Earnings summaries and quarterly performance for ENTERPRISE FINANCIAL SERVICES.

Executive leadership at ENTERPRISE FINANCIAL SERVICES.

James Lally

President and Chief Executive Officer

Bridget Huffman

Senior Executive Vice President and Chief Risk Officer

Doug Bauche

Senior Executive Vice President and Chief Banking Officer

Keene Turner

Senior Executive Vice President, Chief Financial Officer and Chief Operating Officer

Kevin Handley

Chief Credit Officer

Mark Ponder

Senior Executive Vice President and Chief Administrative Officer

Nicole Iannacone

Senior Executive Vice President, Chief Legal Officer and Corporate Secretary

Board of directors at ENTERPRISE FINANCIAL SERVICES.

Lars Anderson

Director

Lina Young

Director

Lyne Andrich

Director

Marcela Manjarrez

Director

Michael DeCola

Chair of the Board

Michael Finn

Director

Michael Holmes

Director

Nevada Kent IV

Director

Richard Sanborn

Director

Sandra Van Trease

Director

Stephen Marsh

Director

Research analysts who have asked questions during ENTERPRISE FINANCIAL SERVICES earnings calls.

Damon Del Monte

Keefe, Bruyette & Woods

7 questions for EFSC

Brian Martin

Janney Montgomery Scott

6 questions for EFSC

Jeff Rulis

D.A. Davidson & Co.

6 questions for EFSC

David Long

Raymond James Financial, Inc.

4 questions for EFSC

Andrew Liesch

Piper Sandler

3 questions for EFSC

Nathan Race

Piper Sandler & Co.

3 questions for EFSC

Ryan Pan

D.A. Davidson & Co.

1 question for EFSC

Recent press releases and 8-K filings for EFSC.

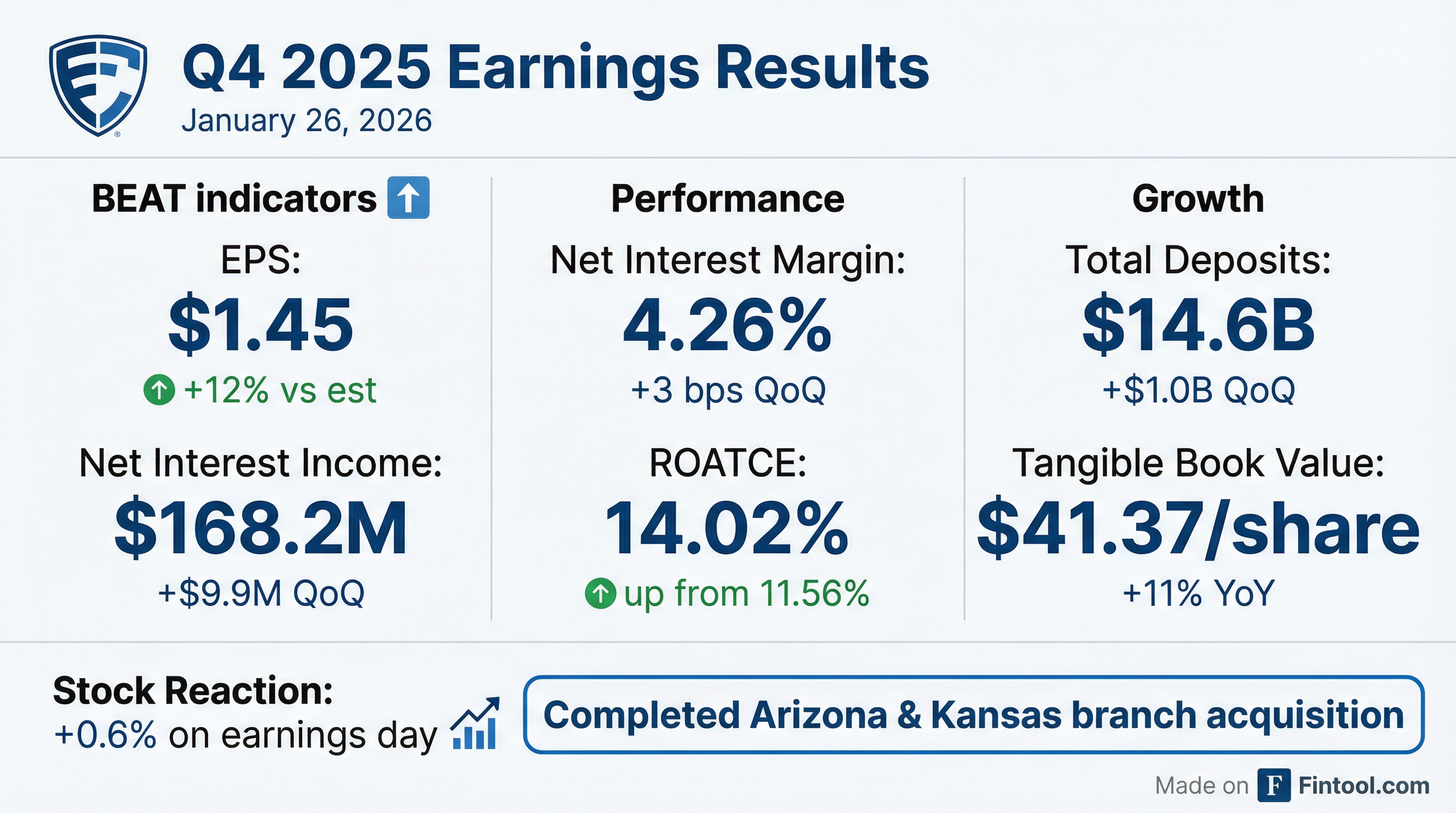

- As of Q4 2025, ENTERPRISE FINANCIAL SERVICES CORP (EFSC) reported $17.3 billion in Total Assets, $14.6 billion in Total Deposits, and $11.8 billion in Total Loans. The company achieved a 13.3% Return on Average Tangible Common Equity (ROATCE) YTD and a 9.07% Tangible Common Equity (TCE) Ratio.

- EFSC completed the acquisition of 12 branches in Arizona and Kansas on October 10, 2025, which added $609.5 million in Total Deposits and $292.0 million in Total Loans, with an expected mid to high single-digit full year EPS accretion.

- The company repurchased 258,739 shares at an average price of $54.60 per share and has a history of regular dividend increases with a 17% CAGR over the last 11 years.

- Key performance metrics for Q4 2025 included Nonperforming Loans/Loans of 0.70% and an Allowance Coverage Ratio of 1.19% (1.29% adjusted for guaranteed loans).

- EFSC reported diluted earnings per share of $1.45 for Q4 2025 and $5.31 for the full year 2025, with net interest income expanding to $168 million and a net interest margin of 4.26% in Q4 2025.

- The company achieved 11% balance sheet growth in 2025, driven by organic growth and a branch acquisition that contributed to $1 billion in deposit growth and $217 million in loan growth in Q4 2025.

- EFSC maintained strong capital with a tangible common equity to tangible assets ratio of 9.07% and an 11% increase in tangible book value per share to $41.37 for the year. The quarterly dividend was increased to $0.32 per share, and 67,000 shares were repurchased in Q4 2025.

- Non-performing assets increased to 95 basis points of total assets in Q4 2025, largely due to $70 million in Southern California commercial real estate loans moving to OREO, with management expecting significant reduction in NPAs in the next two quarters. For 2026, the company anticipates a net interest margin run rate of approximately 4.2%, about 5% growth in fee income, and mid-single-digit loan growth.

- Enterprise Financial Services Corporation (EFSC) reported strong financial results for Q4 and full year 2025, with diluted EPS of $1.45 for Q4 2025 and $5.31 for the full year 2025.

- The company achieved significant balance sheet growth in 2025, growing by 11%, exceeding its mid- to high single-digit goal, driven by organic growth and a branch purchase. Net interest income expanded to $168 million in Q4 2025, a $10 million increase from the linked quarter, and the net interest margin improved slightly to 4.26%.

- EFSC demonstrated strong capital management, increasing its quarterly dividend by $0.01 to $0.32 per share for Q4 2025 and repurchasing 67,000 shares at an average price of $52.64 in Q4.

- While non-performing assets (NPAs) were elevated at 95 basis points, management sees a clear path to reduce them to historical levels of 35-40 basis points over the next one to two quarters, with Q4 2025 net charge-offs at approximately $20 million.

- For 2026, the company expects 6%-8% balance sheet growth and mid-single-digit loan growth, with deposit gathering expected to exceed loan growth.

- EFSC reported diluted earnings per share of $1.45 for Q4 2025 and $5.31 for the full year 2025, with adjusted EPS for Q4 2025 at $1.36. Net interest income expanded to $168 million in Q4 2025, and the net interest margin improved slightly to 4.26%.

- The company achieved 11% balance sheet growth for FY 2025, exceeding its goal, and reported $1 billion in deposit growth for Q4 2025, which included contributions from a branch acquisition.

- Non-performing assets increased to 95 basis points of total assets in Q4 2025, but management anticipates a significant reduction to 35-40 basis points over the next one to two quarters.

- For 2026, EFSC projects balance sheet growth of 6%-8% and mid-single-digit loan growth, with deposit gathering expected to exceed loan growth. The company also increased its quarterly dividend to $0.33 per share for Q1 2026 and repurchased $3.5 million of common stock in Q4 2025.

- Enterprise Financial Services Corp reported diluted earnings per common share of $1.45 for the fourth quarter of 2025 and $5.31 for the full year 2025, with net income of $54.8 million and $201.4 million, respectively.

- For Q4 2025, the company's Net Interest Margin (NIM) was 4.26%, and it achieved a Return on Average Assets (ROAA) of 1.27% and a Return on Average Tangible Common Equity (ROATCE) of 14.02%.

- Total loans increased by $217.2 million to $11.8 billion and total deposits increased by $1.0 billion to $14.6 billion in Q4 2025, partly due to a branch acquisition that added $292.0 million in loans and $609.5 million in deposits.

- The company repurchased 67,000 shares in Q4 2025 and 258,739 shares for the full year 2025, and increased its quarterly dividend by $0.01 to $0.33 per common share for the first quarter of 2026.

- Net income for Q4 2025 was $54.8 million, or $1.45 per diluted common share, and for the full year 2025, it was $201.4 million, or $5.31 per diluted common share.

- Net interest income for Q4 2025 reached $168.2 million with a Net Interest Margin (NIM) of 4.26%.

- Total loans increased to $11.8 billion and total deposits grew to $14.6 billion by the end of Q4 2025, including contributions from a branch acquisition that added $292.0 million in loans and $609.5 million in deposits.

- The company repurchased 67,000 shares during Q4 2025 and increased its quarterly dividend by $0.01 to $0.33 per common share for Q1 2026.

- Enterprise Financial Services Corp (EFSC) reported $16.4 billion in Total Assets, $13.6 billion in Total Deposits, and $11.6 billion in Total Loans as of Q3 2025.

- The company completed the acquisition of 12 branches in Arizona and Kansas on October 10, 2025, a transaction that required no capital raise or share issuance and is anticipated to be mid to high single digit full year EPS accretive.

- Key financial metrics for Q3 2025 include a Tangible Common Equity (TCE) Ratio of 9.60%, a CET1 Ratio of 12.0% (11.2% adjusted for unrealized losses), and $6.8 billion in available liquidity.

- EFSC's strategic focus includes differentiated deposit verticals, a balanced loan portfolio, and a Net Interest Margin (NIM) of 3.41% for Q3 2025.

- Enterprise Financial Services Corp reported diluted earnings per share of $1.19 for Q3 2025, with net interest income improving by $5.5 million and net interest margin expanding by two basis points to 4.23%.

- The company achieved an annualized loan growth of 6% and deposit growth of $240 million (net of brokered CDs) in Q3 2025.

- EFSC completed the acquisition of 12 branches (10 in Arizona and two in Kansas City), which garnered approximately $650 million of deposits and $300 million in loans.

- Non-performing assets increased by $22 million to 83 basis points, primarily due to specific loans, but management expects them to return to historical levels. The company's capital position remains strong, with a tangible common equity ratio of 9.6% and a CET1 ratio of 12%. The quarterly dividend was increased by $0.01 to $0.32 per share for Q4 2025.

- EFSC reported $1.19 per diluted share for Q3 2025, with net interest income improving by $5.5 million and net interest margin expanding by two basis points to 4.23%.

- The company achieved an annualized loan growth of 6% and client deposit growth of $241 million in the linked quarter. A recent acquisition of 12 branches added approximately $650 million in deposits and $300 million in loans, and is projected to be five basis points accretive to net interest margin in Q4.

- Non-performing assets increased by $22 million to 83 basis points of total assets, largely due to a $12 million life insurance premium finance loan and $68.4 million in commercial real estate loans, which management expects to fully collect. The quarter's results also included a $24 million recapture of solar tax credits, offset by an anticipated $30 million insurance recovery.

- Capital metrics remained strong, with the tangible common equity ratio at 9.6% and the CET1 ratio at a historical high of 12%. The quarterly dividend was increased by $0.01 to $0.32 per share for Q4 2025.

- Enterprise Financial Services Corp reported net income of $45.2 million and diluted earnings per common share of $1.19 for the third quarter of 2025.

- Net interest income increased to $158.3 million, a $5.5 million increase from the linked quarter, with a Net Interest Margin (NIM) of 4.23%.

- The company reported solid growth in its portfolio, with total loans reaching $11.6 billion (a $174.3 million quarterly increase) and total deposits growing to $13.6 billion (a $250.6 million quarterly increase).

- Third quarter results included $30.1 million in anticipated insurance proceeds from a pending claim related to a solar tax credit recapture event, which impacted noninterest income and income tax expense.

- The Board of Directors approved an increase in the quarterly common stock dividend by $0.01 to $0.32 per share for the fourth quarter of 2025.

Quarterly earnings call transcripts for ENTERPRISE FINANCIAL SERVICES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more