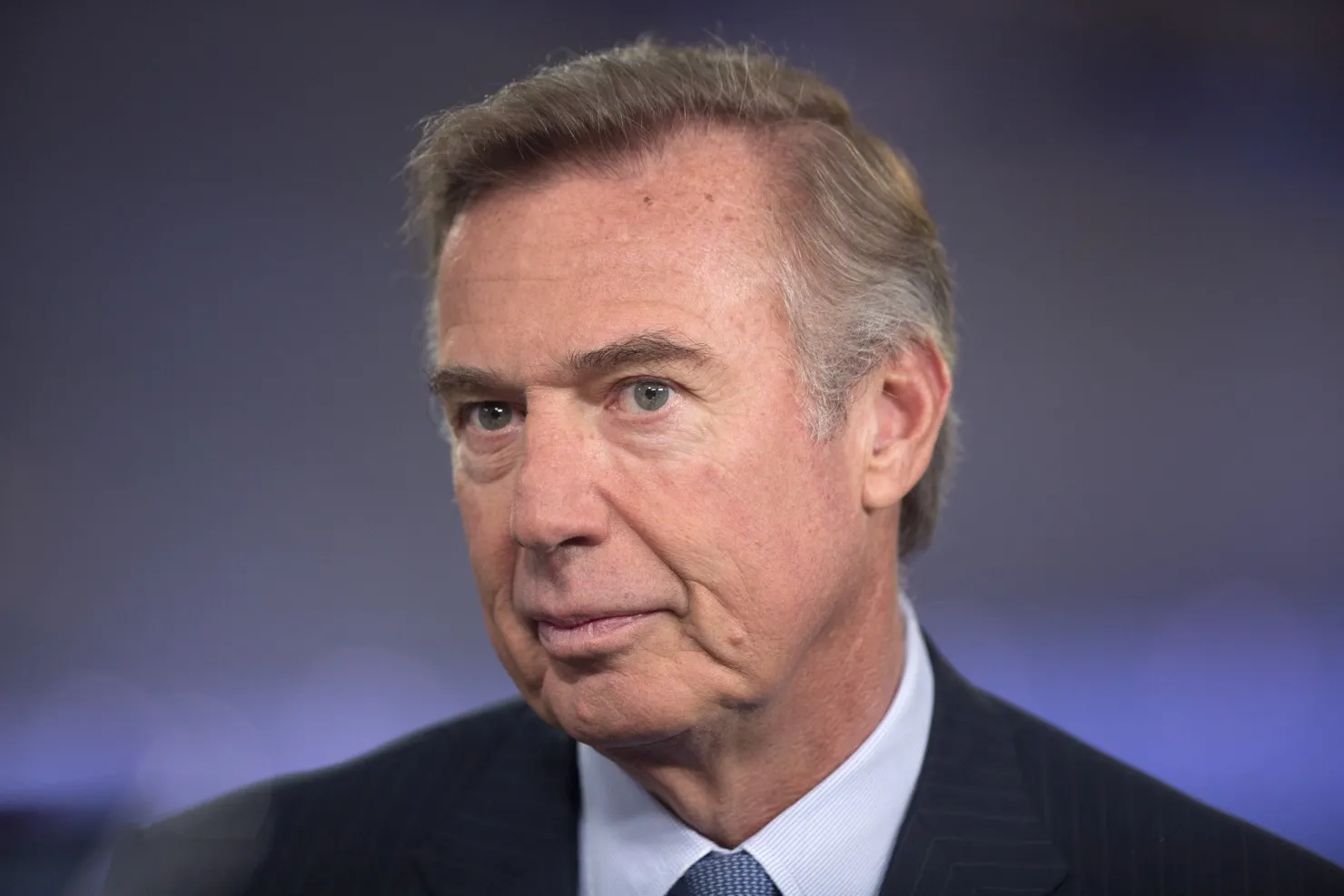

John Weinberg

About John Weinberg

John S. Weinberg (age 68) is Chairman of the Board and CEO of Evercore, serving as Chairman and CEO since February 25, 2022, after roles as Co‑Chairman and Co‑CEO (July 2020–February 2022) and Executive Chairman/Chairman (November 2016–July 2020) . He was previously Vice Chairman of Goldman Sachs, Co‑Head of Global Investment Banking, and a member of its Management Committee (2002–2015), having joined Goldman in 1983 and becoming Partner in 1992 . He holds a B.A. from Princeton (1979) and an M.B.A. from Harvard Business School (1983) . Under his leadership, Evercore delivered 2024 Adjusted Net Revenues of $3.003 billion, Adjusted EPS of $9.42, and Adjusted Operating Margin of 18.6% while advising on three of the seven largest global M&A deals and returning $590.6 million to shareholders .

Past Roles

| Organization | Role | Years | Strategic impact |

|---|---|---|---|

| Evercore | Chairman & CEO | Feb 25, 2022–present | Oversaw recruiting of senior MDs, expansion of coverage, capital returns |

| Evercore | Co‑Chairman & Co‑CEO | Jul 2020–Feb 2022 | Senior leadership across growth initiatives |

| Evercore | Executive Chairman/Chairman | Nov 2016–Jul 2020 | Strategic leadership and client engagement |

| Goldman Sachs | Vice Chairman; Co‑Head Global IB; Management Committee | 2002–2015 | Led global IB franchise; senior governance |

| Goldman Sachs | Associate→Partner | 1983–1992 | Investment banking leadership track |

External Roles

| Organization | Role | Years | Strategic impact |

|---|---|---|---|

| Ford Motor Company | Director | Current | Corporate oversight and governance |

| NewYork‑Presbyterian Hospital | Board member | Current | Non‑profit governance |

| Cystic Fibrosis Foundation | Board member | Current | Non‑profit governance |

Fixed Compensation

| Metric | FY 2022 | FY 2023 | FY 2024 |

|---|---|---|---|

| Base Salary ($USD) | $500,000 | $500,000 | $500,000 |

Performance Compensation

| Metric | FY 2022 | FY 2023 | FY 2024 |

|---|---|---|---|

| Incentive Cash ($USD) | $3,250,000 | $3,125,000 | $6,125,000 |

| RSUs ($USD) | $3,250,000 | $3,125,000 | $6,125,000 |

Grants detail (2024 grants for 2023 performance):

| Grant Date | RSUs Granted (#) | Grant Date Fair Value ($USD) |

|---|---|---|

| 2/14/2024 | 17,731 | $3,241,138 |

Vesting and delivery mechanics:

- Annual RSUs vest in substantially equal annual installments over four years; accelerated upon death, disability, change in control, qualifying retirement or termination without cause .

- 2024 outstanding scheduled vesting: 30,349 RSUs vested on 2/4/2025; 21,298 vest on 2/4/2026; 10,573 vest on 2/4/2027; 4,433 vest on 2/4/2028 .

Compensation metrics and approach (2024):

| Metric | Weighting | Target | Actual | Payout | Vesting |

|---|---|---|---|---|---|

| Adjusted Net Revenues ($USD mm) | Discretionary | N/A | $3,003 | Discretionary | RSUs 4‑yr schedule |

| Adjusted EPS ($USD) | Discretionary | N/A | $9.42 | Discretionary | RSUs 4‑yr schedule |

| Adjusted Net Income ($USD mm) | Discretionary | N/A | $415.8 | Discretionary | RSUs 4‑yr schedule |

| Adjusted Operating Margin (%) | Discretionary | N/A | 18.6% | Discretionary | RSUs 4‑yr schedule |

Equity Ownership & Alignment

| Item | Value |

|---|---|

| Class A shares beneficially owned | 559,775 (1.45% of Class A) |

| Voting Units beneficially owned | 400,000 (17.07% of Voting Units) |

| Total combined voting power | 2.34% |

| Unvested RSUs outstanding | 58,947 |

| CEO/Senior Chairman ownership guideline | 200,000 shares or equivalents |

| Compliance status (NEOs) | Met ownership guidelines for 2024 |

| Hedging/Pledging | Hedging prohibited; pledging prohibited without Compensation Committee approval |

| Clawback | NYSE‑compliant clawback effective Dec 1, 2023; applies to incentive‑based compensation for 3 preceding fiscal years following a restatement |

Insider selling pressure context:

- Four-year RSU delivery schedule with specific deliveries planned through 2028 may create periodic supply; company offsets dilution via repurchases and capital return actions (returned $590.6 million in 2024) .

Employment Terms

| Term | Detail |

|---|---|

| Employment status | At‑will; initial term expired March 1, 2023 |

| Non‑compete | 12 months post‑termination (and while employed) |

| Non‑solicit | 12 months post‑termination (and while employed) |

| Retirement eligibility/vesting | With 1‑year prior notice and age/service criteria, full vesting of deferred comp and equity awards; paid on original schedule subject to covenant compliance |

| Termination benefits | Annual bonus for completed fiscal year paid; equity accelerates on certain events (see potential payments) |

| Potential payments (equity) | Accelerated vesting of equity awards valued at $18,476 ($ thousands) on change in control, death, disability, or termination without cause |

| Clawback/insider policy | NYSE clawback; anti‑hedging/anti‑pledging |

| Perquisites | Corporate aircraft policy; no personal use by Weinberg in 2024 |

Start date and tenure:

- Joined Evercore leadership in 2016; Chairman & CEO since Feb 25, 2022 .

Performance & Track Record (Company context under Weinberg’s leadership)

| Metric | FY 2020 | FY 2021 | FY 2022 | FY 2023 | FY 2024 |

|---|---|---|---|---|---|

| Adjusted Net Revenue ($USD mm) | $2,327 | $3,317 | $2,786 | $2,449 | $3,003 |

| Net Income ($USD mm) | $351 | $740 | $477 | $255 | $378 |

| Value of $100 Investment (Company TSR) | $152 | $192 | $158 | $253 | $417 |

Additional 2024 highlights:

- Net Revenues $2.98b (GAAP), $3.00b (Adjusted); EPS $9.08 (GAAP), $9.42 (Adjusted); Operating Margin 17.7% (GAAP), 18.6% (Adjusted) .

- Advised on three of the seven largest global M&A deals; broadened coverage; returned $590.6 million to shareholders .

Board Governance

- Role and independence: Chairman & CEO; not independent under NYSE rules .

- Committee memberships: None; 100% of committee members are independent .

- Lead Independent Director: Gail B. Harris; leads executive sessions, agenda setting, evaluations .

- Board meeting attendance: Board met five times in 2024; all directors attended over 80% of meetings .

- Director compensation: Employee directors are not paid director compensation .

Dual‑role implications:

- Combined Chair/CEO role is mitigated by a strong Lead Independent Director, fully independent committees, and regular executive sessions of non‑management directors .

Director Compensation (as Director)

| Item | Detail |

|---|---|

| Cash retainer/RSUs | Employee directors receive no director compensation |

| Ownership guideline (non‑management directors) | 3x annual retainer; RSUs deliver after 1 year |

Compensation Peer Group and Say‑on‑Pay

- Peer group referenced by Compensation Committee includes Bank of America, Citigroup, Goldman Sachs, Houlihan Lokey, JPMorgan, Lazard, Moelis, Perella Weinberg Partners, Morgan Stanley, PJT, Jefferies, Piper Sandler, Raymond James, Stifel (no target percentile set) .

- Say‑on‑Pay support: Approximately 93% approval last year; continued strong shareholder support in 2024 .

Risk Indicators & Red Flags

- Clawback policy (NYSE‑compliant) in place and anti‑hedging/anti‑pledging policies; mitigates misalignment risks .

- Discretionary incentive awards rather than formulaic targets; reduces metric‑gaming but lowers transparency .

- Single‑trigger equity acceleration on change in control (accelerates even without termination), though no cash severance multiples disclosed for Weinberg .

- Combined Chair/CEO role could raise independence concerns; mitigated via Lead Director and independent committees .

- No excise tax gross‑up disclosed for Weinberg; Altman has gross‑up protection, not applicable to Weinberg .

Investment Implications

- Strong alignment: Large personal stake (559,775 shares; 2.34% combined voting power) and strict ownership guidelines (200,000 shares/equivalents for CEO) support long‑term orientation .

- Vesting/supply mechanics: Four‑year RSU delivery with known vesting dates through 2028 implies predictable potential selling windows, partially offset by active repurchases and capital returns (2024: $590.6 million) .

- Pay‑for‑performance: 2024 incentive pay up materially (50/50 cash/RSUs), tied to strong Adjusted results and strategic execution; discretionary approach can be investor‑friendly but warrants monitoring for consistency across cycles .

- Governance: Combined Chair/CEO balanced by Lead Independent Director and independent committees; continued high Say‑on‑Pay support (~93%) indicates shareholder endorsement of program design .