New Oriental Education & Technology Group (EDU)·Q2 2026 Earnings Summary

New Oriental Beats on All Metrics, Raises Full-Year Guidance as K-12 Accelerates

January 28, 2026 · by Fintool AI Agent

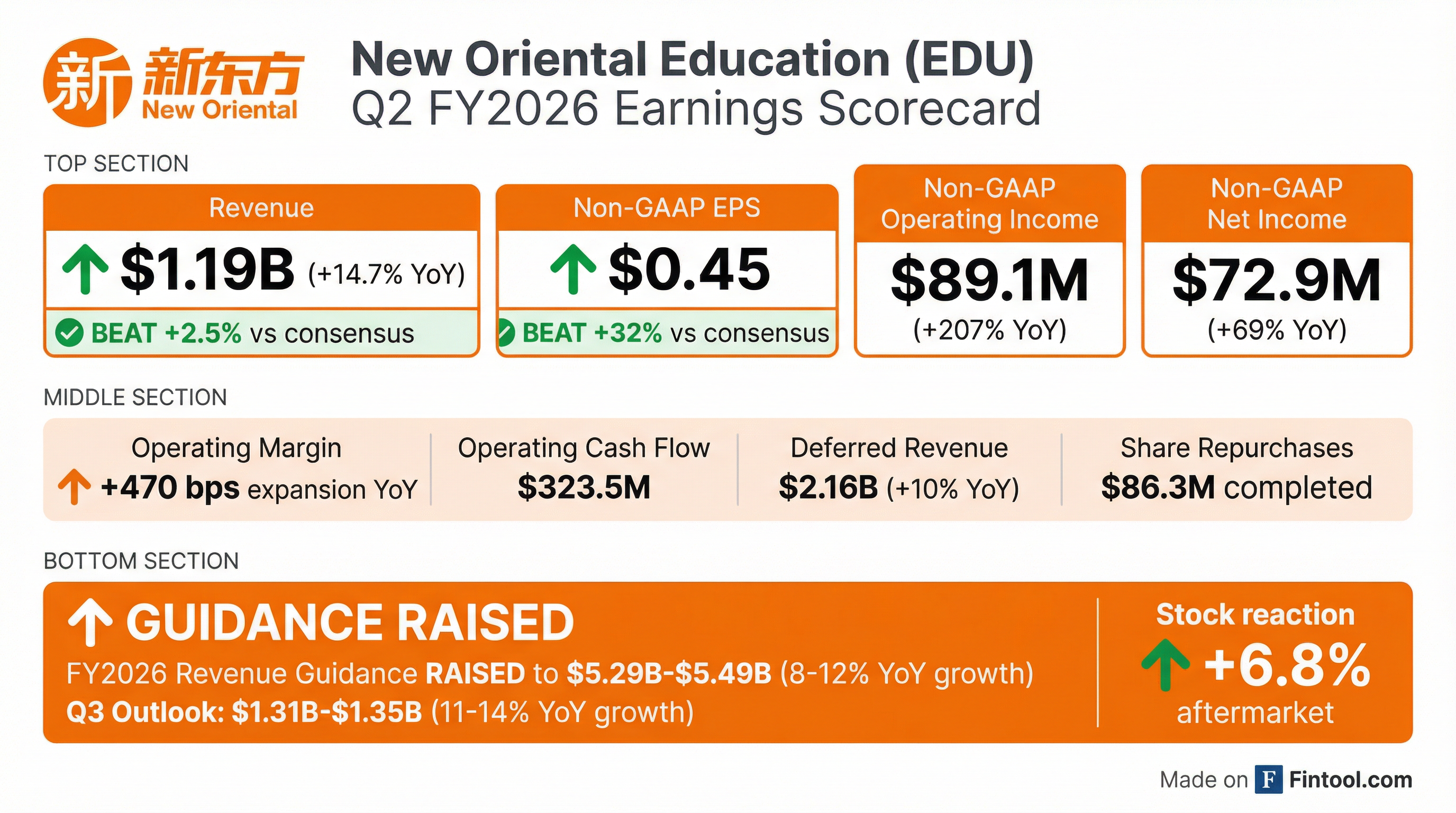

New Oriental Education delivered a strong Q2 FY2026, beating consensus on revenue, EPS, and EBITDA while raising full-year guidance. The stock surged +6.8% in aftermarket trading to $59.80 following the release, as the company's K-12 business showed accelerating growth and East Buy's turnaround contributed to both top and bottom line.

Did New Oriental Beat Earnings?

Yes — New Oriental beat on every key metric:

Values retrieved from S&P Global

The standout metric was non-GAAP operating income, which more than tripled year-over-year to $89.1 million, driving a 470 basis point expansion in non-GAAP operating margin.

Management attributed the margin expansion to three factors: better utilization of learning centers, higher operating leverage from the 14.7% revenue growth, and disciplined cost control that began in March 2025.

"Even though we missed some margin drag from the overseas-related business, we still got the group margin expansion in Q2... The non-GAAP OP margin was increased by 470 basis points year-over-year." — Stephen Yang, CFO

What Did Management Guide?

New Oriental raised full-year guidance and provided strong Q3 outlook:

The guidance raise reflects management's increased confidence following the K-12 business acceleration and East Buy's recovery. CFO Stephen Yang noted they are "now in a more optimistic position regarding our business outlook."

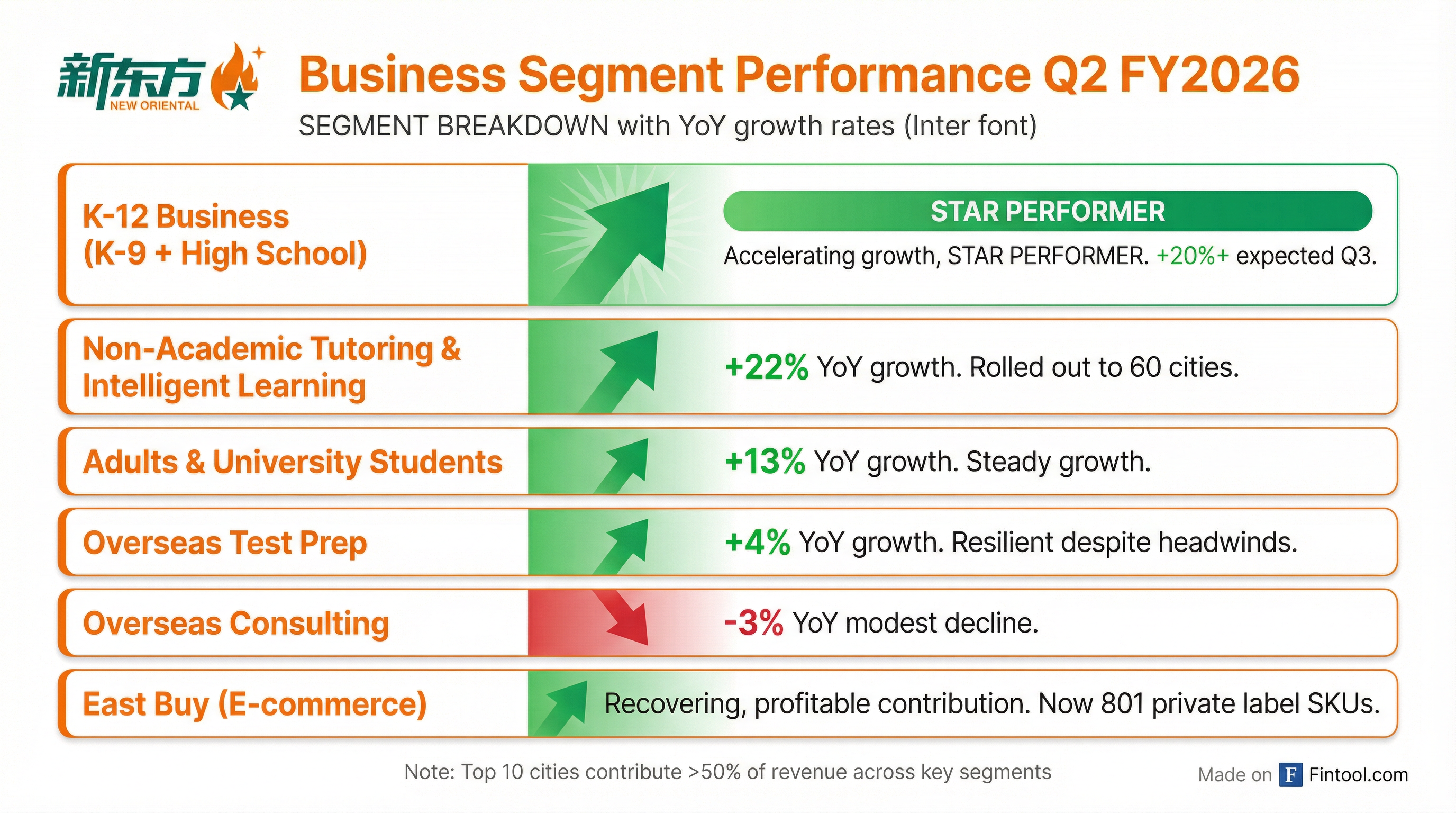

Segment Outlook from Management:

- K-12 Business: Expected to grow 20%+ YoY in Q3, driven by higher student retention and improved word-of-mouth

- College/University: Projected 14-15% growth

- Overseas Business: Expected to be flat to low single-digit growth in H2 due to macro headwinds

- East Buy: Expected to contribute "more revenue and profits" going forward

How Did the Stock React?

The aftermarket surge brings EDU within striking distance of its 52-week high, reflecting investor enthusiasm for the guidance raise and margin expansion. The stock has recovered significantly from its July 2025 lows around $44, when concerns about China's regulatory environment weighed on sentiment.

What Changed From Last Quarter?

Key Deltas vs Q1 FY2026:

Three key changes this quarter:

-

K-12 growth accelerated meaningfully — The company's strategy shift to prioritize quality over quantity (slowing learning center expansion from 20-30% to ~10%) is paying off through higher retention rates and organic growth.

-

Selling & marketing expenses declined — First YoY decrease in several quarters, down 1.1% as better word-of-mouth reduced the need for customer acquisition spend.

-

East Buy turned around — After a challenging period, the e-commerce subsidiary is now profitable and contributing to both revenue and earnings. Private label SKUs expanded to 801 across new categories.

What's Driving the Business?

K-12 Business: The Growth Engine

The K-12 segment (including K-9 and high school tutoring) is the clear driver of New Oriental's acceleration. Management highlighted:

- Higher student retention rates — Both K-9 and high school showing improved retention YoY

- Better word-of-mouth — Reduced reliance on paid marketing to acquire new students

- Quality over quantity strategy — Only 10% new learning center expansion vs 20-30% previously

"All the business line, even the high school and the K-9 business, the student retention rate is getting higher... we don't need to spend crazy marketing expenses to acquire the new student enrollment." — Stephen Yang, CFO

Overseas Business: Resilient Despite Headwinds

Despite macro challenges affecting Chinese demand for overseas education:

Management announced the merger of overseas test prep and consulting businesses to create a "one-stop service" and reduce costs. Results expected next quarter.

East Buy: Back on Track

The e-commerce subsidiary has expanded from its original food focus to a broader product range:

- 801 private label SKUs (up from prior quarters)

- New categories: healthcare products, kitchen condiments, home textiles, apparel

- Vending machine model now profitable in select cities, with nationwide rollout planned

What Did Management Say About AI?

Management discussed AI initiatives across three areas:

-

New product offerings — AI-powered educational products in development, with results expected in coming quarters

-

Enhancing existing products — AI contributing to higher student retention rates by improving product quality

-

Operational efficiency — AI helping reduce costs and support teaching staff

"AI helps the whole group, you know, three points: new offerings, existing product improvement, and cost saving... we will bear more fruit from the AI investment going forward." — Stephen Yang, CFO

The company invested $28.4 million this quarter to upgrade its OMO (Online-Merge-Offline) teaching platform.

Capital Allocation Update

Balance Sheet (as of Nov 30, 2025)

Shareholder Returns

- Dividend: $0.12/share ($1.20/ADS) for FY2026, paid in two installments. First installment completed.

- Share Repurchases: $86.3 million of $300 million authorization completed (29% of program)

Q&A Highlights

On margin outlook (from JP Morgan analyst DS Kim): Excluding East Buy, core education margin expanded approximately 300 basis points YoY. Management expects margin expansion to continue in both Q3 and Q4, driven by ongoing cost control and operating leverage.

On K-12 growth sustainability (from JP Morgan): Management confirmed that with 10% learning center expansion driving 20%+ revenue growth, they see "higher utilization rate and higher margin" continuing. This algorithm is expected to be sustainable "even in the year after."

On marketing efficiency (from CLSA analyst): The cross-department customer service system is reducing acquisition costs. Management expects selling & marketing expense as a percentage of revenue to "go down going forward, in the second half of the year and the year after."

Key Risks and Concerns

-

Overseas business headwinds — Macro environment remains challenging; management guiding flat to low single-digit growth in H2

-

Regulatory environment — Company continues to work "closely with government authorities" and may need to "adjust operations as needed"

-

East Buy execution — While turnaround is progressing, sustained contribution needs continued execution

-

G&A expense growth — G&A increased 15.2% YoY this quarter, outpacing revenue growth

Forward Catalysts

Key Takeaways

- Beat and raise quarter — Revenue beat +2.5%, EPS beat +32%, full-year guidance raised

- K-12 is accelerating — Expect 20%+ growth in Q3 as quality-over-quantity strategy pays off

- Margin expansion story — 470 bps YoY improvement with more to come

- East Buy turnaround — Now contributing positively to both revenue and profits

- Overseas drag manageable — Flat to low single-digit growth expected, not getting worse

- Strong balance sheet — $5.3B in liquidity, active buyback program