Earnings summaries and quarterly performance for ETHAN ALLEN INTERIORS.

Executive leadership at ETHAN ALLEN INTERIORS.

M. Farooq Kathwari

Chairman, President and Chief Executive Officer

Amy Phillips

Executive Vice President, Retail Division

Catherine A. Plaisted

Senior Vice President, Marketing

Douglas H. Diefenbach

Senior Vice President, Business Development

Matthew J. McNulty

Senior Vice President, Chief Financial Officer and Treasurer

Board of directors at ETHAN ALLEN INTERIORS.

Research analysts who have asked questions during ETHAN ALLEN INTERIORS earnings calls.

Cristina Fernandez

Telsey Advisory Group

6 questions for ETD

Taylor Zick

KeyBanc Capital Markets Inc.

3 questions for ETD

Bradley Thomas

KeyBanc Capital Markets Inc.

2 questions for ETD

Brad Thomas

KeyBanc Capital Markets

1 question for ETD

Recent press releases and 8-K filings for ETD.

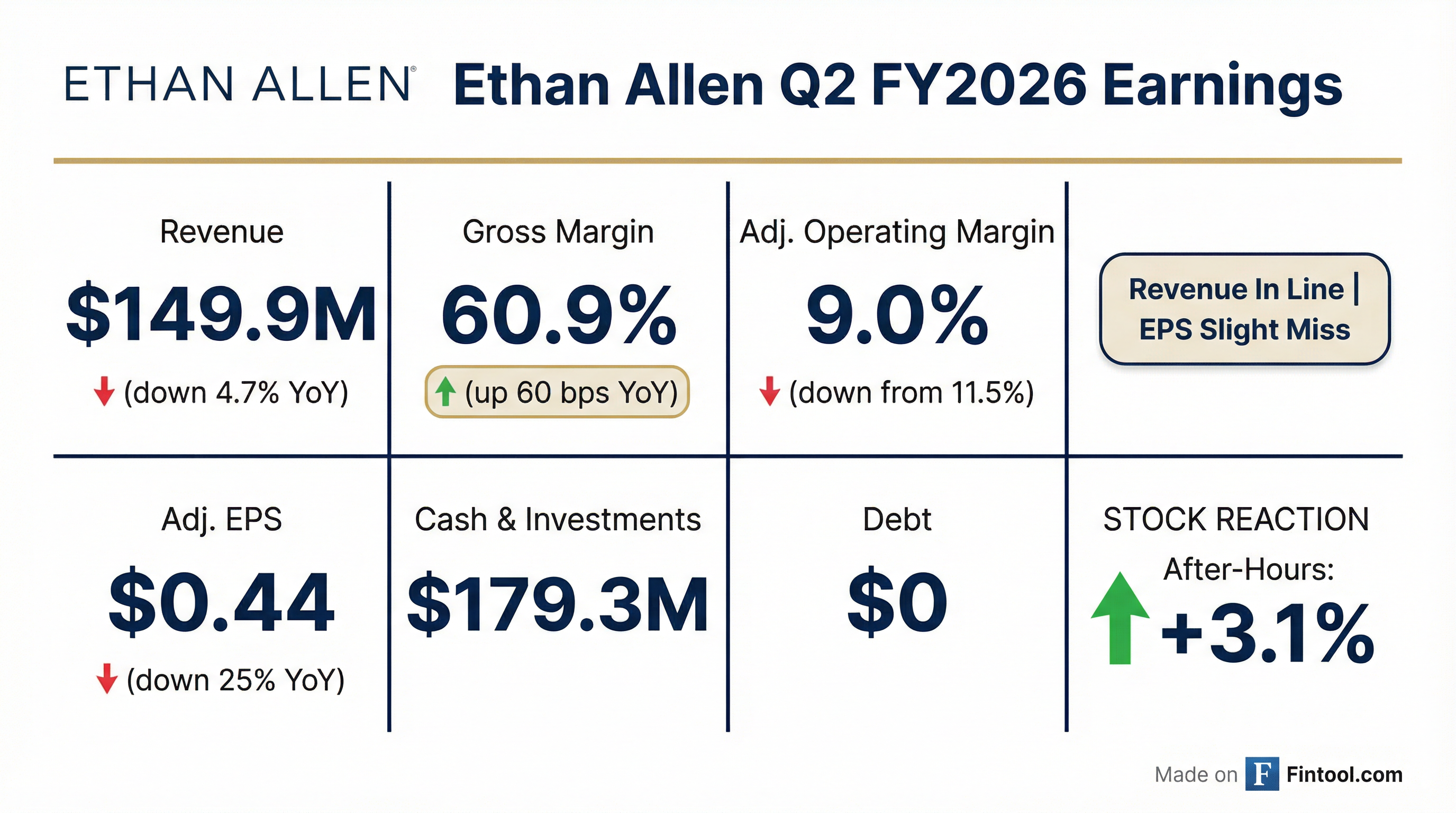

- Ethan Allen reported consolidated net sales of $149.9 million and adjusted diluted EPS of $0.44 for the second quarter of fiscal 2026, ending December 31, 2025.

- The company experienced significant headwinds, including a 17.9% decline in retail written orders and an 11% decrease in design center traffic, primarily due to the government shutdown and lower consumer confidence.

- Despite these challenges, Ethan Allen maintained a strong consolidated gross margin of 60.9% and an operating margin of 9%, supported by a robust balance sheet with $179.3 million in cash and investments and no debt.

- The company is actively mitigating tariff impacts through vendor cost sharing, sourcing diversification, and selective retail price increases, and has observed positive written order growth in January.

- Ethan Allen (ETD) reported Q2 2026 net sales of $149.9 million, a 60.9% consolidated gross margin, and adjusted diluted EPS of $0.44.

- Retail written orders declined 17.9% and wholesaler orders were 19.3% lower year-over-year, reflecting macroeconomic challenges and an 11% decline in design center traffic, although January has shown positive written order growth.

- The company maintains a strong financial position with $179.3 million in cash and investments and no debt, and its board declared a regular quarterly cash dividend of 39 cents per share.

- To mitigate tariff impacts, ETD has implemented vendor cost sharing, sourcing diversification, and selective retail price increases averaging 5%, benefiting from 75% of its furniture being manufactured in North America.

- Ethan Allen reported consolidated net sales of $149.9 million for Q2 2026, with retail written orders declining 17.9% and wholesale orders 19.3% lower year-over-year, primarily due to a government shutdown, reduced consumer confidence, and challenging prior-year comparisons.

- The company maintained strong profitability with a 60.9% consolidated gross margin and a 9% adjusted operating margin, resulting in adjusted diluted EPS of $0.44.

- Ethan Allen ended the quarter with a robust balance sheet, holding $179.3 million in cash and investments and no debt, and declared a regular quarterly cash dividend of $0.39 per share.

- New Section 232 tariffs, effective mid-October, imposed a 25% duty on upholstered wood products, contributing to tariff exposure, which the company is mitigating through vendor cost sharing, sourcing diversification, and selective retail price increases that averaged 5%.

- Management noted a positive start to the third quarter with stronger traffic and positive written sales in January and expects to maintain strong gross margins due to operational efficiencies and investments in talent and technology.

- Ethan Allen Interiors Inc. reported consolidated net sales of $149.9 million for the fiscal 2026 second quarter ended December 31, 2025, a decrease from $157.3 million in the prior year, with adjusted diluted EPS of $0.44.

- Despite a challenging environment, the company achieved a gross margin of 60.9% and an adjusted operating margin of 9.0% for the quarter.

- Written orders were significantly impacted, with the Retail segment 17.9% lower and the Wholesale segment decreasing 19.3% compared to the prior year.

- The company ended the quarter with a robust balance sheet, holding $179.3 million in total cash and investments and no outstanding debt as of December 31, 2025.

- The Board of Directors approved a regular quarterly cash dividend of $0.39 per share, payable on February 25, 2026.

- Ethan Allen Interiors Inc. reported consolidated net sales of $149.9 million and adjusted diluted EPS of $0.44 for the fiscal 2026 second quarter ended December 31, 2025.

- The company achieved a gross margin of 60.9% and an adjusted operating margin of 9.0%, while maintaining a robust balance sheet with $179.3 million in total cash and investments and no outstanding debt at December 31, 2025.

- Written orders were impacted by macroeconomic challenges, with retail segment written orders 17.9% lower and wholesale segment written orders decreasing 19.3% compared to the prior year.

- The Board of Directors approved a regular quarterly cash dividend of $0.39 per share, payable on February 25, 2026.

- Ethan Allen Interiors reported strong financial results for fiscal year 2025, achieving a gross margin of 60.5% and an operating margin of 10.2%.

- The company maintained a robust financial position, ending FY 2025 with $196 million in cash and investments, no debt, and having paid over $50 million in cash dividends.

- Shareholders approved all proposals at the 2025 Annual Meeting, including the election of six directors, the non-binding advisory vote on executive compensation, and the ratification of CohnReznick LLP as the independent public accounting firm for fiscal year 2026.

- Ethan Allen Interiors Inc. (ETD) reported consolidated net sales of $147 million for Q1 2026, with retail written orders growing by 5.2% despite a 7.1% decrease in wholesale orders.

- The company achieved a strong consolidated gross margin of 61.4% and an adjusted operating margin of 7.2%, resulting in adjusted diluted EPS of $0.43.

- ETD maintained a robust balance sheet, ending the quarter with $193.7 million in cash and investments and no debt, while generating $16.8 million in operating cash flow.

- The company continued its capital return strategy, paying $16.4 million in cash dividends during the quarter, including a special cash dividend of $0.25 per share and a regular quarterly dividend of $0.39 per share.

- Marketing costs increased 44% year-over-year, from 2.4% to 3.4% of net sales, primarily due to increased national marketing, direct mail, paid search, and paid social campaigns, while facing challenges from lower traffic and government sales delays.

Quarterly earnings call transcripts for ETHAN ALLEN INTERIORS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more