Earnings summaries and quarterly performance for Moelis &.

Executive leadership at Moelis &.

Board of directors at Moelis &.

Research analysts who have asked questions during Moelis & earnings calls.

Brendan O'Brien

Wolfe Research

6 questions for MC

James Yaro

Goldman Sachs

5 questions for MC

Kenneth Worthington

JPMorgan Chase & Co.

5 questions for MC

Ryan Kenny

Morgan Stanley

5 questions for MC

Brennan Hawken

UBS Group AG

4 questions for MC

Devin Ryan

Citizens JMP

4 questions for MC

Daniel Cocchiara

Bank of America

2 questions for MC

Devin Patrick Ryan

Citizens JMP Securities

2 questions for MC

Michael Brown

Wells Fargo Securities

2 questions for MC

Nathan Stein

Deutsche Bank

2 questions for MC

Aidan Hall

KBW

1 question for MC

Alexander Bond

Keefe, Bruyette & Woods, Inc.

1 question for MC

Alexander Scott Bond

Keefe Bruyette & Woods

1 question for MC

Alex Bond

Keefe, Bruyette & Woods (KBW)

1 question for MC

Ben Rubin

UBS

1 question for MC

James Edwin Yarrow

Goldman Sachs

1 question for MC

James Mitchell

Seaport Global Holdings LLC

1 question for MC

Ken Worthington

JPMorgan

1 question for MC

Ryan Michael Kenny

Morgan Stanley

1 question for MC

Recent press releases and 8-K filings for MC.

- The Cannabist Company has completed the sale of its Virginia assets, which include 5 active retail locations and approximately 82,000 square feet of cultivation and production capacity, to an entity affiliated with Millstreet Credit Fund LP.

- The total consideration for the transaction was $130 million, consisting of $117.5 million paid in cash at closing and the remaining $12.5 million to be escrowed.

- In anticipation of the closing, the company issued a partial redemption notice for its 9.25% Senior Secured Notes due 2028 and 9.00% Senior Secured Convertible Notes due 2028, with an expected redemption date of February 13, 2026. The company plans to redeem $84,488,000 of the 9.25% notes and $6,469,000 of the 9.00% convertible notes.

- Multi-Color Corporation (MCC) received court approval for initial motions related to its Chapter 11 bankruptcy filing from January 29, 2026.

- The approval grants MCC immediate access to $125 million of a $250 million debtor-in-possession (DIP) financing to fund initial restructuring stages.

- The restructuring is expected to significantly reduce MCC's net debt from approximately $5.9 billion to about $2 billion.

- CD&R and secured creditors will invest $889 million in common and preferred equity, and MCC anticipates having over $550 million in liquidity post-restructuring.

- MCC will continue normal operations, pay all suppliers in full, and maintain employee salaries and benefits without interruption during the process.

- Multi-Color Corporation (MCC) received court approval for its first-day motions related to its January 29, 2026, Chapter 11 bankruptcy filing.

- The court authorized the interim use of $125 million from a $250 million debtor-in-possession (DIP) financing facility to support operations during the restructuring.

- The restructuring is expected to reduce MCC's net debt from approximately $5.9 billion to approximately $2.0 billion.

- $889 million in new common and preferred equity investments will be provided by CD&R and existing secured lenders.

- Post-restructuring, MCC anticipates having over $550 million in liquidity, with global operations continuing normally and all trade vendors and suppliers being paid in full.

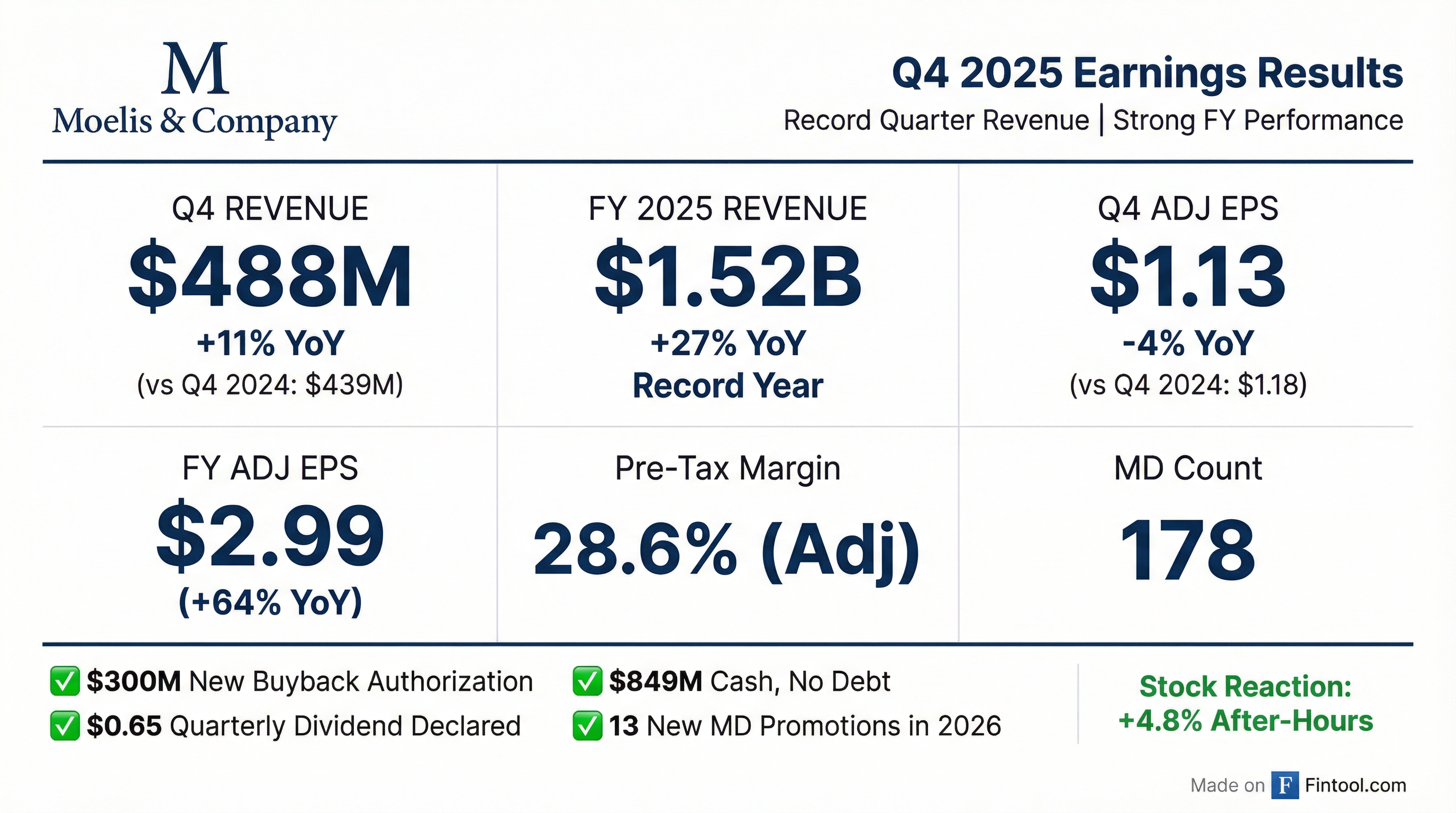

- Moelis & Company reported record Q4 revenues of $488 million and full-year adjusted revenues of $1.54 billion for 2025, representing a 28% increase year-over-year, primarily driven by 35% growth in M&A and a record-setting year for its capital markets business.

- The company demonstrated significant operating leverage in 2025, with the adjusted compensation ratio improving by 320 basis points to 65.8% and the adjusted pre-tax margin reaching 21.5% for the full year.

- Adjusted EPS for full year 2025 was $2.99 per share, marking a 64% increase compared to $1.82 per share in 2024.

- Moelis & Company returned $284 million of capital to shareholders in 2025, including a regular quarterly dividend of $0.65 per share and repurchasing approximately 950,000 shares for the year, and also authorized a new $300 million share repurchase program.

- The firm maintains a strong balance sheet with $849 million of cash and no debt, and its total Managing Director (MD) count reached 178 as of early 2026, following the addition of 21 MDs in 2025 and 13 promotions in early 2026.

- Moelis & Company (MC) reported record fourth quarter revenues of $488 million and full-year 2025 adjusted revenues of $1.54 billion, representing a 28% increase year-over-year.

- The company achieved full-year 2025 adjusted EPS of $2.99 per share, a 64% increase from $1.82 per share in 2024, supported by an improved adjusted compensation ratio of 65.8%.

- Moelis & Company's adjusted pre-tax margin for full-year 2025 was 21.5%, a 510 basis point improvement from 2024.

- The company maintains a strong balance sheet with $849 million of cash and no debt and authorized a new share repurchase program of up to $300 million.

- Strategic investments include adding 21 managing directors in 2025 and promoting 13 more in early 2026, bringing the total to 178 MDs, with the Private Capital Advisory (PCA) business gaining significant traction.

- Moelis & Company reported record fourth quarter revenues of $488 million and full-year adjusted revenues of $1.54 billion, representing a 28% increase year-over-year.

- The company achieved significant operating leverage, with the adjusted compensation ratio improving to 65.8% for the full year and the adjusted pre-tax margin reaching 21.5% for the full year 2025, a 510 basis point improvement from 2024.

- Adjusted EPS for full year 2025 was $2.99 per share, a 64% increase from the prior year.

- Moelis & Company returned $284 million of capital to shareholders in 2025 and authorized a new share repurchase program of up to $300 million, while maintaining a strong balance sheet with $849 million in cash and no debt.

- The firm expanded its talent base, adding 21 managing directors in 2025 and promoting 13 more in early 2026, bringing the total MD count to 178. The Private Capital Advisory (PCA) business is gaining traction and is expected to see meaningful revenue growth in 2026.

- Moelis reported FY 2025 revenue of $1,517 million and a pre-tax margin of 21.6%. For Q4 2025, adjusted revenues were $487,935 thousand with an adjusted operating income margin of 26.5%.

- The firm demonstrated a strong commitment to shareholders, returning $209 million in regular dividends and executing $284 million in share repurchases in 2025, contributing to approximately $3.0 billion in total capital returned since its IPO.

- As of December 31, 2025, Moelis maintained a robust balance sheet with $848.8 million in cash and liquid investments.

- Moelis concluded FY 2025 with 1,420 employees and 178 Managing Directors (as of February 2025), and was recognized as a Top 3 M&A Boutique for FY 2025.

- Moelis & Company reported record fourth quarter revenues of $487.9 million, an 11% increase from the prior year, and full year 2025 Adjusted revenues of $1,535.9 million, up 28%.

- For the full year 2025, Adjusted diluted earnings per share were $2.99, with the Adjusted pre-tax margin improving to 21.5% from 16.4% in 2024.

- The Board declared a regular quarterly dividend of $0.65 per share and approved a new $300 million share repurchase authorization.

- The company maintained a strong balance sheet with $848.8 million in cash and short-term investments and no debt or goodwill as of December 31, 2025.

- Moelis & Company LLC acted as the lead financial advisor to Makarora Management LP in its acquisition of Plymouth Industrial REIT, Inc.

- The acquisition, completed on January 27, 2026, was an all-cash transaction valued at approximately $2.1 billion.

- Plymouth shareholders received $22.00 per share in cash, and Plymouth will no longer be traded or listed on any public securities exchange.

- Mitsubishi Corporation has agreed to acquire Aethon III, Aethon United, and related entities for approximately $5.2 billion in equity, with an enterprise value near $7.5 billion including $2.3 billion of assumed debt.

- This acquisition marks Mitsubishi's entry into the U.S. Haynesville shale, strengthening its integrated North American energy platform and providing favorable access to Gulf Coast LNG export terminals.

- Aethon's Haynesville assets currently produce roughly 2.1 billion cubic feet per day.

- The transaction is expected to close in mid-2026, pending customary regulatory approvals, and Mitsubishi plans to use it as a platform to expand its U.S. presence beyond energy.

Quarterly earnings call transcripts for Moelis &.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more