DAVITA (DVA)·Q4 2025 Earnings Summary

DaVita Crushes Q4, Guides 2026 EPS 34% Above Street

February 2, 2026 · by Fintool AI Agent

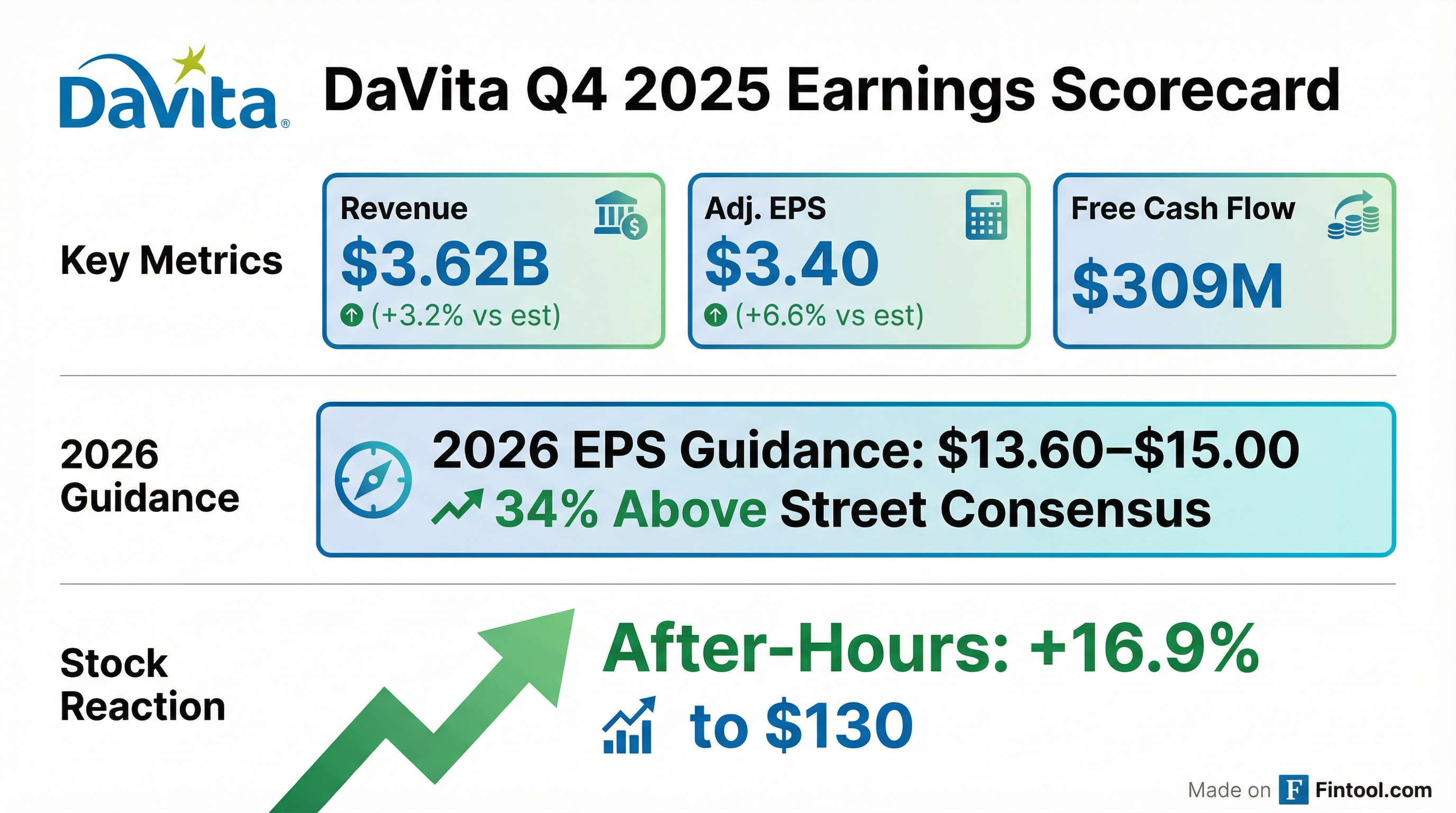

DaVita delivered a clean beat across all metrics in Q4 2025 and issued 2026 guidance that stunned the Street. The dialysis giant posted adjusted EPS of $3.40, topping consensus by 6.6%, while revenue of $3.62 billion exceeded estimates by 3.2% . More importantly, management guided 2026 EPS to $13.60-$15.00—a midpoint 34% above where analysts had been modeling .

DVA shares jumped 9.6% after hours to $119.87.

Did DaVita Beat Earnings?

Yes—DaVita beat on both revenue and EPS.

Full Year 2025:

- Revenue: $13.64B

- Adjusted EPS: $10.78

- Operating Cash Flow: $1.89B

- Free Cash Flow: $1.02B

CEO Javier Rodriguez framed the results: "Our strong platform delivered once again in 2025, providing high quality, innovative care to our patients and achieving the financial targets we set out at the beginning of the year despite a challenging environment" .

What Did Management Guide for 2026?

The guidance is the story. DaVita's 2026 outlook blew past Street expectations:

*Values retrieved from S&P Global

At the $14.30 midpoint, management is guiding EPS 34% above consensus. This reflects confidence in continued operational execution and the benefits of ongoing share repurchases.

Rodriguez noted: "Given our ongoing investments and process improvements, we are confident in our ability to continue to deliver both clinically and financially in 2026 and beyond" .

How Did the Stock React?

DVA shares surged 9.6% after hours to $119.87, recovering from a challenging 2025 that saw the stock trade down from its 52-week high of $178.47.

Key context:

- 52-week high: $178.47

- 52-week low: $101.00

- Pre-earnings close: $109.34

- After-hours price: $119.87

The magnitude of the move reflects how meaningfully the guidance exceeded expectations. Heading into the print, consensus had been modeling ~$10.70 EPS for 2026—management's guidance midpoint is $3.60 higher.

What Changed From Last Quarter?

Several factors drove the strong Q4 performance:

Revenue per treatment improved:

- Q4 2025: $422.60/treatment vs Q3 2025: $410.59

- Drivers: Higher average reimbursement rates, improved mix, and seasonal flu vaccine impact

Operating margin expanded:

- Q4 2025 operating margin: 15.5% vs Q3 2025: 14.8%

- Adjusted operating margin: 16.2% vs 15.1%

Cost pressures persisted but were manageable:

- Patient care costs: $279.60/treatment vs $273.54 in Q3

- G&A increased due to professional fees and IT costs

Cybersecurity incident winding down:

- Q3 2025 included $12M in cybersecurity charges

- Q4 showed minimal incremental impact

Capital Allocation Highlights

DaVita continues to aggressively return capital to shareholders:

Share Repurchases:

- Q4 2025: 2.7M shares at $122.78 average = $331M

- Full Year 2025: 12.7M shares at $140.09 average = $1.79B

- Post quarter-end through Feb 2: 1.7M shares at $120.56 = $200M

Debt Refinancing: In November 2025, DaVita refinanced its credit facilities, replacing the Term Loan A-1 and revolving line of credit with a new $2.0B Term Loan A-2 and $1.5B revolver .

Leverage:

- Net debt: $9.67B

- Leverage ratio: 3.26x (down from 3.37x in Q3)

- Maximum permitted: 5.00x

Operational Metrics

U.S. Dialysis Volume:

- Q4 2025 treatments: 7.26M (91,608 per day)

- Normalized non-acquired treatment growth: -0.6% YoY

Center Footprint:

- Total patients: ~295,000

- Total centers: 3,242 (2,657 U.S., 585 international)

- Q4 activity: Acquired 1, closed 6 U.S. centers; acquired 3, opened 1, closed 5 international

Integrated Kidney Care (IKC):

- Patients in risk-based arrangements: ~66,000

- Annualized medical spend under management: $5.6B

- Additional patients in other arrangements: 9,400

Key Risks and Headwinds

Management flagged several risk factors in the forward-looking disclosure :

- Medicare reimbursement risk: Potential policy changes under OBBBA and federal government actions could impact rates

- Commercial payor concentration: Continued pressure on higher-paying commercial plans

- Labor market: Ongoing challenges with skilled clinical personnel shortages

- Supply chain/tariffs: Evolving trade policies could impact cost of supplies

- Competition: New entrants in dialysis and pre-dialysis marketplace

The Bottom Line

DaVita delivered a textbook quarter: beat estimates, expanded margins, and raised guidance well above consensus. The 34% guidance gap versus Street expectations suggests analysts will need to meaningfully revise their models. Combined with aggressive share repurchases reducing the share count, DaVita enters 2026 with clear line of sight to double-digit EPS growth.

The stock's 9.6% after-hours move reflects how significantly the guidance surprised the market—this was a setup reset, not just an earnings beat.

Related Resources: