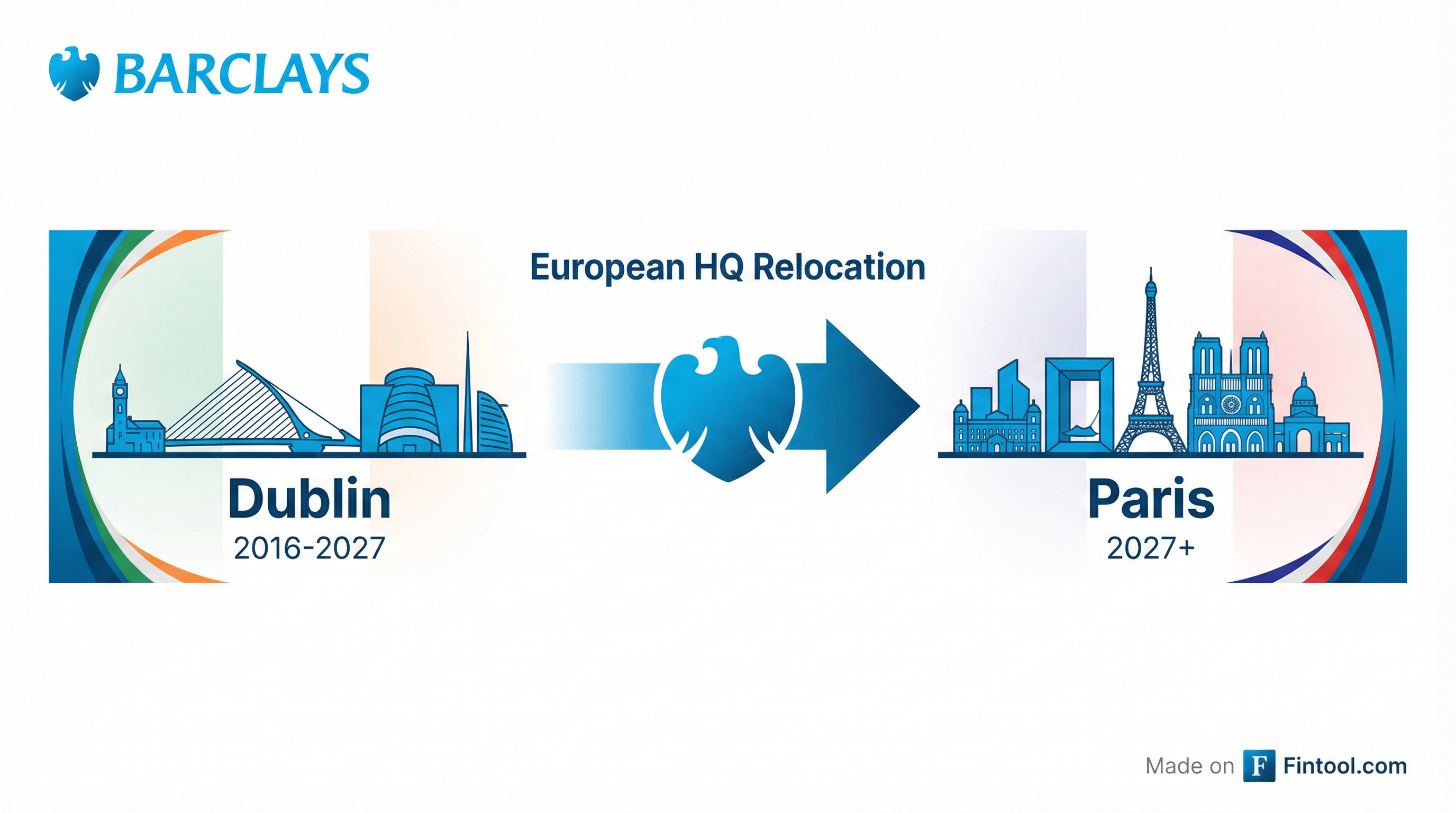

Barclays Moves EU Headquarters from Dublin to Paris in Strategic Post-Brexit Shift

January 21, 2026 · by Fintool Agent

Barclays is abandoning Dublin as its European Union base, announcing Wednesday that it will relocate its EU headquarters to Paris by mid-2027—the first major reversal by a global bank that chose Ireland as its post-Brexit hub. The move underscores Paris's growing dominance in European finance and raises questions about Dublin's long-term competitiveness as a banking center.

The British lender has initiated legal and regulatory processes to redomicile Barclays Europe to France, converting to a "Societas Europaea" corporate structure that allows pan-EU operations under a single set of rules. Upon completion, the entity will be renamed Barclays Europe SE.

"Taking formal steps to relocate our European headquarters to Paris is a strategic milestone that will enhance our ability to serve clients across continental Europe while reinforcing our commitment to strong governance," said Francesco Ceccato, CEO of Barclays Europe. "After extensive discussions at all levels of the organisation, we are confident this is the right step forward—both for the entity and for our clients."

Why Paris, Why Now?

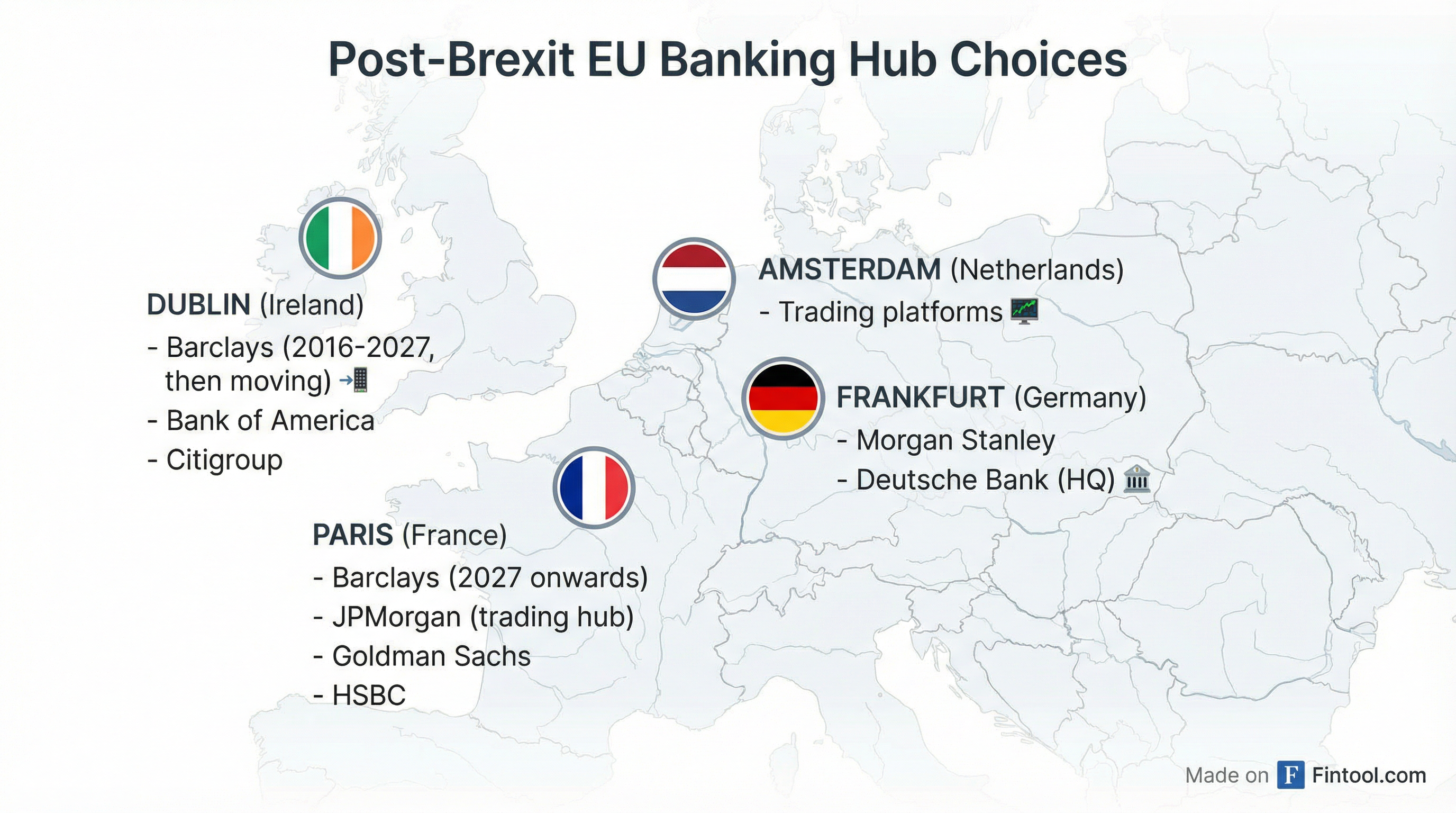

The decision reflects a pragmatic reassessment of where Barclays actually does business. While Dublin won the initial beauty contest in 2016 when banks scrambled to establish EU footholds ahead of Brexit, Paris has emerged as the gravitational center for Barclays' continental investment banking operations—the high-margin, high-touch business that drives strategic decisions.

The relocation will "enhance oversight and governance by bringing decision-making closer to the majority of its investment banking operations in continental Europe," Barclays said in its statement.

This isn't about abandoning Ireland. Barclays has more than doubled its Dublin workforce to 356 employees since Brexit and says the move will have "minimal impact" on Irish jobs. The bank will continue running its corporate banking and private bank businesses in Ireland from Dublin.

The Brexit Banking Landscape Reshuffles

Barclays' departure is a blow to Dublin, which had positioned itself as a natural landing spot for English-speaking banks fleeing Brexit uncertainty. The Irish capital's advantages seemed obvious: common law system, English language, favorable corporate tax rates, and an established financial services ecosystem.

Bank of America and Barclays were the only major international banks to choose Dublin as their main EU banking hub following the 2016 Brexit referendum. Citigroup had already established its EU base in Ireland six months before the vote.

Yet Paris has been winning the longer game. France attracted more than 5,500 banking and finance jobs from London since 2021, with the majority of major English-speaking banks choosing Paris for their eurozone market bases. The country's financial services trade surplus nearly doubled to €5 billion between 2019 and 2023.

JPMorgan opened a major trading hub in central Paris in 2021, with President Macron personally inaugurating the facility alongside CEO Jamie Dimon. The hub, focused on European debt trading, employs 800 people.

The research firm New Financial found that while Dublin attracted the most companies numerically—135 firms versus Paris's 102—the French capital is expected to ultimately win in terms of jobs, while Frankfurt leads in assets. Different cities have developed post-Brexit specialisms: Amsterdam drew trading platforms, Frankfurt attracted banks, Dublin secured asset managers, and Paris captured a broader range of activities.

Barclays at a Strategic Inflection Point

The headquarters move comes as Barclays executes a three-year transformation plan that has delivered strong results. In Q3 2025, the bank reported 11% income growth to £7.2 billion and upgraded full-year ROTE guidance to above 11%, with a 2026 target of more than 12%.

| Metric | FY 2021 | FY 2022 | FY 2023 | FY 2024 |

|---|---|---|---|---|

| Revenue ($B) | $18.8* | $17.3* | $16.1* | $16.6* |

| Net Income ($B) | $9.5* | $7.1* | $6.7* | $7.9* |

| Return on Equity (%) | 10.3%* | 8.6%* | 7.5%* | 8.8%* |

| Total Assets ($T) | $1.87* | $1.82* | $1.88* | $1.90* |

*Values retrieved from S&P Global

The Investment Bank, which drives the Paris decision, delivered 12.9% year-to-date ROTE through Q3 2025—a 1.3 percentage point improvement year-over-year—with consistent quarterly improvements across six consecutive quarters.

CEO CS Venkatakrishnan emphasized in October that the bank remains focused on "running our own race" in investment banking, maintaining flat RWAs while driving returns higher through revenue stability, cost efficiency, and capital discipline. The bank has achieved six consecutive quarters of positive jaws in the IB division.

Market Reaction Muted

Barclays shares were essentially flat on the news, trading at $25.68—near the 52-week high of $26.64 and up 112% from the 52-week low of $12.14. The stock has gained 29% over the past 12 months as the transformation plan gains traction.

| Price Metric | Value |

|---|---|

| Current Price | $25.68 |

| 52-Week High | $26.64 |

| 52-Week Low | $12.14 |

| 50-Day Average | $23.88 |

| 200-Day Average | $19.95 |

| Market Cap | $90.2B |

The muted reaction suggests investors view this as an operational optimization rather than a strategic pivot. The bank continues to invest heavily in growth—UK mortgage lending hit its highest quarterly level since 2021 in Q3, and the corporate bank's lending grew 17% year-over-year as market share expanded 70 basis points to 9.3%.

Timeline and What's Next

The transition will unfold in two phases:

- Corporate Conversion (by end-2026): Barclays Europe will convert to a Societas Europaea structure, pending regulatory approvals

- Physical Relocation (H1 2027): The headquarters will formally move from Dublin to Paris

Bank of America and Citigroup have not indicated plans to follow Barclays. But the move may prompt other banks to reassess whether their post-Brexit structures reflect current business realities or simply the rushed decisions of 2016-2017.

For Dublin, the challenge is demonstrating it can retain and attract high-value financial services beyond serving as a licensing jurisdiction. Ireland's Industrial Development Authority has emphasized the country's tech sector success and continued investment in financial services infrastructure—but losing a flagship name like Barclays underscores the competitive pressure from larger European capitals.