Earnings summaries and quarterly performance for Diamondback Energy.

Executive leadership at Diamondback Energy.

Kaes Van’t Hof

Chief Executive Officer

Al Barkmann

Executive Vice President and Chief Engineer

Chad McAllaster

Executive Vice President - Operations

Daniel Wesson

Executive Vice President and Chief Operating Officer

Jere Thompson

Executive Vice President and Chief Financial Officer

Matt Zmigrosky

Executive Vice President, Chief Legal and Administrative Officer and Secretary

Teresa Dick

Executive Vice President, Chief Accounting Officer and Assistant Secretary

Travis Stice

Executive Chairman

Board of directors at Diamondback Energy.

Charles Meloy

Director

Darin Holderness

Director

Frank Tsuru

Director

Lance Robertson

Director

Mark Plaumann

Director

Melanie Trent

Lead Independent Director

Rebecca Klein

Director

Robert Reeves

Director

Stephanie Mains

Director

Steven West

Director

Vincent Brooks

Director

Research analysts who have asked questions during Diamondback Energy earnings calls.

Arun Jayaram

JPMorgan Chase & Co.

6 questions for FANG

David Deckelbaum

TD Cowen

6 questions for FANG

Kevin MacCurdy

Pickering Energy Partners

6 questions for FANG

Leo Mariani

ROTH MKM

6 questions for FANG

Neil Mehta

Goldman Sachs

6 questions for FANG

Paul Cheng

Scotiabank

6 questions for FANG

Kalei Akamine

Bank of America

5 questions for FANG

Bob Brackett

Bernstein Research

4 questions for FANG

John Freeman

Raymond James Financial

4 questions for FANG

Neal Dingmann

Truist Securities

4 questions for FANG

Phillip Jungwirth

BMO Capital Markets

4 questions for FANG

Scott Hanold

RBC Capital Markets

4 questions for FANG

Charles Meade

Johnson Rice & Company L.L.C.

3 questions for FANG

Derrick Whitfield

Texas Capital

3 questions for FANG

Doug Leggate

Wolfe Research

3 questions for FANG

Geoff Jay

Daniel Energy Partners

3 questions for FANG

Scott Gruber

Citigroup

3 questions for FANG

Betty Jiang

Barclays

1 question for FANG

Carlos de Alba

Morgan Stanley

1 question for FANG

Douglas Leggate

Wolfe Research

1 question for FANG

Kalei Akamai

Bank of America

1 question for FANG

Roger Read

Wells Fargo & Company

1 question for FANG

Wei Jiang

Barclays

1 question for FANG

Recent press releases and 8-K filings for FANG.

- Diamondback unveiled a new Barnett shale position with 900 gross locations, targeting cost reductions from $1,000 to $800 per lateral foot to achieve competitive returns and meaningful NAV uplift.

- Management executed a 60-well surfactant pilot in 2H 2025 to boost production and reserves, describing it as Version 1.0 of a potentially economic enhancement technology.

- The company is rolling out continuous pumping across simul-frac fleets, achieving up to 5,500 ft/day, with the goal of shorter cycle times and eventual frac-crew reductions.

- For 2026, Diamondback plans to maintain flat oil production under a conservative CapEx guide, while leaving room for H2 CapEx cuts if operational gains materialize.

- Diamondback has built a 900-location Barnett position from near zero acreage in recent years without external capital or large acquisitions, with full-field development slated to begin in H2 2026 targeting a 20% cost reduction to drive attractive returns.

- Initial Barnett well results show ~3,000 GORs, with a 67% oil cut sustained over 12 months (versus Midland core’s decline from ~80% to ~75% in 6 months), and the company aims to lower lateral costs to $800/ft (from $1,000/ft) to rival Midland’s $5.10–$5.20/ft development cost.

- For 2026, Diamondback plans to drill ~30 Barnett wells and complete ~10 (ramping to ~100 wells in 2027), with first-half CapEx at the lower end of its ~$3.75 billion guidance and potential for full-year reductions if cost‐saving initiatives advance as expected.

- Innovation remains a focus: the company ran a 60-well surfactant trial in H2 2025 with promising production uplifts, and grew core inventory organically—boosting average lateral lengths by ~600 ft in 2025—while continuing shareholder distributions.

- Diamondback unveiled Barnett Shale well economics with 36 MBOE per 1,000 ft 12-month cum vs 22 in the Midland Basin and current costs of $1,000/ft, targeting $800/ft to achieve returns competitive with core Midland wells.

- The company emphasized inventory replenishment, having increased average lateral lengths by 600 ft in 2025 and planning to add inventory organically across Midland Basin deals without external capital while returning cash to shareholders.

- For 2026, Diamondback set a $3.75 billion capital budget—allocating $150 million to Barnett—with a flat production strategy to maximize free cash flow under a “yellow light” macro outlook, pending a future “green light” for growth.

- A 60-well surfactant pilot launched in H2 2025 delivered early production uplifts, marking V 1.0 of the program and expected to add reserves over time.

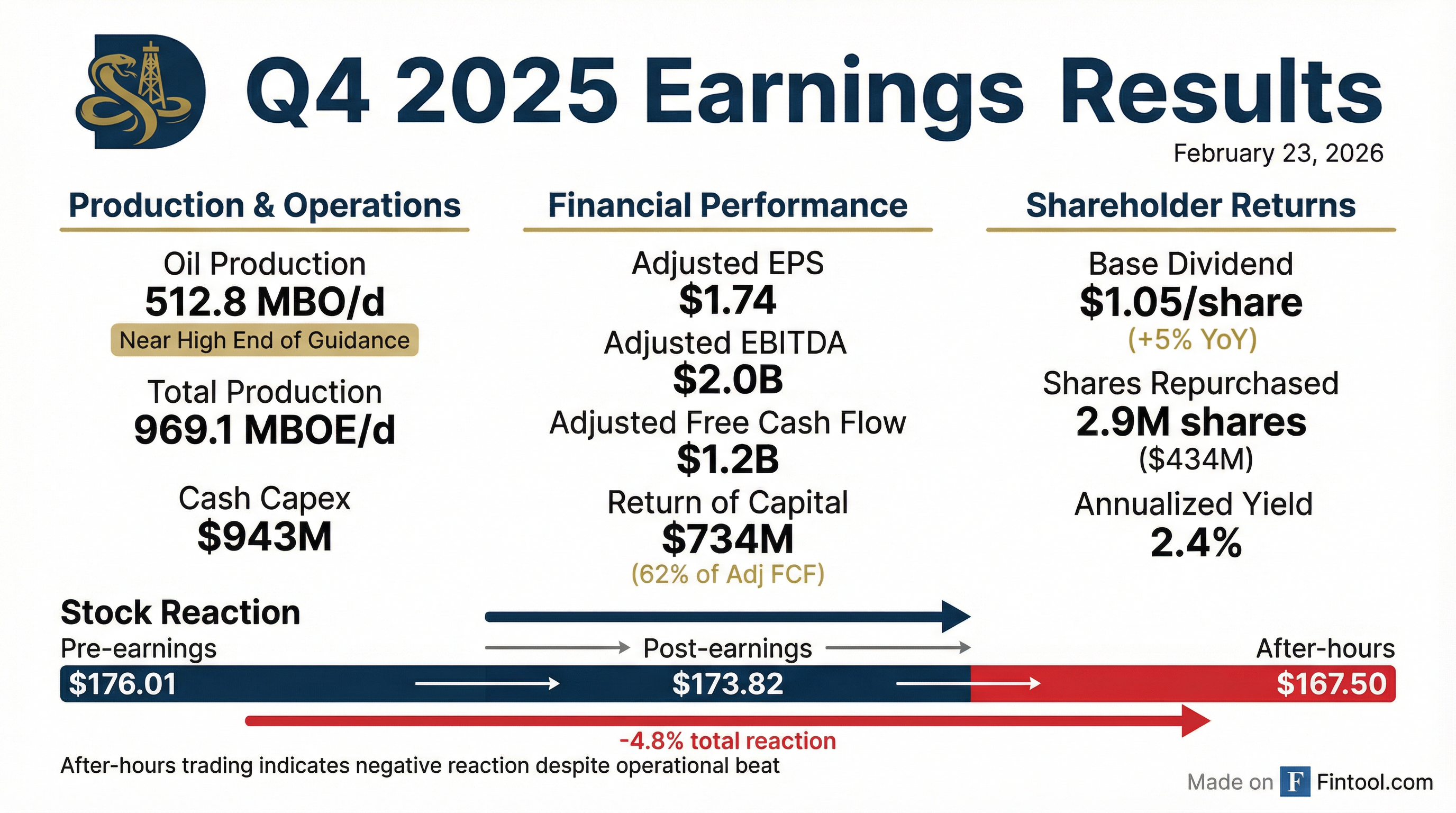

- Diamondback delivered $1.0 billion of free cash flow and $1.2 billion of adjusted free cash flow in Q4 2025, contributing to $5.5 billion FCF and $5.9 billion adj. FCF for FY 2025, and expects ~$4.7 billion of FCF in 2026 at current commodity prices.

- Declared a base cash dividend of $1.05 per share, up 5% QoQ, payable March 12, 2026, reflecting a ~7.1% average quarterly CAGR since 2018.

- Returned $734 million of capital in Q4 2025 (~62% of adj. FCF) via dividend and share repurchases; $8.0 billion buyback authorization has $2.3 billion remaining.

- Maintained net debt of $14.6 billion as of 12/31/2025 and market cap of $49.6 billion (enterprise value $70.2 billion); standalone liquidity was $2.6 billion.

- Delivered 513 MBO/d oil production near the top of guidance and incurred $943 million capex, generating $1.0 billion Free Cash Flow and $1.2 billion Adjusted Free Cash Flow in Q4.

- Recorded a $3.7 billion non-cash impairment due to lower commodity prices, with no change to operational outlook.

- Increased quarterly base dividend 5% to $1.05 per share, repurchasing 13.84 million shares for $2.0 billion in 2025 and executing opportunistic buys under the SGF agreement.

- Generated $1.2 billion from EDS and EPIC pipeline asset sales, applied proceeds to reduce debt by paying down $950 million of term loan and repurchasing senior notes.

- Expanded natural gas strategy with ~350,000 MMBtu/d of long-haul pipeline commitments, targeting ~800,000 MMBtu/d as new capacity comes online to enhance realized pricing.

- Q4 2025: average oil production of 512.8 MBO/d (969.1 MBOE/d); net cash provided by operating activities of $2.3 billion and operating cash flow before working capital changes of $1.9 billion; free cash flow of $1.0 billion and adjusted free cash flow of $1.2 billion

- Q4 capital return: repurchased 2.90 million shares for $434 million, delivering $734 million in total return of capital (62% of adjusted free cash flow); increased annual base dividend 5% to $4.20 per share and declared Q4 2025 dividend of $1.05 per share

- FY 2025: average production of 497.2 MBO/d (921.0 MBOE/d); net cash provided by operating activities of $8.8 billion; adjusted free cash flow of $5.9 billion; repurchased 13.84 million shares for $2.0 billion, returning 54% of adjusted free cash flow via dividends and buybacks; declared total base-plus-variable dividends of $4.05 per share

- Proved reserves as of December 31, 2025 totaled 3,618 MMBOE, up 2% year-over-year

- Diamondback Energy (NASDAQ: FANG) commits a fixed capacity payment as a financial partner in Conduit Power’s development of 200 MW of distributed natural gas power generation in ERCOT’s Load Zone West.

- Conduit Power will build, own and operate the assets, targeting first sites to reach commercial operation in 2026.

- Granite Ridge Resources joins alongside Diamondback, with each partner receiving a preferred share of power proceeds in exchange for capacity payments.

- The project aims to enhance grid reliability and stabilize supply-demand imbalances in West Texas amid rising renewable penetration.

- Q4 2025 maintenance CapEx of $925 million, targeting flat production at ~505 kbd in Q1 2026 and a 36% reinvestment rate at mid-$60 oil YTD.

- Maintains a “yellow light” macro stance, prioritizing free cash flow per share, dividend sustainability, ~1% quarterly share buybacks, and debt reduction.

- Executed $1 billion of non-core asset sales at premiums to trading multiples, including Viper non-core divestitures, and holds a 30% stake in water JV Deep Blue to drive value.

- Endeavor co-development synergies delivering ~20% PV-10 per well uplift, more wells per section and higher returns per DSU; 2026 well performance expected to mirror 2024–25 levels.

- Advancing gas monetization, committing 50 MMcf/d to a 1.3 GW Basin Ranch power plant (2029), reducing Waha exposure from >70% to ~40% by YE 2026 and securing pipeline capacity on Whistler, Matterhorn, Blackcomb, and Hugh Rinson.

- Diamondback achieved a 36% year-to-date reinvestment rate at mid-$60s oil, emphasizing free cash flow per share growth amid cautious macro conditions.

- Q4 CapEx is guided to ~$925 million per quarter to maintain ~510,000 boe/d (down to 505,000 boe/d in Q1 post-Viper sale), setting a 2026 spending baseline.

- The Endeavor merger is driving a ~20% improvement in pro forma PV-10 per well, and 2026 well performance is expected to mirror 2024–25 results.

- Efficiency initiatives like continuous pumping boost lateral footage per day by ~20%, enhancing cycle times and capital efficiency.

- Free cash flow priorities include the base dividend, share buybacks of ≥1% float per quarter, debt reduction, and selective bolt-on M&A.

- Generated $1.8 billion of Free Cash Flow and $1.8 billion of Adjusted Free Cash Flow (~$6.20/share) in Q3 2025; expects ~$5.8 billion of Adjusted FCF in 2025 at current commodity prices

- Returned ~50% of Adjusted FCF in Q3 2025, distributing $892 million via a $1.00/share dividend and share repurchases; $3.0 billion remaining in buyback authorization

- Achieved 503.8 Mbo/d oil production (942.9 Mboe/d) in Q3 2025; full-year 2025 oil production guidance raised to 495–498 Mbo/d with CAPEX of $3.45–3.55 billion

- Maintained an investment-grade balance sheet with ~$15.9 billion net debt and ~$2.4 billion standalone liquidity

Fintool News

In-depth analysis and coverage of Diamondback Energy.

Quarterly earnings call transcripts for Diamondback Energy.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more