Earnings summaries and quarterly performance for FIRSTENERGY.

Executive leadership at FIRSTENERGY.

Brian Tierney

President and Chief Executive Officer

Hyun Park

Senior Vice President, Chief Legal Officer

K. Jon Taylor

Senior Vice President, Chief Financial Officer and Strategy

Toby Thomas

Chief Operating Officer

Wade Smith

President, FirstEnergy Utilities

Board of directors at FIRSTENERGY.

Heidi Boyd

Director

James O’Neil III

Director

Jana Croom

Director

John Somerhalder II

Director

Leslie Turner

Director

Lisa Winston Hicks

Lead Independent Director

Melvin Williams

Director

Paul Kaleta

Director

Steven Demetriou

Director

Research analysts who have asked questions during FIRSTENERGY earnings calls.

Andrew Weisel

Scotiabank

8 questions for FE

Anthony Crowdell

Mizuho Financial Group

7 questions for FE

Carly Davenport

Goldman Sachs

7 questions for FE

David Arcaro

Morgan Stanley

7 questions for FE

Jeremy Tonet

JPMorgan Chase & Co.

7 questions for FE

Nicholas Campanella

Barclays

6 questions for FE

Ryan Levine

Citigroup

4 questions for FE

Shahriar Pourreza

Guggenheim Partners

4 questions for FE

Steve Fleishman

Wolfe Research, LLC

4 questions for FE

Michael Lonegan

Evercore ISI

3 questions for FE

Paul Patterson

Glenrock Associates

3 questions for FE

Ross Fowler

Bank of America

3 questions for FE

Sophie Karp

KeyBanc Capital Markets Inc.

3 questions for FE

Nick Campanella

Barclays PLC

2 questions for FE

Steven Fleishman

Wolfe Research

2 questions for FE

Agnieszka Storozynski

BofA Securities

1 question for FE

Alexander Calvert

Guggenheim Securities, LLC

1 question for FE

Anthony Crowder

Mizuho Securities

1 question for FE

Paul Fremont

Ladenburg Thalmann

1 question for FE

Sophia Karp

KeyBanc Capital Markets

1 question for FE

William Appicelli

UBS

1 question for FE

Recent press releases and 8-K filings for FE.

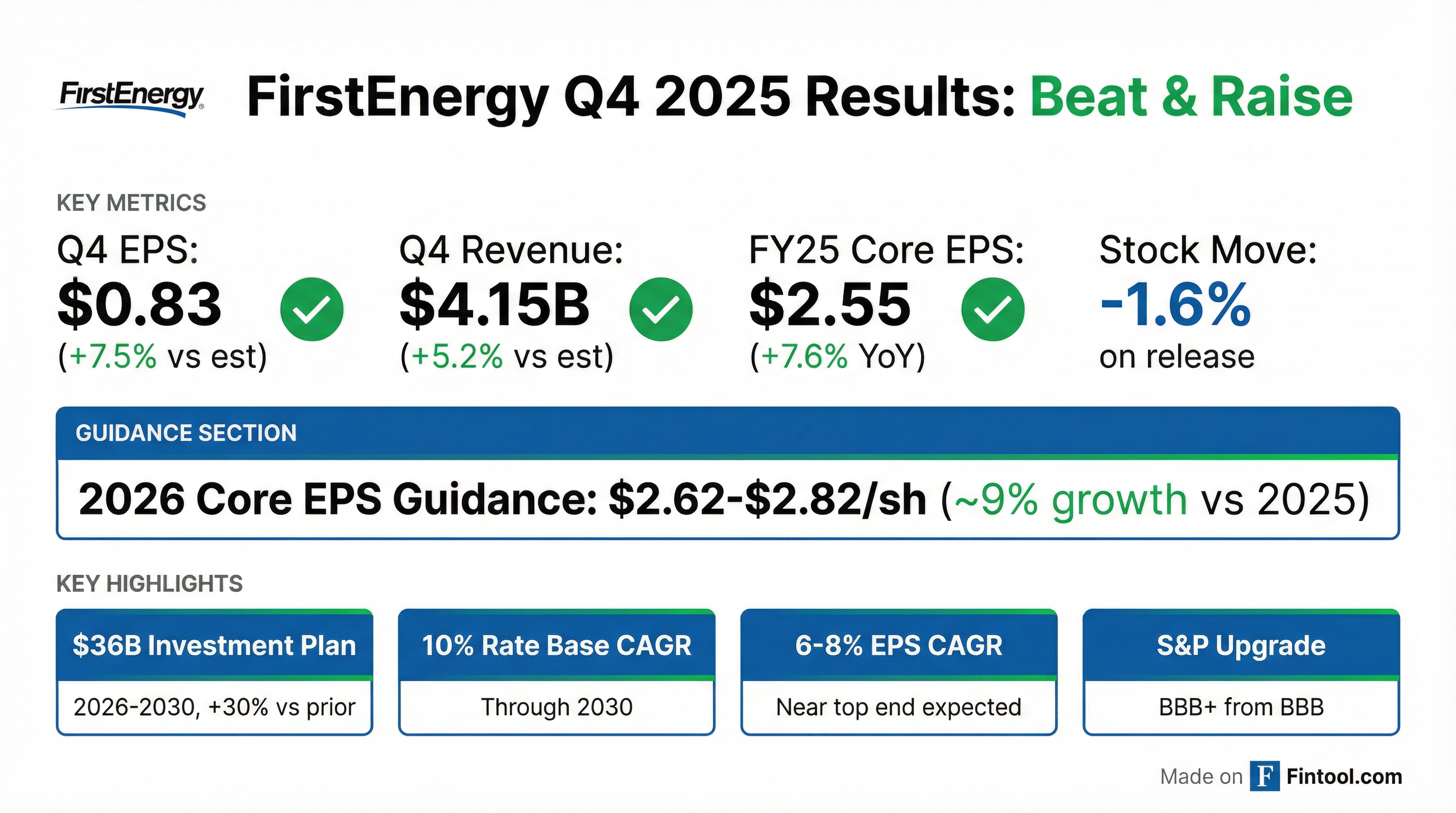

- Delivered 2025 GAAP EPS of $1.77 (vs $1.70 in 2024) and core EPS of $2.55, up 7.6% year-over-year, supporting a positive S&P ratings action.

- Deployed $5.6 billion in capital investments in 2025 (25% above 2024; 12% above plan) and launched a $36 billion, 5-year capex program targeting 6–8% core EPS CAGR from 2026–2030.

- Achieved a 10% improvement in distribution reliability, advanced key regulatory strategies, and declared $1.78 per share in dividends, a 5% increase from 2024.

- Planning rate filings in West Virginia and Maryland, plus an Ohio three-year rate plan, to drive 10% rate base growth through 2030 with 75% of investments in formula rates.

- Delivered 2025 GAAP EPS of $1.77 (vs $1.70 in 2024) and core EPS of $2.55, up 7.6%, alongside a positive S&P ratings action.

- Announced a $36 billion 5-year capital program (2026–2030) focused on grid reliability, targeting 10% rate base growth and 6%–8% core EPS CAGR.

- Filed regulatory request for a 1.2 GW combined-cycle gas facility in West Virginia with $2.5 billion capex, EPC delivery, expected operational by 2031 upon approval.

- Invested $5.6 billion in 2025 capital (+25% YoY), achieved 15% O&M savings (> $200 million since 2022), and raised dividends 5% to $1.78/share.

- Delivered 2025 Core EPS of $2.55, up 7.6% versus 2024 and at the top end of guidance range

- Executed $5.6 B of investments in 2025, +25% YoY and ~12% above plan

- Received S&P upgrade on senior unsecured credit rating to BBB from BBB–

- Issued 2026 Core EPS guidance of $2.62–$2.82 per share (mid-point $2.72), ~7% growth vs. 2025

- Expanded 2026–2030 investment plan to $36 B, targeting 10% FE-Owned rate base CAGR

- 2025 GAAP EPS of $1.77 and core EPS of $2.55, up 4% and 7.6% year-over-year.

- $5.6 B capital investments in 2025, a 25% increase over 2024, and unveiled a $36 B, 5-year capex plan targeting 10% rate base growth and 6%–8% core EPS CAGR through 2030.

- Achieved positive S&P ratings action, with 2025 ROE of 9.8% on a $27.8 B rate base, up from 9.4% on $25.6 B in 2024.

- Declared $1.78 per share in dividends for 2025, a 5% increase over 2024, reinforcing dividend growth.

- FirstEnergy reported 2025 GAAP EPS of $1.77 and Core EPS of $2.55 on revenues of $15.1 billion, marking a 7.6% Core EPS increase versus 2024.

- The company affirmed 2026 Core EPS guidance of $2.62 to $2.82, reflecting approximately 9% growth versus the original 2025 guidance midpoint.

- Announced a $36 billion capital investment plan for 2026–2030, targeting ~10% rate base CAGR and Core EPS CAGR at the top end of 6–8%.

- The Board approved an increased quarterly dividend, underscoring confidence in the company’s financial strength.

- FirstEnergy delivered 2025 GAAP earnings of $1.77 per share on $15.1 billion revenue and Core EPS of $2.55, up 7.6% year-over-year.

- The company reaffirmed 2026 Core EPS guidance of $2.62–$2.82, reflecting 9% growth versus the original 2025 guidance midpoint.

- Announced a $36 billion capital investment plan for 2026–2030, including over $19 billion in transmission, to drive 10% rate base growth through 2030.

- Targets Core EPS CAGR near the top end of 6–8% from 2026 to 2030 under the Energize365 program.

- The Board declared a $0.465 per-share quarterly dividend, a 4.5% increase from the prior quarter, payable June 1, 2026, to shareholders of record May 7, 2026.

- This dividend implies a 2026 annual rate of $1.86 per share (pending Board approval), compared with $1.78 in 2025.

- FirstEnergy expects to maintain a 60–70% payout ratio of Core (non-GAAP) earnings in 2026.

- The company serves over 6 million customers and operates approximately 24,000 miles of transmission lines across six states.

- Ohio’s PUCO approved a $275 million settlement returning $250 million in restitution and $5 million in additional credits to Ohio Edison, The Illuminating Company and Toledo Edison customers.

- Residential customers using 1,000 kWh/month will receive approximately $65.61 in bill credits over three months, with utility-specific monthly decreases of $17.81 (Toledo Edison), $13.27 (Ohio Edison) and $1.02 (The Illuminating Company) compared to January 2026 bills.

- The agreement allocates $20 million to support low-income bill assistance, weatherization and energy-efficiency programs.

- FirstEnergy will invest $14 billion in Ohio transmission and distribution infrastructure, workforce and facilities through 2029.

- $275 million settlement reached to benefit Ohio customers: $250 M in restitution credited to 2026 bills and $25 M in additional residential relief (including $20 M for low-income assistance).

- Resolves four PUCO matters (Corporate Separation, Rider DMR, Rider DCR and Political & Charitable Spending), redirecting the initial $250 M payment fully to customers pending PUCO approval.

- Plans $14 billion investment in Ohio transmission and distribution infrastructure from 2025–2029 to enhance reliability and support economic growth.

- On December 9, 2025, FirstEnergy provided 2026 Core (non-GAAP) earnings guidance of $2.62–$2.82 per share (midpoint $2.72), representing 7.5% growth over its increased 2025 guidance midpoint and ~9% over the original 2025 midpoint.

- The guidance is underpinned by a $6 billion capital investment plan for 2026, a 9% increase from the $5.5 billion plan in 2025, focusing on distribution renewal, grid modernization, and transmission enhancements.

- Subject to board approval, FirstEnergy plans 2026 quarterly dividends totaling $1.86 per share, consistent with its 60–70% targeted payout ratio.

- The company reaffirmed its 6–8% Core EPS CAGR through 2029, guiding to the upper half of that range and intends to update its five-year plan in early 2026.

Quarterly earnings call transcripts for FIRSTENERGY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more