Earnings summaries and quarterly performance for FARMERS & MERCHANTS BANCORP.

Executive leadership at FARMERS & MERCHANTS BANCORP.

Kent Steinwert

Detailed

Chief Executive Officer

CEO

BO

Bart Olson

Detailed

Chief Financial Officer

DZ

David Zitterow

Detailed

Director of Wholesale Banking Division

JW

John Weubbe

Detailed

Chief Credit Officer

RM

Ryan Misasi

Detailed

Retail Banking Division Manager

TB

Thomas Bennett

Detailed

Enterprise Risk Officer

TH

Troy Harper

Detailed

Chief Administrative Officer

Board of directors at FARMERS & MERCHANTS BANCORP.

Research analysts covering FARMERS & MERCHANTS BANCORP.

Recent press releases and 8-K filings for FMCB.

Farmers & Merchants Bancorp provides 2025 year-end financial and operational update

FMCB

Earnings

Dividends

Share Buyback

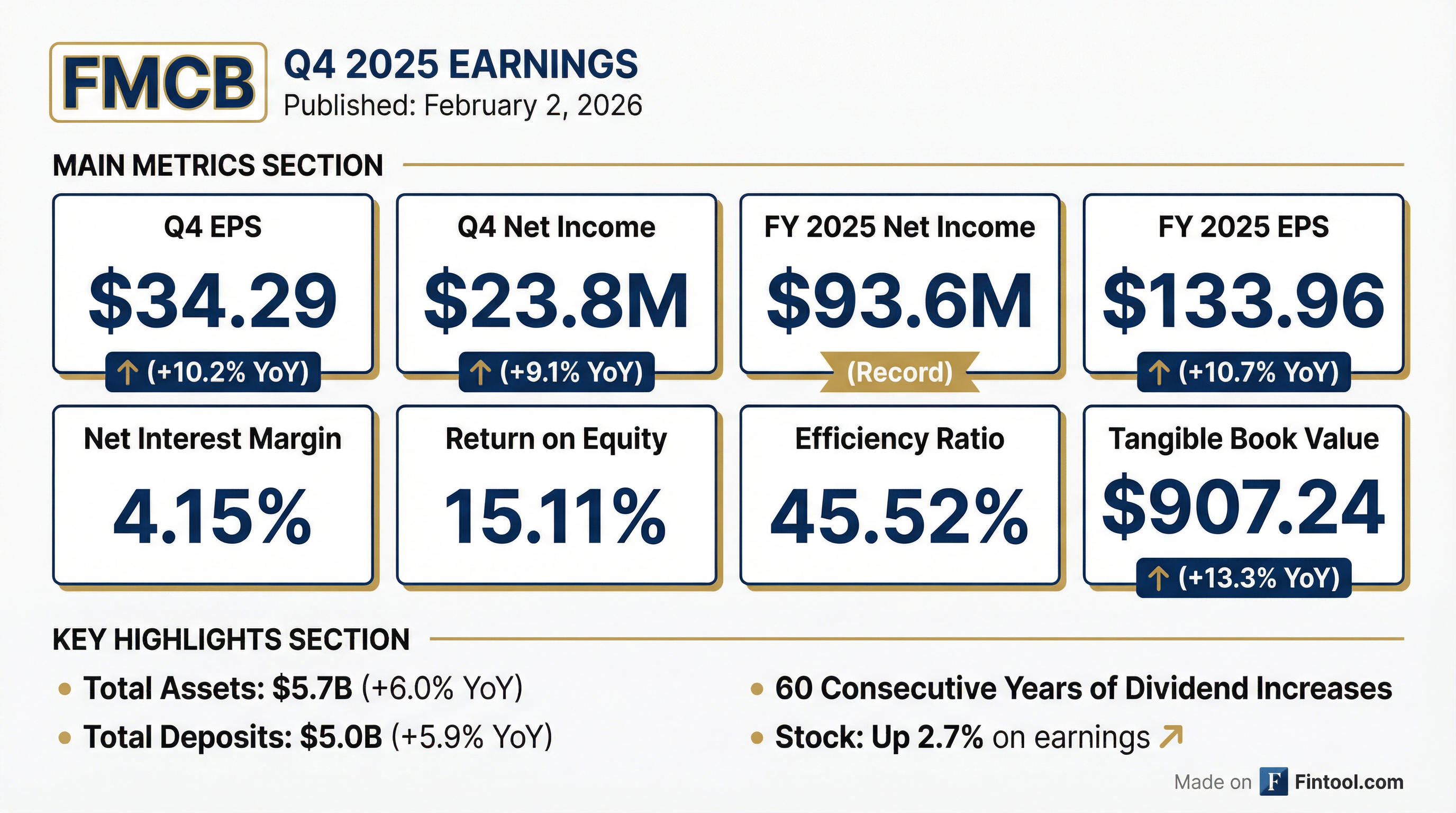

- As of December 31, 2025, Farmers & Merchants Bancorp reported $5.7 billion in assets, a Return on Assets (ROA) of 1.67%, a Return on Equity (ROE) of 15.11%, and a Net Interest Margin (NIM) of 4.15%.

- The company maintained strong credit quality with non-performing loans totaling $750,000 (0.02% of total loans) and net charge-offs of $1.8 million (0.05% of average loans) for the year ended 2025.

- FMCB has a history of 90 consecutive years of dividends with 60 years of continuous increases, and repurchased 33,562 shares (4.80% of outstanding) in 2025, transitioning to quarterly dividends starting in Q3 2025.

- The company's loan portfolio includes $1.0 billion (26.6%) in Ag related lending as of December 31, 2025, and it was ranked the #3 Performing Bank in the U.S. in 2024 by Bank Director’s Magazine.

4 days ago

Farmers & Merchants Bancorp Reports Record Q4 and Annual 2025 Financial Results

FMCB

Earnings

Dividends

Share Buyback

- Farmers & Merchants Bancorp reported record annual net income of $93.6 million for 2025, an increase of nearly 6% from 2024, with diluted earnings per common share of $133.96, up 10.69% from the prior year.

- Total assets grew 5.96% to $5.7 billion and total deposits increased 5.93% to $5.0 billion at year-end 2025.

- The company achieved a net interest margin (tax equivalent basis) of 4.15% in 2025, up from 4.05% in 2024, and an improved efficiency ratio of 45.52%, down from 46.24%.

- FMCB maintained a strong capital position with a total risk-based capital ratio of 15.29% and increased its tangible book value per share by 13.33% to $907.24. The company also paid $19.35 per share in dividends for 2025 and repurchased $34.7 million in common stock.

4 days ago

Farmers & Merchants Bancorp Reports Record 2025 Financial Results

FMCB

Earnings

Dividends

Share Buyback

- Farmers & Merchants Bancorp reported record annual net income of $93.6 million for 2025, an increase of $5.1 million compared to 2024, with diluted earnings per common share of $133.96, up 10.69% from the prior year.

- The company demonstrated strong financial health with a return on average assets of 1.67%, a return on average equity of 15.11%, and a net interest margin (tax equivalent basis) of 4.15% in 2025.

- FMCB's balance sheet grew, with total assets reaching $5.7 billion and total deposits increasing to $5.0 billion at year-end 2025. The tangible book value per share rose to $907.24, up 13.33% year-over-year.

- The company maintained a robust capital position, with a total risk-based capital ratio of 15.29% and a tangible common equity ratio of 11.15% at December 31, 2025, while also increasing total dividends per share to $19.35 and repurchasing 33,562 shares during the year.

4 days ago

Farmers & Merchants Bancorp Declares Record Quarterly Dividend and Reports Strong Q3 2025 Results

FMCB

Dividends

Earnings

- Farmers & Merchants Bancorp (FMCB) declared a quarterly cash dividend of $5.05 per share, payable on January 2, 2026, to shareholders of record on December 15, 2025.

- For the third quarter ended September 30, 2025, the company reported net income of $23.7 million, or $33.92 per diluted common share, marking a 13.2% increase over the prior year.

- The company's diluted earnings per share over the trailing twelve months reached $130.83, an increase of 10.4% compared to the same period a year ago, and it has paid dividends for 90 consecutive years, increasing them for 60 consecutive years.

Nov 12, 2025, 11:46 PM

Farmers & Merchants Bancorp Releases Q3 2025 Investor Presentation

FMCB

Earnings

Dividends

Share Buyback

- Farmers & Merchants Bancorp (FMCB) released an investor presentation on October 28, 2025, detailing its financial position, business, and operations for the third quarter ended September 30, 2025.

- For Q3 2025, the company reported net income of $23,718 thousand and diluted earnings per common share of $33.92. Key performance metrics included a return on average assets of 1.70% and a return on average equity of 15.10%.

- As of September 30, 2025, FMCB maintained a strong capital position with a tangible common equity ratio of 11.26% and a risk-based capital to risk-weighted assets of 15.74%. The non-performing assets ratio stood at 0.03%.

- The company has a history of 90 consecutive years of dividends and 60 years of continuous increases, transitioning to a quarterly dividend beginning in Q3 2025. Additionally, it repurchased 7,789 shares during the nine months ended September 30, 2025.

Oct 28, 2025, 11:00 PM

Farmers & Merchants Bancorp Reports Record Q3 2025 Earnings

FMCB

Earnings

Dividends

Share Buyback

- Farmers & Merchants Bancorp reported record net income of $23.7 million for the third quarter of 2025, marking a 7.22% increase compared to the third quarter of 2024, with diluted earnings per share reaching $33.92, up 13.22% year-over-year.

- The company's financial position remains strong, with tangible book value per share increasing 9.8% to $877.13 as of September 30, 2025, compared to September 30, 2024.

- As of September 30, 2025, FMCB maintained robust capital levels, with a preliminary total risk-based capital ratio of 15.76% and a common equity tier 1 ratio of 14.28%, both exceeding regulatory requirements for "well-capitalized" banks.

- The company announced a change in its dividend policy from semi-annual to quarterly payments and authorized an increase of $45.0 million to its share repurchase program, extending it through December 31, 2027, with $57.1 million remaining authorized for repurchases.

Oct 16, 2025, 1:01 PM

Farmers & Merchants Bancorp Increases Share Repurchase Program

FMCB

Share Buyback

- Farmers & Merchants Bancorp (FMCB) authorized a $45.0 million increase to its existing share repurchase program, bringing the total program to $57.6 million.

- The share repurchase program has been extended through December 31, 2027.

- Since January 2021, FMCB has repurchased 97,376 shares, or approximately 12.3% of shares outstanding, through August 12, 2025.

- As of June 30, 2025, the company maintained a strong capital position, with a tier 1 leverage capital ratio of 11.18%, a common equity tier 1 ratio (CET1) of 13.88%, and a total capital ratio of 15.36%.

Aug 14, 2025, 12:00 AM

Farmers & Merchants Bancorp Announces Quarterly Dividend Policy and Declaration

FMCB

Dividends

Earnings

- Farmers & Merchants Bancorp (FMCB) has changed its cash dividend payment frequency from semi-annually to quarterly.

- The Board of Directors declared a quarterly cash dividend of $5.00 per share, payable on October 1, 2025, to shareholders of record on September 11, 2025. The company's last semi-annual cash dividend of $9.30 was paid on July 1, 2025.

- For the second quarter ended June 30, 2025, FMCB reported net income of $23.1 million and diluted earnings per share of $32.94.

- The company has a long history of dividend payments, marking its 90th consecutive year of paying cash dividends and 60th consecutive year of increasing dividends, which designates it as a "Dividend King".

Aug 13, 2025, 12:00 AM

Farmers & Merchants Bancorp Reports Q2 2025 Financial Highlights and Strong Performance

FMCB

Earnings

Dividends

Share Buyback

- Farmers & Merchants Bancorp reported net income of $23,055 thousand and diluted earnings per common share of $32.94 for the three months ended June 30, 2025. For the six months ended June 30, 2025, net income was $46,064 thousand and diluted EPS was $65.80.

- The company demonstrated a strong capital position with a Risk-based capital to risk-weighted assets ratio of 15.36% and a Tangible common equity ratio of 11.08% as of June 30, 2025. Asset quality remained robust with no non-performing loans as of June 30, 2025.

- FMCB has a long history of consistent shareholder returns, including 90 consecutive years of dividends and 60 years of continuous increases. Additionally, the company repurchased 5,249 shares during the six months ended June 30, 2025.

- The bank has received significant industry recognition, ranking as the #1 Performing Bank in the U.S. in 2022, #2 in 2023, and #3 in 2024.

Jul 24, 2025, 12:00 AM

Farmers & Merchants Bank Reports Q2 2025 Results

FMCB

Earnings

Share Buyback

- For the second quarter of 2025, Farmers & Merchants Bank reported net income of $13.9 million , or $112.71 per diluted share , an increase from $13.5 million , or $107.86 per diluted share , in the second quarter of 2024.

- Net interest income before provision for credit losses rose to $66.9 million in Q2 2025 from $57.1 million in Q2 2024, with the net interest margin improving to 2.42% from 1.92% over the same period.

- As of June 30, 2025, total assets were $11.40 billion , total deposits were $8.69 billion , and gross loans were $6.47 billion. The Bank's regulatory capital ratios, including a total risk-based capital ratio of 19.16% and a tier 1 leverage ratio of 12.18% , significantly exceed regulatory requirements.

- During the six months ended June 30, 2025, the Bank repurchased 704 shares of its common stock for $4.0 million at an average price of $5,661.92 per share.

Jul 22, 2025, 12:05 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more