Earnings summaries and quarterly performance for DAVITA.

Executive leadership at DAVITA.

Javier Rodriguez

Chief Executive Officer

Christopher Berry

Chief Accounting Officer

David Maughan

Chief Operating Officer, DaVita Kidney Care

James Hearty

Chief Compliance Officer

Joel Ackerman

Chief Financial Officer and Treasurer

Kathleen Waters

Chief Legal and Public Affairs Officer

Board of directors at DAVITA.

Research analysts who have asked questions during DAVITA earnings calls.

Andrew Mok

Barclays

6 questions for DVA

Ryan Langston

TD Cowen

6 questions for DVA

Justin Lake

Wolfe Research, LLC

5 questions for DVA

Pito Chickering

Deutsche Bank

4 questions for DVA

A.J. Rice

UBS Group AG

3 questions for DVA

Albert Rice

UBS

3 questions for DVA

Kevin Fischbeck

Bank of America

3 questions for DVA

Joanna Gajuk

Bank of America

2 questions for DVA

Lisa Clive

Sanford C. Bernstein & Co., LLC

2 questions for DVA

Peter Chickering

Deutsche Bank AG

2 questions for DVA

Christian Malachy Porter

Bank of America

1 question for DVA

Dean Rosales

Wolfe Research

1 question for DVA

Recent press releases and 8-K filings for DVA.

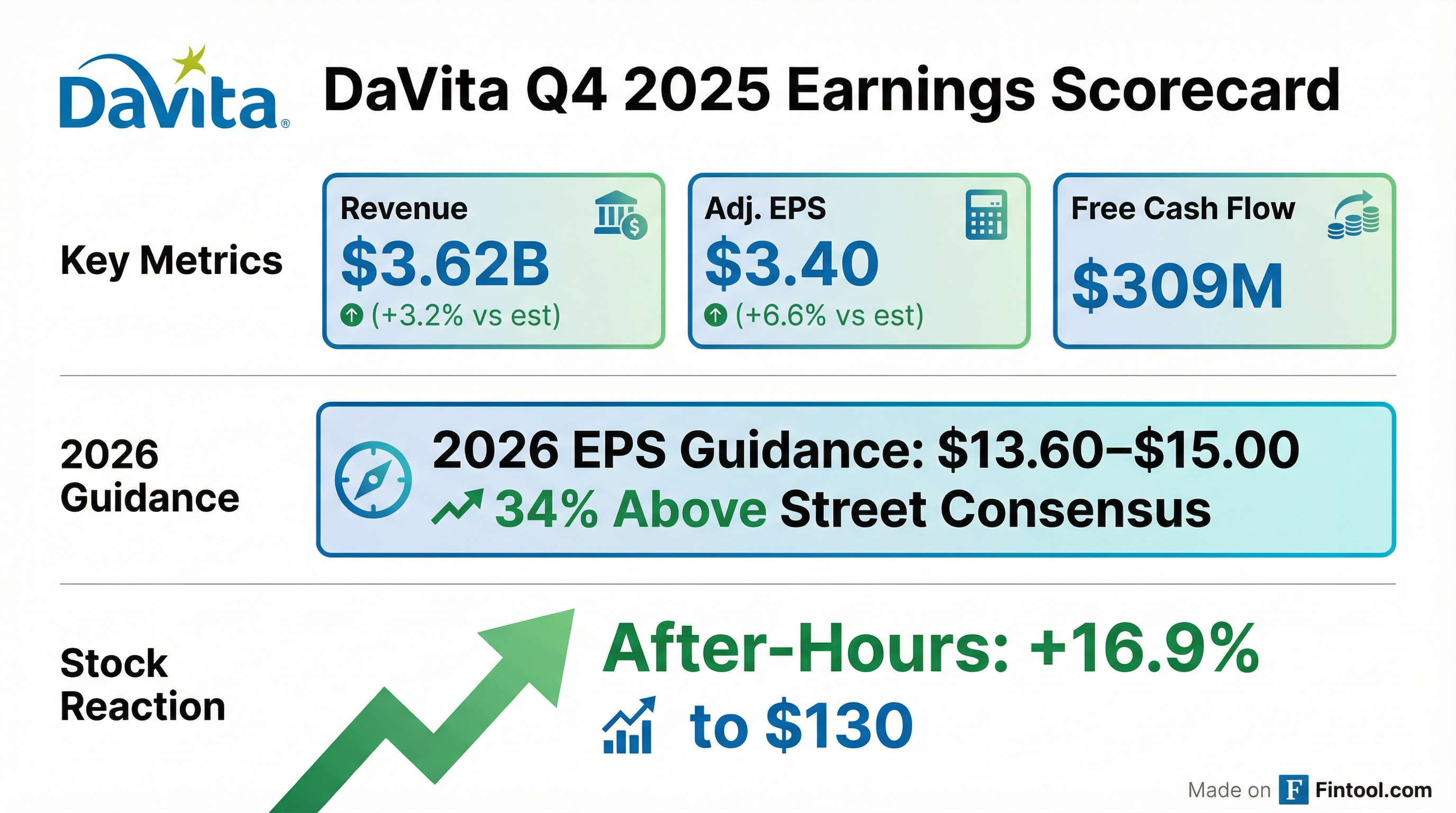

- For Q4 2025, DaVita posted adjusted operating income of $586 million (FY: $2.094 billion), adjusted EPS of $3.40 (FY: $10.78), and free cash flow of $309 million (FY: just over $1 billion).

- U.S. dialysis treatments declined 0.2% in Q4 and 1.1% for FY, while revenue per treatment grew 4.7% to ~$410 and patient care costs rose 5.9% yoy.

- Integrated Kidney Care (IKC) delivered its first profitable year, with $46 million in Q4 and $22 million in FY adjusted operating income, ahead of the 2026 target.

- Executed ~13 million share repurchases (~$1.8 billion) in FY, including 4.4 million in Q4, ending the year with a 3.26x leverage ratio.

- 2026 guidance: adjusted operating income of $2.085 billion–$2.235 billion (+3.2% at midpoint), adjusted EPS of $13.60–$15.00 (+33% at midpoint), and free cash flow of $1.0–$1.25 billion.

- Q4 adjusted operating income of $586 million and adjusted EPS of $3.40; full-year operating income of $2.094 billion, EPS of $10.78, and free cash flow exceeding $1 billion

- U.S. dialysis treatments down 20 bps in Q4 and 1.1% for FY 2025; full-year revenue per treatment was $410, up 4.7%; Integrated Kidney Care (IKC) delivered its first profitable year with Q4 adjusted OI of $46 million and FY OI of $22 million

- 2026 guidance: adjusted operating income of $2.085 billion–$2.235 billion (≈3.2% growth midpoint), adjusted EPS of $13.60–$15.00 (33% growth midpoint), and free cash flow of $1.0 billion–$1.25 billion

- Capital allocation: repurchased nearly 13 million shares for $1.8 billion in 2025; year-end leverage ratio at 3.26× EBITDA; announced a $200 million minority investment in Elara Caring to expand home care services

- Delivered Q4 adjusted operating income of $586 million and adjusted EPS of $3.40, bringing full-year 2025 adjusted operating income to $2.094 billion and EPS to $10.78; free cash flow was $309 million in Q4 and just over $1 billion for the year.

- Integrated Kidney Care achieved its first profitable year in 2025, with Q4 adjusted operating income of $46 million and full-year operating income of $22 million; management expects an incremental $20 million IKC operating income growth in 2026.

- Issued 2026 guidance for adjusted operating income of $2.085 billion–$2.235 billion (3.2% growth at midpoint), adjusted EPS of $13.60–$15.00 (33% growth at midpoint), and free cash flow of $1.0 billion–$1.25 billion.

- Repurchased 2.7 million shares in Q4 (plus 1.7 million additional shares post-quarter) and nearly 13 million shares (~$1.8 billion) in FY 2025; leverage ended at 3.26× EBITDA, within target range of 3.0–3.5×.

- Consolidated revenues were $3.620 billion in Q4 and $13.643 billion for FY 2025.

- Q4 operating income was $561 million (15.5% margin) and diluted EPS from continuing operations was $2.94; FY operating income was $2.044 billion and EPS was $9.51.

- Q4 operating cash flow was $541 million and free cash flow was $309 million; repurchased 2.7 million shares for $331 million in Q4 and 12.7 million shares for $1.788 billion in FY 2025.

- In November 2025, refinanced existing Term Loan A-1 and revolver into a $2.0 billion Term Loan A-2 and $1.5 billion revolver facility.

- 2026 guidance calls for adjusted operating income of $2.085–2.235 billion, adjusted EPS of $13.60–15.00, and free cash flow of $1.0–1.25 billion.

- In Q4 2025, DaVita delivered $3.620 billion in consolidated revenues, $561 million in operating income (adjusted $586 million), and $2.94 diluted EPS (adjusted $3.40).

- For the full year 2025, revenues were $13.643 billion, operating income $2.044 billion (adjusted $2.094 billion), and diluted EPS $9.51 (adjusted $10.78).

- Operating cash flow reached $541 million in Q4 (free cash flow $309 million), driving full-year operating cash flow of $1.887 billion and free cash flow of $1.024 billion.

- In Q4, DaVita refinanced its Term Loan A-1 and revolving credit with a $2.0 billion Term Loan A-2 and up to $1.5 billion revolver, and during 2025 issued 6.75% senior notes due 2033.

- The company repurchased 2.7 million shares at an average price of $122.78 in Q4, totaling $331 million of buybacks.

- Elara Caring has agreed to receive a strategic investment from Ares’ Private Equity Group and DaVita to expand its capacity in skilled home health and hospice services.

- The company will remain independent under CEO Ananth Mohan and continue operating its existing management team and care programs.

- As part of the partnership, DaVita and Elara will co-develop a kidney-specific home-based care model to reduce hospitalizations and lower total cost of care.

- The transaction, with terms undisclosed, is expected to close later in 2026 pending customary regulatory approvals.

- DaVita posted Q4 2025 non-GAAP EPS of $3.40 and revenue of $3.62 billion, beating analyst estimates; adjusted operating income was $586 million and free cash flow $309 million.

- Full-year 2025 results included GAAP EPS of $10.78, revenue of $13.32 billion, adjusted operating income of $2.094 billion, and over $1 billion in free cash flow.

- 2026 guidance calls for adjusted operating income of $2.085 billion–$2.235 billion and EPS of $13.60–$15.00, implying roughly 33% growth at the midpoint.

- DaVita remains the largest U.S. dialysis provider with ~35% of clinics (serving ≈280,000 patients) and has a ~45% stake held by Berkshire Hathaway; shares rose 11–15% in after-hours trading.

- On November 24, 2025, DaVita entered into an Eighth Amendment to its Credit Agreement, replacing its prior $1.95 billion term loan and $1.5 billion revolving facility with a new five-year $2 billion Term A-2 facility and a $1.5 billion revolving facility maturing in 2030.

- Borrowings under the new facilities bear interest at the Base Rate + 50 bps or Term SOFR + 150 bps, with margins resetting to 0–175 bps after delivery of Q1 2026 financials; the Term A-2 facility amortizes quarterly starting March 31, 2026.

- Proceeds will refinance the prior facilities, cover amendment fees, and be used for working capital and general corporate purposes, including potential stock repurchases and acquisitions.

- 2025 volume down 1%, driven by a severe flu season in Q1 and a cyber incident in Q2, with core dialysis growth running roughly –25 to –50 bps after adjusting for non-core impacts.

- Mortality remains elevated by over 100 bps versus pre-COVID levels, and mistreatment rates run at ~7%, about 100 bps above historical norms, both exacerbated by flu and cyber disruptions.

- New patient starts are volatile but remain within their pre-COVID range, and there is no observable impact from GLP-1 therapies on admission trends.

- For 2026, the focus is on reducing mortality through enhanced clinical operations—longer therapy duration, improved pharmaceuticals, and new dialysis technologies—to drive volume recovery alongside ~3% top-line growth via a balanced mix of rate and volume improvements.

- 2025 challenges: faced a 1% volume decline due to a tough flu season in Q1 and a cyber incident in Q2, which also pressured revenue per treatment, yet full-year guidance was maintained.

- Mortality and mistreatments remain elevated, with mortality >100 bps above pre-COVID and mistreatment rates around 7% versus 6% historically; focus is on clinical improvements and new dialytic technologies to drive volume recovery.

- New patient starts have stayed within the pre-COVID range, and the Q4 2024 dip linked to GLP-1 was deemed noise with no sustained impact observed.

- 2026 outlook targets ~3% U.S. dialysis revenue growth through mortality improvements and balanced price/volume contributions, while expiration of enhanced premium tax credits is expected to create a $40 million headwind.

Quarterly earnings call transcripts for DAVITA.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more