Earnings summaries and quarterly performance for BARCLAYS.

Research analysts who have asked questions during BARCLAYS earnings calls.

Andrew Coombs

Citigroup

5 questions for BCS

Guy Stebbings

BNP Paribas

5 questions for BCS

Chris Hallam

Goldman Sachs Group Inc.

4 questions for BCS

Daniel David

Autonomous Research

4 questions for BCS

Edward Firth

Keefe, Bruyette & Woods (KBW)

4 questions for BCS

Jason Napier

UBS Group AG

4 questions for BCS

Lee Street

Citigroup

4 questions for BCS

Paul Fenner-Leitao

Societe Generale Corporate and Investment Banking - SG CIB

4 questions for BCS

Robert Smalley

Verition Fund Management LLC

4 questions for BCS

Alvaro Serrano

Morgan Stanley

3 questions for BCS

Christopher Cant

Autonomous Research

3 questions for BCS

Perlie Mong

KBW

3 questions for BCS

Amit Goel

Mediobanca S.p.A.

2 questions for BCS

Amit Gul

MGA Banker

2 questions for BCS

Benjamin Budish

Barclays PLC

2 questions for BCS

Chris Mann

Autonomous

2 questions for BCS

Gildas Surry

Crédit Agricole

2 questions for BCS

Jonathan Pierce

Jefferies

2 questions for BCS

Jonathan Richard Pierce

Numis

2 questions for BCS

Jonathan Young

Cantor Fitzgerald

2 questions for BCS

Nicholas Campanella

Barclays

2 questions for BCS

Robert Noble

Deutsche Bank AG

2 questions for BCS

Adam Terelak

Mediobanca

1 question for BCS

Alvaro de Tejada

Morgan Stanley

1 question for BCS

Alvaro Serrano Saenz de Tejada

Morgan Stanley

1 question for BCS

Benjamin Toms

RBC Capital Markets

1 question for BCS

Joseph Dickerson

Jefferies

1 question for BCS

Pui Mong

Bank of America

1 question for BCS

Robin Down

HSBC

1 question for BCS

Rob Noble

Deutsche Bank

1 question for BCS

Rohith Chandra-Rajan

Bank of America

1 question for BCS

Recent press releases and 8-K filings for BCS.

- Barclays PLC is issuing a total of $4,000,000,000 in new senior callable notes.

- The offering includes $1,000,000,000 4.219% Fixed-to-Floating Rate Senior Callable Notes due 2030, $1,200,000,000 4.521% Fixed-to-Floating Rate Senior Callable Notes due 2032, $1,500,000,000 5.207% Fixed-to-Floating Rate Senior Callable Notes due 2037, and $300,000,000 Floating Rate Senior Callable Notes due 2030.

- These notes are classified as Senior Debt / Unsecured and carry expected issue ratings of Baa1 (Moody’s) / BBB+ (S&P) / A (Fitch).

- The trade date for these notes was February 17, 2026, with settlement occurring on February 24, 2026.

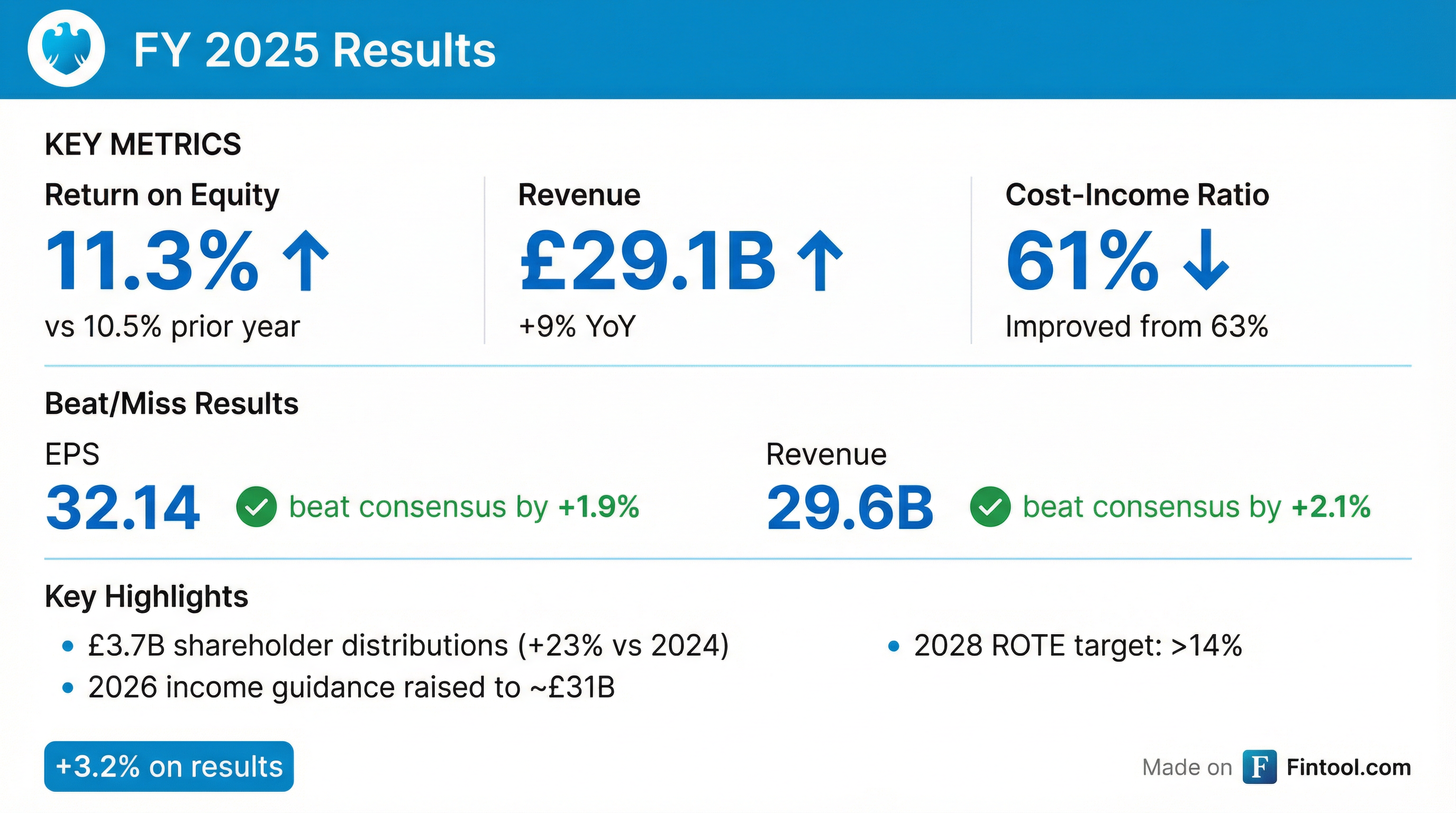

- Barclays achieved all financial guidance in 2025, reporting a Return on Tangible Equity (RoTE) of 11.3% and earnings per share (EPS) of 43.8p. Profit before tax increased by 13% to £9.1bn.

- The company announced total capital distributions of £3.7bn in relation to 2025, including a £1.0bn share buyback and a total dividend of 8.6p.

- Barclays set new financial targets, aiming for a Group RoTE of greater than 12% in 2026 and greater than 14% in 2028.

- The company plans to return at least £10bn of capital to shareholders between 2024 and 2026, and greater than £15bn between 2026 and 2028.

- The Common Equity Tier 1 (CET1) ratio stood at a robust 14.3% at year-end 2025.

- Barclays achieved all financial targets in 2025, reporting a return on tangible equity of 11.3% and a 9% year-on-year top-line income growth to GBP 29.1 billion. The cost-income ratio improved to 61%, and the group loan loss rate was 52 basis points.

- The company ended 2025 with a CET1 ratio of 14.3% and announced a GBP 1 billion share buyback and an GBP 800 million final dividend, equivalent to 5.6 pence per share.

- Barclays provided guidance for a Group RoTE greater than 12% in 2026, building to more than 14% in 2028, with an expected low 50s group cost-income ratio in 2028.

- The company anticipates GBP 19 billion to GBP 26 billion of regulatory RWA inflation, with Basel 3.1 implementation expected from January 1, 2027, and IRB migration in the US Consumer Bank contributing circa GBP 16 billion.

- Barclays achieved all financial targets in 2025, reporting a Return on Tangible Equity (RoTE) of 11.3% and 9% year-on-year top-line income growth to GBP 29.1 billion.

- The company provided future guidance, targeting Group RoTE greater than 12% in 2026 and more than 14% in 2028, with expected loan growth exceeding 5% annually.

- Barclays maintains a strong capital position with a CET1 ratio of 14.3% at year-end 2025, and announced a GBP 1 billion share buyback and an GBP 800 million final dividend equivalent to 5.6 pence per share.

- The bank expects GBP 19 billion to GBP 26 billion in regulatory RWA inflation and is operating at the higher end of its 13%-14% CET1 target range due to anticipated regulatory changes.

- Barclays achieved all financial targets and guidance in 2025, reporting a return on tangible equity of 11.3% and 9% year-on-year top-line income growth to GBP 29.1 billion. The cost-income ratio improved to 61%.

- The company ended 2025 with a CET1 ratio of 14.3% and announced a GBP 1 billion share buyback and an GBP 800 million final dividend.

- Looking forward, Barclays is confident in delivering a Group RoTE greater than 12% in 2026, building to more than 14% in 2028, and expects a low 50s group cost income ratio in 2028.

- Barclays plans for more than 5% loan growth annually to 2028 and anticipates investment bank RWAs as a percentage of the group to fall to circa 50% by 2028.

- The company is actively exploring digital assets, including the tokenization of deposits and participation in the Sterling Tokenized Deposits (GBTD) pilot phase.

- Barclays achieved all financial targets in 2025, reporting a Return on Tangible Equity (ROTE) of 11.3% and 9% year-on-year top-line growth to GBP 29.1 billion.

- The company announced GBP 3.7 billion in shareholder distributions for 2025, including GBP 1.2 billion in dividends and GBP 2.5 billion in share buybacks.

- Barclays upgraded its 2026 group income guidance to circa GBP 31 billion and set a new target for ROTE greater than 14% by 2028.

- The company plans to distribute greater than GBP 15 billion to shareholders between 2026 and 2028, with the 2026 dividend increasing to GBP 2 billion.

- Barclays achieved all financial targets in 2025, reporting a return on tangible equity of 11.3%, 9% year-on-year top-line growth to GBP 29.1 billion, and a cost-income ratio of 61%.

- The company announced GBP 3.7 billion in shareholder distributions for 2025, including GBP 1.2 billion in dividends and GBP 2.5 billion in share buybacks, up from GBP 3 billion in 2024.

- Barclays upgraded its 2026 group income guidance to circa GBP 31 billion and set new targets, including a return on tangible equity of greater than 12% for 2026 and greater than 14% for 2028.

- The bank plans for greater than GBP 15 billion in shareholder distributions between 2026 and 2028 and aims for a low 50s% group cost-income ratio by 2028.

- Strategic initiatives include doubling investment in growth and efficiency, accelerating AI adoption, and growing UK lending by more than 5% annually in the next three years.

- Barclays achieved all financial targets and guidance in 2025, reporting a return on tangible equity of 11.3% and 9% year-on-year top line growth to GBP 29.1 billion.

- The company announced GBP 3.7 billion of shareholder distributions for 2025, comprising GBP 1.2 billion in dividends and GBP 2.5 billion in share buybacks, while maintaining a strong CET1 ratio of 14.3%.

- For 2026, Barclays upgraded its expected group income to circa GBP 31 billion and set return on tangible equity targets of greater than 12% for 2026 and greater than 14% for 2028.

- The company plans to deliver greater than GBP 15 billion in shareholder distributions from 2026 to 2028 and will increase investments twofold for technological transformation, including AI adoption.

- Barclays achieved GBP 700 million in gross efficiency savings in 2025 and continued to rebalance the group, deploying GBP 20 billion of the GBP 30 billion RWA growth targeted for the end of 2026.

- Barclays reported a full-year profit of £9.1bn for 2025 and a 12% rise in Q4 2025 pretax profit to £1.86bn on 2% higher revenue of £7.08bn.

- The bank outlined multi-year capital-return programs, committing at least £10bn for 2024–26 and planning to return over £15bn for 2026–28 through dividends and share buybacks, including a newly launched £1bn share buyback and a final dividend of 5.6p.

- Barclays raised midterm targets, guiding for total income around £31bn by 2026, annual revenue growth above 5%, and a return on tangible equity above 14% by 2028.

- CEO C.S. Venkatakrishnan's total pay increased to £15m for 2025, and the overall staff bonus pool rose by about 15% to £2.2bn.

- Vantage Data Centers has raised an additional £254 million through securitized term notes, comprising a £200 million tap of existing Class A-2 Notes and a new £54 million Class B Tranche.

- This financing builds on their £600 million debut public issuance in 2024, which was the first-ever EMEA data center asset-backed securitization (ABS) completed in sterling.

- The funds will be used to refinance indebtedness connected to Vantage's 148MW Cardiff, Wales, campus and support expansion across EMEA to meet AI and cloud demand.

- The notes have an anticipated repayment date of May 2029.

Fintool News

In-depth analysis and coverage of BARCLAYS.

Quarterly earnings call transcripts for BARCLAYS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more