Earnings summaries and quarterly performance for Elanco Animal Health.

Executive leadership at Elanco Animal Health.

Jeffrey Simmons

Chief Executive Officer

David Kinard

Executive Vice President, Human Resources, Corporate Communications and Administration

Ellen de Brabander

Executive Vice President, Innovation and Regulatory Affairs

Grace McArdle

Executive Vice President, Manufacturing and Quality

James Meer

Senior Vice President, Chief Accounting Officer

José Manuel Correia de Simas

Executive Vice President, U.S. Farm Animal Business

Rajeev Modi

Executive Vice President, U.S. Pet Health and Global Digital Transformation

Ramiro Cabral

Executive Vice President and President, Elanco International

Robert VanHimbergen

Chief Financial Officer

Shiv O'Neill

Executive Vice President, General Counsel and Corporate Secretary

Timothy Bettington

Executive Vice President, Corporate Strategy and Market Development

Board of directors at Elanco Animal Health.

Art Garcia

Director

Deborah Kochevar

Director

Denise Scots-Knight

Director

Kapila Anand

Director

Kirk McDonald

Director

Lawrence Kurzius

Chairman of the Board

Michael Harrington

Director

Paul Herendeen

Director

R. David Hoover

Director

Stacey Ma

Director

Research analysts who have asked questions during Elanco Animal Health earnings calls.

Michael Ryskin

Bank of America Merrill Lynch

8 questions for ELAN

Brandon Vazquez

William Blair & Company, L.L.C.

6 questions for ELAN

Daniel Clark

Leerink Partners

6 questions for ELAN

Erin Wright

Morgan Stanley

6 questions for ELAN

Jonathan Block

Stifel Financial Corp.

6 questions for ELAN

Navann Ty

BNP Paribas S.A.

5 questions for ELAN

Umer Raffat

Evercore ISI

4 questions for ELAN

Andrea Zayco Narvaez Alfonso

UBS

3 questions for ELAN

Michael DiFiore

Evercore ISI

3 questions for ELAN

Andrea Alfonso

UBS

2 questions for ELAN

Andrew Dusing

Cleveland Research

2 questions for ELAN

Balaji Prasad

Barclays

2 questions for ELAN

Chris Schott

JPMorgan Chase & Company

2 questions for ELAN

Christopher Schott

JPMorgan Chase & Co.

2 questions for ELAN

David Westenberg

Piper Sandler

2 questions for ELAN

Ekaterina Pirogova

JPMorgan Chase & Co.

2 questions for ELAN

Jon Block

Stifel, Nicolaus & Company, Incorporated

2 questions for ELAN

Linda Bolduc

Morgan Stanley

2 questions for ELAN

Navann Ty Dietschi

BNP Paribas

2 questions for ELAN

Ekaterina Knyazkova

Cantor Fitzgerald

1 question for ELAN

Mike Curry

Evercore ISI

1 question for ELAN

Ross Sparenblek

William Blair & Company

1 question for ELAN

Recent press releases and 8-K filings for ELAN.

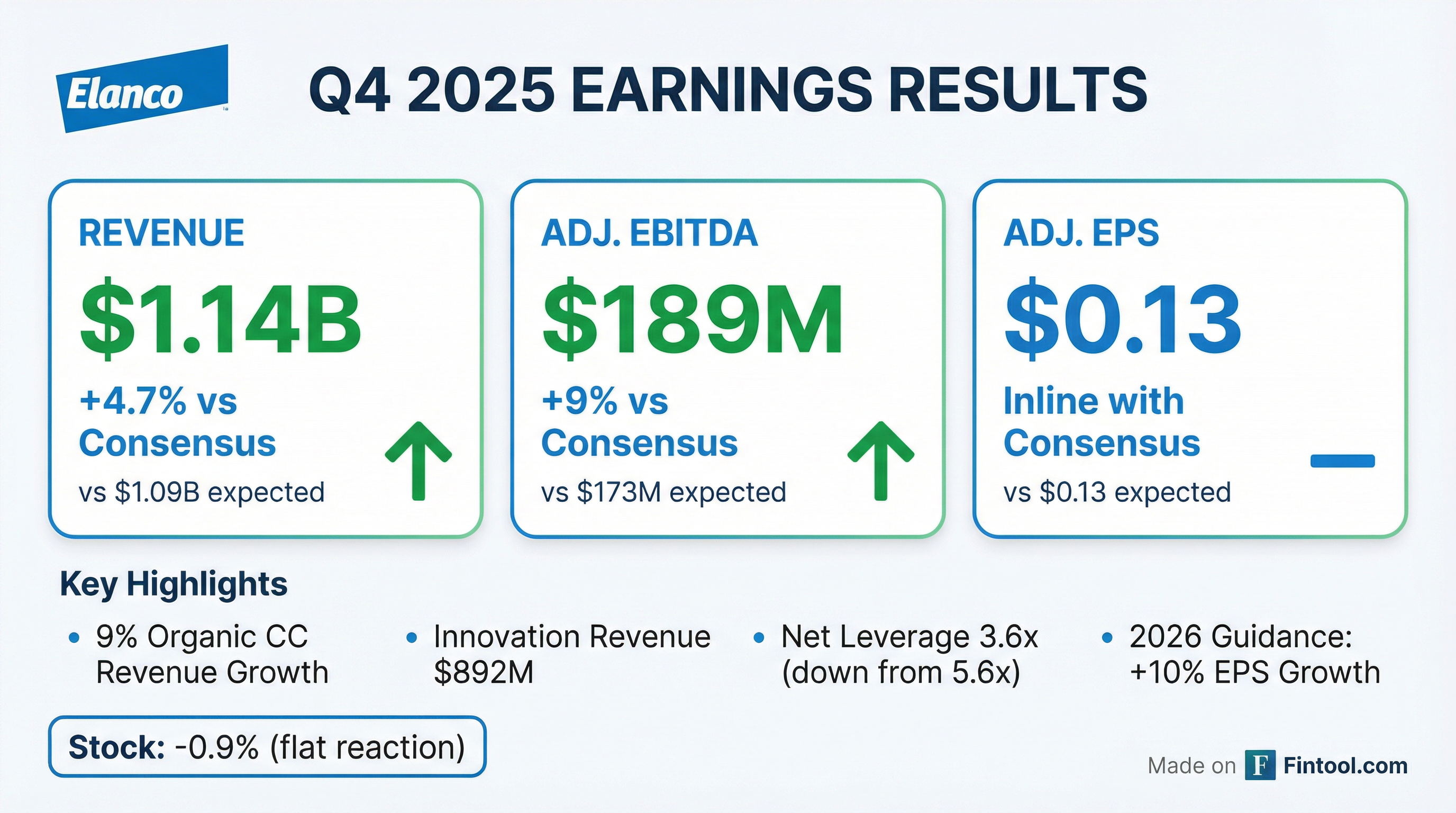

- Elanco reported 9% growth in Q4 2025, with innovation revenue reaching $892 million in 2025, and provided 2026 guidance for mid-single-digit top-line growth, high-single-digit EBITDA growth, and low-double-digit EPS growth.

- The company increased its 2026 revenue expectation from its basket of innovation to $1.15 billion, up from $1.1 billion, highlighting the strong performance of products like Quattro, which achieved blockbuster status in 8 months.

- Elanco is in active discussions with the FDA for Zenrelia label enhancements, noting its use in 40 countries with a clean label and by over 1 million dogs worldwide.

- Strategic initiatives include Elanco Ascend, expected to deliver $200 million-$250 million in EBITDA improvement by 2030, with 75% from gross margin and 25% from OpEx, and leveraging AI for cost savings and R&D.

- The company plans to reduce leverage to the low 3s by end of 2026 and below 3x in 2027, with a long-term target of 2.0 to 2.5x, which is expected to enable future shareholder returns.

- Elanco reported 9% growth in Q4 2025, with its innovation basket generating $892 million in revenue for the year, and ended 2025 with leverage at 3.6 times.

- For 2026, the company projects mid-single-digit top line growth, high-single-digit EBITDA growth, and low-double-digit EPS growth, aiming to reduce leverage to the low 3s. The innovation basket revenue target for 2026 was raised to $1.15 billion.

- Key products like Credelio Quattro achieved blockbuster status in 8 months, the fastest for an Elanco pet health product, while Zenrelia shows reorder rates north of 80% in approximately half of US vet clinics. The company expects limited impact from generic competition on its Seresto brand, whose US patent extends through Q3 2027.

- The Elanco Ascend program is anticipated to contribute $200 million-$250 million of EBITDA improvement by 2030, with 75% from gross margin and 25% from OpEx. The company targets a long-term leverage of 2.0 to 2.5x, expecting to achieve below 3x in 2027.

- Elanco reported 9% growth in Q4 2025, with its innovation basket contributing $892 million in revenue for the year, and ended 2025 with leverage at 3.6 times.

- For 2026, the company provided guidance for mid-single-digit top-line growth, high-single-digit EBITDA growth, and low-double-digit EPS growth, with plans to reduce leverage to the low 3s.

- The innovation basket, featuring products like Quattro and Zenrelia, is now projected to generate $1.15 billion in revenue for 2026, an increase from previous expectations, and carries a higher margin profile.

- Elanco's Seresto brand, with sales split 50% US and 50% OUS, has US patent protection until Q3 2027, and the company anticipates limited generic impact, which is factored into its 2026 guidance.

- The Elanco Ascend program is expected to deliver $200 million-$250 million in EBITDA improvement by 2030, with 75% of savings from gross margin and 25% from OpEx.

- Elanco reported above-expectation Q4 2025 results for adjusted EBITDA, revenue, and EPS. The company provided initial fiscal 2026 guidance in line with Investor Day targets, projecting mid-single-digit top-line growth, high single-digit EBITDA growth, and low double-digit EPS growth, with an expectation to delever to the low threes by year-end 2026.

- The company highlighted strong performance from its innovation basket, including Zenrelia which is exceeding international launch expectations with 40% market share in Brazil and 30% in Japan, and Credelio Quatro which achieved $358 million in revenue in 2025. A Q2 2026 phased launch is planned for Befrena.

- Elanco anticipates price acceleration in 2026 from the 2% seen in 2025, driven by new product launches and a strategy to price for value based on efficacy.

- The company expects EBITDA margins to improve 200 to 350 basis points by 2028, supported by the Elanco Ascend program, which is projected to generate $200 million-$250 million of net EBITDA improvement over five years, with 75% from gross margin and 25% from OpEx.

- Elanco reported above-expectation results for 2025 in adjusted EBITDA, revenue, and EPS, driven by strong growth across international, U.S., pet, and farm segments, underpinned by innovation.

- The company provided 2026 guidance projecting mid-single-digit top-line growth, high single-digit EBITDA growth, and low double-digit EPS growth, with an expectation to delever to low threes by year-end.

- Key innovation products, including Zenrelia (dermatology), Befrena (dermatology), and Quatro (parasiticide), are significant growth drivers; Zenrelia is showing strong international uptake, and the Credelio line (including Quatro) achieved $358 million in 2025 sales. Befrena is slated for a Q2 2026 launch.

- Elanco's Ascend program is focused on operational excellence, aiming to improve EBITDA margins by 200 to 350 basis points by 2028 and generate $200 million-$250 million in net EBITDA improvement over five years.

- The company anticipates price acceleration in 2026, having implemented the highest pricing in U.S. vet clinics in five years, attributing success to product efficacy rather than price competition.

- Elanco reported 4Q 2025 results that were above expectations for Adjusted EBITDA, revenue, and EPS, and provided initial fiscal 2026 guidance targeting mid-single-digit top-line growth, high single-digit EBITDA growth, and low double-digit EPS growth.

- The company raised its innovation revenue target to $1.15 billion and expects to delever to the low threes by the end of 2026.

- Zenrelia is demonstrating strong momentum, with international launches exceeding expectations (e.g., 40% market share in Brazil, 30% in Japan), and the company is increasing investment in the product.

- Credelio QUATTRO was Elanco's fastest-growing product in 2025, achieving blockbuster status and contributing to the Credelio line's $358 million in revenue.

- Elanco anticipates Befreba (for derm) to launch in Q2 2026 and expects EBITDA margins to improve by 200 to 350 basis points by 2028 through volume leverage, mix benefits, and the Elanco Ascend program.

- Elanco Animal Health delivered strong Q4 2025 results, with 9% organic constant currency revenue growth and $1.14 billion in revenue, outperforming guidance for revenue, Adjusted EBITDA, and Adjusted EPS. For the full year 2025, organic constant currency revenue growth was 7%, with total revenue reaching $4.715 billion.

- Innovation revenue was a significant driver, totaling $892 million in 2025, and the company raised its 2026 outlook for innovation revenue to $1.15 billion.

- The company provided 2026 full-year guidance, projecting organic constant currency revenue growth of 4%-6%, Adjusted EBITDA between $955 million and $985 million, and Adjusted EPS of $1.00-$1.06.

- Elanco improved its net leverage ratio to 3.6x by year-end 2025, faster than planned, and expects to further reduce it to 3.1x-3.3x by the end of 2026.

- Growth in Q4 2025 was led by U.S. Farm Animal, up 17%, and U.S. Pet Health, up 10%, driven by key products like Credelio Quattro and Zenrelia. Elanco also signed an agreement to acquire AHV International.

- Elanco exceeded its Q4 2025 guidance for revenue, Adjusted EBITDA, and Adjusted EPS, reporting 9% organic constant currency (CC) revenue growth.

- For the full year 2025, the company achieved revenue of $4,715 million, Adjusted EBITDA of $901 million, and Adjusted Diluted EPS of $0.94, surpassing its previous guidance.

- The company issued full year 2026 guidance, projecting revenue between $4,950 million and $5,020 million (4%-6% organic CC growth), Adjusted EBITDA of $955 million to $985 million (8% growth at midpoint), and Adjusted Diluted EPS of $1.00 to $1.06 (10% growth at midpoint).

- Innovation revenue reached $892 million in 2025 and is targeted to grow to $1.15 billion in 2026; Elanco also reduced its net leverage ratio to 3.6x by year-end 2025, ahead of schedule.

- Elanco delivered a strong Q4 2025 with 9% organic constant currency revenue growth and full-year 2025 organic constant currency revenue growth of 7%, outperforming guidance for revenue, Adjusted EBITDA, and Adjusted EPS.

- Innovation revenue reached $892 million in 2025 and the company raised its 2026 outlook to $1.15 billion, driven by key products like Credelio Quattro and Zenrelia.

- For full-year 2026, Elanco provided guidance for organic constant currency revenue growth of 4%-6% (translating to $4.95 billion-$5.02 billion), Adjusted EBITDA of $955 million-$985 million, and Adjusted EPS of $1.00-$1.06.

- The company improved its net leverage ratio to 3.6 times at year-end 2025, faster than planned, and expects to reach 3.1-3.3 times by year-end 2026.

- Elanco is expanding its portfolio through the acquisition of AHV International and anticipates accelerated pricing in 2026, including the largest increase to U.S. vet clinics in five years.

- Elanco Animal Health reported strong Q4 2025 organic constant currency revenue growth of 9% and full-year 2025 organic constant currency revenue growth of 7%.

- For the full year 2025, the company achieved $4.715 billion in reported revenue, $901 million in Adjusted EBITDA, and $0.94 in Adjusted EPS.

- Innovation revenue reached $892 million in 2025 and is projected to grow to $1.15 billion in 2026.

- The company issued 2026 guidance, expecting 4%-6% organic constant currency revenue growth, $955 million-$985 million in Adjusted EBITDA, and $1.00-$1.06 in Adjusted EPS.

- Net leverage improved to 3.6 times at year-end 2025, with a target of 3.1-3.3 times by year-end 2026.

Quarterly earnings call transcripts for Elanco Animal Health.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more