Moelis & (MC)·Q4 2025 Earnings Summary

Moelis Posts Record Q4 Revenue as M&A Momentum Drives 27% FY Growth

February 4, 2026 · by Fintool AI Agent

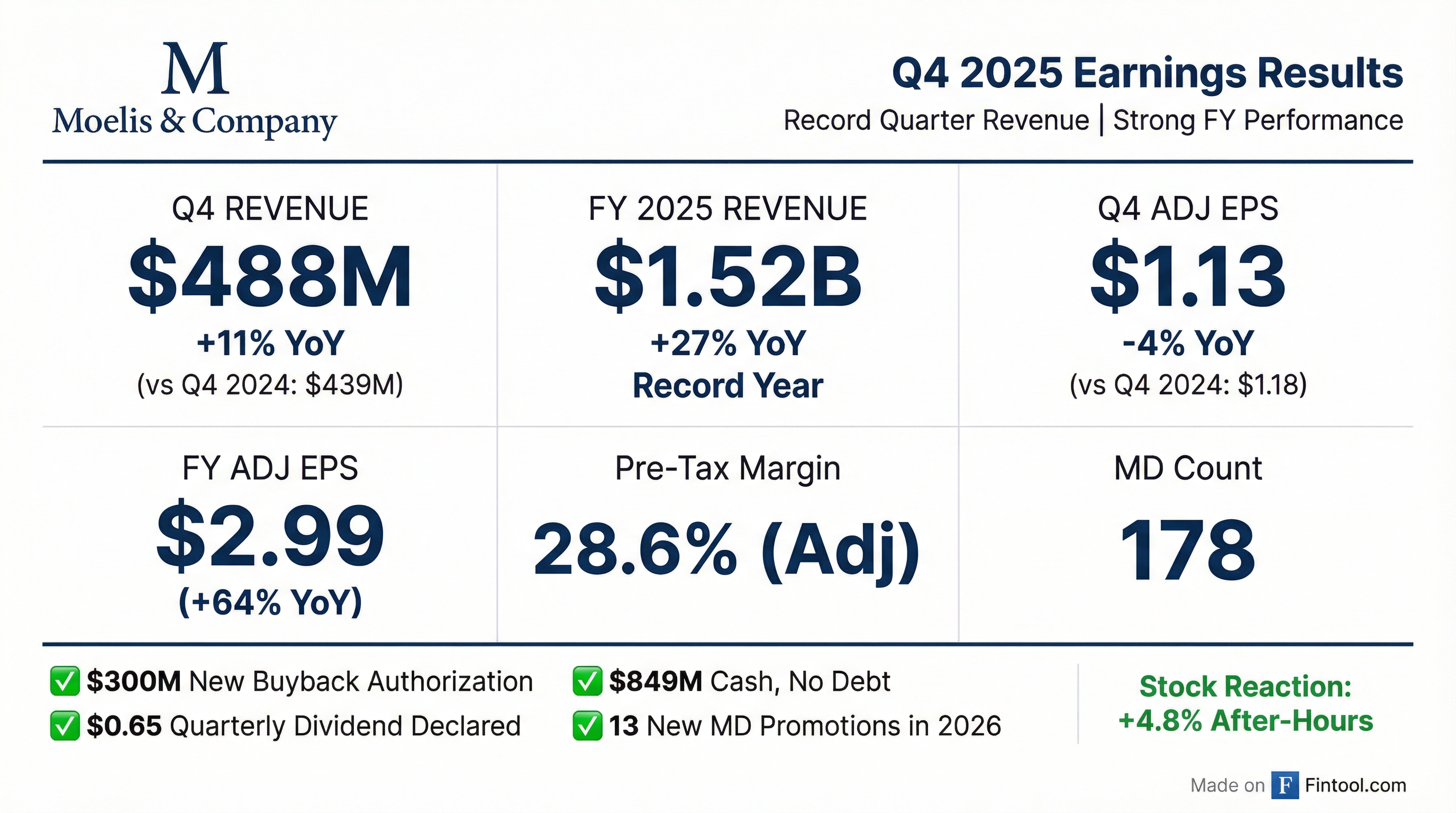

Moelis & Company (NYSE: MC) delivered record fourth quarter revenue of $487.9 million, up 11% year-over-year, capping off a strong 2025 with full-year revenue of $1.52 billion (+27%). The independent investment bank's stock surged nearly 5% in after-hours trading to $72.74, driven by a new $300 million buyback authorization and continued M&A momentum.

Did Moelis Beat Earnings?

Revenue beat expectations significantly; EPS was modestly lower YoY. Q4 2025 marked the firm's highest quarterly revenue on record, though profitability metrics showed some pressure from rising expenses.

The EPS decline was driven by higher compensation expenses (up 16% to $298M) reflecting increased headcount and bonus accruals, plus elevated non-compensation costs from deal-related travel and technology investments.

Full Year 2025 was the standout story:

What Drove the Results?

M&A and Capital Markets carried the quarter. The increase in revenue was driven by higher average fees per completed transaction in both M&A and Capital Markets, partially offset by a decline in Capital Structure Advisory (restructuring).

This pattern reflects broader market dynamics:

- M&A activity remained robust, with sponsors sitting on near-record levels of capital and improving dealmaking conditions

- Capital Markets experienced significant growth from private credit expansion and emerging tech trends

- Capital Structure Advisory declined as ample market liquidity and low credit spreads reduced traditional restructuring activity

Notable Deal Wins: The quarter included Netflix's acquisition of Warner Bros. Discovery, Allied Gold's sale to Zijin Gold, and Ventyx Biosciences' sale to Eli Lilly, plus USA Rare Earth's partnership with the U.S. Department of Commerce and X-energy's pre-IPO convert transaction.

CEO Navid Mahmoodzadegan struck a confident tone:

"We close 2025 with significant momentum and enter 2026 from a position of strength underscored by elevated levels of client activity, record new business generation, and the highest quality talent and breadth of expertise we've ever had."

How Did the Stock React?

MC shares closed regular trading at $70.89 (+2.2%), then surged to $72.74 in after-hours (+4.8% from prior close). The positive reaction reflects investor enthusiasm for the capital return announcements and strong FY performance.

The stock has underperformed year-to-date (-0.5%) and trails its February 2025 highs by about 13%, but the after-hours reaction signals renewed optimism.

Q&A Highlights: What Did Analysts Ask?

On Sponsor M&A Upside (Devin Ryan, Citizens): Asked about the order of magnitude of upside if sponsors truly reengage. CEO Navid responded that sponsor deal velocity increased throughout 2025 but there's "still a fair amount to go" before equilibrium. The middle market is expected to open up in 2026 as LP pressure to return capital intensifies:

"There's just a real push from LPs to get capital returned... we're reaching the point where valuations are what they are in the market, and sponsors are getting their head around what options are available."

On Restructuring Outlook: Previously guided "flat to down" for Capital Structure Advisory but now sees "flat to up" given the long runway of overleveraged companies and technology disruption coming:

"There's just a number of companies that took advantage of very favorable rate and financing environment to take on a fair amount of leverage... some of that's going to happen through amend-and-extend and liability management type exercises out of court. But some of those companies are going to tip into more active in-court restructuring."

On AI Disruption (Brendan O'Brien, Wolfe): Asked about AI's impact on M&A and software PE portfolios. Navid acknowledged the dual nature—AI accelerates M&A in some sectors but could stress software company balance sheets:

"The public markets are clearly devaluing... multiples on software companies and SaaS companies are coming down because people are worried about the threat to the business model that AI brings. At some point, that could impact the ability of those companies to finance themselves, and that could lead to transactions that look more like liability management transactions than M&A transactions."

On MD Ramp-Up (Ryan Kenney, Morgan Stanley): About a third of MDs have been on the platform less than 3 years, and a quarter less than 2 years—indicating significant untapped productivity ahead:

"We're still a firm that's maturing into its talent base... The best years of those MDs, the most productive years of those MDs, are really in front of them as they sink into the platform."

On PCA Build-Out Timeline: The Private Capital Advisory business is ramping "pretty much exactly" as expected. Revenue contribution will be more meaningful in 2026. Management believes PCA can become a "fourth pillar" alongside M&A, Capital Markets, and CSA.

What Changed From Last Quarter?

Margin expansion continued. Q4 adjusted pre-tax margin of 28.6% improved 50bps YoY, while full-year margin of 21.5% represented a 510bps expansion from 2024's 16.4%.

MD headcount accelerated. Moelis now has 178 Managing Directors—up from 169 at year-end 2025—after promoting 13 advisory professionals in early 2026. Since Q3 2025, the firm added 10+ MDs with focuses on technology (20 additions), M&A, Capital Markets, and new geographies.

Balance sheet remains fortress-like: $848.8M in cash and liquid investments, zero debt, zero goodwill.

Capital Return Highlights

Moelis announced significant shareholder returns:

The new $300M authorization replaces the prior program with only $1.5M remaining, signaling management confidence in the stock at current levels.

Expense Trends to Watch

Operating leverage remains a key focus. The compensation ratio of 61.1% in Q4 improved from 65.8% in 9M 2025, but non-compensation expenses jumped 21% YoY driven by:

- Travel & Entertainment: Up $4.9M (+45%) from client conferences and deal activity

- Occupancy: Up $1.9M (+23%) including duplicate UK office costs

- Technology: Up $1.7M (+13%) from continued platform investments

The UK office duplication costs ($1.5M in Q4) will cease in Q2 2026 when the new space is occupied.

Revenue Trend: 8-Quarter History

The Q4 period consistently represents the strongest quarter due to deal timing and year-end closings.

Forward Outlook

Management does not provide formal guidance but offered significant color on 2026 expectations:

Pipeline & Activity:

- New business generation at "all-time highs" with pipeline near record levels

- Q1 may be seasonally lighter, with revenue building through the year as typical

- Large-cap M&A momentum expected to continue given strategic push for scale and technology positioning

Sponsor M&A Reopening:

- Middle market sponsor activity "opening up" in 2026 as valuation alignment improves

- Sponsors owning portfolio companies 6-9 years now facing pressure: "It now is what it is. It's time to monetize."

- GP-led secondaries providing an alternative liquidity path for sponsors not ready to sell

Expenses:

- Non-compensation expenses expected to grow at similar rate to 2025

- Compensation ratio target remains "low 60s" over time, though 2026 depends on revenue, talent competition, and hiring opportunities

- UK office duplication costs ($1.5M/quarter) will cease in Q2 2026

Risks & Uncertainties:

- Geopolitical flare-ups could dampen large-scale transactions, though clients are increasingly "playing through" uncertainty

- AI disruption could pressure software/SaaS company balance sheets, potentially creating restructuring opportunities

Key Takeaways

- Record Q4 revenue of $488M caps a transformative year with 28% top-line growth and 64% EPS growth

- Sponsor M&A reopening — CEO sees middle market deals unlocking in 2026 as LP pressure mounts on 6-9 year holds

- Restructuring outlook upgraded from "flat to down" to "flat to up" on overleveraged balance sheets and tech disruption

- PCA gaining traction — GP-led secondaries business ramping "exactly as expected" with 7 MDs by year-end

- MD productivity upside — ~1/3 of MDs less than 3 years on platform, with best years ahead

- $300M new buyback and $849M cash fortress provide strategic optionality

Read the full Q4 2025 earnings call transcript

Data sources: Company filings, earnings call transcript, S&P Global Capital IQ