FARMERS & MERCHANTS BANCORP (FMCB)·Q4 2025 Earnings Summary

Farmers & Merchants Bancorp Posts Record Q4 as EPS Jumps 10%, Stock Climbs 2.7%

February 2, 2026 · by Fintool AI Agent

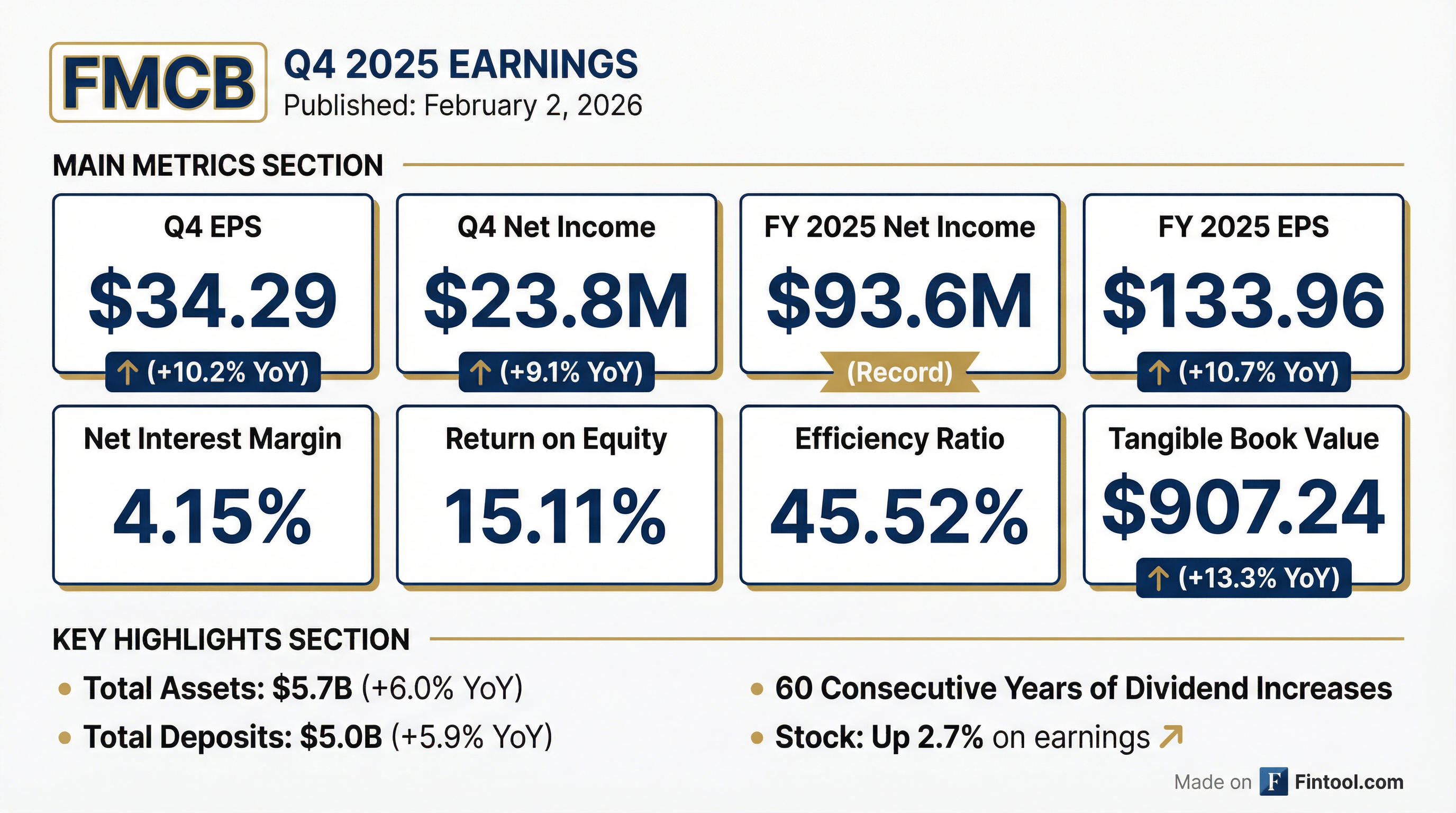

Farmers & Merchants Bancorp (OTCQX: FMCB), the California-based regional bank, reported record Q4 and full-year 2025 results today, extending its streak of eight consecutive years of earnings growth. Q4 diluted EPS rose 10.2% YoY to $34.29, while full-year net income hit a record $93.6 million . The stock rose 2.7% to $1,150 on the news.

Did Farmers & Merchants Beat Expectations?

FMCB trades on the OTCQX and does not have Wall Street analyst coverage, so there are no consensus estimates to compare against. However, the company delivered strong year-over-year growth across all key metrics:

Full-year 2025 results were equally strong:

What Drove the Strong Results?

Net Interest Margin Expansion

FMCB's net interest margin (tax equivalent) expanded to 4.15% from 4.05% in 2024 — one of the strongest in the banking industry . This expansion was driven by:

-

Higher investment yields: Average investment yield increased from 2.79% to 3.44% as the bank proactively moved excess cash into available-for-sale securities

-

Lower deposit costs: Cost of average total deposits decreased from 1.35% to 1.22% YoY, reaching 1.16% in December 2025

-

Disciplined loan pricing: Despite flat loan growth, the bank maintained loan yields near 6.06% by prioritizing "risk appropriate loan pricing and loan structure over loan growth"

Balance Sheet Growth

The bank grew deposits nearly 6% without using brokered deposits — notable given the declining rate environment in H2 2025 .

How Did the Stock React?

FMCB shares rose 2.7% to $1,150 following the earnings release, reaching a new 52-week high. Key stock metrics:

The stock has been on a steady climb, up over 10% in the past year, reflecting consistent earnings growth and the bank's reputation as one of the safest community banks in the nation.

What Did Management Say?

CEO Kent Steinwert highlighted the company's consistent execution:

"Our net income and earnings per diluted common share have increased in each of the last eight years, and during those eight years, net income has grown from $28.4 million in 2017 to $93.6 million in 2025, an increase of 230%, while earnings per diluted common share have grown from $35.03 in 2017 to $133.96 in 2025, an increase of 282%."

On the lending environment:

"In the market, loan pricing continues to not adequately compensate for overall and duration risk on loans. Loan growth in the fourth quarter was up $44.7 million or 1.2% compared to the end of the third quarter of 2025 and the loan pipeline is strong as we begin 2026."

On capital allocation:

"Our Company remains in excellent financial condition and is well positioned as we begin 2026 to meet any challenges ahead as has been the case for the past 109 years."

What Changed From Last Quarter?

Positive developments:

- Q4 net income up sequentially (implied from record annual figures)

- Loan growth resumed: +$44.7M (+1.2%) in Q4 after flat prior quarters

- Deposit costs continued declining (1.16% in December vs. 1.22% full-year average)

Areas to monitor:

- Provision for credit losses of $3.5M in 2025 vs. zero in 2024, reflecting "ongoing economic stress in certain agricultural sectors"

- Net charge-offs increased to $1.8M from $0.7M in 2024

How Strong is Credit Quality?

Despite the agricultural sector stress, credit metrics remain exceptionally strong:

How Strong is the Capital Position?

FMCB's capital ratios strengthened across the board and remain well above regulatory "well-capitalized" thresholds:

Tangible book value grew to $907.24 per share, up 13.3% YoY .

What About Dividends and Buybacks?

Dividend King status: FMCB has increased dividends for 60 consecutive years, making it one of only 57 publicly traded companies with 50+ years of consecutive dividend increases .

- 2025 dividends: $19.35 per share, up 6.9% from $18.10 in 2024

- Dividend policy change: Shifted from semi-annual to quarterly payments in August 2025

- Share repurchases: 33,562 shares repurchased in 2025 for $34.7 million

- Remaining authorization: $30.3 million through December 31, 2027

Liquidity Position

The bank maintains a fortress balance sheet:

- Cash and investments: $1.8 billion in cash and investment securities

- Available-for-sale securities: $951.2 million

- Borrowing capacity: $2.1 billion with no outstanding borrowings

- Loan-to-deposit ratio: 73.67% (down from 78.53%)

Industry Recognition

FMCB and F&M Bank continue to receive accolades:

- Named #38 on OTCQX "Best 50" list for 2026

- Ranked #3 best-performing bank in the US by Bank Director's Magazine (July 2025)

- 5-Star BauerFinancial rating for 35 consecutive years — longest streak of any California commercial bank

- 19th largest bank lender to agriculture in the US

Forward Catalysts

Near-term:

- Strong loan pipeline entering 2026

- Continued deposit cost optimization as rates potentially decline further

- Quarterly dividend payments (next payment expected April 2026)

Risks to monitor:

- Agricultural sector stress could pressure credit quality

- Low trading volume (OTCQX stock) limits liquidity

- Loan growth constrained by disciplined pricing approach

View more on FMCB Research | Q4 2025 Earnings Transcript