Earnings summaries and quarterly performance for New Oriental Education & Technology Group.

Research analysts who have asked questions during New Oriental Education & Technology Group earnings calls.

Felix Liu

UBS

9 questions for EDU

Lucy Yu

Bank of America Merrill Lynch

9 questions for EDU

Timothy Zhao

Goldman Sachs

9 questions for EDU

D. S. Kim

JPMorgan Chase & Co.

7 questions for EDU

Alice Cai

Citigroup Global Markets Inc.

6 questions for EDU

Elsie Sheng

CLSA Limited

5 questions for EDU

Charlotte Wei

HSBC

4 questions for EDU

Yijing Cai

Citigroup

3 questions for EDU

DS Kim

JPMorgan Chase & Co.

2 questions for EDU

Yi Kuen Cheng

CITIC

2 questions for EDU

Yikun Zheng

CITIC Securities Company Limited

2 questions for EDU

Yiran Sheng

Morgan Stanley

2 questions for EDU

Yiwen Zhang

Leerink Partners

2 questions for EDU

E. Quinn Chung

Citibank

1 question for EDU

Equin Yung

CITIC Securities

1 question for EDU

Yiqun Chen

BOCI

1 question for EDU

Recent press releases and 8-K filings for EDU.

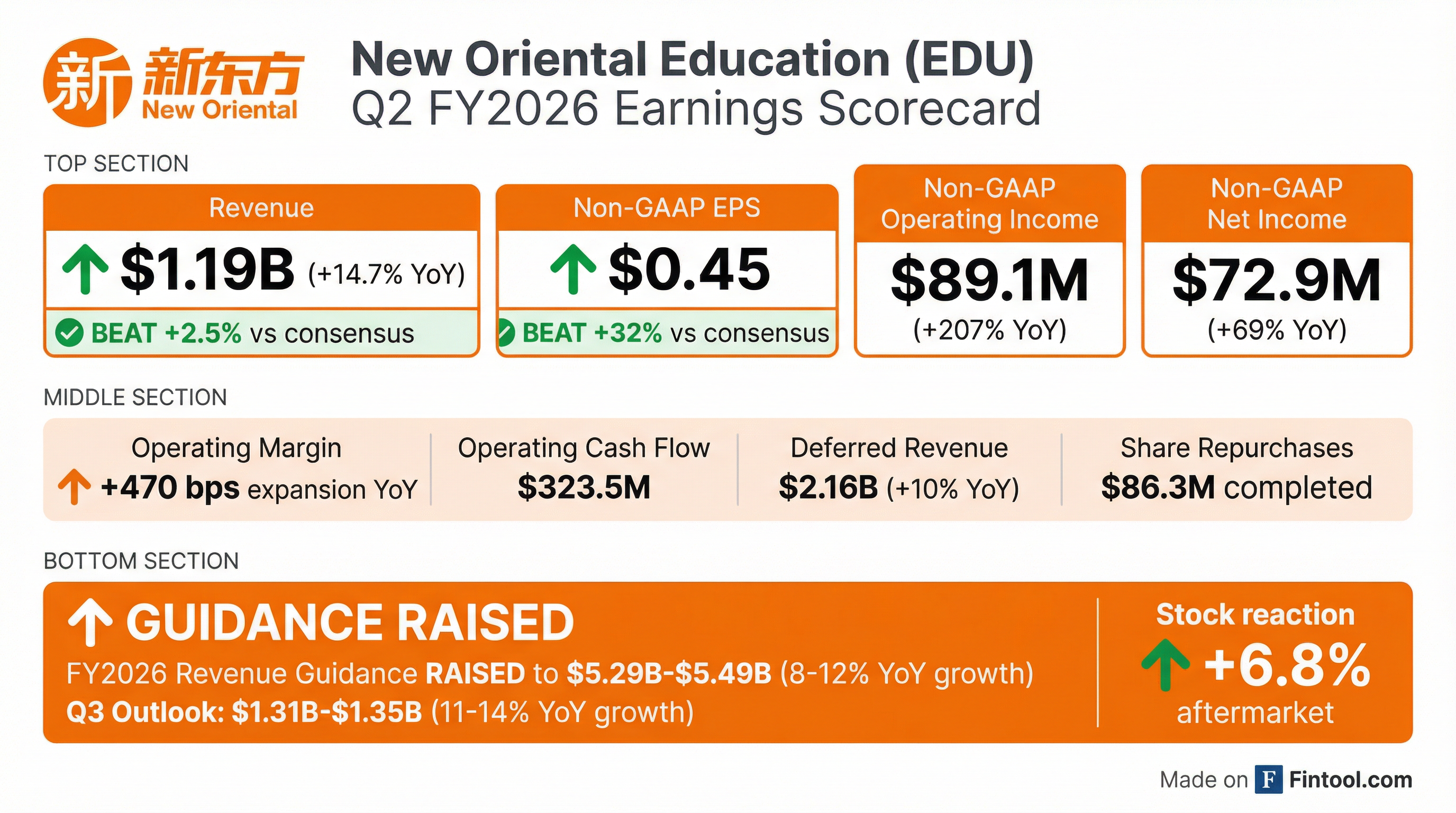

- New Oriental reported strong Q2 2026 financial results, with total net revenue increasing by 14.7% year-over-year to $1.19 billion, non-GAAP operating income more than tripling by 206.9% to $89.1 million, and non-GAAP net income attributable to New Oriental rising 68.6% to $72.9 million.

- The company raised its full fiscal year 2026 total net revenue guidance to a range of $5,292.3 million to $5,488.3 million, representing an 8%-12% year-over-year increase, and expects Q3 2026 total net revenue to be between $1,313.2 million and $1,348.7 million.

- Key growth drivers included accelerated year-over-year revenue growth in K-9 new educational business and high school tutoring business, a 22% year-over-year revenue increase from new education initiatives, and East Buy making a positive contribution to both top and bottom lines.

- Operational efficiency and disciplined resource management led to a 4 percentage point improvement in non-GAAP operating margin year-over-year , driven by better utilization, higher operating leverage, and cost control.

- New Oriental announced a share repurchase program of up to $300 million over 12 months, having already repurchased 1.6 million ADS for approximately $86.3 million as of January 27, 2026, and an ordinary dividend of $0.12 per common share or $1.2 per ADS for fiscal year 2026.

- New Oriental reported Q2 FY2026 total net revenue of $1.19 billion, a 14.7% year-over-year increase. Non-GAAP operating income surged 206.9% to $89.1 million, and non-GAAP net income attributable to New Oriental increased 68.6% to $72.9 million.

- The company raised its full fiscal year 2026 total net revenue guidance to a range of $5,292.3 million to $5,488.3 million, reflecting an 8%-12% year-over-year increase.

- Accelerated revenue growth was seen in the K-9 new educational business and high school tutoring, while new education initiatives (non-academic tutoring, intelligent learning system/devices) grew 22% year-over-year. East Buy also contributed positively to both top and bottom lines.

- New Oriental announced a share repurchase program of up to $300 million over the next 12 months, with $86.3 million already repurchased as of January 27, 2026. An ordinary dividend of $0.12 per common share or $1.2 per ADS for FY2026 was also approved, with the first installment paid.

- New Oriental reported strong Q2 FY2026 financial results, with total net revenue increasing 14.7% year-over-year to $1.19 billion and non-GAAP net income attributable to New Oriental surging 68.6% to $72.9 million.

- The company achieved significant margin expansion, with non-GAAP operating margin improving by 470 basis points year-over-year, primarily due to better utilization, operating leverage, cost control, and East Buy's profit contribution.

- New Oriental raised its full fiscal year 2026 total net revenue guidance to a range of $5,292.3 million - $5,488.3 million, representing an 8%-12% year-over-year increase.

- Key business segments demonstrated strong growth, including accelerated revenue in K-9 new educational and high school tutoring businesses, a 22% year-over-year increase in new education initiatives, and East Buy's expanded product offerings and profitable vending machine model.

- The company is implementing a shareholder return plan for FY2026, including an ordinary dividend of $0.12 per common share or $1.2 per ADS, and has repurchased approximately $86.3 million of ADS as of January 27, 2026, under a $300 million program.

- New Oriental Education & Technology Group reported a 6.1% year-over-year increase in total net revenue for Q1 FY 2026, with non-GAAP operating margin reaching 22%, a 100 basis point improvement. Non-GAAP net income attributable to New Oriental was $258.3 million, a 1.6% decrease year over year.

- The company's new educational business initiatives and the adults and university students business were strong performers, with revenue increases of about 15% and 14% year over year, respectively, in Q1 FY 2026. The K-9 new business is expected to grow around 20% year-over-year in Q2 FY 2026 and for the full fiscal year.

- For Q2 FY 2026, total net revenue (including East Buy) is projected to be between $1,132.1 million and $1,263.3 million, representing a 9% to 12% year-over-year increase. The full fiscal year 2026 revenue guidance remains at $5,145.3 million to $5,390.3 million, a 5% to 10% year-over-year increase.

- New Oriental announced a shareholder return plan for FY 2026, including an ordinary cash dividend of $0.12 per common share (or $1.20 per ADS) totaling approximately $190 million, and a new share repurchase program of up to $300 million over the next 12 months.

- New Oriental Education & Technology Group reported a 6.1% year-over-year increase in total net revenue for Q1 2026, with non-GAAP operating margin reaching 22%, a 100 basis point improvement.

- The company provided Q2 FY2026 total net revenue guidance in the range of $1,132.1 million to $1,263.3 million, representing a year-over-year increase of 9% to 12%. For the full fiscal year 2026, total net revenue is projected to be between $5,145.3 million and $5,390.3 million, an increase of 5% to 10% year over year.

- A shareholder return plan for FY2026 was announced, including an ordinary cash dividend of $0.12 per common share or $1.20 per ADS (totaling approximately $190 million) and a new share repurchase program of up to $300 million over the next 12 months. The combined payout ratio for this year is over 130% compared to last year's net profit.

- Key business segments demonstrated growth in Q1 2026, with the adults and university students business revenue increasing by 14% year over year, and new educational business initiatives growing by 15% year over year. The K-9 new business is expected to grow over 20% year-over-year for FY2026.

- New Oriental Education & Technology Group reported a 6.1% year-over-year increase in total net revenue for Q1 2026, reaching a non-GAAP operating margin of 22%, an improvement of 100 basis points.

- The company projects Q2 FY2026 total net revenue to be between $1,132.1 million and $1,263.3 million, representing a 9%-12% year-over-year increase, and maintains its FY2026 total net revenue guidance of $5,145.3 million to $5,390.3 million.

- A shareholder return plan for FY2026 was announced, including an ordinary cash dividend of $0.12 per common share or $1.20 per ADS (totaling approximately $190 million) and a new share repurchase program of up to $300 million.

- Key business segments like adults and university students grew 14% and new education initiatives grew 15% year-over-year in Q1 2026, with the K-12 business expected to see "notable acceleration" in Q2, including over 20% year-over-year growth for K-9 business in FY2026.

- New Oriental Education & Technology Group Inc. (EDU) reported Q1 FY2026 net revenues of US$1,523.0 million, an increase of 6.1% year over year, with operating income rising 6.0% to US$310.8 million for the quarter ended August 31, 2025.

- The company's domestic test preparation business grew by approximately 14.4% year over year, and new educational business initiatives saw a revenue increase of 15.3%. Non-academic tutoring courses attracted approximately 530,000 student enrollments.

- New Oriental announced a shareholder return plan, including an ordinary cash dividend of US$0.12 per common share (or US$1.2 per ADS) and a new share repurchase program of up to US$300 million over the next 12 months.

- For Q2 FY2026, net revenues are projected to be between US$1,132.1 million and US$1,163.3 million, and the full fiscal year 2026 net revenue guidance is reaffirmed at US$5,145.3 million to US$5,390.3 million.

- New Oriental Education & Technology Group Inc. (EDU) announced an ordinary cash dividend and a share repurchase program to implement its three-year shareholder return plan for fiscal year 2026.

- The total cash dividend is US$0.12 per common share, or US$1.2 per ADS, to be distributed in two installments, with an aggregate amount expected to be approximately US$190 million.

- The first installment of US$0.06 per common share (or US$0.6 per ADS) has a record date of November 18, 2025, and is expected to be paid around December 2, 2025, for common shares and December 5, 2025, for ADSs.

- The share repurchase program authorizes the company to repurchase up to US$300 million of its ADSs or common shares over the next 12 months, funded from its existing cash balance.

Quarterly earnings call transcripts for New Oriental Education & Technology Group.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more