Earnings summaries and quarterly performance for FLEXSTEEL INDUSTRIES.

Executive leadership at FLEXSTEEL INDUSTRIES.

Derek Schmidt

President and Chief Executive Officer

David Crimmins

Vice President, Sales and Product Management

Michael McClaflin

Chief Information and Technology Officer

Michael Ressler

Chief Financial Officer, Treasurer and Secretary

Stacy Kammes

Vice President, Human Resources

Board of directors at FLEXSTEEL INDUSTRIES.

Research analysts who have asked questions during FLEXSTEEL INDUSTRIES earnings calls.

Recent press releases and 8-K filings for FLXS.

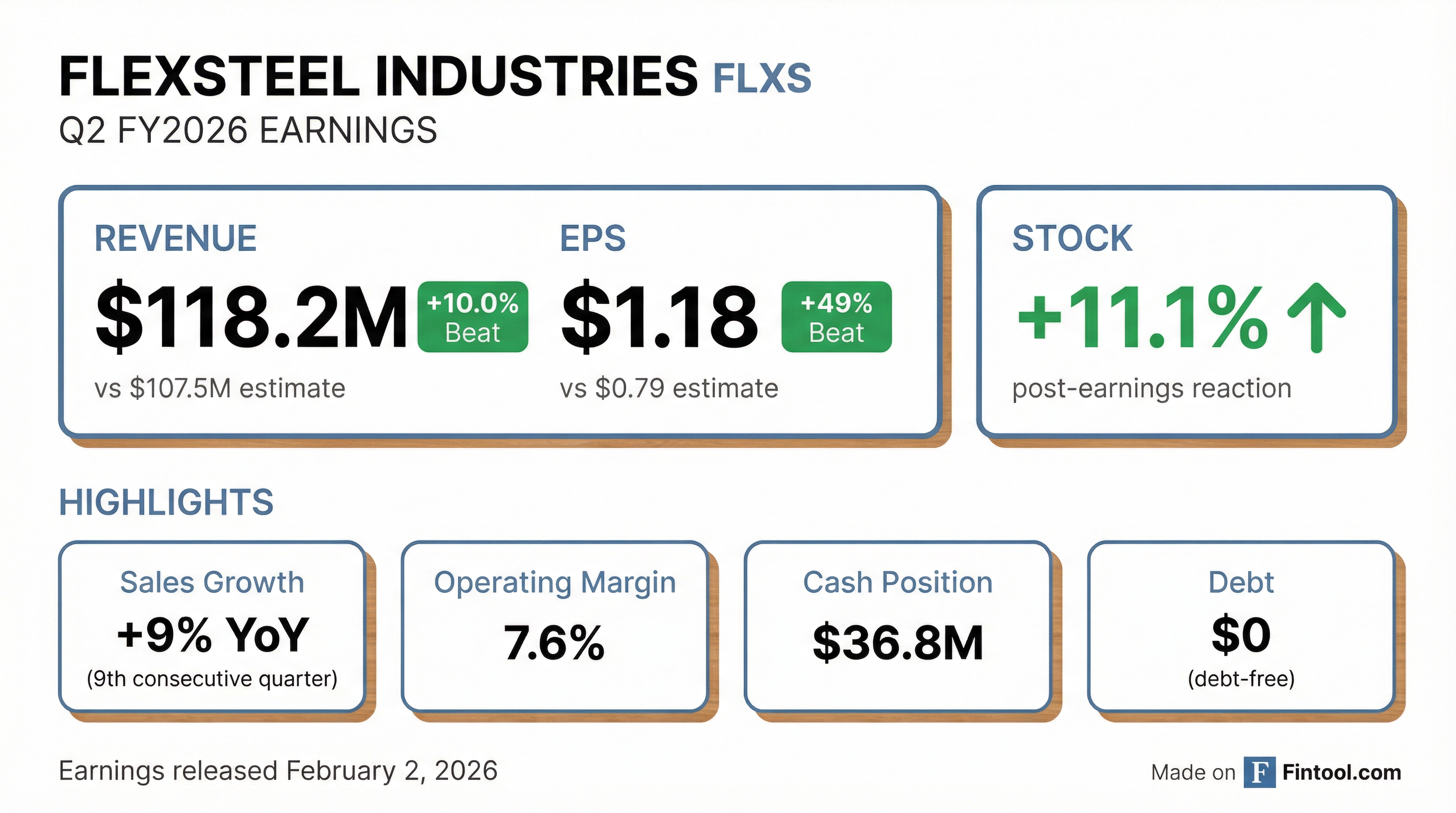

- Flexsteel Industries reported net sales of $118.2 million for the second quarter of fiscal year 2026, a 9% increase year-over-year, marking its ninth consecutive quarter of sales growth.

- The company achieved GAAP operating income of $9.0 million, or 7.6% of sales, in Q2 2026, driven by higher unit volume in sourced soft seating and a favorable sales mix of higher margin new products.

- While the impact of tariffs on operating margin was largely mitigated in the current quarter, Flexsteel anticipates some margin dilution in the second half of fiscal year 2026 as it sells higher-cost inventory burdened with 25% tariffs.

- Flexsteel ended the quarter with a strong financial position, including $36.8 million in cash and no bank debt, but continues to withhold forward-looking guidance due to market uncertainty.

- Flexsteel Industries reported net sales of $118.2 million for Q2 Fiscal Year 2026, a 9% increase year-over-year, marking its ninth consecutive quarter of sales growth.

- GAAP operating income for the quarter was $9.0 million, or 7.6% of sales, reflecting a 35% increase compared to the adjusted prior year quarter.

- The company maintained a strong financial position with a cash balance of $36.8 million and no bank debt at the end of the quarter.

- Management expects some margin dilution in the second half of fiscal year 2026 due to higher cost inventory burdened with 25% tariffs, despite mitigating tariff impacts in Q2 through pricing and cost savings.

- New products continue to be a substantial growth driver, accounting for 30%-40% of overall sales over the past 6-8 quarters, with a strong pipeline anticipated for the next 18 months.

- Flexsteel Industries (FLXS) reported Q2 FY2026 net sales of $118.2 million, a 9% year-over-year increase, marking its ninth consecutive quarter of sales growth.

- The company achieved GAAP operating income of $9.0 million, or 7.6% of sales, in Q2 FY2026, driven by higher unit volume in sourced soft seating and a favorable sales mix of higher-margin new products, with tariff impacts largely mitigated by pricing actions and cost savings.

- Flexsteel ended the quarter with a strong financial position, including $36.8 million in cash and no bank debt.

- Management anticipates some margin dilution in the second half of fiscal year 2026 due to higher cost inventory burdened with 25% tariffs and has paused forward-looking guidance given the uncertain demand and tariff environment.

Flexsteel Industries Inc. reported its fiscal second quarter 2026 results for the period ended December 31, 2025. The company achieved net sales of $118.2 million, representing a 9.0% increase compared to the prior year quarter. Both adjusted operating income and adjusted net income per diluted share saw significant improvements year-over-year. Gross margin increased by 170 basis points to 22.7%, driven by a favorable sales composition of higher margin products. Flexsteel maintained a strong liquidity position with a cash balance of $36.8 million and working capital of $126.0 million as of December 31, 2025.

| Metric | Q2 2025 (ended Dec 31, 2024) | Q2 2026 (ended Dec 31, 2025) |

|---|---|---|

| Net sales ($USD Thousands) | 108,483 | 118,249 |

| GAAP operating income ($USD Thousands) | 11,654 | 8,997 |

| Adjusted operating income ($USD Thousands) | 6,663 | 8,997 |

| GAAP net income per diluted share ($USD) | 1.62 | 1.18 |

| Adjusted net income per diluted share ($USD) | 0.95 | 1.18 |

| Gross margin (%) | 21.0 | 22.7 |

| Cash and cash equivalents ($USD Thousands) | N/A | 36,771 |

| Working capital ($USD Thousands) | N/A | 126,000 |

- Flexsteel Industries, Inc. reported net sales of $118.2 million for the second quarter of fiscal 2026, representing a 9.0% increase compared to the prior year quarter.

- The company's adjusted operating income rose 35% to $9.0 million, and adjusted diluted earnings per share increased to $1.18 from $0.95 in the prior year quarter.

- Gross margin improved to 22.7% for the quarter, up 170 basis points from 21.0% in the prior-year period, primarily due to favorable sales composition.

- Flexsteel concluded the quarter with a strong liquidity position, including a cash balance of $36.8 million and working capital of $126.0 million as of December 31, 2025.

- Management emphasized strong execution despite uneven industry demand and tariff uncertainties, attributing performance to new product introductions, share gains, and operating discipline.

- Flexsteel Industries (FLXS) reported net sales of $110.4 million for Q1 2026, a 6.2% increase year-over-year, marking its eighth consecutive quarter of sales growth.

- The company achieved a GAAP operating income of $9 million, or 8.1% of sales, representing its tenth consecutive quarter of year-over-year adjusted operating margin improvement.

- New Section 232 tariffs will impose a 25% tariff, increasing to 30% by year-end, on upholstered furniture, impacting over 90% of Flexsteel's sales and leading to the implementation of tariff surcharges.

- Due to the uncertainty surrounding the impact of these new tariffs, Flexsteel has paused providing forward-looking guidance.

- Flexsteel Industries reported net sales of $110.4 million for Q1 fiscal year 2026, a 6.2% increase compared to the prior year quarter, marking its eighth consecutive quarter of sales growth.

- The company achieved a GAAP operating income of $9.0 million, or 8.1% of sales, in Q1 2026, representing its tenth consecutive quarter of year-over-year adjusted operating margin improvement.

- New Section 232 tariffs will subject all upholstered furniture sourced from Vietnam and Mexico to a 25% tariff effective October 14, 2025, increasing to 30% by the end of the calendar year, impacting over 90% of the company's sales.

- To mitigate the tariff impact, Flexsteel is implementing tariff surcharges (e.g., increasing from 8.5% to 15% on source products and adding 15% on made-to-order products) and is evaluating structural cost reduction opportunities and alternative supply chain sources.

- Due to the uncertainty surrounding the tariffs, the company has paused providing forward-looking guidance at this time.

- Flexsteel Industries, Inc. reported strong fiscal first quarter 2026 results, with net sales increasing 6.2% to $110.4 million for the quarter ended September 30, 2025. This represents the eighth consecutive quarter of year-over-year growth.

- GAAP operating income for the quarter was $9.0 million, or 8.1% of net sales, compared to $6.0 million (5.8% of net sales) in the prior year quarter, marking the tenth consecutive quarter of year-over-year improvement in operating margin.

- GAAP net income per diluted share for the quarter ended September 30, 2025, rose to $1.31, up from $0.74 in the prior year quarter.

- The company anticipates new Section 232 tariffs on imported upholstered furniture, effective October 14th at 25% and increasing to 30% on January 1, 2026, will be highly disruptive to consumer demand and industry margins in the short term.

- Flexsteel Industries Inc. reported strong fiscal first quarter 2026 results, with net sales increasing 6.2% to $110.4 million and diluted EPS rising to $1.31 compared to $0.74 in the prior year quarter.

- The company achieved its eighth consecutive quarter of year-over-year sales growth and tenth consecutive quarter of year-over-year operating margin improvement, with operating income reaching $9.0 million or 8.1% of net sales.

- Management highlighted significant near-term risks and headwinds, including new Section 232 tariffs on imported upholstered furniture, which became 25% effective October 14, 2025, and will increase to 30% effective January 1, 2026, anticipating broad price increases and disruption to demand and margins.

- The company ended the quarter with a cash balance of $38.6 million and working capital of $116.9 million as of September 30, 2025.

- Flexsteel Industries reported $441 million in sales for the fiscal year ending June 2025, achieving 6.9% growth.

- The company recorded its seventh consecutive quarter of year-over-year sales growth in the quarter ending June 2025, with 3.4% growth in Q4 FY2025, and projects Q1 FY2026 sales growth of 1% to 6%.

- Adjusted operating margin expanded by over 60% in fiscal year 2025 to 7.1% of sales, driven by operating leverage, higher-margin new products, and cost savings.

- Flexsteel is focused on growth through market expansion, new product innovations like the Flex modular line and ZCLINER, and has returned approximately $95 million to shareholders over the past six years.

Quarterly earnings call transcripts for FLEXSTEEL INDUSTRIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more