Earnings summaries and quarterly performance for FIRST COMMUNITY BANKSHARES INC /VA/.

Executive leadership at FIRST COMMUNITY BANKSHARES INC /VA/.

Board of directors at FIRST COMMUNITY BANKSHARES INC /VA/.

Research analysts covering FIRST COMMUNITY BANKSHARES INC /VA/.

Recent press releases and 8-K filings for FCBC.

First Community Bankshares, Inc. Announces Fourth Quarter and Full Year 2025 Results, Quarterly Dividend, and Acquisition Completion

FCBC

Earnings

Dividends

M&A

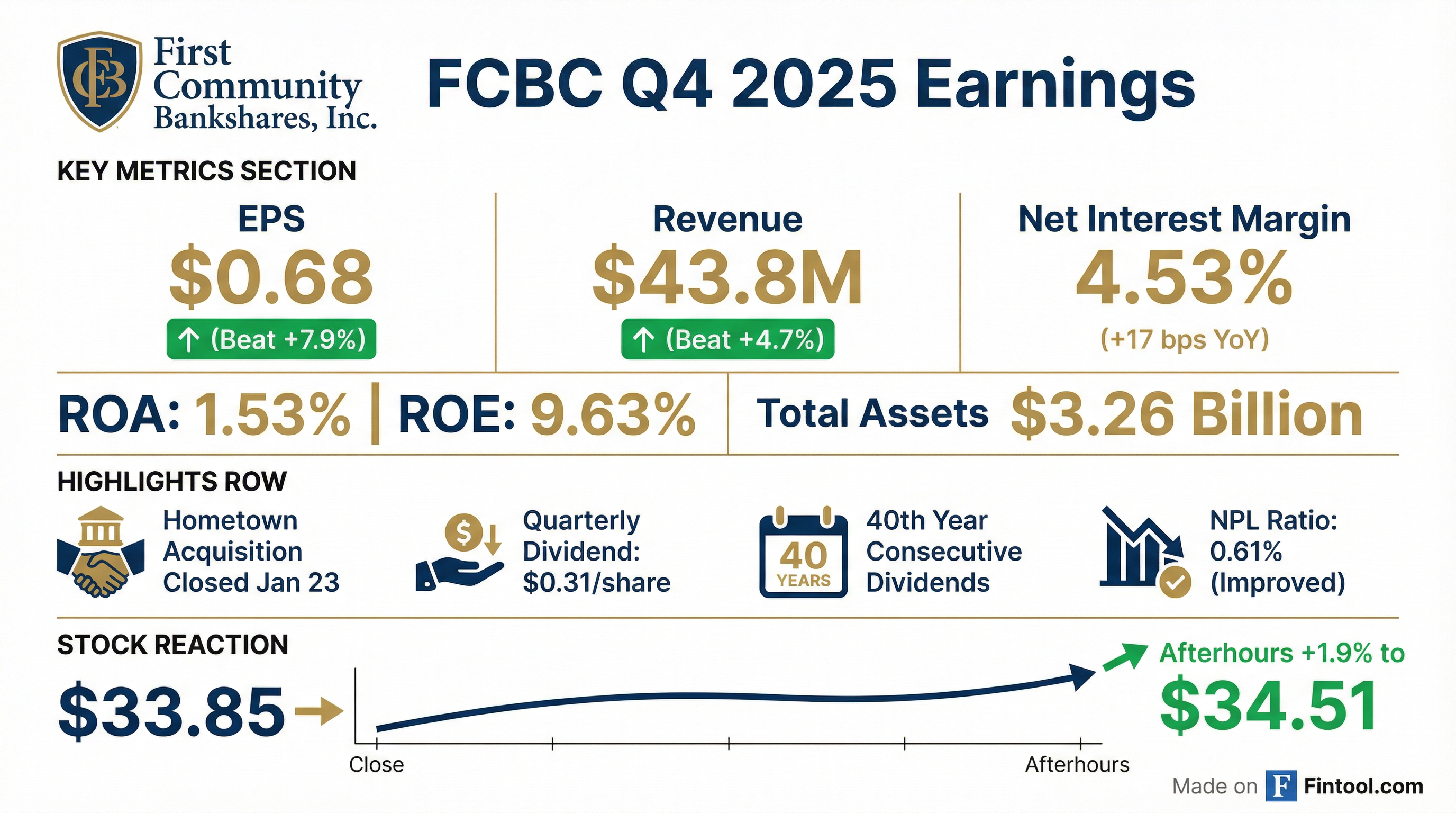

- First Community Bankshares, Inc. reported net income of $12.46 million, or $0.68 per diluted common share, for the fourth quarter ended December 31, 2025, and $48.79 million, or $2.65 per diluted common share, for the full year 2025.

- The company declared a quarterly cash dividend of $0.31 per common share and paid two special cash dividends totaling $3.07 per common share in 2025, marking the 40th consecutive year of regular dividends and 16th consecutive year of increases.

- On January 23, 2026, First Community Bankshares, Inc. completed the acquisition of Hometown Bancshares, Inc., which had approximately $415 million in total assets at the end of 2025.

- As of December 31, 2025, consolidated assets totaled $3.26 billion, with total non-performing assets at $14.15 million, and book value per share was $27.30.

Jan 27, 2026, 10:00 PM

First Community Bankshares, Inc. Announces Q4 2025 Results and Quarterly Cash Dividend

FCBC

Earnings

Dividends

M&A

- First Community Bankshares, Inc. reported net income of $12.46 million, or $0.68 per diluted common share, for the fourth quarter of 2025, and $48.79 million, or $2.65 per diluted common share, for the full year 2025.

- The company declared a quarterly cash dividend of $0.31 per common share for Q4 2025, payable on February 27, 2026. In 2025, two special cash dividends totaling $3.07 per common share were also declared.

- On January 23, 2026, the company completed the acquisition of Hometown Bancshares, Inc., which had approximately $415 million in total assets at the end of 2025.

- For the fourth quarter of 2025, the net interest margin was 4.53% , consolidated assets totaled $3.26 billion , and book value per share was $27.30 as of December 31, 2025.

Jan 27, 2026, 9:43 PM

First Community Bankshares Completes Acquisition of Hometown Bancshares

FCBC

M&A

- First Community Bankshares, Inc. (FCBC) completed its acquisition of Hometown Bancshares, Inc. and its wholly owned subsidiary, Union Bank, Inc., effective January 23, 2026.

- Under the terms of the merger, Hometown shareholders received 11.706 shares of First Community common stock for each share of Hometown common stock.

- The acquisition adds eight branch locations in West Virginia to First Community Bank's operations and aligns with FCBC's strategic focus on growing low-cost core deposits and expanding its presence in the Parkersburg-Marietta-Vienna MSA.

- As of December 2025, Hometown Bancshares had approximately $415 million in total assets, $172 million in total loans, and $376 million in total deposits.

Jan 26, 2026, 9:53 PM

First Community Bankshares Completes Acquisition of Hometown Bancshares

FCBC

M&A

- First Community Bankshares, Inc. (FCBC) completed the acquisition of Hometown Bancshares, Inc. and its wholly-owned subsidiary, Union Bank, Inc., effective January 23, 2026.

- Under the terms of the merger agreement, Hometown shareholders received 11.706 shares of First Community common stock for each share of Hometown common stock.

- The acquisition adds eight branch locations in West Virginia to First Community Bank, which will open as First Community Bank branches on January 26, 2026.

- As of December 2025, Hometown Bancshares had approximately $415 million in total assets, $172 million in total loans, and $376 million in total deposits.

Jan 26, 2026, 9:43 PM

Community Bank & Trust – West Georgia Caps Historic Turnaround, Reports Strong Q3 2025 Performance

FCBC

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- Community Bank & Trust – West Georgia, a subsidiary of Community Bankshares Inc., is completing a significant financial and operational turnaround, positioning itself as a national leader in government-guaranteed lending.

- Through Q3 2025, the bank reported $280 million in assets, $5.8 million in net income, and $18.8 million in non-interest income.

- The $18.8 million in non-interest income represents a 400% year-over-year increase, primarily driven by its strong SBA and USDA lending platform.

- A key achievement was the successful closing of an SBA loan securitization, enhancing liquidity and expanding lending capacity, with another scheduled for January.

Jan 20, 2026, 5:54 PM

First Community Bankshares Amends Merger Proxy Statement and Provides Update on Regulatory Approvals

FCBC

M&A

Proxy Vote Outcomes

- First Community Bankshares, Inc. (FCBC) and Hometown Bancshares, Inc. entered into an Agreement and Plan of Merger on July 19, 2025, under which Hometown will merge with and into First Community.

- On November 12, 2025, First Community filed an amendment and supplement to its proxy statement/prospectus, correcting an error to state that Institution A valued Hometown at a lower valuation than First Community's indication of interest.

- The Hometown board of directors reaffirms its unanimous recommendation for shareholders to vote FOR the merger proposal at the special meeting scheduled for December 2, 2025.

- Regulatory approval for the merger was received from the Federal Reserve Bank of Richmond on November 6, 2025, and the West Virginia Division of Financial Institutions issued a no objection; however, the merger remains subject to approval from the Virginia State Corporation Commission Bureau of Financial Institutions and Hometown's shareholders.

Nov 12, 2025, 10:09 PM

Phoenix Lender Services Reports Strong First Fiscal Year Performance

FCBC

Guidance Update

New Projects/Investments

- Phoenix Lender Services, a subsidiary of Community Bankshares Inc., facilitated over $325 million in SBA and USDA loan closings during its first full fiscal year in operation.

- The company facilitated $156.8 million in funded SBA 7(a) loans, earning a #34 national ranking among all SBA lenders as of September 30, 2025, and an additional $168.2 million in USDA-guaranteed financings.

- Phoenix currently manages a $901 million servicing portfolio and projects facilitating between $250 million and $300 million in new SBA and USDA loan production for fiscal year 2026.

Nov 4, 2025, 1:00 PM

First Community Bankshares, Inc. Announces Third Quarter 2025 Results and Quarterly Cash Dividend

FCBC

Earnings

Dividends

M&A

- First Community Bankshares, Inc. reported net income of $12.27 million and $0.67 per diluted common share for the third quarter ended September 30, 2025.

- The company declared a quarterly cash dividend of $0.31 per common share, payable on November 28, 2025, to shareholders of record on November 14, 2025, marking its 40th consecutive year of regular dividends.

- Consolidated assets totaled $3.19 billion as of September 30, 2025, with non-performing assets decreasing to $16.90 million from $20.54 million at December 31, 2024.

- Noninterest income increased by approximately $437 thousand (4.18%) compared to the third quarter of 2024, while noninterest expense increased by $2.10 million (8.69%), including $787 thousand in merger expenses related to the forthcoming merger with Hometown Bank.

Oct 28, 2025, 8:35 PM

First Community Bankshares Announces Q3 2025 Results and Quarterly Dividend

FCBC

Earnings

Dividends

M&A

- First Community Bankshares, Inc. reported net income of $12.27 million, or $0.67 per diluted common share, for the third quarter ended September 30, 2025.

- The company declared a quarterly cash dividend of $0.31 per common share, payable on November 28, 2025, marking the 40th consecutive year of regular dividends.

- While net income for Q3 2025 decreased 5.89% from the same quarter in 2024, adjusted net income increased 4.00% to $12.90 million when excluding merger and non-recurring expenses.

- The net interest margin remained strong at 4.43% for the third quarter of 2025, an increase of 2 basis points over the same quarter of 2024. The company also incurred $787 thousand in merger expenses related to its forthcoming merger with Hometown Bank, anticipated to complete in January 2026.

Oct 28, 2025, 8:20 PM

Community Bank & Trust Closes Second SBA 7(a) Securitization

FCBC

Debt Issuance

New Projects/Investments

- Community Bank & Trust (CB&T), a subsidiary of Community Bankshares Inc, successfully closed the SOUP 7(a) Trust 2025-FBC1, a $118.9 million securitization backed by the unguaranteed portions of U.S. Small Business Administration (SBA) 7(a) loans.

- This transaction represents the second-ever securitization of its kind, establishing a pathway for SBA lenders to access permanent liquidity, and received a BBB (high) (sf) rating from Morningstar DBRS.

- Falcon Bridge Capital acted as Deal Manager, Structuring Agent, and Asset Manager, partnering with CB&T and other SBA-approved lenders to pool unguaranteed loan interests into a scalable securitization platform.

Oct 7, 2025, 12:39 PM

Quarterly earnings call transcripts for FIRST COMMUNITY BANKSHARES INC /VA/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more