Earnings summaries and quarterly performance for FiEE.

Executive leadership at FiEE.

Board of directors at FiEE.

Research analysts covering FiEE.

Recent press releases and 8-K filings for FIEE.

FiEE, Inc. Announces Preliminary Q4 and Full-Year 2025 Financial Results and Private Placement

FIEE

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

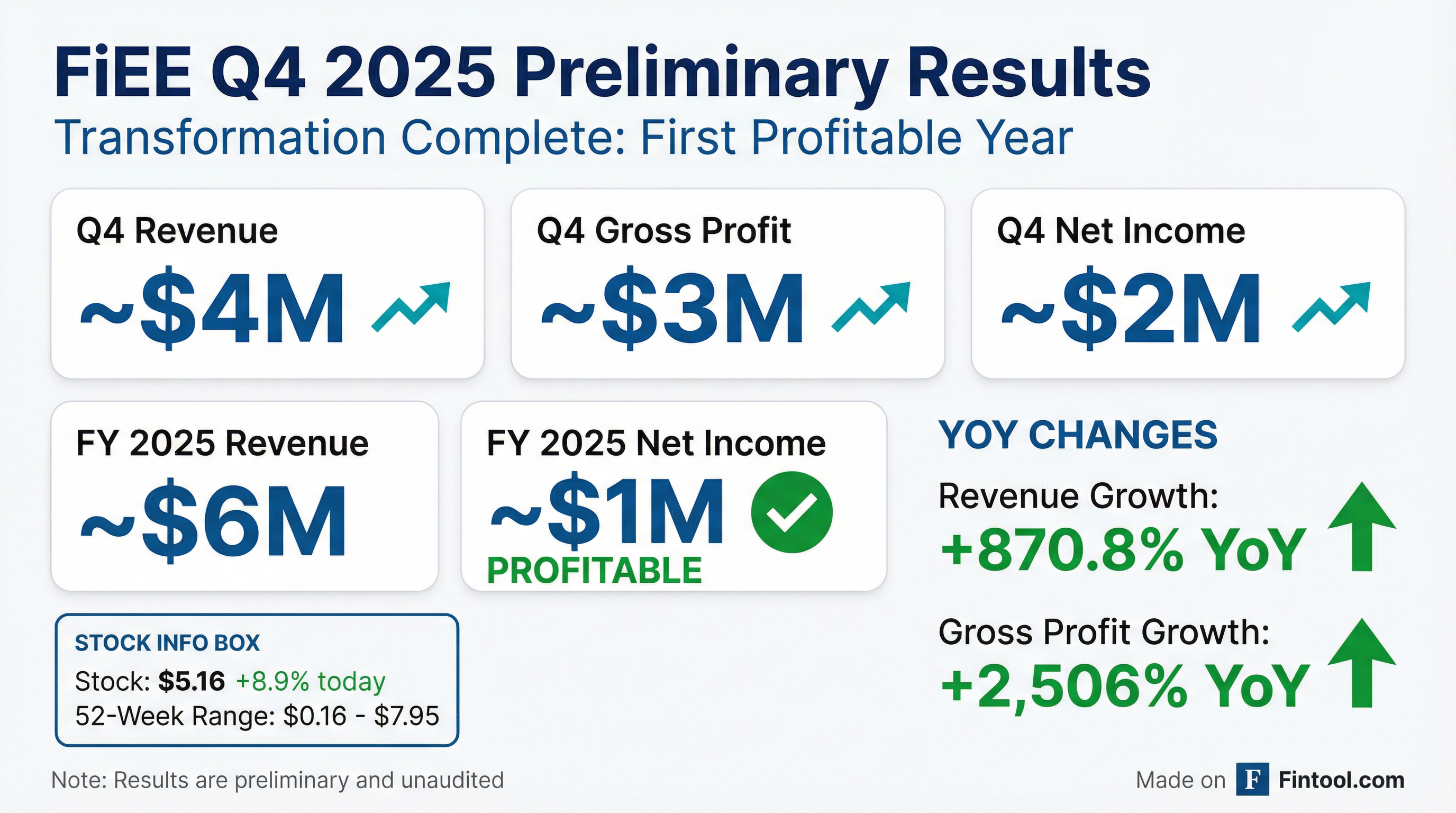

- FiEE, Inc. reported preliminary financial results for Q4 2025, with Net Sales of approximately $4 million and Net Income of approximately $2 million, and for the full fiscal year 2025, with Net Sales of approximately $6 million and Net Income of approximately $1 million.

- The company's net sales increased 870.8% year-over-year and gross profit increased 2,506.1% year-on-year, reflecting a strategic transformation towards SaaS solutions.

- FiEE, Inc. entered into a securities purchase agreement on January 30, 2026, for a private placement to sell 394,476 shares of common stock at $5.07 per share, expecting to raise approximately $2 million in gross proceeds for potential future acquisitions and general corporate purposes.

Feb 2, 2026, 9:24 PM

FiEE Reports Preliminary Q4 and Full-Year 2025 Financial Results

FIEE

Earnings

Guidance Update

Revenue Acceleration/Inflection

- FiEE announced preliminary financial results for Q4 and full-year 2025, reporting net sales of approximately $4 million and $6 million, respectively.

- The company achieved significant year-over-year growth in 2025, with net sales increasing 870.8% and gross profit increasing 2,506.1%.

- FiEE reported a preliminary net income of approximately $1 million for the full fiscal year 2025, highlighting a successful transformation.

- These preliminary results are unaudited and subject to change, with final results for fiscal year 2025 expected in March 2026.

Feb 2, 2026, 9:15 PM

FiEE Acquires Japanese Tech Firm Houren-Geiju

FIEE

M&A

New Projects/Investments

- FiEE, Inc. acquired 100% of the outstanding equity interests and all assets of Japanese technology company Houren-Geiju Kabushikikaisha for an aggregate purchase price of $3.5 million.

- Houren-Geiju specializes in digital authentication services for art collections leveraging artificial intelligence and blockchain technology.

- The acquisition, which closed on November 30, 2025, is expected to bolster FiEE's technological capabilities, broaden revenue streams, and expand its service offerings to include blockchain authentication.

Dec 2, 2025, 9:45 PM

FiEE Announces Fiscal Q3 2025 Unaudited Financial Results

FIEE

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- Net sales for FiEE, Inc. for the nine months ended September 30, 2025, increased significantly by 210% year-over-year to $1,984,660.

- The company reported a net loss of $252,985 for the third quarter ended September 30, 2025, and a $1,266,575 net loss for the nine months ended September 30, 2025, representing a 71% reduction year-over-year for the nine-month period.

- Gross profit for the nine months ended September 30, 2025, was $1,648,241, with the gross margin improving to 83% from 32.4% in the prior year, reflecting a successful pivot to SaaS solutions.

- Cash and cash equivalents as of September 30, 2025, stood at $5,905,372, a significant increase from $30,162 at December 31, 2024.

- FiEE onboarded 528 customers for its SaaS service by September 30, 2025, and prepaid subscription fees reached $4.24 million for the nine months ended September 30, 2025.

Nov 12, 2025, 9:10 PM

FIEE Announces Fiscal 2025 Third Quarter Unaudited Financial Results

FIEE

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- Net sales for the nine months ended September 30, 2025, increased by 210% year-over-year to $1,984,660, reflecting a successful transition to SaaS solutions and the introduction of customized software R&D services.

- The company significantly reduced its net loss for the nine months ended September 30, 2025, by approximately 71% year-over-year to $1,266,575, with a net loss of $252,985 for the third quarter of 2025.

- Gross margin improved significantly to 83% for the nine months ended September 30, 2025, up from 32.4% in the prior year period, driven by the strategic pivot to SaaS solutions.

- Net cash provided by operating activities reached $2,478,829 during the nine months ended September 30, 2025, contributing to a substantial increase in total cash and cash equivalents to $5,905,372 as of September 30, 2025, from $30,162 at December 31, 2024.

- Operationally, FiEE onboarded 528 customers for its SaaS service as of September 30, 2025, and secured $480 thousand in contracts from its newly introduced customized software R&D services.

Nov 12, 2025, 8:15 PM

Quarterly earnings call transcripts for FiEE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more