FiEE (FIEE)·Q4 2025 Earnings Summary

FiEE Achieves First Profitable Year as SaaS Pivot Delivers 870% Revenue Surge

February 2, 2026 · by Fintool AI Agent

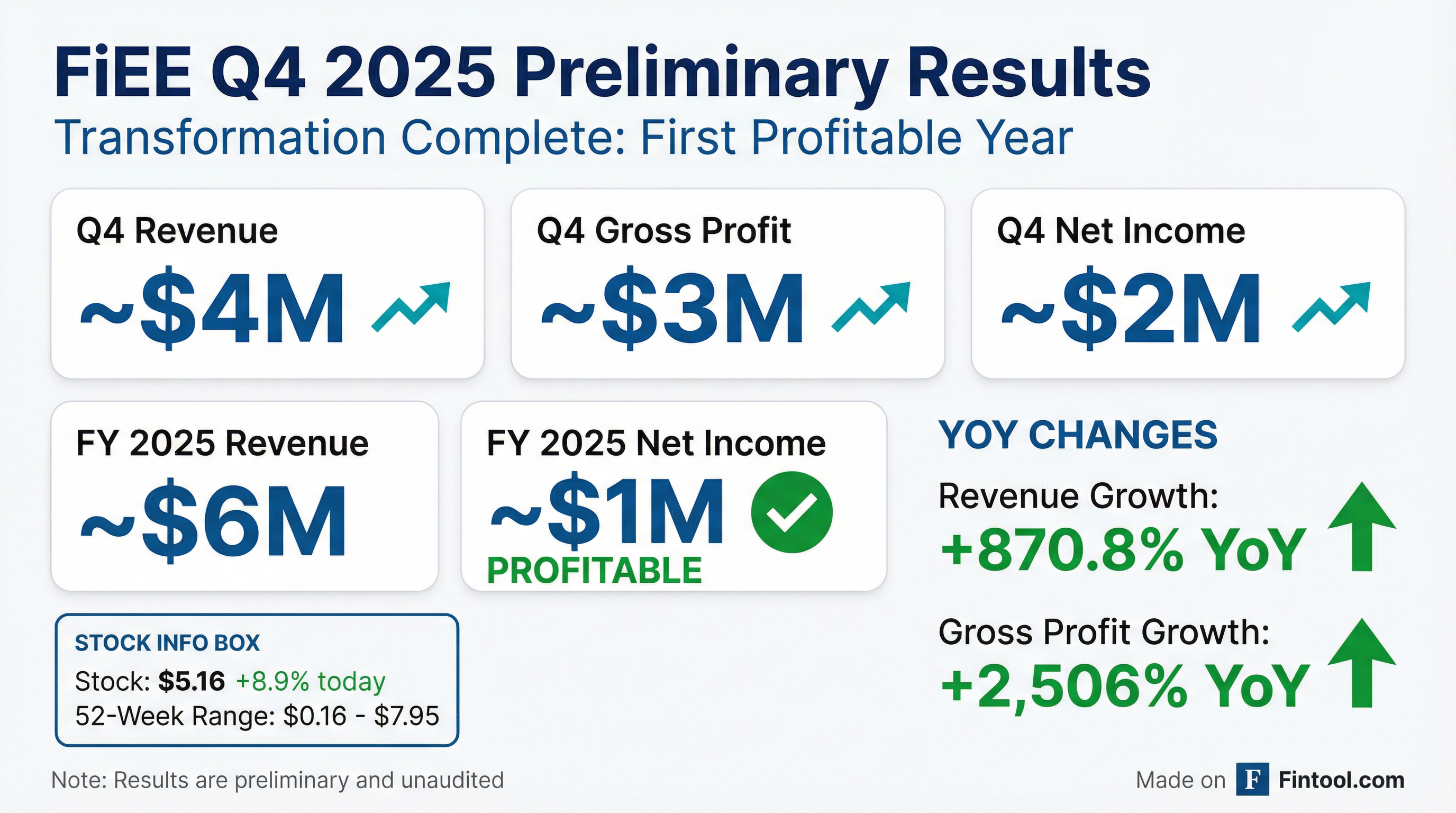

FiEE, Inc. (NASDAQ: FIEE) released preliminary Q4 and full-year 2025 results showing a dramatic turnaround. The company posted approximately $4 million in Q4 revenue and ~$2 million in net income, achieving profitability for the first time since its strategic transformation to SaaS solutions.

Full-year 2025 results were equally striking: ~$6 million in revenue (up 870.8% YoY) and approximately $1 million in net income — a complete reversal from prior losses.

What Did FiEE Report?

FiEE provided select preliminary unaudited results for Q4 and fiscal year 2025:

Note: Results are preliminary and unaudited. Final results expected in March 2026.

These results show dramatic sequential acceleration. Q3 2025 revenue was $1.94 million — meaning Q4 revenue more than doubled quarter-over-quarter.

What Changed From Last Quarter?

The Q4 results represent a dramatic inflection point in FiEE's turnaround:

*Q3 2025 Net Income from GetFinancials

The transformation is stark when compared to a year ago:

- Q4 2024: $0 revenue, minimal operations

- Q1 2025: $125 revenue, net loss of -$374K

- Q2 2025: $45K revenue, net loss of -$640K

- Q3 2025: $1.94M revenue, net loss of -$253K

- Q4 2025: ~$4M revenue, ~$2M net income

The business has gone from effectively dormant to generating meaningful profits in under a year.

What Is Driving the Growth?

FiEE's transformation centers on its pivot to SaaS solutions for digital content and brand management. The company now provides:

- Cloud-Managed Connectivity (WiFi) Platform — legacy business

- IoT Hardware Sales & Licensing

- SaaS Solutions — AI and data analytics integrated into content creation and brand management

- Professional Services — to-B and to-C support

The SaaS segment focuses on managing KOLs (Key Opinion Leaders) on social media platforms, providing customized graphics, short videos, and editorial calendars.

What Did Management Say?

"We are pleased with our strong fourth quarter 2025 performance, along with a full-year growth across both sales and profit. Supported by our strategic transformation towards SaaS solutions, our net sales recorded an increase of 870.8% year-over-year."

— Rafael Li, CEO and President

"Looking ahead, we plan to remain committed to investing in R&D to enhance customer experience and deliver greater brand value across the digital content landscape."

— Rafael Li, CEO and President

Did FiEE Raise Capital?

Yes. Concurrent with the preliminary results, FiEE announced a $2 million private placement:

The placement includes registration rights requiring FiEE to file a resale registration statement within 60 days of closing.

How Did the Stock React?

FIEE shares closed at $5.16 on February 2, 2026, up 8.9% on the day of the preliminary results announcement.

Key price action:

The stock hit a 52-week high of $7.95 on January 28 before pulling back 31.7% on the private placement news. Today's results helped recover some of those losses.

Year-to-date performance:

- YTD return: Approximately +35% (from ~$3.80 at year-end 2025)

- 52-week range: $0.16 - $7.95

- Market cap: ~$19-30 million (micro-cap)

The stock has risen dramatically from its 52-week low of $0.16, reflecting the market's recognition of the turnaround.

What Are the Key Risks?

Several factors warrant attention:

-

Preliminary and Unaudited — Final results could differ from these estimates

-

Micro-Cap Liquidity — Market cap of ~$20-30 million with limited trading volume

-

Concentration Risk — SaaS revenue appears dependent on KOL management services; customer concentration unknown

-

Execution Risk — Management references "potential future acquisitions" without specifics

-

Historical Losses — Company only just achieved profitability; sustainability unproven

-

Limited Analyst Coverage — No institutional estimates to benchmark against

What Comes Next?

Near-term catalysts:

- March 2026: Final Q4 and FY 2025 results release

- Within 30 days: Private placement closing

- 60 days post-closing: Resale registration statement filing

Key questions for the final results:

- What drove the ~$2M Q4 net income (operating leverage vs. one-time items)?

- Customer count and revenue concentration

- Q1 2026 guidance or outlook commentary

- Acquisition targets or M&A pipeline details

Bottom Line

FiEE's preliminary Q4 2025 results mark a significant milestone: the company's first profitable quarter and year following its strategic pivot to SaaS solutions. Revenue grew 870% YoY to ~$6 million, with Q4 alone generating ~$4 million — more than double the prior quarter. The concurrent $2 million private placement at $5.07/share provides growth capital for potential acquisitions.

Key watch items: sustainability of the growth trajectory, customer concentration, and execution on M&A strategy. Final audited results in March 2026 will provide the full picture.

This analysis is based on preliminary, unaudited results announced February 2, 2026. Final results may differ materially.