Earnings summaries and quarterly performance for Evercore.

Executive leadership at Evercore.

Board of directors at Evercore.

Research analysts who have asked questions during Evercore earnings calls.

Brendan O'Brien

Wolfe Research

6 questions for EVR

Devin Ryan

Citizens JMP

6 questions for EVR

Ryan Kenny

Morgan Stanley

6 questions for EVR

James Yaro

Goldman Sachs

5 questions for EVR

Alex Bond

Keefe, Bruyette & Woods (KBW)

3 questions for EVR

Brennan Hawken

UBS Group AG

3 questions for EVR

Jim Mitchell

Seaport Global

3 questions for EVR

Michael Brown

Wells Fargo Securities

3 questions for EVR

Aidan Hall

KBW

2 questions for EVR

Brent Thielman

D.A. Davidson

2 questions for EVR

Daniel Cocchiara

Bank of America

2 questions for EVR

Mike Brown

UBS

2 questions for EVR

Nathan Stein

Deutsche Bank

2 questions for EVR

Ben Rubin

UBS

1 question for EVR

Brian Brophy

Stifel Financial Corp

1 question for EVR

Christopher Ellinghaus

Siebert Williams Shank & Co., LLC

1 question for EVR

Christopher Senyek

Wolfe Research

1 question for EVR

Ian Zaffino

Oppenheimer & Co. Inc.

1 question for EVR

James Mitchell

Seaport Global Holdings LLC

1 question for EVR

Michael Dudas

Vertical Research Partners

1 question for EVR

Sunshine Jones

Goldman Sachs

1 question for EVR

Recent press releases and 8-K filings for EVR.

- Encore Capital Group reported full-year 2025 earnings per share of $10.91 and net income of $257 million.

- Global portfolio purchases in 2025 increased 4% to $1.41 billion, including $1.17 billion in the U.S.. Global collections rose 20% to $2.59 billion, with U.S. collections up 24% to $1.95 billion.

- The company repurchased approximately 9% of ECPG shares outstanding for $89.5 million in 2025.

- For 2026, Encore anticipates global portfolio purchases between $1.4 billion and $1.5 billion , global collections to increase 5% to $2.7 billion , and earnings per share to increase 10% to $12.00.

- Multi-Color Corporation (MCC) received court approval for initial requests related to its prepackaged Chapter 11 filing from January 29, 2026, ensuring normal operations and full payment to vendors.

- The court granted MCC immediate access to $125 million of $250 million in new debtor-in-possession financing.

- The restructuring support agreement (RSA) is projected to reduce MCC's net debt from approximately $5.9 billion to about $2.0 billion.

- Additionally, $889 million in new common and preferred equity investment will be provided by CD&R and existing secured lenders, with MCC expected to have over $550 million in liquidity post-emergence.

- Multi-Color Corporation (MCC) received court approval for its first day motions related to its prepackaged Chapter 11 filing on January 29, 2026, affirming normal operations and full payment to trade vendors and suppliers during the restructuring process.

- The court granted MCC immediate access to $125 million of $250 million in debtor-in-possession (DIP) new money financing, provided by certain secured first lien debt holders and its equity sponsor, CD&R.

- This restructuring is expected to significantly deleverage MCC's balance sheet, reducing its net debt from approximately $5.9 billion to approximately $2.0 billion.

- Upon emergence, MCC anticipates having more than $550 million of liquidity, supported by an $889 million new common and preferred equity investment from CD&R and existing secured lenders.

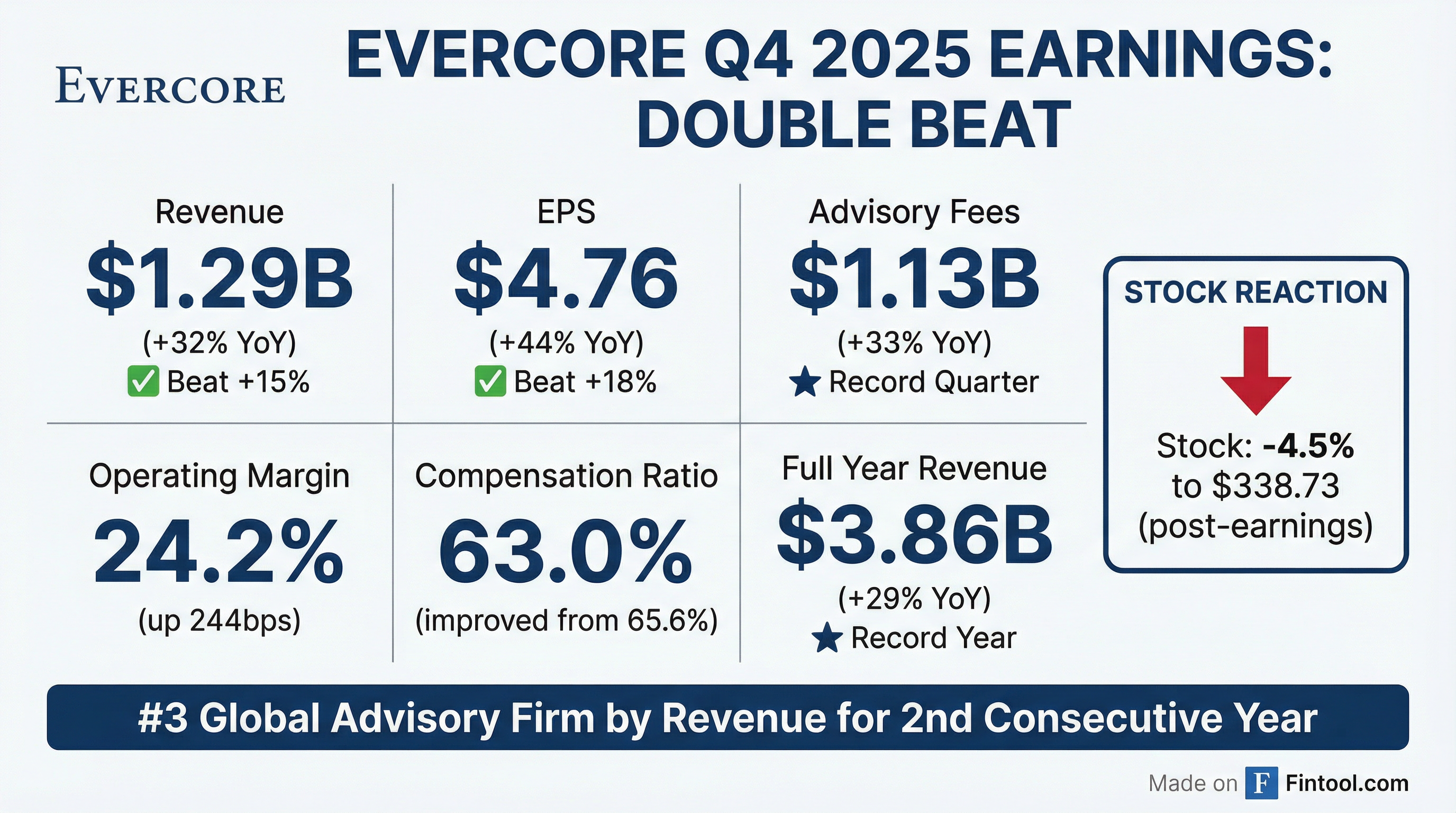

- Evercore achieved record adjusted net revenue of $3.9 billion for the full year 2025, marking a 29% increase over the prior year, and record adjusted earnings per share of $14.56, up 55% from 2024. The fourth quarter of 2025 also represented the strongest revenue quarter in the company's history, with nearly $1.3 billion in adjusted net revenue.

- The company ranked as the third-largest investment bank globally in 2025 based on advisory fees, benefiting from a 49% rebound in global M&A activity to approximately $4.5 trillion.

- Evercore continued its strategic growth and diversification, with 45% of its revenues generated from non-M&A businesses for the full year, and entered 2026 with 171 investment banking Senior Managing Directors after significant talent investment.

- Entering 2026 with record-level backlogs and optimism for continued strong M&A and restructuring activity, Evercore returned $812 million to shareholders in 2025, including $661 million through the repurchase of 2.4 million shares.

- Evercore achieved record financial results for both the fourth quarter and full-year 2025, with adjusted net revenue reaching approximately $3.9 billion for the full year, a 29% increase over the prior year, and adjusted earnings per share of $14.56, up 55% from 2024.

- The company maintained a strong market position, ranking as the third-largest investment bank globally in 2025 based on advisory fees and advising on five of the 15 largest global M&A deals.

- Diversification efforts were evident, with approximately 45% of revenues in both Q4 and the full year 2025 generated from non-M&A businesses.

- Evercore enters 2026 with strong momentum and optimism, citing record-level backlogs in both M&A and restructuring, and expects a healthy environment for large deals to continue.

- The firm continued to invest in talent, entering 2026 with 171 investment banking Senior Managing Directors, and demonstrated leverage with an adjusted compensation ratio of 64.2% and a non-comp ratio of 14.2% for the full year, both showing improvement from 2024.

- Evercore achieved record net revenues of $3.9 billion in 2025 with an operating margin of 21.6%.

- The company was ranked #1 in Advisory Revenues among Independent Firms and #3 among All Firms in FY 2025, also securing the #1 M&A league table ranking globally among all independent firms in 2025.

- Approximately 45% of Adjusted Total Net Revenue in 4Q25 and FY 2025 was derived from non-M&A businesses, indicating significant revenue diversification.

- Evercore returned $812 million of capital to shareholders in FY 2025 through dividends and share repurchases, contributing to a total of $3.4 billion returned since 2021.

- Strategic expansion included increasing Investment Banking Senior Managing Directors (SMDs) to 171 by the end of 2025, a 50% increase since the end of 2021, and completing the acquisition of Robey Warshaw in October 2025.

- Evercore achieved record adjusted net revenue of $3.9 billion for the full year 2025, a 29% increase year-over-year, and $1.3 billion for Q4 2025, marking its strongest quarter ever, with full-year adjusted EPS reaching $14.56.

- The firm was ranked the third-largest investment bank globally in 2025 based on advisory fees and saw approximately 45% of revenues generated from non-M&A businesses, which also posted record results.

- Strategic investments included the acquisition of Robey Warshaw and expansion in EMEA, alongside significant talent growth, entering 2026 with 171 investment banking Senior Managing Directors.

- Evercore anticipates continued activity and strong momentum into 2026, with backlogs at record levels, and returned $812 million to shareholders in 2025.

- Evercore Inc. reported record Fourth Quarter and Full Year 2025 Net Revenues of $1.3 billion and $3.9 billion, respectively, on both a U.S. GAAP and Adjusted basis, marking increases of 32% and 29% versus 2024.

- Diluted Earnings Per Share for Q4 2025 were $4.76 (U.S. GAAP) and $5.13 (Adjusted), and for Full Year 2025, they were $14.05 (U.S. GAAP) and $14.56 (Adjusted).

- The company's Board of Directors declared a quarterly dividend of $0.84 per share on February 3, 2026, to be paid on March 13, 2026.

- In Strategic Advisory, Evercore advised on five of the top 15 globally announced transactions in 2025, and its North American Advisory, EMEA Advisory, Private Capital Advisory, and Private Funds Group businesses each achieved record revenue years.

- During 2025, Evercore repurchased an aggregate of 2.4 million shares at an average price of $275.42 per share.

- Multi-Color Corporation (MCC) has initiated pre-arranged Chapter 11 bankruptcy reorganization proceedings to implement a previously announced Restructuring Support Agreement (RSA).

- The reorganization aims to significantly reduce MCC's net debt from approximately $5.9 billion to $2.0 billion and decrease annualized cash interest expense for 2026 from about $475 million to $140 million.

- The RSA includes $889 million in new common and preferred equity investment and is expected to provide over $500 million in new liquidity upon completion of the reorganization.

- MCC has secured $250 million in new debtor-in-possession (DIP) financing to support operations during Chapter 11, with all global business operations and customer service expected to continue uninterrupted, and trade suppliers and vendors anticipated to be paid in full.

- Multi-Color Corporation (MCC) has initiated a pre-arranged Chapter 11 bankruptcy restructuring process to rebuild its balance sheet for long-term growth and investment.

- The restructuring plan, supported by CD&R and a supermajority of first lien secured lenders, is expected to shrink MCC's net debt from approximately $5.9 billion to $2.0 billion and reduce annualized cash interest expense for 2026 from approximately $475 million to $140 million.

- Upon completion, MCC anticipates receiving over $500 million in new liquidity and has secured $250 million in new Debtor-in-Possession (DIP) financing to ensure uninterrupted global business operations during the Chapter 11 process.

- The plan also includes an $889 million investment in new common and preferred equity to support long-term growth and investment, and extends long-term debt maturities to 2033.

Quarterly earnings call transcripts for Evercore.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more