Earnings summaries and quarterly performance for Elevance Health.

Executive leadership at Elevance Health.

Gail Boudreaux

President and Chief Executive Officer

Felicia Norwood

Executive Vice President and President of Government Health Benefits

Mark Kaye

Executive Vice President and Chief Financial Officer

Morgan Kendrick

Executive Vice President and President of Commercial and Specialty Health Benefits

Peter Haytaian

Executive Vice President and President of Carelon and CarelonRx

Board of directors at Elevance Health.

Antonio Neri

Director

Bahija Jallal

Governance Committee Chair

Deanna Strable

Director

Kerry Clark

Finance Committee Chair

Lewis Hay III

Director

Ramiro Peru

Independent Chair of the Board

Robert Dixon Jr

Director

Ryan Schneider

Audit Committee Chair

Steven Collis

Director

Susan DeVore

Director

Research analysts who have asked questions during Elevance Health earnings calls.

Andrew Mok

Barclays

8 questions for ELV

Erin Wright

Morgan Stanley

8 questions for ELV

George Hill

Deutsche Bank

8 questions for ELV

Justin Lake

Wolfe Research, LLC

8 questions for ELV

Lance Wilkes

Sanford C. Bernstein & Co., LLC

8 questions for ELV

Lisa Gill

JPMorgan Chase & Co.

8 questions for ELV

Ann Hynes

Mizuho Financial Group

7 questions for ELV

Ryan Langston

TD Cowen

7 questions for ELV

Joshua Raskin

Nephron Research

6 questions for ELV

Sarah James

Cantor Fitzgerald

6 questions for ELV

Scott Fidel

Stephens Inc.

6 questions for ELV

Benjamin Hendrix

RBC Capital Markets

5 questions for ELV

Dave Windley

Jefferies LLC

5 questions for ELV

Kevin Fischbeck

Bank of America

5 questions for ELV

A.J. Rice

UBS

4 questions for ELV

Albert Rice

UBS

3 questions for ELV

Benjamin Mayo

Leerink Partners

3 questions for ELV

Hua Ha

Robert W. Baird & Co. Incorporated

3 questions for ELV

Jason Cassorla

Guggenheim Partners

3 questions for ELV

Joanna Gajuk

Bank of America

3 questions for ELV

Stephen Baxter

Wells Fargo

3 questions for ELV

Stephen Baxter

Wells Fargo & Company

3 questions for ELV

Ben Hendricks

RBC Capital Markets

2 questions for ELV

David Windley

Jefferies Financial Group Inc.

2 questions for ELV

Josh Raskin

Nathron Research

2 questions for ELV

A.J. Rice

UBS Group AG

1 question for ELV

Christian Borgmeyer

TD Cowen

1 question for ELV

Michael Ha

Robert W. Baird & Co.

1 question for ELV

Whit Mayo

Leerink Partners

1 question for ELV

Recent press releases and 8-K filings for ELV.

- Elevance Health implements a leadership restructure to simplify decision-making and strengthen execution across Carelon and Health Benefits.

- Mark Kaye, EVP & CFO, will expand his role to oversee Carelon’s healthcare services operations, including pharmacy services, behavioral health, and value-based care.

- Felicia Norwood, EVP & Chief Health Benefits Officer, will lead the newly consolidated Health Benefits organization, unifying Commercial and Government health benefits under one structure.

- Peter D. Haytaian will transition from President of Carelon on May 4, 2026, and serve as Special Advisor through December 31, 2026 to support an orderly leadership handover.

- Management set 2026 adjusted EPS guidance of at least $25.50, with operating revenue expected to decline low-single-digit % driven by membership declines, a consolidated medical loss ratio of 90.2% ±150 bps, and an adjusted operating expense ratio of 10.6% ±150 bps.

- 2026 is viewed as a trough year: Medicaid operating margin projected at approximately –1.75% amid membership declines and rate lag; Medicare Advantage membership is expected to drop in the high-teens % range; ACA plans are being repriced for elevated costs and subsidy expirations.

- Long-term targets were recalibrated to reflect current business mix: enterprise margin of 5–6%, health benefits mid-single-digit margins, and a return to at least 12% adjusted EPS growth in 2027 off the 2026 baseline.

- Capital deployment includes approximately $2.3 billion in share repurchases in 2026, with a reduced M&A focus and opportunistic buybacks prioritized.

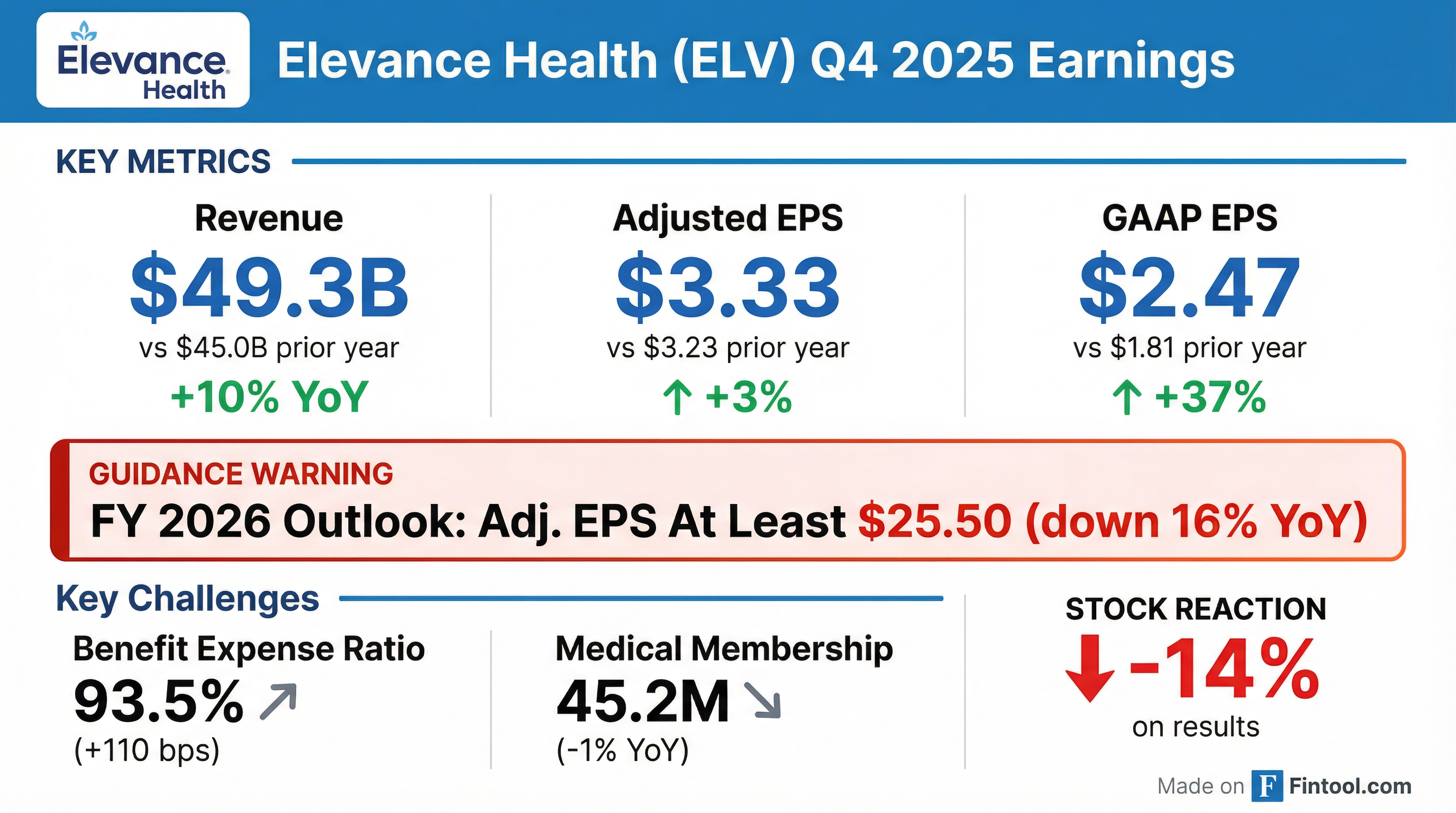

- Q4 2025 adjusted diluted EPS of $3.33 (up 3.1% year-over-year) and full-year EPS of $30.29 (down 8.3%) driven by non-recurring 2024 tax benefits.

- Operating revenue of $49.3 billion in Q4 2025 (+9.6% YoY) and $197.6 billion for the full year (+12.8%) on higher premium yields, acquisitions, and Medicare Advantage membership growth.

- Benefit expense ratio of 93.5% in Q4 2025 and 90.0% for 2025; 2026 guidance targets a ratio of 90.2% ± 50 bps alongside a low-single-digit decline in operating revenue.

- 2026 adjusted diluted EPS guidance of at least $25.50, with an adjusted operating gain projected at a minimum of $6.8 billion.

- Ended Q4 with 45.2 million members, down ~500,000 YoY driven by Medicaid eligibility reverifications.

- Q4 operating revenue of $49.3 billion (+10% YoY), full-year benefit expense ratio of 90% and adjusted operating expense ratio of 10.5%.

- 2026 guidance: ≥ $25.50 adjusted diluted EPS; low-single-digit % revenue decline; medical loss ratio 90.2% (±50 bps); operating expense ratio 10.6% (±50 bps); ~65% of EPS in Q1.

- Segment outlook: Medicaid operating margin ~ -1.75%; Medicare Advantage membership down high-teens % with margin improvement; continued commercial momentum in ASO national accounts.

- Returned $4.1 billion of capital in 2025 including $2.6 billion of share repurchases; plans $2.3 billion of buybacks in 2026.

- Elevance reported adjusted diluted EPS of $3.33 in Q4 2025 and $30.29 for the full year.

- Operating revenue rose 10% year-over-year to $49.3 billion in Q4, while membership decreased by about 500,000 to 45.2 million.

- 2026 guidance assumes mid-single-digit cost trend, Medicaid operating margin of approximately –1.75%, and expects Medicare Advantage membership to decline in the high-teens % with meaningful margin improvement.

- Long-term margin targets refined to 5–6% enterprise margin, mid-single-digit health benefits margins, and unchanged targets for Carelon Services.

- Elevance Health posted 4Q 2025 operating revenue of $49.3 billion (+9.6% y/y) and full-year 2025 revenue of $197.6 billion (+12.8% y/y); 4Q GAAP diluted EPS was $2.47 (adjusted $3.33), and FY GAAP EPS was $25.21 (adjusted $30.29).

- The company projects FY 2026 GAAP diluted EPS of at least $22.30 and adjusted diluted EPS of at least $25.50.

- Returned $4.1 billion of capital to shareholders in 2025 and declared a Q1 2026 dividend of $1.72 per share, payable March 25, 2026.

- Total medical membership stood at 45.2 million as of December 31, 2025, down 1% year over year, driven by Medicaid attrition.

- Operating revenue of $49.3 billion in Q4 2025 and $197.6 billion for FY 2025, up 10% and 13% respectively

- Q4 2025 GAAP EPS $2.47 and adjusted EPS $3.33; FY 2025 GAAP EPS $25.21 and adjusted EPS $30.29

- Projects FY 2026 GAAP EPS of at least $22.30 and adjusted EPS of at least $25.50

- Returned $4.1 billion of capital to shareholders in 2025, including $471 million in Q4 share repurchases and a $1.71 Q4 dividend; declared Q1 2026 dividend of $1.72

- Elevance Health has issued a policy effective October 21, 2025 covering HistoSonics’ non-invasive histotripsy system for liver tumors

- Coverage applies to commercial, Medicare, and Medicaid plans in 14 states, including California, Colorado, Connecticut, Georgia, Indiana, Kentucky, Maine, Missouri, Nevada, New Hampshire, New York, Ohio, Virginia, and Wisconsin

- The expansion increases access to approximately 45.4 million members

- Decision is based on growing clinical evidence of long-term safety and efficacy of HistoSonics’ histotripsy therapy

- Elevance Health will extend insurance coverage for HistoSonics’ non-invasive histotripsy treatment of hepatic tumors to about 45.4 million members across its commercial, Medicare and Medicaid plans, effective October 21, 2025.

- Coverage will include plans in 14 states—California, Colorado, Connecticut, Georgia, Indiana, Kentucky, Maine, Missouri, Nevada, New Hampshire, New York, Ohio, Virginia and Wisconsin—broadening patient access to the therapy.

- The decision is driven by growing clinical evidence of the long-term safety and efficacy of the Edison® Histotripsy System, with additional real-world data currently being collected worldwide.

- Elevance Health will extend insurance coverage for HistoSonics’ Edison® histotripsy system to 45.4 million plan members across 14 states, broadening access to non-invasive liver tumor treatment.

- The Edison® system, FDA-cleared via De Novo in October 2023, uses focused ultrasound to mechanically ablate tumors without incision, radiation, or heat.

- In the HOPE4LIVER pivotal trial, the system achieved 90 % tumor control at 12 months with comparable outcomes and shorter recovery versus existing ablation therapies.

- Coverage decisions build on multiple Blue Cross Blue Shield plan approvals, and HistoSonics is pursuing UNOS recognition to include histotripsy in liver transplant candidate selection.

Quarterly earnings call transcripts for Elevance Health.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more