ETHAN ALLEN INTERIORS (ETD)·Q2 2026 Earnings Summary

Ethan Allen Q2 FY2026: Revenue In Line Despite Government Shutdown; Stock Jumps 3% After Hours

January 28, 2026 · by Fintool AI Agent

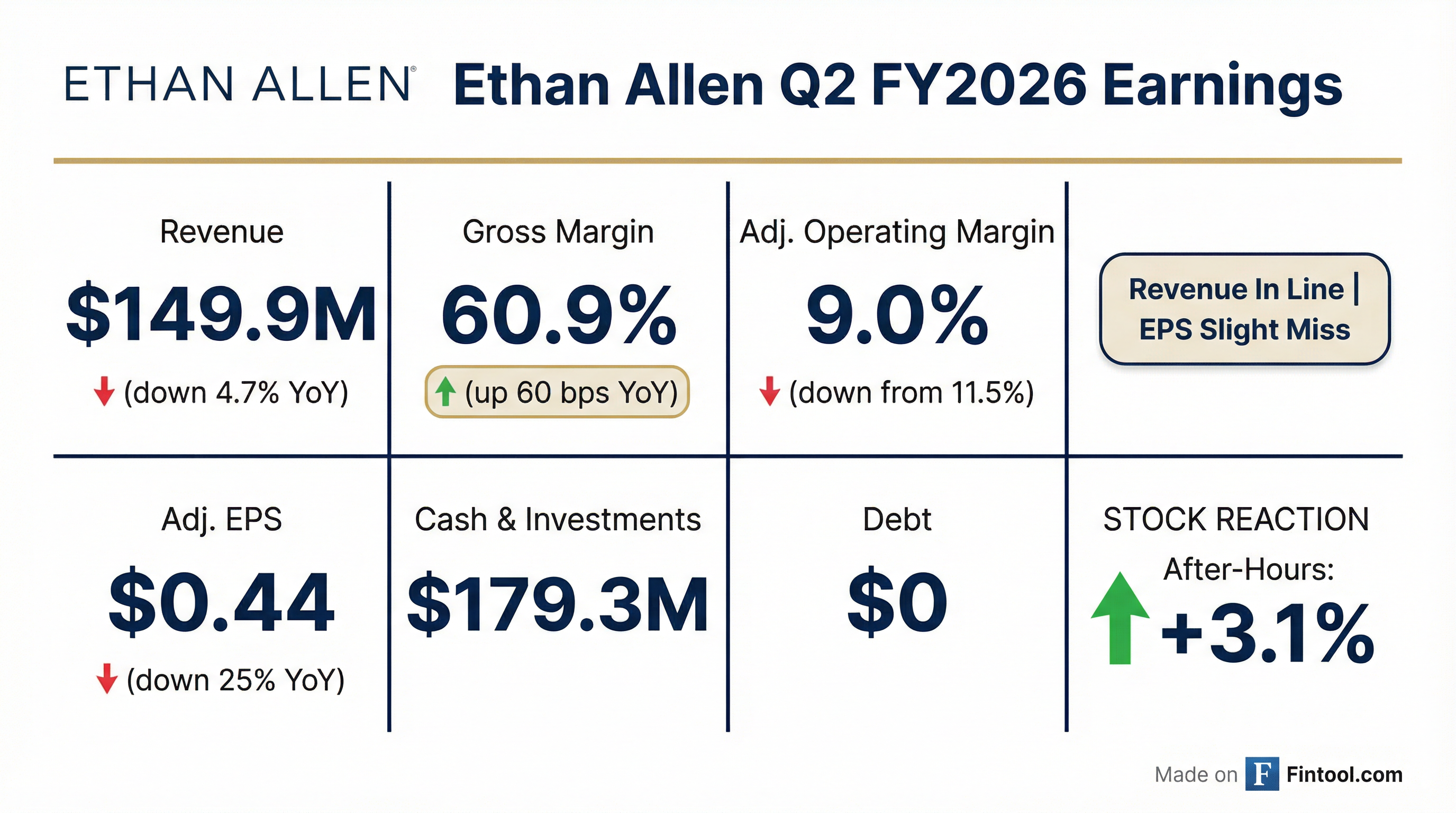

Ethan Allen Interiors (NYSE: ETD) reported Q2 FY2026 results that came in roughly in line on revenue but slightly missed on EPS. The premium furniture retailer posted net sales of $149.9M (down 4.7% YoY) and adjusted diluted EPS of $0.44 (down 25% YoY). Despite the profit decline, the stock jumped 3.1% in after-hours trading to $24.89, suggesting investors were positioned for worse given macro headwinds including the government shutdown.

Did Ethan Allen Beat Earnings?

Revenue: $149.9M vs ~$149M consensus — In Line

Adjusted EPS: $0.44 vs $0.445 consensus — Slight Miss (-1%)

The modest results came against a difficult backdrop. CEO Farooq Kathwari highlighted the U.S. government shutdown and challenging YoY comparisons as key headwinds that pressured written orders during the quarter.

What Drove the Results?

The Good: Gross Margin Expansion

Gross margin expanded 60 basis points YoY to 60.9%, a notable achievement given revenue pressure. This reflects Ethan Allen's vertically integrated model — manufacturing 75% of furniture in North American facilities — which provides better cost control than import-dependent competitors.

The Bad: Written Orders Collapse

The demand picture was concerning:

- Retail written orders: Down 17.9%

- Wholesale written orders: Down 19.3%

Customer deposits from undelivered orders fell to $63.6M from $75.1M at the start of the fiscal year, as deliveries outpaced new orders. This suggests the backlog cushion is eroding.

Marketing Investment

Management increased marketing spend by 25.2% YoY to $4.9M (3.2% of sales), signaling efforts to stimulate demand. This contributed to the SG&A increase of 1.5% despite headcount being down 5.1% YoY.

What Did Management Say?

CEO Farooq Kathwari struck a cautiously optimistic tone, with particular emphasis on improving January trends:

"The second quarter results were strongly impacted by the government shutdown, resulting in lower consumer confidence, lower traffic to our design centers, and lower orders at retail, and especially from the U.S. government contract... The good news is that we have started the third quarter with stronger traffic and positive written sales in January."

On the company's vertically integrated advantage:

"About 75% of our furniture is made in our manufacturing workshops in North America, and all products are custom made... This is possible because of our North American manufacturing and provides a strong competitive advantage."

On the unique logistics model:

"We deliver our products to our clients all across North America at one delivered price with what we call White Glove Service. Very unique. If a customer is in Seattle or in Florida or in Texas, it's exactly the same delivered price."

How Strong Is the Balance Sheet?

Ethan Allen's fortress balance sheet remains a key differentiator:

With zero debt and $179M in cash/investments, Ethan Allen has significant financial flexibility. Cash from operations totaled $15.0M in H1 FY2026, down from $26.7M in the prior year period due to lower net income and working capital changes.

How Did the Stock React?

Despite the earnings miss, ETD stock jumped in after-hours trading:

- Regular Session Close: $24.15 (down 0.82%)

- After-Hours: $24.89 (+3.1%)

The positive reaction suggests investors were positioned for worse results given the government shutdown headlines and housing market weakness. The dividend yield of approximately 6.4% (at $24.15 with $0.39 quarterly dividend) also provides support.

What Changed From Last Quarter?

*Values retrieved from S&P Global

Sequential improvement reflects typical seasonality (holiday quarter) and ongoing cost control efforts. The December quarter is historically stronger due to holiday-related furniture purchases.

8-Quarter Financial Trend

Revenue has contracted from the $168M peak in Q4 FY2024, but gross margins have remained remarkably stable in the 60-61% range — a testament to Ethan Allen's vertically integrated manufacturing model.

Capital Allocation & Dividends

Ethan Allen continues to prioritize shareholder returns:

- Quarterly Dividend: $0.39/share declared, payable February 25, 2026

- H1 FY2026 Dividends Paid: $26.3M (including $6.4M special dividend)

- Capital Expenditures: $2.9M in Q2 (vs $3.8M prior year)

At current prices, the $1.56 annualized dividend yields approximately 6.4%, making ETD attractive for income-focused investors.

Key Risks & Concerns

- Demand Volatility: Q2 written orders down ~18-19%, though January has turned positive

- Customer Deposit Erosion: Backlog at $49.8M down from prior levels as deliveries outpace orders

- Tariff Uncertainty: Section 232 and IEEPA tariffs creating cost pressure; Supreme Court ruling pending

- Government Contract Lag: Embassy orders resuming but "a little bit lower than last year"

- Operating Leverage: Margins compressed 250 bps YoY on fixed cost deleveraging

Q&A Highlights: What Analysts Asked

January Recovery Signal

KeyBanc analyst Taylor Zick asked about underlying demand trends. CFO Matt McNulty confirmed that monthly written orders decelerated through Q2, with October starting stronger but November/December weakening due to the government shutdown and tough prior-year comparisons.

The critical bullish signal: January has turned positive. CEO Kathwari attributed the rebound to consumers returning and the end of government shutdown uncertainty:

"I think the most important one is that the consumers came back. I think in the last quarter, with all the uncertainty, government shutdowns, all, people were scared. People were not coming in. What we've seen in January, people are coming back... our traffic has increased."

Government Contract Business Update

When asked about government contract recovery (a material revenue stream for Ethan Allen), Kathwari noted orders are coming in but below last year's pace:

"The good news is, the orders are coming in, and they are coming in reasonably high, but not as strong as, you know, we had last year because they, it is now taking the government, all the embassies, all over the world, little time to get back on. So yes, we are seeing new orders. It's a little bit lower than last year, but every week it's growing."

Tariff Exposure Breakdown

Telsey's Cristina Fernández pressed for tariff details. CFO McNulty provided a detailed breakdown:

Potential Upside: If the Supreme Court invalidates IEEPA tariffs, Ethan Allen would save approximately $8 million annually.

Management's three-pronged mitigation strategy: (1) vendor cost-sharing negotiations, (2) supplier sourcing diversification, and (3) selective 5% retail price increases on certain SKUs.

Marketing Strategy Shift

On the 25% marketing increase, Kathwari explained the shift is primarily to digital channels:

"We are going to reduce some of our advertising expense in some other mediums... in the last year or so, we spent a fair amount of money on sending magazines, digital magazines and print magazines. So one of the things we looked at was the impact of our digital magazine, where we're spending close to, I think close to $18 million a month. We decided that we'll take it down to $9-$10 million and still make an impact, and especially spending this more money on the digital marketing will help us."

Gross Margin Sustainability

When asked if 60%+ gross margins are sustainable, Kathwari expressed confidence:

"I think we have a good opportunity of maintaining them because of the fact that a lot of work has been done at all levels in terms of combining great talent and technology. That has really impacted all elements, especially our retail network in our manufacturing, our logistics."

Forward Catalysts

- January Momentum: Positive written comps and traffic improvement suggest Q3 could outperform Q2

- Supreme Court Tariff Ruling: IEEPA decision could save ~$8M annually if tariffs invalidated

- New Product Traction: Fall 2025 product introductions now reaching design centers

- Government Contract Recovery: Weekly orders improving as embassies re-engage

- North American Manufacturing: 75% domestic production provides tariff insulation

- Workforce Efficiency: Headcount down 30% vs 5-6 years ago with strong talent retention

View the full Ethan Allen company profile or read the Q2 FY2026 8-K filing.