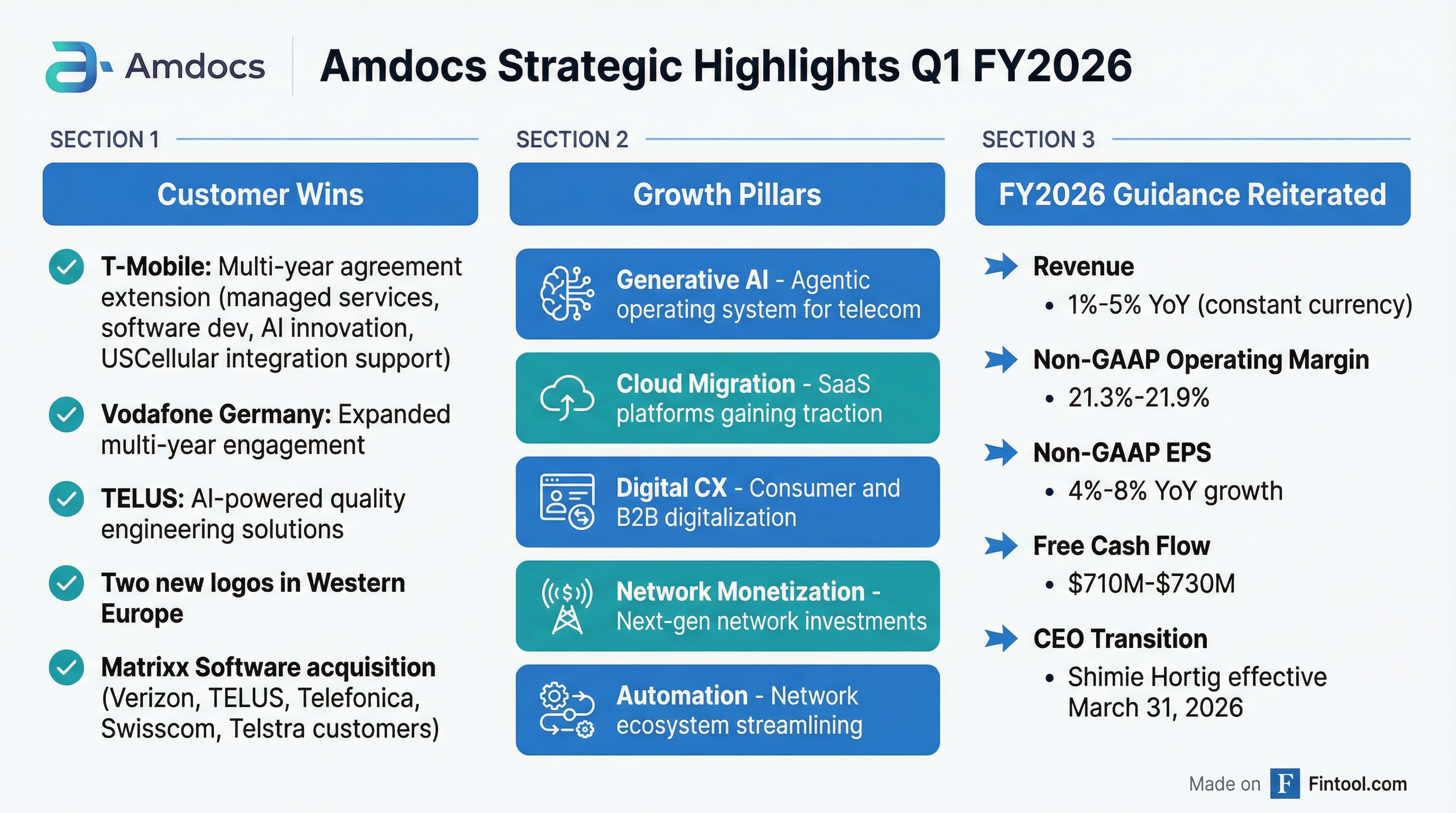

- T-Mobile deal extended: New 5-year agreement including managed services, software development, AI innovation, and USCellular integration support

- Matrixx Software acquisition closed ($197M): Acquired tier-2 charging solution that complements Openet (tier-1), consolidating Amdocs' market leadership in billing and monetization; adds customers including Verizon, TELUS, Telefónica, Three, Virgin Media O2, and Telstra

- Vodafone Germany expansion: Multi-year digital transformation engagement

- TELUS AI win: Selected to deliver AI-powered quality engineering solutions on TELUS Sovereign Cloud, meeting Canadian data residency mandates

- 12-month backlog: Increased $60M sequentially to $4.25B (+2.7% YoY)

Areas to watch:

- CEO transition: Shuky Sheffer steps down March 31, 2026; Shimie Hortig (President of Americas) takes over after 20 years at Amdocs

- T-Mobile revenue decline: Expected in FY26, creating headwind for North America growth

- Restructuring costs: FCF before restructuring payments of $49M was $237M in Q1; ongoing optimization

Revenue Breakdown by Region

North America delivered its fourth consecutive quarter of sequential growth, though the T-Mobile revenue headwind looms for the balance of FY26. Europe posted strong 17% YoY growth driven by Vodafone Germany and other transformation wins. Rest of World continues diversification into Japan, Africa, and Middle East .

Managed Services: The Resilience Engine

Managed services revenue was approximately $746M, representing ~65% of Q1 revenue . The company noted close to 100% managed services contract renewals, highlighting the stickiness of these multi-year arrangements .

Key managed services developments:

- T-Mobile: Extended multi-year agreement including managed services, software development, and AI innovation

- Vodafone Germany: Multi-year digital transformation including legacy tech stack decommissioning and IT architecture simplification

Balance Sheet and Capital Allocation

Capital returns in Q1:

- Dividends: $57M

- Share repurchases: $146M

- Total returned: $203M

Board authorized quarterly dividend of $0.569 per share, payable April 24, 2026 . Remaining share repurchase authorization stands at approximately $800M .

Margin Trajectory

Amdocs has delivered consistent margin expansion, with FY26 guidance implying +20bps YoY improvement at the midpoint. Management is balancing generative AI growth investments against internal cost and efficiency improvements .

CEO Transition: What We Know

Shimie Hortig will succeed Shuky Sheffer as President and CEO effective March 31, 2026 .

About Shimie Hortig:

- Currently President of Americas Group (Amdocs' largest region)

- Led company-wide strategic growth initiatives and built strong partnerships

- 20 years of experience in technology and telecommunications

- Long-tenured Amdocs leader with senior roles across business, services, and corporate functions

The incoming CEO spoke briefly on the call, stating: "I'm excited to lead Amdocs to the next chapter... As we look ahead, Amdocs is well positioned to combine emerging technologies with deep domain expertise to drive value to customers and shareholders."

The transition appears orderly with internal succession, though investors may want visibility into any strategic shifts under new leadership.

Forward Catalysts

- MWC Barcelona (early March 2026): Showcasing AOS, an agentic operating system purpose-built for telecommunications that sits on top of any BSS/OSS stack and executes complex end-to-end workflows via AI agents

- Matrixx integration: Realizing synergies from the billing/monetization acquisition

- GenAI monetization: Converting pilot wins (Optimum, Consumer Cellular, Telefónica Germany, e&) into recurring revenue

- CEO transition: New leadership under Shimie Hortig starting March 31, 2026

Q&A Highlights

On the T-Mobile contract structure:

"We're talking about a five-year agreement. This is quite typical for long-term managed services engagements... We are covering managed services, development services, some AI-related activities, integration of common systems." — Tamar Rapaport-Dagim, CFO

On MATRIXX acquisition rationale:

"It gives us an additional charging engine... it's more like what we call tier-two level rather than tier-one. This is one. It gives us a very nice set of customers... I think its strengths positioned [us] by far the market leader in this critical domain of charging and monetization." — Shuky Sheffer, CEO

The CEO clarified that Openet (acquired ~5 years ago) serves tier-one high-scale deployments, while MATRIXX complements the portfolio for tier-two operators and MVNOs .

On Verizon cost-cutting initiatives:

"Regarding Verizon, I cannot comment more than you need to assume that we are engaging with Verizon to see how we can help them in the future." — Shuky Sheffer, CEO

On USCellular integration timeline: Management emphasized that integration work is non-recurring by nature: "Usually, integration is measured by quarters rather than years."

On Q1 beat and full-year guidance:

"It's not anything specific in particular. It's not a customer that caused that. Actually, I'm happy about the fact that we were able to show now faster performance on the revenue to meet the numbers." — Tamar Rapaport-Dagim, CFO

Key Risks

- T-Mobile concentration: Revenue decline from largest customer expected in FY26

- Telecom industry spending: Macro uncertainty affecting customer demand and spending behavior

- FX volatility: Currency movements impacting as-reported results

- CEO transition execution: Leadership change during ongoing transformation

The Bottom Line

Amdocs delivered operationally sound Q1 results with revenue slightly ahead and non-GAAP EPS above its own guidance, but the stock sold off on a lowered GAAP EPS outlook and CEO transition announcement. Core operating metrics remain on track—non-GAAP EPS growth of 4%-8%, 21%+ margins, and strong cash conversion—but investors are digesting leadership change and T-Mobile headwinds. The ~8% free cash flow yield and $4.25B backlog provide fundamental support, though near-term sentiment may remain cautious until the new CEO provides strategic clarity.

Sources: Amdocs Q1 FY2026 Earnings Presentation (February 3, 2026), S&P Global Market Intelligence

Related Resources: