Earnings summaries and quarterly performance for AMDOCS.

Research analysts who have asked questions during AMDOCS earnings calls.

Shlomo Rosenbaum

Stifel, Nicolaus & Company, Incorporated

5 questions for DOX

Timothy Horan

Oppenheimer & Co. Inc.

4 questions for DOX

Dan McDermott

Oppenheimer & Co. Inc.

2 questions for DOX

George Notter

Jefferies

2 questions for DOX

Tal Liani

Bank of America

2 questions for DOX

Tamar Zilberman

Bank of America

2 questions for DOX

Brian Potter

Citigroup

1 question for DOX

Kevin Niederpruem

Bank of America Merrill Lynch

1 question for DOX

Shlomo Rosenbaum

Stifel Financial Corp.

1 question for DOX

Taryn

Wolfe Research, LLC

1 question for DOX

Tavy Rosner

Barclays

1 question for DOX

William Power

Baird

1 question for DOX

Recent press releases and 8-K filings for DOX.

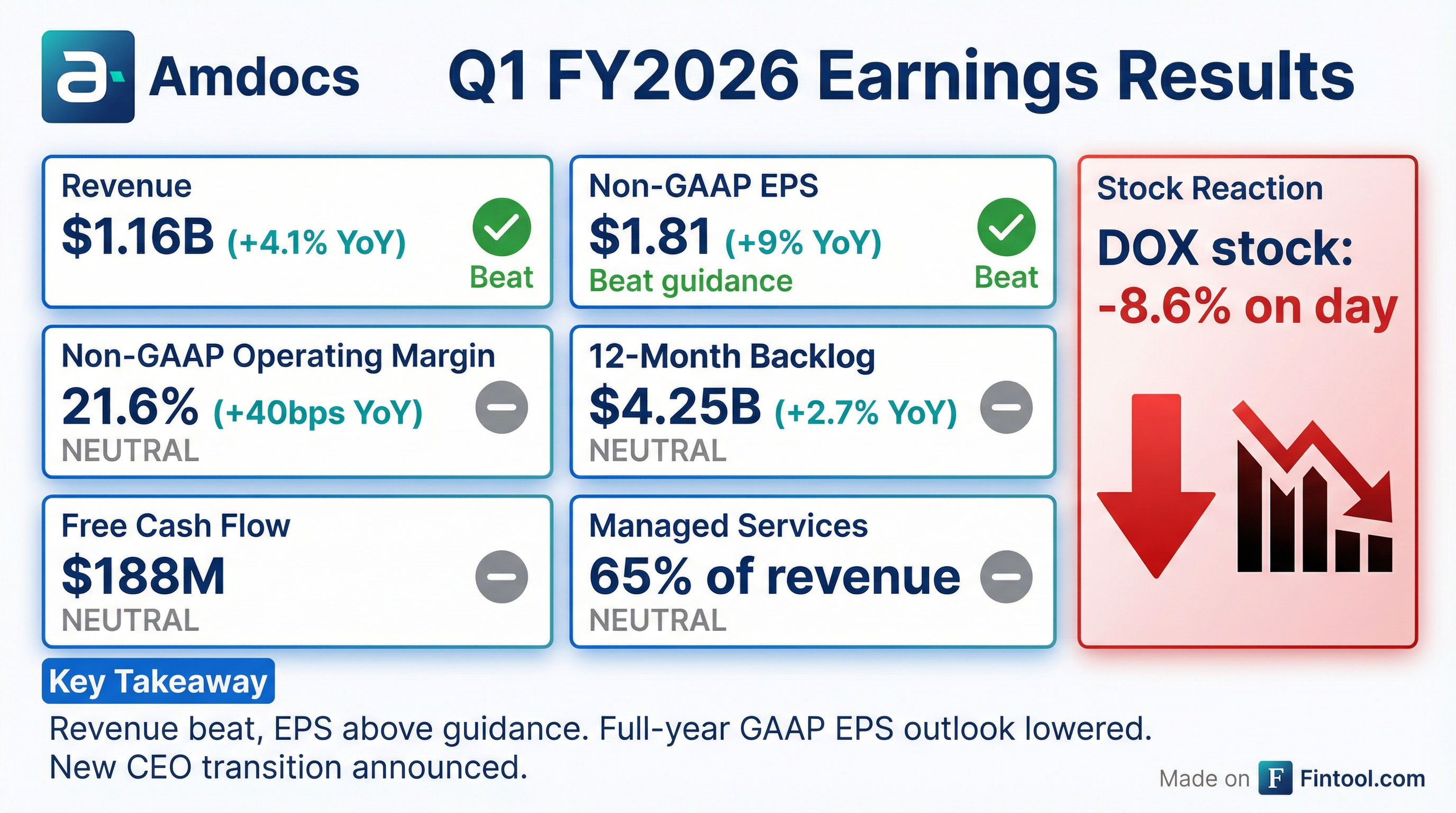

- Amdocs Limited reported a 4.1% increase in revenue to $1,155,939 thousand for the three months ended December 31, 2025, compared to the same period in the prior year.

- Net income attributable to Amdocs Limited grew by 4.3% to $157,566 thousand, and diluted earnings per share increased by 9.0% to $1.45 for the three months ended December 31, 2025.

- The company generated $220,182 thousand in net cash provided by operating activities and $188.0 million in free cash flow for the three months ended December 31, 2025.

- Amdocs Limited repurchased 1.8 million ordinary shares at an average price of $79.78 per share and declared a cash dividend of $0.527 per ordinary share for the three months ended December 31, 2025.

- The company completed the acquisition of Matrixx Software for approximately $197,000 thousand in cash during the three months ended December 31, 2025.

- Amdocs Limited reported Q1 Fiscal 2026 revenue of $1.16 billion, an increase of 4.1% year-over-year as reported, and Non-GAAP diluted EPS of $1.81, which was above the guidance range.

- The company's twelve-month backlog reached $4.25 billion, up 2.7% compared to the prior year's first fiscal quarter, and it generated free cash flow of $188 million.

- Amdocs entered into a strategic multi-year agreement with T-Mobile USA, Inc. and introduced aOS, an Agentic Operating System for Telecommunications.

- The Board approved an increased quarterly cash dividend payment of $0.569 per share, and the company repurchased $146 million of ordinary shares during the quarter.

- Shimie Hortig will succeed Shuky Sheffer as President and CEO, effective March 31, 2026.

- Amdocs reported strong Q1 FY2026 financial results, with revenue of $1.16 billion, a Non-GAAP operating margin of 21.6%, and Non-GAAP EPS of $1.81, all exceeding or meeting guidance.

- The company reiterated its full-year FY2026 outlook, projecting revenue growth of 1.0%-5.0% in constant currency, a Non-GAAP EBIT margin of 21.3%-21.9%, and Free Cash Flow of $710-$730 million.

- Shimy Hortig will succeed Shuky Sheffer as President and CEO, effective March 31, 2026.

- Strategic highlights include an extended multi-year agreement with T-Mobile, expansion with Vodafone Germany and two new Western European logos, and continued progress in Generative AI initiatives.

- Amdocs returned $203 million to shareholders in Q1 FY2026 through dividends and share repurchases, and authorized a quarterly dividend payment of 56.9 cents per share.

- Amdocs reported Q1 2026 revenue of $1.16 billion, a 4.1% increase year-over-year, and Non-GAAP diluted earnings per share of $1.81, which was above the guidance range. The company's 12-month backlog grew to $4.25 billion.

- The company reiterated its fiscal year 2026 guidance for constant currency revenue growth of 1% to 5% and Non-GAAP diluted earnings per share growth of 4% to 8%. For Q2 2026, revenue is expected to be between $1.15 billion and $1.19 billion.

- Amdocs announced the acquisition of MATRIXX Software for $197 million cash and signed a new multi-year agreement with T-Mobile. Additionally, the company unveiled AOS (Agentic Operating System), a new AI platform purpose-built for telecommunications.

- Shuky Sheffer, President and CEO, announced his retirement, with Shimie Hortig set to succeed him as President and Chief Executive Officer effective March 31, 2026.

- Amdocs reported Q1 2026 revenue of $1.156 billion, a 3.5% increase year-over-year in constant currency, with non-GAAP diluted EPS of $1.81 exceeding guidance.

- The company reiterated its fiscal year 2026 guidance for revenue growth of 1% to 5% in constant currency and non-GAAP diluted EPS growth of 4% to 8%.

- Amdocs announced AOS (Agentic Operating System), a new AI platform purpose-built for telecommunications, and confirmed the acquisition of MATRIXX Software closed in Q1 2026.

- Shuky Sheffer will retire as President and CEO effective March 31, 2026, and Jimmy Hortick will succeed him.

- Amdocs reported Q1 2026 revenue of $1.16 billion, an increase of 4.1% year-over-year, and non-GAAP diluted earnings per share of $1.81, which was above the guidance range.

- The company reiterated its fiscal year 2026 guidance for revenue growth of 1% to 5% in constant currency and non-GAAP diluted earnings per share growth of 4% to 8%.

- Key business developments include a new multi-year agreement with T-Mobile, an expanded engagement with Vodafone Germany, and the acquisition of MATRIXX Software for $197 million.

- Shuky Sheffer will retire as President and CEO on March 31, 2026, and Jimmy Hortick will succeed him.

- Amdocs supports the telco industry's IT domain with a unique product-led services approach and an outcome-based business model, differentiating it from competitors who typically use rate card relationships.

- The company's key growth drivers include the cloud journey, which currently represents approximately 30% of its business and is growing double-digit, and the GenAI transformation, with a new "Cognitive Core" layer expected to be announced in Q1 next year.

- Amdocs demonstrates strong financial fundamentals, with 65% of its revenue derived from managed services, 75% recurring revenue, and 90% visibility within its 12-month backlog.

- Internal GenAI implementation is contributing to margin expansion, with the company anticipating an expansion of 20 basis points in 2026, even with increased investments in GenAI capabilities like Cognitive Core.

- Amdocs supports the telco industry's IT domain, focusing on monetization activities (BSS/OSS systems) for major global carriers like AT&T, T-Mobile, and Vodafone, and is unique as a product-led services company offering both product development and system integration.

- The company's monetization model is primarily outcome-based, committing to service levels and KPIs rather than rate card relationships, which differentiates it from traditional system integrators.

- Amdocs is strategically transforming by phasing out $600 million of non-core, low-margin business and prioritizing cloud migration and GenAI.

- Cloud migration is a significant growth engine, already accounting for approximately 30% of the business and growing double-digit, with most customers having started their journey.

- The company is heavily investing in GenAI, with its amAIz platform for current use cases and the upcoming Cognitive Core, a GenAI layer over all Amdocs platforms, which is expected to be announced in the first quarter of next year (2026) at Mobile World Congress. Amdocs anticipates margin expansion of 20 basis points in 2026, driven by internal GenAI implementation, despite increased investments in GenAI capabilities.

- Amdocs specializes in telecommunications software and platforms, offering a unique accountability model that integrates software products with implementation services to simplify complex back-end operations and enhance customer experience.

- Key growth drivers include cloud migration, which constitutes 30% of the business and is growing double digits, supported by strategic partnerships with AWS, Azure, and GCP.

- The company is making significant investments in Generative AI, with its Amaze platform demonstrating 40-50% uplifts in call center KPIs and expecting AI-driven revenue to impact starting in 2026 through a strategic partnership with NVIDIA.

- Amdocs employs an outcome-based monetization model and anticipates that its AI solutions will positively impact long-term margin profiles.

- Additional growth areas include the eSIM platform with over 30 customers (including AT&T), the ConnectX SaaS platform for MVNOs, and the MarketOne platform for digital product and service sales.

- Amdocs specializes in the telecommunications vertical, offering software and platforms for customer experience, and employs a unique accountability model that covers both product delivery and implementation.

- Key growth drivers include cloud migration, facilitated by strategic partnerships with AWS, Azure, and GCP, and a strong emphasis on Generative AI.

- The company's AI platform, Amaze, has demonstrated 40-50% uplifts in critical call center KPIs, with initial revenue impact from AI solutions anticipated starting in 2026.

- Amdocs utilizes an outcome-based pricing model, which aligns with delivering business value to customers and is well-suited for monetizing its Generative AI offerings.

- New SaaS platforms such as eSIM, ConnectX (enabling rapid MVNO launches), and MarketOne (for digital product sales) are identified as additional areas for growth and expansion.

Quarterly earnings call transcripts for AMDOCS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more