FIRST COMMUNITY BANKSHARES INC /VA/ (FCBC)·Q4 2025 Earnings Summary

First Community Bankshares Beats on EPS and Revenue, Closes Hometown Acquisition

January 27, 2026 · by Fintool AI Agent

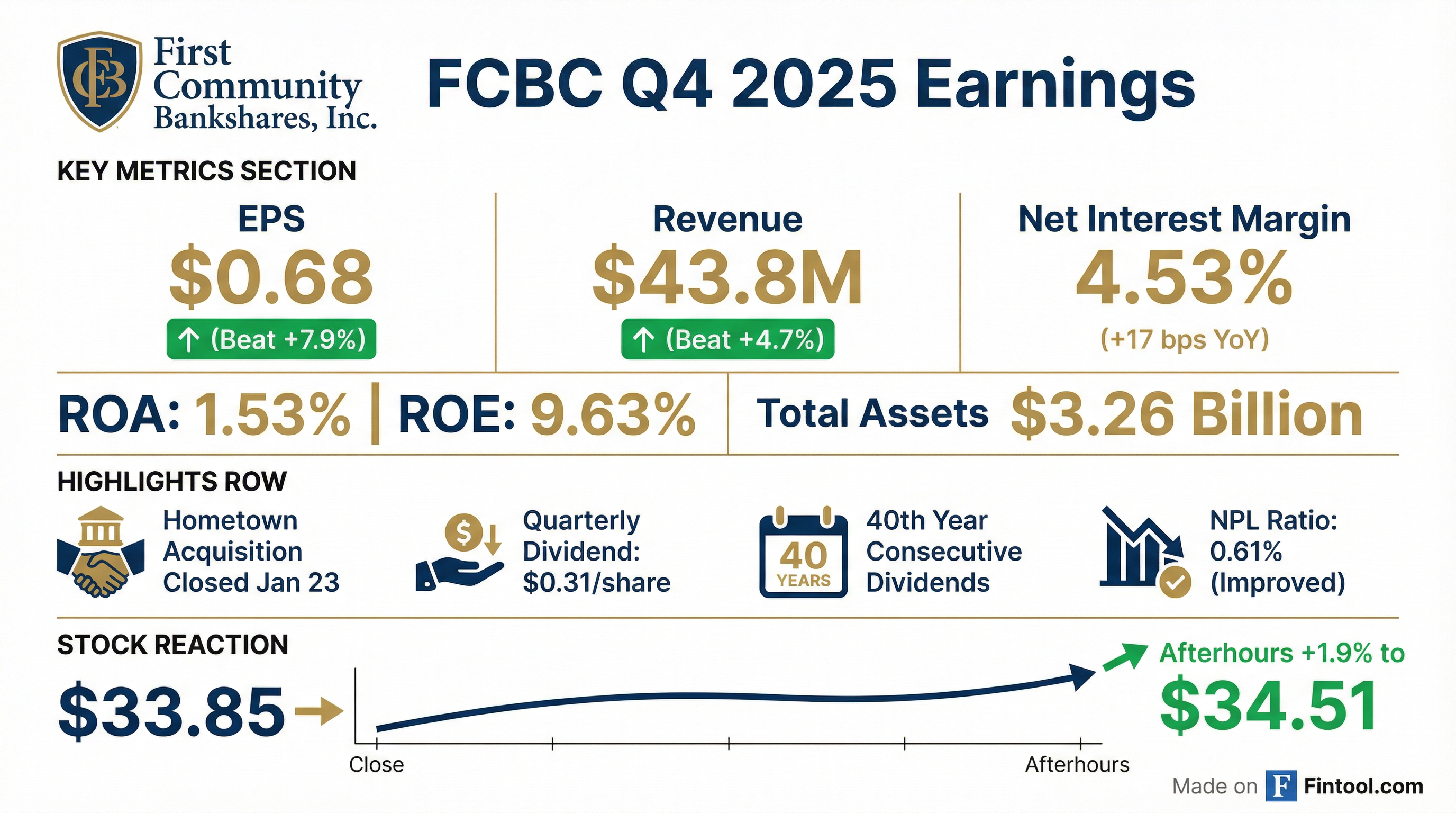

First Community Bankshares (FCBC) delivered a solid Q4 2025, beating both earnings and revenue estimates while closing its acquisition of Hometown Bancshares. The Virginia-based regional bank reported EPS of $0.68 (GAAP) with adjusted EPS of $0.77 after excluding merger expenses, beating the $0.63 consensus estimate by 11.1%. Net interest margin expanded 17 basis points year-over-year to 4.53%, and credit quality continued to improve with non-performing loans falling to 0.61% of total loans.

Did First Community Bankshares Beat Earnings?

Yes — FCBC beat on both EPS and revenue.

*Values retrieved from S&P Global

The adjusted EPS of $0.77 adds back $2.1M in merger expenses related to the Hometown acquisition, representing an 8.6% increase from Q4 2024.

What Drove the Beat?

Net interest margin expansion was the headline story. NIM reached 4.53% in Q4, up 17 basis points from 4.36% a year ago. The improvement came from:

- Lower funding costs: Average cost of interest-bearing liabilities fell 25 basis points (22% decline) to 0.88%

- Stable asset yields: Loan yields held steady at 5.37% despite the rate environment

- Improved deposit mix: Declining reliance on higher-rate time deposits

Net interest income rose 3.3% year-over-year to $32.4M on a fully tax-equivalent basis.

Credit quality also supported results. The provision for credit losses was just $36,000 in Q4, down sharply from $1.08M a year ago.

How Did the Stock React?

FCBC shares closed at $33.85, down 0.3% during the regular session on light volume. In after-hours trading, the stock moved up 1.9% to $34.51.

The stock has traded down from its 52-week high of $45.57, partly due to $3.07 per share in special dividends paid during 2025 that reduced book value.

What Changed From Last Quarter?

The decline in book value reflects the $1.00 per share special dividend declared in Q4.

Major development: FCBC completed its acquisition of Hometown Bancshares on January 23, 2026. The deal adds:

- $415 million in assets

- $172 million in loans

- $376 million in deposits

- West Virginia market expansion

Balance Sheet Highlights

The loan portfolio contracted as the company maintained disciplined underwriting while building liquidity ahead of the Hometown acquisition. Cash and equivalents increased $135M or 35.7% year-over-year.

Credit Quality Trends

Credit quality improved across all metrics. Non-performing loans declined to $14.2M from $20.0M a year ago, and net charge-offs fell to 0.14% of average loans from 0.24%.

Capital Return

FCBC continues to be a strong capital return story:

- Quarterly dividend: $0.31 per share, payable February 27, 2026

- Special dividends in 2025: $2.07/share (Q1) + $1.00/share (Q4) = $3.07 total

- Dividend streak: 40th consecutive year of regular dividends

- Dividend growth: 16th consecutive year of dividend increases

The company repurchased 50,338 shares for $1.85M during 2025, compared to 257,294 shares for $8.72M in 2024.

Management emphasized their capital philosophy: "The Company intends to return excess capital to shareholders through regular cash dividends and share repurchases after funding growth in core operations and other strategic uses. To the extent that current earnings exceed these capital needs, the Company may declare special dividends."

Full Year 2025 Results

On an adjusted basis (excluding merger expenses), full-year ROA was 1.59% and ROE was 10.09%, showing relatively stable profitability.

What to Watch

- Hometown integration: Management will need to successfully integrate $415M in assets while maintaining credit quality and efficiency

- Margin sustainability: Can NIM hold above 4.50% as rate cuts continue?

- Loan growth: The portfolio contracted in 2025; does the Hometown deal restart growth?

- Special dividend potential: Will excess capital generation continue to support additional special dividends?

EPS Beat/Miss History

FCBC has a strong track record of meeting or beating estimates:

*Values retrieved from S&P Global

Over the last 8 quarters, FCBC has beat or met estimates 7 times (88% hit rate).

About First Community Bankshares: First Community Bankshares is a $3.3 billion asset financial holding company headquartered in Bluefield, Virginia. The company operates 52 branches across Virginia, West Virginia, North Carolina, and Tennessee through First Community Bank. The wealth management division manages $1.79 billion in assets.