FLEXSTEEL INDUSTRIES (FLXS)·Q2 2026 Earnings Summary

Flexsteel Crushes Estimates as Revenue Beats by 10%, Stock Jumps 11%

February 3, 2026 · by Fintool AI Agent

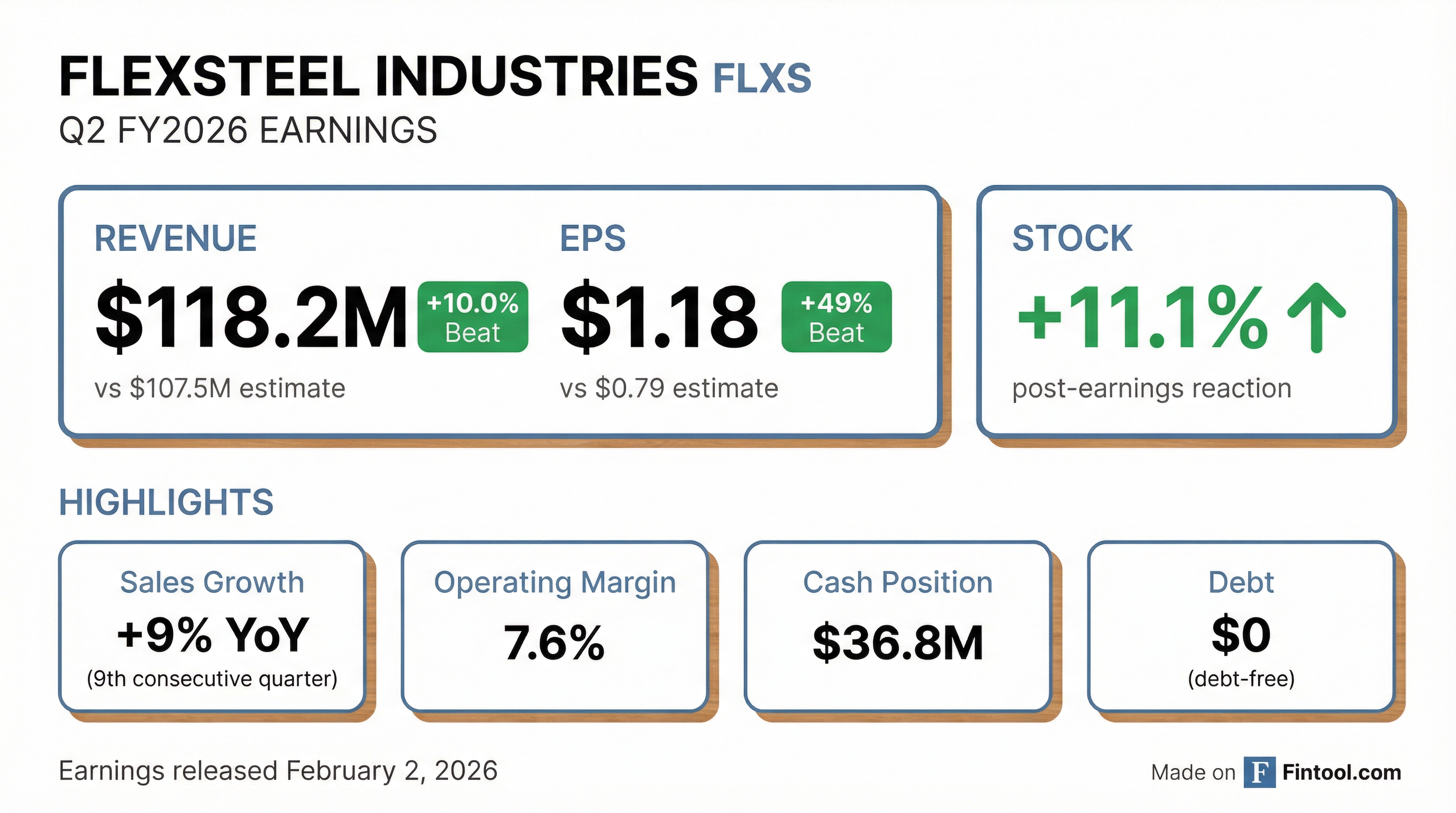

Flexsteel Industries delivered a blowout Q2 FY2026, with revenue beating consensus by 10% and EPS crushing estimates by 49%. The furniture manufacturer posted its 9th consecutive quarter of YoY sales growth, driving shares up 11% in early trading to $46.29.

Did Flexsteel Beat Earnings?

Yes — and by a wide margin on both metrics.

*Values retrieved from S&P Global

This marks Flexsteel's 8th consecutive double beat — the company has exceeded both revenue and EPS estimates every quarter since Q3 FY2024.

Beat/Miss History (Last 8 Quarters)

*Values retrieved from S&P Global

How Did the Stock React?

FLXS surged +11.1% following the earnings release, trading as high as $46.76 intraday.

The stock remains well below its February 2025 high of ~$63, offering potential upside if the execution continues.

What Changed From Last Quarter?

Revenue acceleration: Q2's 9% YoY growth accelerated from Q1's 5% growth, driven by stronger unit volumes in sourced soft seating despite tariff-related pricing increases.

Tariff impact now visible: Tariff revenue contributed approximately $9.5 million to the quarter — meaning core organic revenue was essentially flat, though this still beat expectations.

Margin normalization: Operating margin of 7.6% was down from Q1's 8.1% and Q4 FY25's 9.0%, reflecting investments in growth initiatives and timing of tariff cost absorption.

Balance sheet strengthened: Cash increased to $36.8M with no bank debt and $126M in working capital. The company intentionally built safety stock ahead of anticipated tariff increases.

Financial Trends (Last 8 Quarters)

*Values retrieved from S&P Global

What Did Management Guide?

No formal guidance — management suspended forward guidance due to tariff uncertainty.

However, CFO Mike Ressler provided directional color:

"Given the level of uncertainty regarding both demand and the impact of tariffs on our business, we believe it is appropriate to continue our pause on providing any forward-looking guidance. However... we expect some margin dilution in the second half of the fiscal year relative to the second quarter, as we are now selling higher cost inventory burdened with 25% tariffs."

Key takeaways on outlook:

- Margin headwind: Higher-cost inventory with 25% tariffs will pressure H2 margins

- Demand uncertainty: Tariffs + pricing may impact unit demand, though magnitude is unclear

- Cost offsets in progress: Team working on cost initiatives expected to offset tariff impact in midterm

What Drove the Beat?

1. New Product Momentum

New products continue to drive 30-40% of total sales — a consistent contributor over the past 6-8 quarters. CEO Derek Schmidt noted an "exciting and focused pipeline" over the next 18 months.

"What's particularly encouraging is the quality and balance of our growth. We are performing well in our core business with new product introductions and share gains with strategic accounts."

2. Strategic Account Expansion

The company's focus on 20 large independent retailers ("strategic accounts") continues to pay dividends. These retailers are progressing their omnichannel capabilities and gaining market share.

"The vast majority of those 20 customers, we already have very strong relationships. There are a handful that we're... emerging relationships, which we believe there's pretty significant growth potential."

3. Pricing Power + Cost Discipline

Despite passing through tariff surcharges, the company saw positive unit volume growth in core soft seating — evidence of pricing power and product differentiation.

Key Management Quotes

On execution in a choppy environment:

"What's notable this quarter is that our growth drivers are reinforcing one another and scaling more effectively across the portfolio. Our investments in consumer insights, product development, and innovation are improving the effectiveness of new launches."

On tariff mitigation:

"The impact of tariffs on operating margin in the quarter was largely mitigated through a combination of pricing actions and cost savings initiatives."

On competitive positioning:

"Periods of disruption often create opportunity for companies that are prepared to act decisively while maintaining strategic focus. We believe our combination of operating discipline, financial strength, and investment in innovation and consumer-led growth positions us well."

What Are the Risks?

1. Tariff Escalation

The 25% tariff level is now fully embedded in inventory costs. Further escalation could pressure margins and demand. Management is evaluating alternative supply chain options.

2. Homestyles Drag

The Homestyles ready-to-assemble segment saw sales decline ~50% in the quarter — a meaningful drag on an otherwise strong portfolio.

3. Consumer Demand Uncertainty

"Consumer behavior remains highly variable, with periods of engagement followed by pullbacks driven by economic uncertainty and inflation concerns."

4. Made-to-Order Softness

While sourced soft seating grew, made-to-order seating volumes declined — a category that has been persistently soft.

Balance Sheet Snapshot

The company maintained its debt-free status while building inventory safety stock ahead of potential tariff increases.

Q&A Highlights

On unit volumes vs. pricing (Anthony Lebiedzinski, Sidoti): CFO Mike Ressler: "Tariff revenue in the quarter was roughly... $9.5 million. So when you look at it from a unit volume perspective, we are relatively flat versus the prior quarter." CEO Derek Schmidt added: "We saw really nice unit volume gains in many areas of our soft seating business... despite the fact that we took pricing."

On tariff mitigation confidence: Ressler: "With that said, the current quarter inventory is probably burdened with give or take, a 20% tariff level. So as we think about the back half of the year, we would expect some dilution to margins."

On strategic accounts runway: Schmidt: "I still believe that there is ample room for strategic accounts to drive exponential growth... both share gains with existing accounts and the handful of other retailers that we're probably under penetrated or under indexed with."

The Bottom Line

Flexsteel delivered another outstanding quarter, extending its beat streak to 8 consecutive quarters while navigating a challenging tariff environment. The +10% revenue beat and +49% EPS beat drove an 11% stock pop.

Bulls will point to:

- Consistent execution through macro volatility

- New product pipeline driving 30-40% of sales

- Debt-free balance sheet with cash flexibility

- Strategic account relationships driving share gains

Bears will note:

- H2 margin pressure from 25% tariffs baked into inventory

- Homestyles segment down 50%

- No formal guidance due to uncertainty

- Stock still 28% below 52-week highs

The company's agility and balance sheet strength position it well to navigate tariff volatility, but the back half will test whether margin offsets can keep pace with cost headwinds.

Report generated by Fintool AI Agent. Data sourced from company filings, earnings call transcripts, and S&P Global.

Related Links: