FIRST MID BANCSHARES (FMBH)·Q4 2025 Earnings Summary

First Mid Bancshares Posts Record Quarter as Loan Growth Accelerates

January 29, 2026 · by Fintool AI Agent

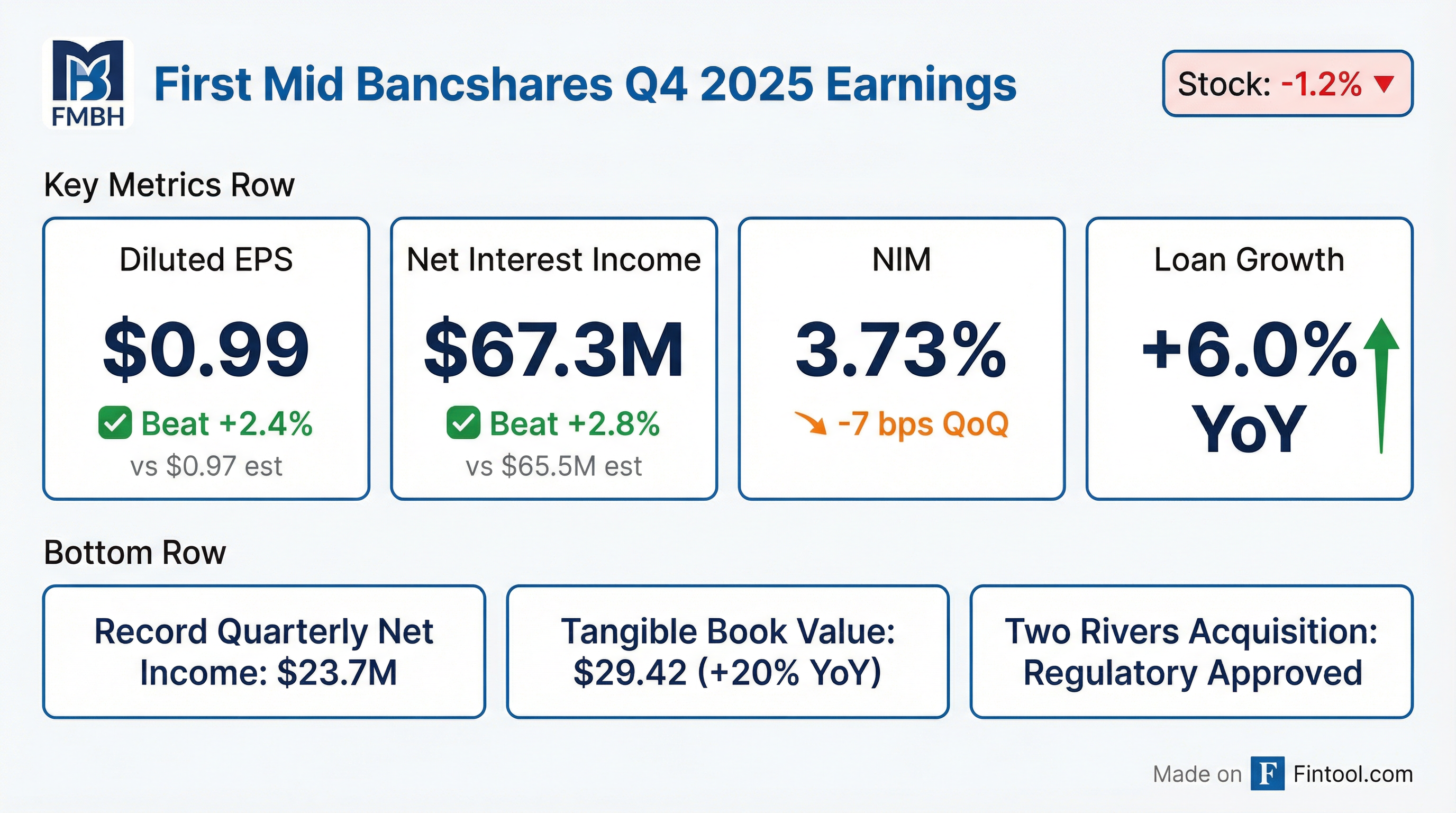

First Mid Bancshares delivered record quarterly earnings in Q4 2025, with diluted EPS of $0.99 (adjusted: $1.06) beating consensus estimates by 2.4%. The Illinois-based community bank posted net income of $23.7 million on robust loan growth of 6% for the year, while securing regulatory approval to acquire Two Rivers Financial Group.

Did First Mid Beat Earnings?

Yes — both EPS and net interest income beat expectations.

*Consensus estimates from S&P Global

This marks the sixth consecutive quarter of EPS beats for First Mid, extending a strong execution track record.

How Did Net Interest Margin Perform?

Net interest margin (tax equivalent) came in at 3.73%, down 7 basis points from Q3 2025's 3.80%. Management attributed the decline to:

- Lower accretion income — Down $0.5M from prior quarter as acquired loan payoffs slowed

- Sub-debt repricing — Mid-October 2025 repricing added interest expense

Excluding accretion, NIM declined only 4 basis points — a relatively modest compression in the current rate environment.

What Drove the Record Earnings?

Three factors combined to deliver record results:

1. Accelerating Loan Growth Total loans reached $6.01 billion, up 3.2% QoQ and 6.0% YoY. Growth was broad-based:

- Construction and land development: +$24M QoQ

- Commercial real estate: +$133M QoQ

- Commercial & industrial: +$32M QoQ

2. Fee Income Momentum Both wealth management and insurance delivered record annual revenues:

- Wealth management: $6.6M in Q4 (+$1.4M QoQ)

- Insurance commissions: $7.4M in Q4 (+$0.4M QoQ)

3. Expense Discipline Adjusted efficiency ratio improved to 57.55% from 58.75% in Q3, reflecting operating leverage from completed technology investments.

What Changed From Last Quarter?

Credit Quality: Watch List

The most notable change was an uptick in non-performing loans:

Management disclosed that two relationships drove the increase — notably a long-time customer in consumer finance that is in discussions to sell their book of business. Minimal losses are expected from this credit.

Technology Platform Complete

The company completed its core banking conversion and new retail online banking implementation during Q4, positioning for more efficient growth.

How Did the Stock React?

FMBH shares traded down approximately 1.2% following the earnings release, despite the beat. The muted reaction likely reflects:

- NIM compression concerns — The 7 bps decline signals potential pressure ahead

- Credit migration — Special mention loans nearly doubled QoQ

- Acquisition uncertainty — Two Rivers closing still pending

The stock has gained 53% over the past year, trading near 52-week highs of $44.32.

*Values retrieved from S&P Global

What Did Management Guide?

Management did not provide explicit forward guidance but offered the following outlook:

On Two Rivers Acquisition:

"We are pleased with the continued progress towards closing our pending acquisition of Two Rivers Financial Group, Inc. as we received all regulatory approvals in the fourth quarter. We still anticipate closing to occur in the first quarter of 2026 as we enter Iowa with a great partner." — Joseph Dively, Chairman and CEO

On Growth Platform:

"Our team executed at the highest levels on key strategic technology projects and now with our new retail online banking and core banking applications implemented, we have improved the customer experience and deployed a more efficient platform for growth." — Joseph Dively, Chairman and CEO

Dividend: The Board declared a regular quarterly dividend of $0.25 per share, payable February 27, 2026 to shareholders of record as of February 12, 2026.

Capital Position Remains Strong

Tangible book value per share increased 4.3% during Q4 and 20.3% for the full year, driven by earnings and improvement in the unrealized loss position on the investment portfolio.

Key Risks and Concerns

- Credit Migration — Special mention loans jumped from $61M to $121M, requiring monitoring

- Margin Pressure — NIM declined despite strong loan growth; rate sensitivity a factor

- Integration Execution — Two Rivers acquisition adds integration risk in 2026

- CRE Concentration — Commercial real estate represents significant portion of loan book

The Bottom Line

First Mid Bancshares delivered on all fronts in Q4 2025 — record earnings, accelerating loan growth, and regulatory approval for its Iowa expansion. The 6% full-year loan growth and 20% tangible book value appreciation demonstrate strong fundamental execution. Credit migration bears watching, but management's characterization suggests these are idiosyncratic issues rather than systemic deterioration. With the Two Rivers closing expected in Q1 2026, the focus shifts to integration execution and maintaining NIM stability.