Earnings summaries and quarterly performance for ERIE INDEMNITY.

Research analysts covering ERIE INDEMNITY.

Recent press releases and 8-K filings for ERIE.

Erie Indemnity reports Q4 2025 results

ERIE

Earnings

Dividends

New Projects/Investments

- Q4 direct written premiums grew 5% year-over-year and full-year premiums rose 9%, driving policyholder surplus up to $10.1 billion from $9.3 billion at the start of 2025.

- Q4 combined ratio improved to 94.1% versus 105.7% a year ago; full-year combined ratio fell to 104.9% from 110.4%, aided by rate adequacy and muted second-half catastrophe losses.

- Net income for Q4 was $63 million ( $1.21 diluted EPS) versus $152 million ($2.91 EPS) in Q4 2024; full-year net income was $559 million ($10.69 EPS) versus $600 million ($11.48 EPS), reflecting a $100 million charitable contribution that reduced EPS by $1.54.

- Erie paid $254 million in dividends in 2025, and its board approved a 7.1% increase in the quarterly dividend for 2026.

- Launched Erie Secure Auto in West Virginia and Virginia, expanded Business Auto Two pointO to nine states, and through Erie Strategic Ventures invested in Atomic and Feathery.

3 days ago

Erie Indemnity reports Q4 2025 results

ERIE

Earnings

Dividends

- Erie Insurance Exchange Q4 direct written premiums rose 5% YoY, with combined ratio improving to 94.1% from 105.7% a year ago, while FY combined ratio improved to 104.9% from 110.4%

- Q4 net income of $63 M ($1.21 per diluted share) vs $152 M ($2.91) in Q4 2024; FY net income of $559 M ($10.69) vs $600 M ($11.48), including a $100 M charitable foundation contribution reducing EPS by $1.54

- Policies in force declined 1.1% to above 7 million, with retention at 88.4%; catastrophe losses were 0.7 pts in Q4 and 10.6 pts for FY vs 9.6 pts in 2024

- Paid $254 M in dividends in 2025 and approved a 7.1% quarterly dividend increase for 2026

3 days ago

Erie Indemnity reports Q4 and year-end 2025 results

ERIE

Earnings

Dividends

- Exchange direct written premiums grew 5% in Q4 and 9% full year; combined ratio improved to 94.1% in Q4 (vs 105.7% LY) and 104.9% FY (vs 110.4% LY), boosting policyholder surplus to $10.1 billion (from $9.3 billion).

- Indemnity net income was $63 million ($1.21 EPS) in Q4 (vs $152 million, $2.91 EPS) and $559 million ($10.69 EPS) for FY, with a $100 million charitable foundation contribution reducing EPS by $1.54.

- Paid $254 million in dividends in 2025; board approved a 7.1% quarterly dividend increase for 2026.

3 days ago

Erie Indemnity reports Q4 and FY2025 results

ERIE

Earnings

Dividends

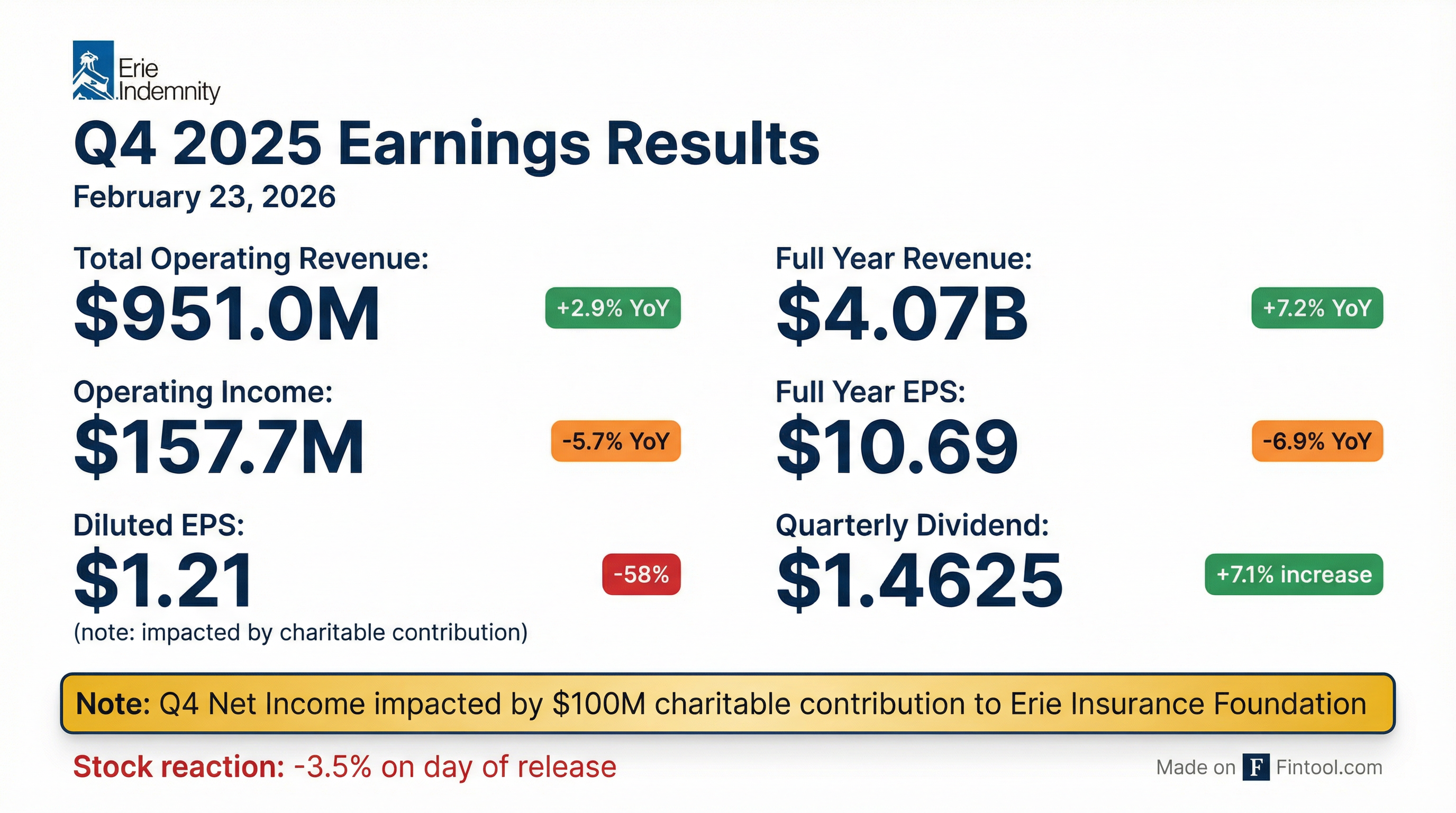

- Full year net income of $559.3 million (EPS $10.69) and Q4 net income of $63.4 million (EPS $1.21), down from $600.3 million (EPS $11.48) and $152.0 million (EPS $2.91) year-over-year.

- FY operating income increased to $717.2 million (+6.0%), with full year operating revenue of $4.067 billion (+7.2%), and Q4 operating income of $157.7 million on revenues of $951.0 million.

- The results reflect an after-tax impact of a $100 million contribution to the newly formed Erie Insurance Foundation (reducing Q4 and FY EPS by $1.54).

- Board declared a quarterly dividend of $1.4625 per Class A share, ex-dividend April 7 and payable April 21, 2026.

4 days ago

Erie Indemnity Company announces Q4 and full-year 2025 results

ERIE

Earnings

- ERIE reported 2025 net income of $559.3 million ( $10.69 per diluted share) versus $600.3 million ($11.48 per share) in 2024; Q4 net income was $63.4 million ($1.21 per share) versus $152.0 million ($2.91) in Q4 2024.

- Full-year operating income rose 6.0% to $717.2 million, while Q4 operating income declined 5.7% to $157.7 million year-over-year.

- Management fee revenue increased, with policy issuance and renewal services up 8.2% and administrative services up 8.3% in 2025.

- Results reflect a $100 million charitable contribution to the Erie Insurance Foundation, reducing net income by $80.6 million in both Q4 and FY 2025.

4 days ago

Erie Indemnity approves dividend increase and maintains management fee rate

ERIE

Dividends

- At its Dec. 9, 2025 board meeting, Erie Indemnity maintained the management fee rate at 25% for the period Jan. 1 – Dec. 31, 2026, the maximum permitted under its subscriber agreement.

- The Board approved a 7.1% increase in the regular quarterly cash dividend, raising the Class A dividend from $1.365 to $1.4625 per share and the Class B dividend from $204.75 to $219.375 per share.

- Dividend number 382 is payable on Jan. 21, 2026, with an ex-dividend and record date of Jan. 6, 2026.

Dec 11, 2025, 9:10 PM

Erie Indemnity approves fee rate and dividend increase

ERIE

Dividends

- The Board maintained the management fee rate at 25% for services provided by Erie Indemnity Company to Erie Insurance Exchange, effective January 1, 2026.

- Regular quarterly cash dividends were increased by 7.1%, with Class A rising from $1.365 to $1.4625 and Class B from $204.75 to $219.375 per share.

- The next dividend is payable on January 21, 2026, to shareholders of record as of January 6, 2026 (ex-date January 6, 2026).

Dec 11, 2025, 9:05 PM

Erie Indemnity reports Q3 2025 results

ERIE

Earnings

Product Launch

- Direct written premiums grew 7.6% in Q3 (10.1% YTD), average premium per policy increased 10.7%, and retention held at 89.1%.

- Combined ratio improved to 100.6% in Q3 (vs. 113.7% in Q3 2024); YTD combined ratio was 108.6% (vs. 113.4% 2024).

- Net income rose 14% to $183 million (EPS $3.50) in Q3; YTD net income was $496 million (EPS $9.48, +11%).

- Policyholder surplus increased by over $300 million to $9.6 billion; launched enhanced auto product “Erie Secure Auto” pilot in Ohio with expansion to PA, WV, and VA in December.

Oct 31, 2025, 2:00 PM

Erie Indemnity reports Q3 2025 results

ERIE

Earnings

- Net income of $182.9 million or $3.50 per diluted share in Q3 2025, up from $159.8 million or $3.06 in Q3 2024; first nine months net income of $495.955 million, $9.48 per diluted share (vs $448.285 million, $8.57).

- Operating income rose 16.0% to $208.9 million, on total operating revenue of $1,066.7 million, a 6.7% increase, driven by management fee revenue growth in policy issuance (+7.3%) and administrative services (+9.8%).

- Investment income before taxes totaled $21.6 million in Q3 2025 (net investment income $21.0 million) vs $19.5 million in Q3 2024.

- Total assets reached $3.324 billion and shareholders’ equity was $2.309 billion at September 30, 2025; cash and cash equivalents increased to $568.6 million.

Oct 30, 2025, 8:21 PM

Erie Indemnity reports third quarter 2025 results

ERIE

Earnings

Dividends

- Net income of $182.9 million, or $3.50 per diluted share, in 3Q25, versus $159.8 million, or $3.06 per diluted share, in 3Q24.

- Operating income increased 16.0% year-over-year to $208.9 million in 3Q25.

- Management fee revenue – policy issuance and renewal services rose 7.3% to $825.3 million, and administrative services revenue rose 9.8% to $18.8 million in 3Q25.

- Declared a quarterly dividend of $1.365 per Class A common share.

Oct 30, 2025, 8:15 PM

Quarterly earnings call transcripts for ERIE INDEMNITY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more