Earnings summaries and quarterly performance for ESSEX PROPERTY TRUST.

Executive leadership at ESSEX PROPERTY TRUST.

Angela L. Kleiman

Chief Executive Officer and President

Anne Morrison

Chief Administrative Officer, General Counsel and Executive Vice President

Barb M. Pak

Chief Financial Officer and Executive Vice President

Rylan K. Burns

Chief Investment Officer and Executive Vice President

Board of directors at ESSEX PROPERTY TRUST.

Amal M. Johnson

Director

Anne B. Gust

Director

George M. Marcus

Chairman of the Board

Irving F. Lyons, III

Lead Independent Director

John V. Arabia

Director

Keith R. Guericke

Vice Chairman of the Board

Maria R. Hawthorne

Director

Mary Kasaris

Director

Research analysts who have asked questions during ESSEX PROPERTY TRUST earnings calls.

Alexander Goldfarb

Piper Sandler

6 questions for ESS

Haendel St. Juste

Mizuho Financial Group

6 questions for ESS

John Kim

BMO Capital Markets

6 questions for ESS

Austin Wurschmidt

KeyBanc Capital Markets Inc.

5 questions for ESS

Brad Heffern

RBC Capital Markets

5 questions for ESS

Julien Blouin

The Goldman Sachs Group, Inc.

5 questions for ESS

Rich Hightower

Barclays

5 questions for ESS

Adam Kramer

Morgan Stanley

4 questions for ESS

John Pawlowski

Green Street

4 questions for ESS

Michael Goldsmith

UBS

4 questions for ESS

Steve Sakwa

Evercore ISI

4 questions for ESS

Alex Kim

Zelman & Associates

3 questions for ESS

Eric Wolfe

Citi

3 questions for ESS

Jana Galan

Bank of America

3 questions for ESS

Linda Tsai

Jefferies

3 questions for ESS

Nicholas Yulico

Scotiabank

3 questions for ESS

Nick Joseph

Citigroup Inc.

3 questions for ESS

Omotayo Okusanya

Deutsche Bank AG

3 questions for ESS

Wesley Golladay

Robert W. Baird & Co.

3 questions for ESS

Alex Kalmus

Zelman & Associates

2 questions for ESS

Jaime Feldman

Wells Fargo

2 questions for ESS

James Feldman

Wells Fargo

2 questions for ESS

Jamie Feldman

Wells Fargo & Company

2 questions for ESS

Nick Yulico

Scotiabank

2 questions for ESS

Richard Anderson

Wedbush Securities

2 questions for ESS

Wes Golladay

Baird

2 questions for ESS

Alexander Kim

Zelman & Associates

1 question for ESS

Ami Probandt

UBS

1 question for ESS

Daniel

Citi

1 question for ESS

David Segall

Green Street

1 question for ESS

Jeffrey Spector

BofA Securities

1 question for ESS

Josh Dennerlein

Bank of America

1 question for ESS

Joshua Dennerlein

BofA Securities

1 question for ESS

Sanket Agrawal

Evercore ISI

1 question for ESS

Recent press releases and 8-K filings for ESS.

- 0.8% increase to Q1 dividend to $2.59 per share, marking the 32nd consecutive annual increase; annualized at $10.36 per share, ~4.07% yield.

- Dividend increased five times over five years, growing ~5.14% over that period.

- Portfolio comprises ~258 communities and 62,000+ units across Southern California, Northern California and Seattle; $16.4 billion market capitalization.

- Latest financial metrics show $1.89 billion in revenue; 7.7% 3-year revenue growth; 6.9% earnings decline year-over-year; 170% payout ratio; 1.24 debt-to-equity ratio; Altman Z-Score 1.69.

- Reported Q4 2025 net income per diluted share of $1.25, down from $4.00 in Q4 2024; full-year net income per share $10.40 vs $11.54 in 2024.

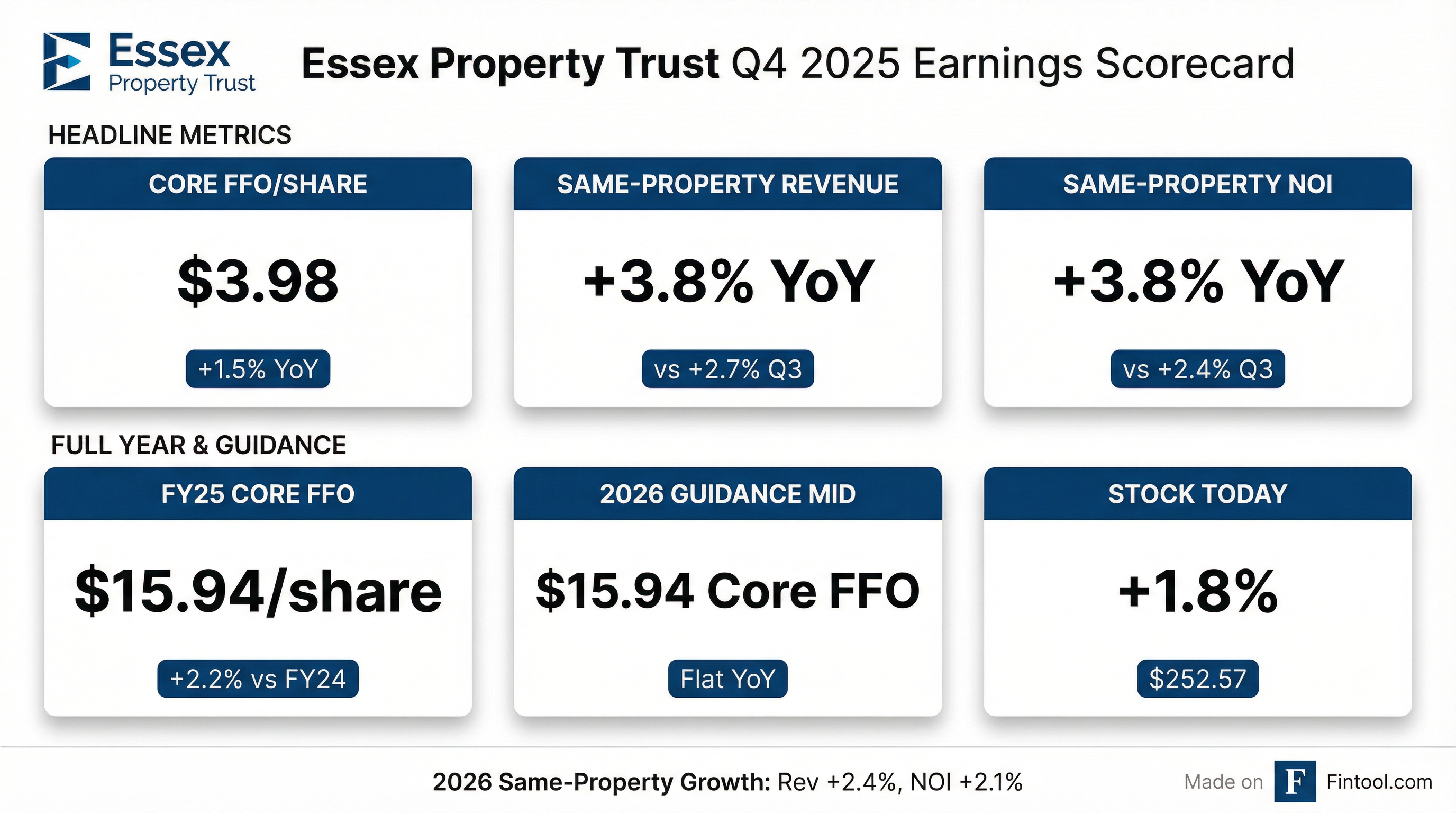

- Achieved 1.5% Q4 and 2.2% FY growth in Core FFO per share, driven by 3.8% Q4 same-property revenue and NOI growth.

- Completed FY 2025 acquisitions of seven communities for $829.4 million and dispositions of five communities for $563.8 million.

- Issued $350.0 million of 10-year senior unsecured notes at 4.875% interest; ended 2025 with >$1.7 billion of liquidity.

- 2026 guidance: net income per share of $5.55–$6.05 and Core FFO of $15.69–$16.19, with same-property revenue growth midpoint of 2.4%.

- Achieved 3.3% full‐year same‐property revenue growth at the high end of guidance and FFO per share growth above the midpoint of the range for 2025.

- Q4 2025 delivered 1.9% blended lease rate growth, 96.3% occupancy (up 20 bps sequentially) and average concessions of one week, led by Northern California and a 70 bps occupancy improvement in Los Angeles.

- 2026 guidance assumes 2.4% same‐property revenue growth at midpoint (85 bps earn-in, 2.5% blended lease growth, 30 bps other income), 3.0% expense growth and flat Core FFO per share (impacted by a 1.8% structured‐finance headwind).

- West Coast institutional multifamily transactions totaled $12.6 billion in 2025 (+43% YoY), with cap rates compressing to the low- to mid-4% range; Essex remains the largest Northern California investor.

- Maintains strong liquidity (over $1.7 billion), with free cash flow covering dividends, planned capex and development, and reduced near-term debt maturities following a December bond offering.

- Achieved 3.3% same-property revenue growth (high end of guidance) and FFO per share growth above midpoint for full year 2025.

- Q4 property operations delivered 1.9% blended lease rate growth, occupancy of 96.3% (+20 bps QoQ) with typical one-week concessions; Northern California led performance and Los Angeles occupancy rose 70 bps sequentially.

- 2026 guidance calls for 2.4% same-property revenue growth midpoint, 3% expense growth and flat Core FFO per share; forecasts a 20% YoY decline in new supply to support rent growth similar to 2025.

- West Coast institutional multifamily transactions totaled $12.6 billion in 2025 (↑43% YoY) with cap rates in the low- to mid-4% range; Essex was the largest investor in Northern California.

- Full-year 2025 same-store revenue growth of 3.3% at the high end of guidance and FFO per share growth above midpoint ; Q4 blended lease rate growth of 1.9%, occupancy rose to 96.3% with a 70 bps sequential gain in Los Angeles.

- 2026 outlook assumes stable demand and ~20% decline in new supply, targeting blended rent growth above the U.S. average and Core FFO per share flat YoY, reflecting a 1.8% headwind from Structured Finance redemptions.

- West Coast multifamily transaction volume reached $12.6 billion in 2025 (+43% YoY), with cap rates in the low to mid-4% range; Essex was the largest investor in Northern California, driving significant NAV appreciation.

- Balance sheet fortified with $1.7 billion of liquidity; free cash flow covers dividends, capital expenditures, and development, with reduced near-term maturity risk following a December bond offering.

- Reported Q4 Net Income per diluted share of $1.25 (vs. $4.00 Q4 2024), FFO of $3.94 and Core FFO of $3.98; full-year Net Income per share of $10.40 (vs. $11.54), FFO of $15.98 (vs. $15.99) and Core FFO of $15.94 (vs. $15.60).

- Achieved same-property revenue and NOI growth of 3.8% in Q4; full-year same-property revenue and NOI rose 3.3% and 3.2%, respectively.

- Completed seven apartment community acquisitions for $829.4 million and five dispositions for $563.8 million in 2025; issued $350 million of 10-year senior unsecured notes at 4.875%.

- Entered 2026 with over $1.7 billion of immediately available liquidity and provided 2026 Core FFO per share guidance of $15.69–16.19 (midpoint $15.94) and Q1 Core FFO guidance of $3.89–4.01.

- Q4 2025 net income per diluted share of $1.25, down 68.8% YoY; FY 2025 net income per share of $10.40, down 9.9% YoY.

- Core FFO per diluted share rose 1.5% to $3.98 in Q4 and 2.2% to $15.94 for FY 2025, driven by favorable same-property revenue growth.

- Same-property revenue and NOI grew 3.8% in Q4 and 3.3%/3.2% for FY, both exceeding guidance midpoints.

- Full-year 2025 transaction activity: acquired seven communities for $829.4 million and disposed of five for $563.8 million.

- 2026 guidance: net income of $5.55–$6.05 per share, total FFO of $15.54–$16.04, and core FFO of $15.69–$16.19 per share.

- On December 12, 2025, Essex Portfolio, L.P., the operating partnership of Essex Property Trust, Inc., issued $350.0 million of 4.875% senior notes due February 15, 2036.

- Net proceeds were approximately $344.2 million, planned to repay upcoming maturities including part of the $450.0 million 3.375% senior notes due April 2026 and for general corporate and working capital purposes.

- The unsecured notes rank equally with other senior obligations but are effectively subordinated to secured debt and subsidiaries’ liabilities; interest is payable semi-annually on February 15 and August 15, commencing August 15, 2026.

- Essex Property Trust, Inc. unconditionally guarantees the notes, which are governed by the Base Indenture (March 14, 2024) and a Third Supplemental Indenture dated December 12, 2025, featuring customary restrictive covenants.

- Essex Property Trust’s operating partnership, Essex Portfolio, L.P., priced an underwritten public offering of $350 million aggregate principal amount of 4.875% senior notes due 2036 at 99.093% of par, yielding 4.988%.

- Interest is payable semiannually on February 15 and August 15, commencing August 15, 2026, and the notes are fully guaranteed by Essex Property Trust, Inc.

- Net proceeds will repay $450 million of 3.375% senior notes maturing in April 2026 and fund general corporate and potential acquisition activities.

- The offering is expected to close on December 12, 2025, with Wells Fargo Securities and J.P. Morgan Securities as joint book-running managers.

- Net income per diluted share was $2.56, up from $1.84 in Q3 2024, with same-property revenue/NOI growth of 2.7%/2.4% y/y and sequential revenue up 0.7%

- Core FFO per diluted share rose by 1.5% y/y, exceeding the guidance midpoint by $0.03

- Acquired a 234-unit apartment community for $100.0 million and disposed of three communities for $244.7 million, recording $67.5 million in pro rata gains excluded from FFO

- Raised full-year 2025 Net Income guidance to $10.53–10.63 per share (midpoint $10.58) and Core FFO guidance to $15.89–15.99 per share (midpoint $15.94)

- Maintained strong liquidity with $1.38 billion of available unsecured commitments and $1.507 billion of total liquidity as of September 30, 2025

Quarterly earnings call transcripts for ESSEX PROPERTY TRUST.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more