Earnings summaries and quarterly performance for EVI INDUSTRIES.

Research analysts covering EVI INDUSTRIES.

Recent press releases and 8-K filings for EVI.

EVI Industries Reports Record Second Quarter Results

EVI

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

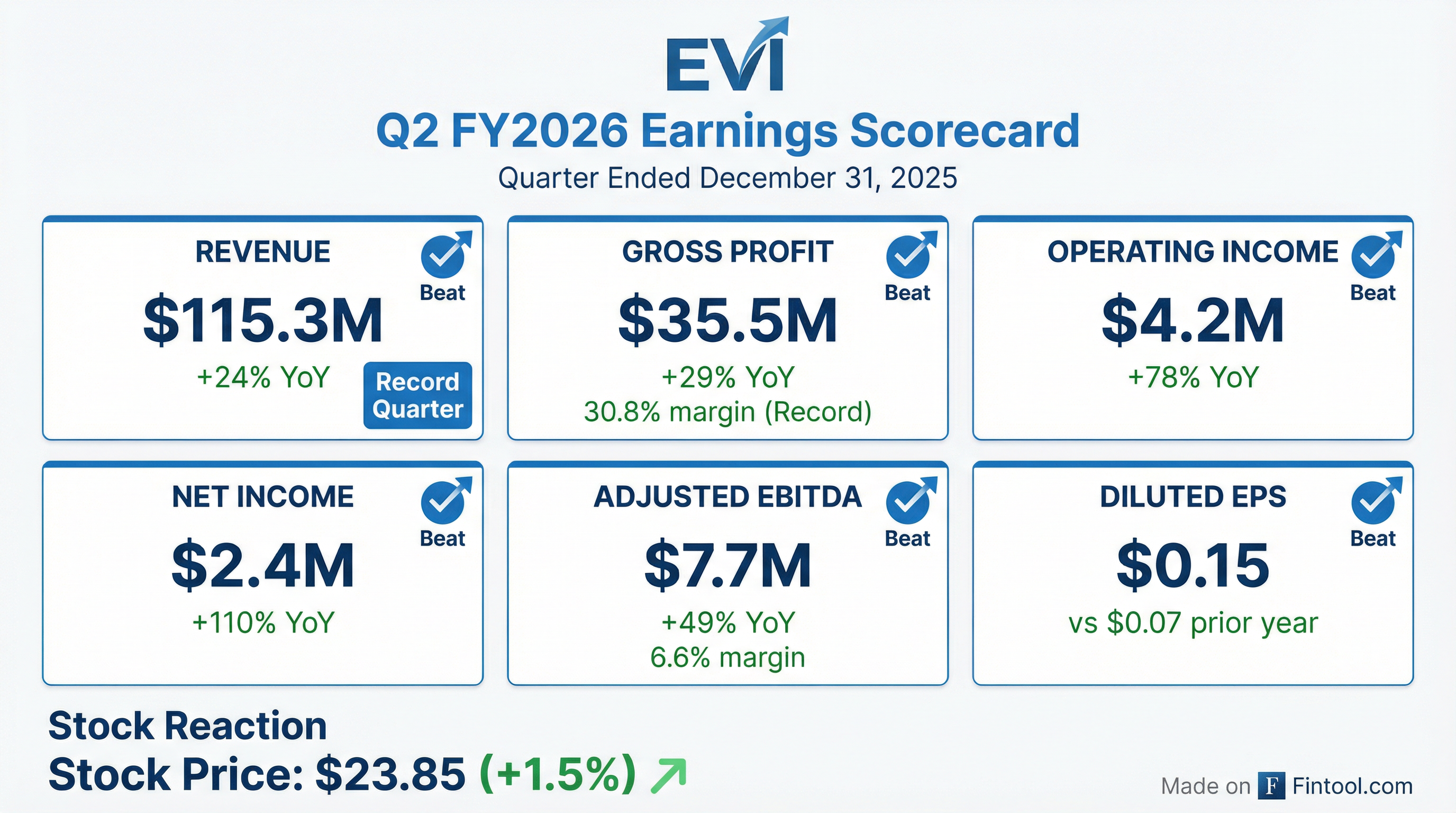

- EVI Industries reported record second quarter results for the period ended December 31, 2025, with revenue increasing 24% to $115.3 million, gross profit increasing 29% to $35.5 million, operating income increasing 78% to $4.2 million, net income increasing 110% to $2.4 million, and Adjusted EBITDA increasing 49% to $7.7 million.

- For the six months ended December 31, 2025, revenue increased 20% to $223.6 million, gross profit increased 23% to $69.4 million, and Adjusted EBITDA increased 13% to $14.4 million.

- The company continues to execute its "buy-and-build" growth strategy and is making significant investments in people, processes, and technology aimed at building a more scalable, integrated, and efficient organization.

- Operating cash flow was positive for both the three- and six-month periods ended December 31, 2025, despite an approximately $12 million inventory buildup and the payment of an approximately $5 million cash dividend.

Feb 9, 2026, 9:12 PM

EVI Industries Reports Record Second Quarter Results

EVI

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- EVI Industries reported record second quarter results for the fiscal year ending June 30, 2026, with revenue increasing 24% to $115.3 million, net income rising 110% to $2.4 million, and Adjusted EBITDA growing 49% to $7.7 million for the three months ended December 31, 2025.

- The company achieved over $425 million in revenues for the twelve months ended December 31, 2025.

- EVI is continuing its "buy-and-build" growth strategy and making significant investments in technology, modernization, and operational optimization to enhance scalability and efficiency.

- The company generated positive operating cash flow for both the three- and six-month periods ended December 31, 2025, despite a $12 million inventory buildup.

Feb 9, 2026, 9:02 PM

EVI Industries Announces Record Q2 2026 Results

EVI

Earnings

New Projects/Investments

M&A

- EVI Industries reported record second quarter revenue of $115 million, a 24% year-over-year increase, primarily driven by contributions from acquired businesses and legacy operations.

- The company achieved significant profit growth in Q2 2026, with net income increasing 110% to 2.1% of revenues and Adjusted EBITDA growing 49% to $7.7 million, or 6.6% of revenue.

- EVI continued to invest in modernization, technology, and operational capabilities, which impacted operating margins but are intended to drive long-term scalability and efficiency.

- The company maintains a strong balance sheet and financial flexibility, generating positive operating cash flow during the period despite a $12 million inventory buildup and a $5 million cash dividend payment.

Feb 9, 2026, 9:00 PM

EVI Industries Reports Record Q2 2026 Results and Continued Strategic Investments

EVI

Earnings

New Projects/Investments

M&A

- EVI Industries reported record second quarter revenue of $115 million, a 24% year-over-year increase, with gross margin expanding to nearly 31% and net income increasing 110% to 2.1% of revenues for Q2 2026.

- Adjusted EBITDA for the quarter increased 49% to $7.7 million, or 6.6% of revenue, and trailing twelve months revenue surpassed $425 million as of December 31, 2025.

- The company is investing in modernization and optimization initiatives, including data-driven operational systems and field service technology, which contributed to an approximately 13% improvement in average response time over the past 12 months.

- EVI generated positive operating cash flow during the three- and six-month periods ended December 31, 2025, while maintaining strong liquidity and evaluating a robust pipeline of acquisition opportunities.

Feb 9, 2026, 9:00 PM

EVI Industries Reports Record Q2 2026 Results and Continued Strategic Investments

EVI

Earnings

New Projects/Investments

M&A

- EVI Industries achieved record second quarter revenue, gross profit, and operating profit for Q2 2026, with revenue increasing 24% year-over-year to $115 million and Adjusted EBITDA growing 49% to $7.7 million. For the six-month period ended December 31, 2025, revenue increased 20% to over $223 million.

- The company is making significant investments in technology, modernization, and infrastructure, which impacted operating margin expansion. Despite these investments, a planned $12 million inventory buildup, and a $5 million cash dividend payment, EVI generated positive operating cash flow for both the 3- and 6-month periods ended December 31, 2025.

- EVI has demonstrated strong long-term growth, achieving compounded annual growth rates of approximately 30% in revenue, 16% in net income, and 27% in adjusted EBITDA since 2016, and continues to evaluate a robust pipeline of acquisition opportunities.

Feb 9, 2026, 9:00 PM

EVI Industries Reports Record Q1 Fiscal 2026 Revenues and Gross Profits

EVI

Earnings

Dividends

M&A

- EVI Industries, Inc. reported record revenues of $108 million for the first quarter of fiscal 2026, a 16% increase compared to the prior-year period, and record gross profits of $33.9 million, up 17%.

- Net income decreased to $1.8 million and Adjusted EBITDA decreased to $6.8 million for Q1 2026, primarily due to accelerated investments in modernization, optimization, integration, and costs associated with an industry exposition.

- The company declared a $5.0 million special cash dividend ($0.33 per share), which was paid on October 6, 2025.

- EVI continues to execute its "buy-and-build" growth strategy, having completed four additional acquisitions since the first quarter of fiscal 2025, and is investing in technology for field service, e-commerce, and customer relationship management.

Nov 10, 2025, 9:23 PM

EVI Industries Reports First Quarter Fiscal 2026 Results

EVI

Earnings

Dividends

New Projects/Investments

- EVI Industries reported record revenues of $108 million, a 16% increase compared to the prior year, and record gross profit of $33.9 million, up 17%, resulting in a 31.3% gross margin for the first quarter of fiscal year 2026.

- Net income decreased to $1.8 million (1.7% of revenue) and Adjusted EBITDA was $6.8 million (6.2% of revenue), down from $3.2 million (3.5% of revenue) and $7.6 million (8.1% of revenue) respectively in the prior-year period.

- The decline in profitability is attributed to accelerated investments in modernization, optimization, integration, and technology initiatives, along with costs from migrating acquired operations and participating in an industry exposition.

- The company declared a $5.0 million special cash dividend, or $0.33 per share, which was paid on October 6, 2025.

- Net debt increased by $2.2 million to $46.3 million during the quarter.

Nov 10, 2025, 9:03 PM

EVI Industries Reports Record Fiscal 2025 Results and Announces Special Cash Dividend

EVI

Earnings

M&A

Dividends

- EVI Industries reported record fiscal year 2025 results, with revenue increasing 10% to $390 million, net income increasing 33% to $7.5 million, and Adjusted EBITDA increasing 11% to $25.0 million.

- The company completed four acquisitions in fiscal 2025, including its largest ever, Girbau North America (now Continental Laundry Solutions), which is expected to add approximately $50 million in annual revenue.

- EVI also announced a special cash dividend of $0.33 per share, payable on October 6, 2025, to shareholders of record as of September 25, 2025.

- Net debt increased to $44.1 million as of June 30, 2025, from $8.3 million as of June 30, 2024, reflecting ongoing investment in acquisitions, technology, and working capital.

Sep 11, 2025, 8:42 PM

EVI Industries Reports Record Fiscal 2025 Results, Strategic Acquisitions, and Special Cash Dividend

EVI

Earnings

Dividends

M&A

- EVI Industries reported record fiscal year 2025 results (ended June 30, 2025), with revenue increasing 10% to $390 million, net income increasing 33% to $7.5 million, and Adjusted EBITDA increasing 11% to $25.0 million.

- The company continued its buy-and-build growth strategy, completing four acquisitions in fiscal 2025, including the largest in company history, Girbau North America (now Continental Laundry Solutions), which is expected to add approximately $50 million in annual revenue.

- EVI made significant investments in technology, with its field service platform expanding to 27 business units by June 2025, completing over 8,500 appointments that month, and 28 of 31 business units operating on its end-state ERP platform by the end of fiscal 2025.

- The Board of Directors declared a special cash dividend of $0.33 per share, payable on October 6, 2025, to shareholders of record as of September 25, 2025.

- Net debt increased to $44.1 million as of June 30, 2025, from $8.3 million as of June 30, 2024, reflecting $46.9 million deployed for strategic acquisitions during fiscal 2025.

Sep 11, 2025, 8:33 PM

Quarterly earnings call transcripts for EVI INDUSTRIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more