Earnings summaries and quarterly performance for FirstCash Holdings.

Executive leadership at FirstCash Holdings.

Rick Wessel

Chief Executive Officer

Brent Stuart

President and Chief Operating Officer

Doug Orr

Executive Vice President, Chief Financial Officer, Secretary and Treasurer

Howard Hambleton

AFF President

Raul Ramos

Senior Vice President – Latin American Operations

Board of directors at FirstCash Holdings.

Research analysts who have asked questions during FirstCash Holdings earnings calls.

Antonio Gonzalez

Credit Suisse

2 questions for FCFS

Bill Armstrong

C.L. King & Associates

2 questions for FCFS

David Scharf

Citizens Capital Markets and Advisory

2 questions for FCFS

Henry Coffey

Wedbush Securities

2 questions for FCFS

John Hecht

Jefferies

2 questions for FCFS

John Rowan

Janney Montgomery Scott

2 questions for FCFS

Richard Cathcart

HSBC

2 questions for FCFS

David Scharf

JMP Securities

1 question for FCFS

Recent press releases and 8-K filings for FCFS.

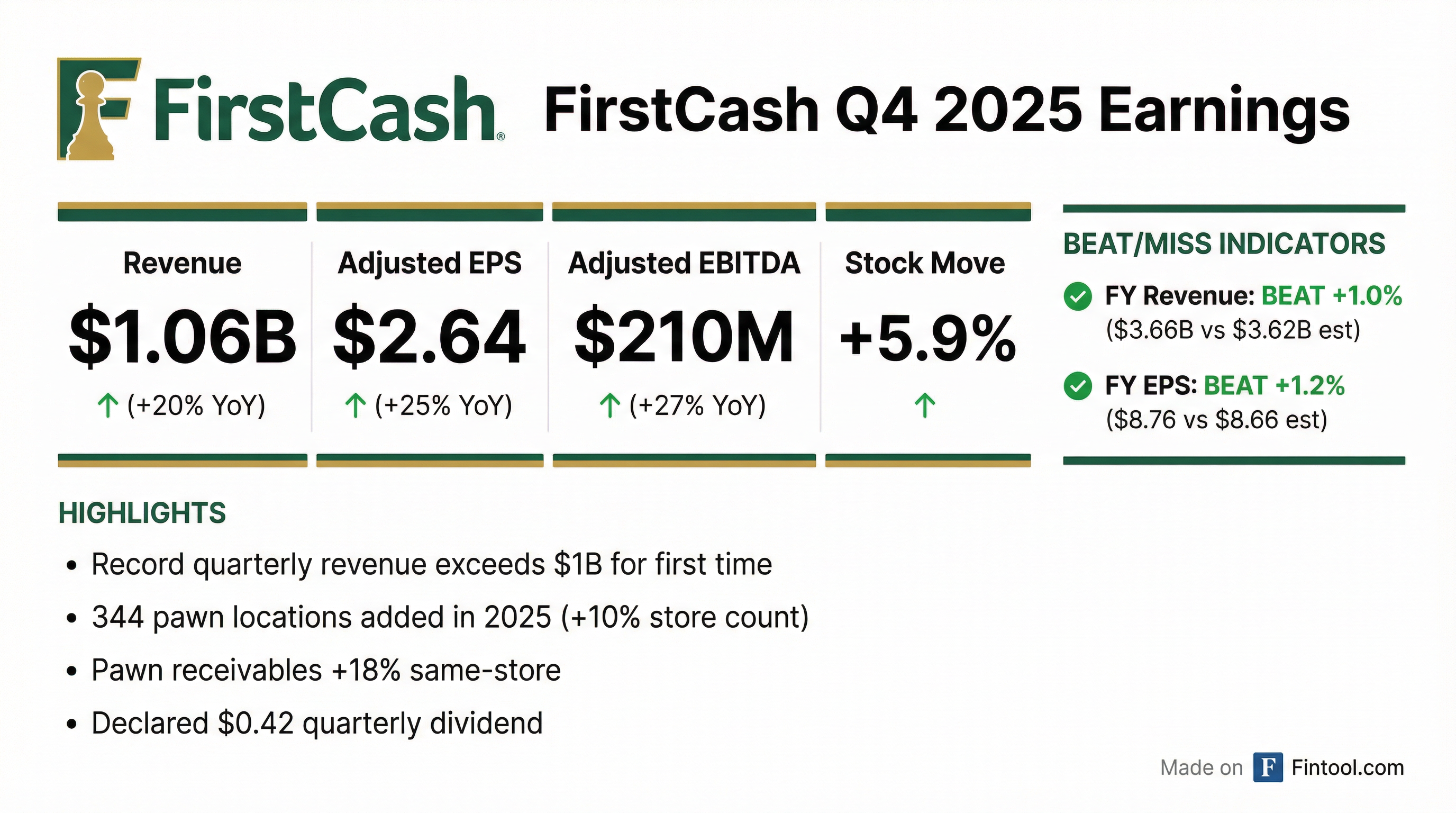

- FirstCash Holdings, Inc. reported record fourth quarter and full-year 2025 revenue and earnings, with Q4 revenues increasing 20% to $1,058,419 thousand and diluted earnings per share growing 26% to $2.35 (GAAP).

- For the full year 2025, consolidated revenue totaled $3,661,043 thousand, an 8% increase, and diluted earnings per share rose 29% to $7.42 (GAAP).

- The company significantly expanded its global pawn operations in 2025, adding 344 pawn locations, including the 286-store H&T acquisition in the U.K., bringing the total to 3,330 locations as of December 31, 2025.

- FirstCash returned capital to shareholders by declaring a quarterly cash dividend of $0.42 per share and repurchasing $115 million of common stock in 2025, with a new $150 million share repurchase program authorized in October 2025.

- FirstCash Holdings, Inc. reported strong financial results for the third quarter of 2025, with GAAP Net Income up 28% and Adjusted EPS up 35% compared to the prior year.

- For the trailing twelve months ended September 30, 2025, the company achieved $3.5 billion in revenue, $368 million in Adjusted Net Income, and $654 million in Adjusted EBITDA.

- The company completed the acquisition of H&T Group in August 2025, adding 286 pawn stores in the U.K. and anticipating $0.18 to $0.20 per share in EPS accretion for the fourth quarter of 2025.

- FirstCash increased its Q3 2025 dividend to $0.42 per share, annualizing to $1.68 per share, and repurchased $90 million of shares year-to-date as of September 30, 2025.

- FirstCash Holdings, Inc. reported record third quarter operating results for the period ended September 30, 2025, with revenue of $935.6 million and adjusted diluted earnings per share of $2.26.

- Consolidated revenue for Q3 2025 increased 12% over the prior-year quarter, and adjusted diluted earnings per share increased 35%. The company experienced strong pawn demand, with local currency same-store pawn receivables up 13% in the U.S., 18% in Latin America, and 25% in the U.K..

- The company completed the acquisition of H&T in the U.K. on August 14, 2025, adding 286 locations and bringing the total store count to 3,311 as of September 30, 2025.

- The Board of Directors declared a quarterly cash dividend of $0.42 per share and authorized a new $150 million share repurchase plan, increasing the total available for repurchases to $175 million.

- Consolidated assets exceeded $5 billion for the first time, reaching $5.2 billion at September 30, 2025, and the company raised full-year revenue growth expectations for the U.S. and Latin America segments.

- FirstCash Holdings, Inc. reported strong Q2 2025 financial results, with GAAP EPS up 24% and Adjusted EPS up 31% year-over-year, alongside a 19% increase in Adjusted EBITDA.

- For the trailing twelve months ended June 30, 2025, the company achieved revenue of $3.4 billion, GAAP net income of $292 million, adjusted net income of $343 million, and adjusted EBITDA of $613 million.

- The company completed the acquisition of H&T Group on August 14, 2025, for a total USD equity value of $383 million and assumed net debt of approximately $85 million. This acquisition is expected to add $0.20 to $0.25 per share in earnings accretion for the remainder of 2025.

- FirstCash also increased its Q3 2025 dividend to $0.42 per share, annualizing to $1.68 per share, and repurchased $90 million of shares year-to-date as of August 15, 2025.

- FirstCash Holdings, Inc. completed the acquisition of H&T Group plc on August 14, 2025, marking its entry into the European market and establishing it as the U.K.'s leading pawnbroker.

- The acquisition expands FirstCash's global retail pawn locations to over 3,300 and is expected to result in annualized pro forma revenues approaching $4 billion.

- The transaction had an equity value of £289 million (approximately $383 million) and assumed £64 million (approximately $85 million) in net debt, funded via FirstCash's existing revolving bank credit facility.

- FirstCash anticipates the acquisition to be immediately accretive to earnings, projecting an earnings per share accretion of $0.20 to $0.25 per share for the remainder of 2025.

- FirstCash Holdings, Inc. reported strong Q2 2025 results, with GAAP EPS up 24% and Adjusted EPS up 31% compared to the prior year.

- For the trailing twelve months ended June 30, 2025, the company achieved $3.4 billion in revenue, $343 million in Adjusted Net Income, and $613 million in Adjusted EBITDA.

- The H&T Acquisition is on target to close in August.

- The company increased its Q3 2025 dividend to $0.42 per share, annualizing to $1.68 per share, and has $55 million remaining for future share repurchases under the current authorization.

- FirstCash Holdings, Inc. operates more than 3,000 pawn locations globally as of June 30, 2025, with pawn operations contributing 78% of segment contribution for the trailing twelve months.

- FirstCash Holdings, Inc.'s indirect wholly-owned subsidiary, Chess Bidco Limited, is acquiring H&T Group plc through a recommended final cash acquisition.

- On July 30, 2025, the UK Financial Conduct Authority (FCA) gave its requisite approval for the acquisition.

- The acquisition is now expected to be consummated and become effective on August 14, 2025, following the Court Sanction Hearing scheduled for August 12, 2025.

- The financial terms of the acquisition are final and will not be increased or improved, except under specific circumstances.

- FirstCash Holdings, Inc. reached a settlement with the Consumer Financial Protection Bureau (CFPB) on July 11, 2025, regarding alleged violations of the Military Lending Act.

- As part of the settlement, FirstCash will pay consumer redress estimated between $5 million and $7 million and a $4 million fine to the CFPB victims relief fund.

- The company will also offer a new pawn lending product for covered members of the U.S. military and their immediate families and dependents.

- The settlement was approved by the court.

- The financial impact of the settlement will be reflected in the company's GAAP financial results for the second quarter of 2025.

- FirstCash Holdings, Inc. (FCFS) announced on July 11, 2025, a settlement with the Consumer Financial Protection Bureau (CFPB) regarding alleged violations of the Military Lending Act.

- As part of the settlement, FirstCash will offer a new pawn lending product for covered U.S. military members and their families.

- The company will pay an estimated $5 million to $7 million in consumer redress and a $4 million fine to the CFPB victims relief fund.

- The financial impact of this settlement will be reflected in the company's second quarter 2025 GAAP financial results.

- Business Operations: The presentation highlights FirstCash’s leadership in pawn store operations across the U.S. and Latin America with over 3,000 stores and expanding retail POS payment solutions.

- Financial Performance: It details strong Q1 2025 performance with $3.4 billion in revenue (TTM), robust net income, and significant adjusted EBITDA, along with active share repurchase and dividend initiatives.

- Strategic Outlook: The document includes forward-looking statements outlining growth strategies through new store openings and acquisitions while noting potential regulatory and market risks.

Quarterly earnings call transcripts for FirstCash Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more