ECB Bancorp, Inc. /MD/ (ECBK)·Q4 2025 Earnings Summary

ECB Bancorp Earnings Nearly Double as NIM Expands 38bps

February 5, 2026 · by Fintool AI Agent

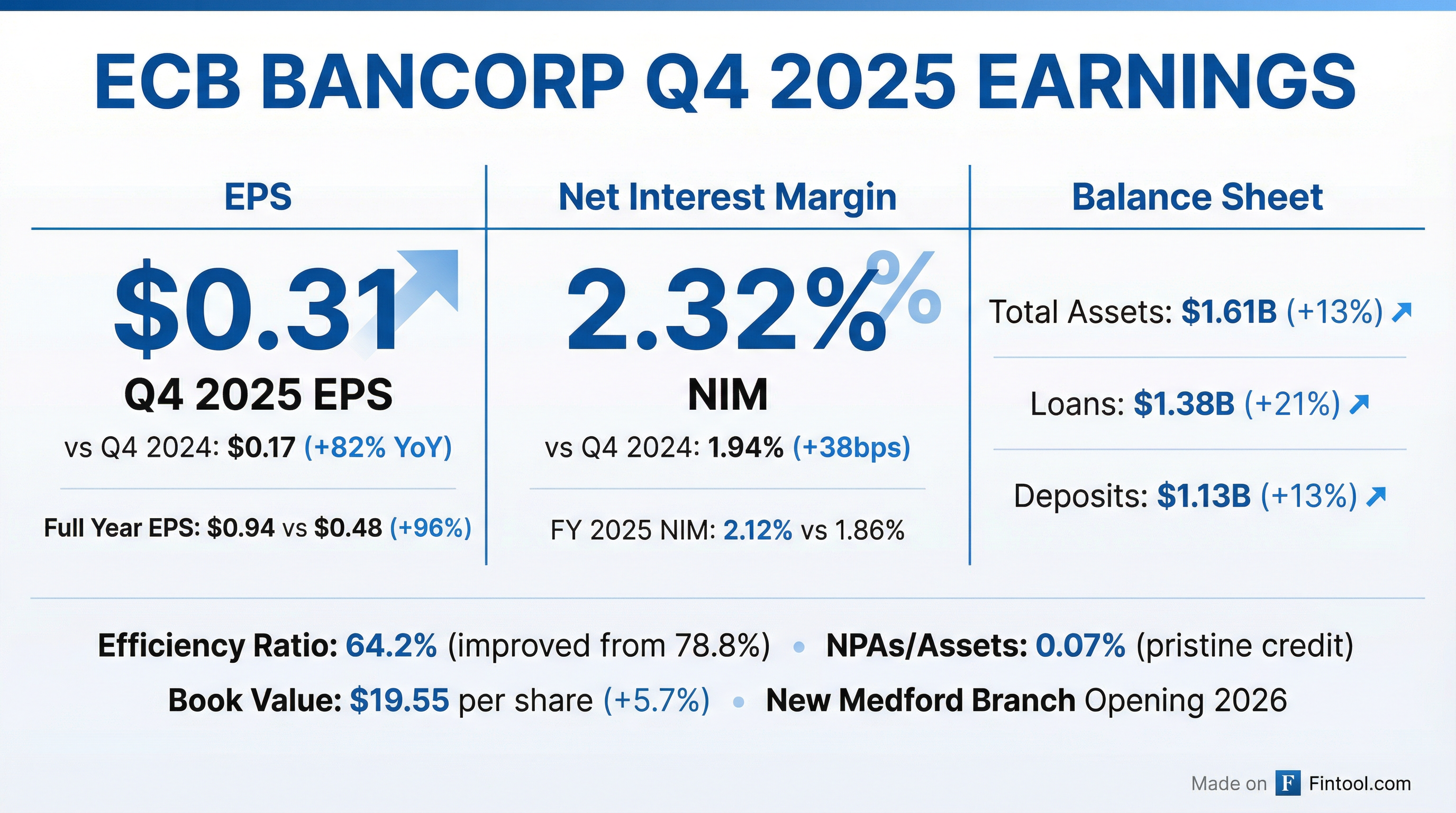

ECB Bancorp (NASDAQ: ECBK) reported Q4 2025 net income of $2.6 million, or $0.31 per diluted share, representing an 82% increase from $0.17 per diluted share in the year-ago quarter . For full-year 2025, the community bank earned $7.8 million ($0.94 per share) compared to $4.0 million ($0.48 per share) in 2024—a near-doubling of profitability .

The Massachusetts-based thrift delivered strong balance sheet growth while dramatically improving operating efficiency. Loans grew 21% year-over-year to $1.38 billion, and the efficiency ratio improved to 64.2% from 78.8% .

Did ECB Bancorp Beat Estimates?

No analyst coverage available. ECBK is a $159 million market cap community bank with limited institutional following. There are no consensus EPS or revenue estimates to compare against.

However, the results represent a significant improvement versus the prior year:

What Drove the Margin Expansion?

Net interest margin expansion was the primary earnings driver. NIM improved 38 basis points to 2.32% in Q4 2025, driven by:

- Higher loan yields — Average loan balances and yields increased as the portfolio grew

- Lower funding costs — Average cost of interest-bearing liabilities decreased

- Mix shift — Commercial and multi-family real estate loans grew faster than lower-yielding residential mortgages

Net interest and dividend income before provision reached $9.2 million in Q4, up 35% from $6.8 million in Q4 2024 .

What Did Management Say?

CEO Richard J. O'Neil, Jr. highlighted the bank's disciplined execution:

"During the fourth quarter, we continued to execute on our strategy of disciplined balance sheet growth and thoughtful capital deployment. Loans increased $237.0 million, or 20.7% year over year, while deposits grew $133.8 million, or 13.4% over the same period."

On credit quality, O'Neil noted:

"Credit quality remains extremely strong, with nonperforming assets representing just 0.07% of total assets."

Looking ahead:

"As we look ahead to 2026, we are excited to further expand our footprint with the opening of our new branch in Medford, MA."

How Is the Balance Sheet Positioned?

Loan growth by segment:

- Commercial real estate: +$107M (+47%)

- Multi-family real estate: +$82M (+24%)

- Residential real estate: +$51M (+12%)

- Home equity lines: +$5M (+10%)

Funding for loan growth came from a combination of deposit growth and increased FHLB advances.

How Is Credit Quality?

Pristine. Nonperforming assets totaled just $1.1 million, or 0.07% of total assets, improving from 0.14% a year ago . The allowance for credit losses was $10.3 million (0.74% of gross loans) compared to $8.9 million (0.78%) at year-end 2024 .

Net charge-offs for full-year 2025 were minimal at $86,000 compared to just $3,000 in 2024 .

What About Capital?

ECB Bancorp remains well-capitalized:

The decline in capital ratios reflects the rapid loan growth outpacing retained earnings. The company also repurchased $4.6 million in shares under its buyback program .

How Did the Stock React?

ECBK shares were trading at $18.11 on February 5, 2026, down 0.9% on the day the results were announced. The muted reaction may reflect:

- No estimate surprise — Without analyst coverage, there's no beat/miss narrative

- Thin trading — Average volume is low given the $159M market cap

- Already priced in — Stock near 52-week high of $18.49

The stock trades at 0.93x book value ($19.55 book value per share) .

What Are the Forward Catalysts?

- New Medford Branch — Opening in 2026 should drive further deposit and loan growth

- Continued NIM Expansion — If funding costs continue to decline, margins could expand further

- Operating Leverage — Efficiency ratio improvements suggest the bank is scaling effectively

- Credit Quality — Pristine asset quality provides cushion for any economic softness

What Are the Risks?

- Interest Rate Sensitivity — Rate cuts could compress NIM gains

- Concentration — Heavy exposure to commercial and multi-family real estate in Greater Boston

- Thin Capital — Capital ratios declined with rapid growth; further growth may require capital raise

- Liquidity — Cash and equivalents declined 45% YoY to fund loan growth

Key Takeaways

- Earnings nearly doubled — $0.31 EPS vs $0.17 YoY (+82%)

- Margin expansion — NIM +38bps to 2.32%

- Strong loan growth — +21% YoY led by CRE and multi-family

- Operating efficiency — Efficiency ratio improved to 64.2% from 78.8%

- Credit pristine — NPAs just 0.07% of assets

- Expansion coming — New Medford branch in 2026

ECB Bancorp's annual meeting of stockholders is scheduled for May 20, 2026 .