Earnings summaries and quarterly performance for First Guaranty Bancshares.

Executive leadership at First Guaranty Bancshares.

Board of directors at First Guaranty Bancshares.

Research analysts covering First Guaranty Bancshares.

Recent press releases and 8-K filings for FGBI.

First Guaranty Bancshares, Inc. Announces Fourth Quarter and Fiscal Year 2025 Results

FGBI

Earnings

Demand Weakening

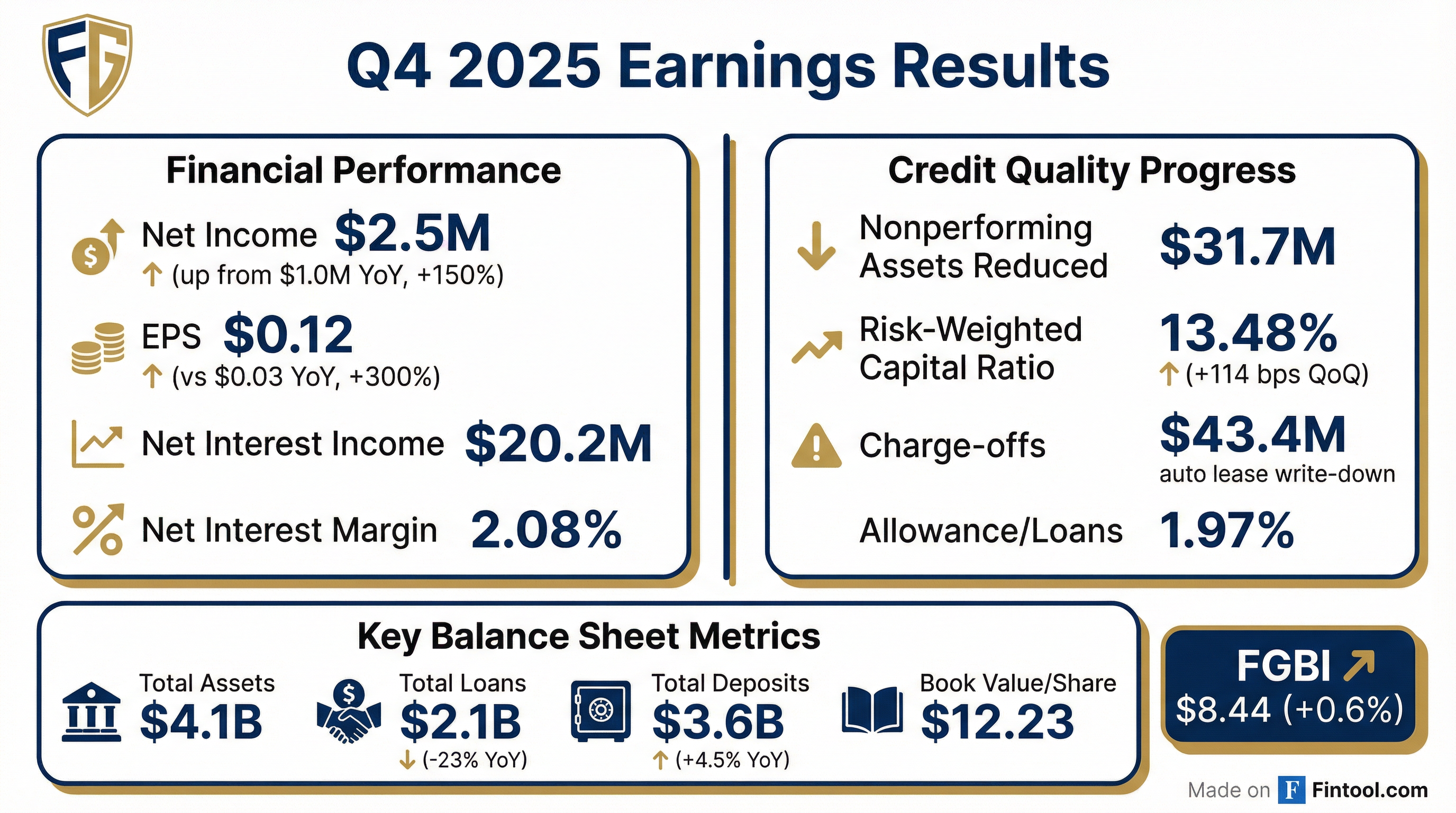

- First Guaranty Bancshares, Inc. reported a net loss of $(56.0) million for the year ended December 31, 2025, resulting in earnings per common share of $(4.17), a significant decrease from a net income of $12.4 million and EPS of $0.81 in 2024. For the fourth quarter of 2025, the company achieved net income of $2.5 million and EPS of $0.12.

- Total assets increased to $4.1 billion at December 31, 2025, while total loans decreased by $624.0 million (23.2%) to $2.1 billion compared to December 31, 2024. Nonperforming assets were reduced by $31.7 million in the fourth quarter of 2025, totaling $95.5 million at year-end.

- The provision for credit losses for the year ended December 31, 2025, significantly increased to $81.7 million from $20.0 million in 2024. Despite this, the consolidated total risk-based capital ratio improved to 13.12% at December 31, 2025, from 11.73% at December 31, 2024.

Jan 28, 2026, 9:30 PM

First Guaranty Bancshares, Inc. Reports Q3 2025 Net Loss Driven by Credit Losses and Goodwill Impairment

FGBI

Earnings

Profit Warning

Accounting Changes

- First Guaranty Bancshares, Inc. reported a net loss of $(45.0) million for the third quarter of 2025 and a net loss of $(58.5) million for the nine months ended September 30, 2025.

- The Q3 2025 net loss was primarily attributed to a $47.9 million provision for credit losses, with $39.8 million tied to a single commercial lease exposure, and a $12.9 million non-cash goodwill impairment charge.

- As of September 30, 2025, the company's total assets were $3.8 billion, total loans were $2.3 billion, and total deposits were $3.4 billion.

- The allowance for credit losses increased to $85.7 million, or 3.76% of total loans, compared to 1.29% at year-end 2024, and the risk-weighted capital ratio improved to 12.34%.

Nov 14, 2025, 9:30 PM

First Guaranty Bancshares, Inc. Announces Q3 2025 Financial Results

FGBI

Earnings

Profit Warning

Dividends

- First Guaranty Bancshares, Inc. reported a net loss of $(45.0) million for the third quarter ended September 30, 2025, a decrease of $46.9 million compared to net income of $1.9 million in the prior year period. This loss was primarily driven by a $47.9 million provision for credit losses and a $12.9 million goodwill impairment charge.

- (Loss) earnings per common share for the three months ended September 30, 2025, was $(3.01), down from $0.11 for the same period in 2024.

- Total assets decreased by $175.4 million to $3.8 billion at September 30, 2025, compared to December 31, 2024, with total loans decreasing by $414.0 million, or 15.4%, to $2.3 billion.

- The allowance for credit losses increased significantly to 3.76% of total loans at September 30, 2025, up from 1.29% at December 31, 2024, reflecting proactive reserving, including a $39.8 million provision associated with one commercial lease relationship that declared Chapter 11 bankruptcy.

- The company's Board of Directors declared a cash dividend of $0.01 per common share for the third quarter of 2025, a reduction from $0.08 per common share in the third quarter of 2024, as part of a strategy to preserve capital.

Oct 31, 2025, 1:17 PM

First Guaranty Bancshares, Inc. Reports Q2 2025 Results

FGBI

Earnings

Profit Warning

Dividends

- First Guaranty Bancshares, Inc. reported a net loss of $(7.3) million for Q2 2025, a significant reversal from a net income of $7.2 million in Q2 2024. For the first half of 2025, the company recorded a net loss of $(13.5) million. This was accompanied by a substantial increase in the provision for credit losses to $16.6 million in Q2 2025, up from $6.8 million in Q2 2024.

- The company is actively managing its asset quality, reducing non-performing assets by $6.8 million in Q2 2025 and increasing its allowance for credit losses to $58.9 million (2.44% of total loans) as of June 30, 2025. Total loan balances declined to $2.41 billion from $2.51 billion at the end of Q1 2025.

- Operational efficiency efforts resulted in a decrease in noninterest expense to $17.3 million in Q2 2025, down $3.3 million from Q2 2024, with an objective to achieve annualized savings of approximately $13.4 million. The company also paid a cash dividend of $0.01 per common share in Q2 2025, marking its 128th consecutive dividend payment.

Aug 25, 2025, 12:00 AM

First Guaranty Bancshares, Inc. Announces Q2 2025 Financial Results

FGBI

Earnings

Layoffs

- First Guaranty Bancshares, Inc. reported a net loss of $(5.8) million for the second quarter of 2025, a significant decline from a net income of $7.2 million in the same period of 2024. This resulted in a (loss) earnings per common share of $(0.50) for Q2 2025, compared to $0.53 in Q2 2024.

- The primary driver for the loss was a $14.7 million provision for credit losses in Q2 2025, which was more than double the $6.8 million provision in Q2 2024.

- The company continued its strategy to reduce risk, with non-performing assets reduced by $6.8 million compared to March 31, 2025, and total loan balances declining to $2.41 billion at June 30, 2025, from $2.51 billion at March 31, 2025.

- First Guaranty also continued its expense reduction plans, with noninterest expense totaling $17.3 million in Q2 2025, a decline of $0.8 million from Q1 2025 and $3.3 million from Q2 2024. Full-time equivalent employees decreased to 360 at June 30, 2025, from 495 at June 30, 2024.

Aug 1, 2025, 12:00 AM

First Guaranty Bancshares, Inc. Completes Common Stock Issuance

FGBI

- First Guaranty Bancshares, Inc. issued a total of 2,201,448 shares of its common stock on June 30, 2025.

- This included 131,460 shares sold in a private placement at $8.10 per share for general corporate purposes.

- Additionally, 1,981,506 shares were issued to Edgar Ray Smith, III, a director and significant shareholder, in exchange for a $15,000,000 Floating Rate Subordinated Note.

- The company also issued 36,060 shares and 52,422 shares to Smith & Tate Investment, L.L.C. (controlled by Edgar Ray Smith, III) as interest payments on a Promissory Note and a Subordinated Note, respectively.

Jul 7, 2025, 12:00 AM

First Guaranty Bancshares exchanges $15 M subordinated note for common stock

FGBI

Debt Issuance

- On June 16, 2025, First Guaranty Bancshares entered into an Exchange Agreement with director Edgar Ray Smith III to swap a $15 million Floating Rate Subordinated Note due June 21, 2032 for 1,981,506 newly issued common shares, with closing expected on or about June 30, 2025.

- Upon closing, interest on the subordinated note will cease, the note will be retired, and all of Mr. Smith’s rights under the note will terminate.

- The agreement includes customary representations and warranties, conditions precedent (including absence of injunctions and required consents), and mutual termination rights if the transaction isn’t completed by July 31, 2025.

Jun 18, 2025, 12:00 AM

First Guaranty Bancshares, Inc. Amends Debt Instruments

FGBI

Debt Issuance

- FGBI entered into several amendments affecting its debt instruments, including a Promissory Note and a Floating Rate Subordinated Note, as disclosed in the 8-K filing on June 9, 2025.

- The Promissory Note Amendment includes a four-quarter waiver of principal payments from June 30, 2025, to March 31, 2026, and provides an option for interest payments to be made in either cash or common stock.

- The Floating Rate Subordinated Note is modified to shift from monthly to quarterly interest payments, also offering the opportunity to pay interest in common stock during the specified period.

Jun 9, 2025, 12:00 AM

FGBI 2025 Annual Shareholder Meeting Overview

FGBI

Proxy Vote Outcomes

CEO Change

Management Change

- Management Commentary: Reflects on a challenging 2024 period and the transition after long-serving CEO Alton Lewis retired, highlighting the commitment to improved capital and risk management strategies.

- Q1 2025 Financial Highlights & Strategy Shift: CFO Eric Dosch reported a loss of $0.54 per share in Q1 2025 with increased loan provision expenses, alongside measures such as reducing risk-weighted assets and cost-cutting initiatives.

- Governance Actions: The meeting featured proxy voting on board elections and ratification of prior board actions, emphasizing continued leadership and governance adjustments.

May 15, 2025, 7:01 PM

First Guaranty Bancshares, Inc. Announces Q1 2025 Financial Results

FGBI

Earnings

Dividends

- Financial Performance: Reported a Q1 2025 net loss of $(6.2) million with earnings per common share of $(0.54), compared to a net income of $2.3 million and EPS of $0.14 in Q1 2024.

- Asset & Loan Reduction: Total assets declined to $3.8 billion and net loan balances dropped to $2.51 billion as of March 31, 2025, reflecting the bank’s strategy to reduce loan concentration risk.

- Risk Management Initiative: Executed the sale of two commercial real estate loans totaling $70.0 million, realizing a loss of $5.8 million on the sale to mitigate credit risk.

- Dividend Update: The Board declared a reduced common stock dividend of $0.01 per share in Q1 2025, down from $0.16 in Q1 2024, as part of a broader capital enhancement strategy.

Apr 29, 2025, 12:00 AM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more